Cloudflare Is The Best Growth Story In 2023

Summary

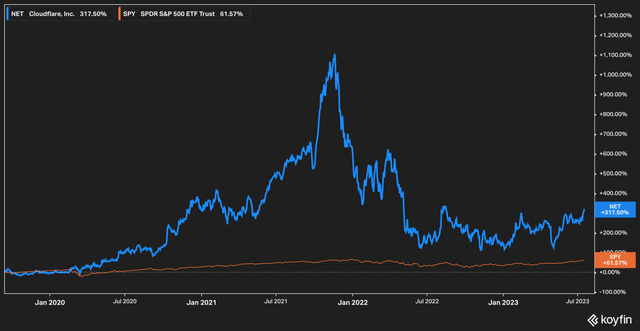

- Cloudflare, a tech company that provides website and application services, has seen its stock price remain elevated despite the 2022 tech wreck.

- Cloudflare's management is making a strategic decision to spend on Sales and Marketing, which will continue to push down margin in the near term.

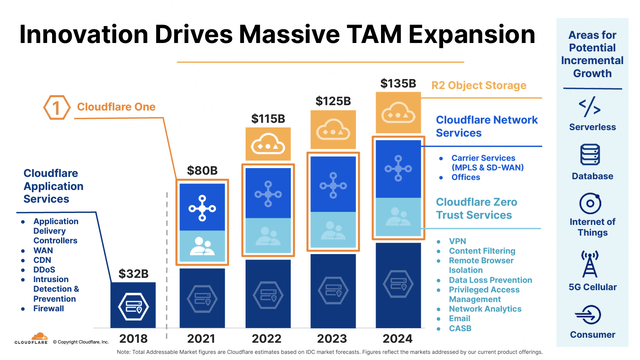

- The company estimates its total addressable market to be $135 billion in 2024, and analysts predict a 30% annual sales growth until 2025.

Sundry Photography

Background

In most industries there are consumer facing entities and entities with which consumers have little familiarity yet are vitally important to the functioning of the industry itself. They are the suppliers, architects, and maintainers of the systems that allow consumer facing companies to function. This is no more true than in the industry of the internet itself--websites are presented to us seamlessly by companies where we can transact business, store information, and even monitor the security of our homes. The back-end facilitation and architecture of these sites (the plumbing, so to speak) is done by companies like Cloudflare (NYSE:NET), which is the subject of our article today.

Founded in 2009, Cloudflare operates in two main segments. The first is Website and Application Services, in which is contained the company's Website and Application Security (which provides services such as firewalls, bot management, and API gateways, among other things), and Website and Application Performance (which facilitates things like content delivery and load balance for websites) divisions. The second segment is Cloudflare One, the company's cloud offering which allows companies to utilize Cloudflare's virtual infrastructure for a fee rather than buying and paying for the upkeep of costly equipment themselves.

Like many high-growth tech companies, Cloudflare was not immune to the 2022 tech wreck, where rising inflation and interest rates brought low many Silicon Valley darlings.

However, unlike many other tech companies, Cloudflare's stock price has remained respectably elevated. On a five year time frame the stock still remains up more than 300%.

Financials, Valuation, & Estimates

We find it particularly interesting that Cloudflare has delivered a substantial return for multi-year investors (so long as one didn't buy at the late 2021 peak, of course), because the company has yet to turn a profit.

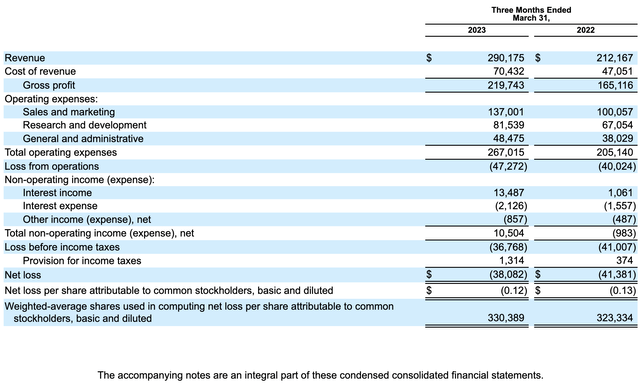

In the first quarter of 2023, the company generated $219 million in gross profit off of $290 million in revenue, and posted an operating loss of $47 million, driven primarily by a Sales and Marketing expense that sat at 42% of revenue. While we are generally skeptical of companies that spend copious amounts of money to acquire customers, we think that Cloudflare's opportunity and niche in the market is unique enough to where, in this case, the juice might actually be worth the squeeze.

Further, looking at the cash flow statement reveals that--sigh--the company posted $57 million in stock-based compensation. This is an exorbitant amount, and those familiar with our work know our disdain for the excessive stock-based compensation that Silicon Valley is infamous for. It also means that, as much as we hate to say it, the company could actually turn a profit if it were to dial back its stock-based compensation expense.

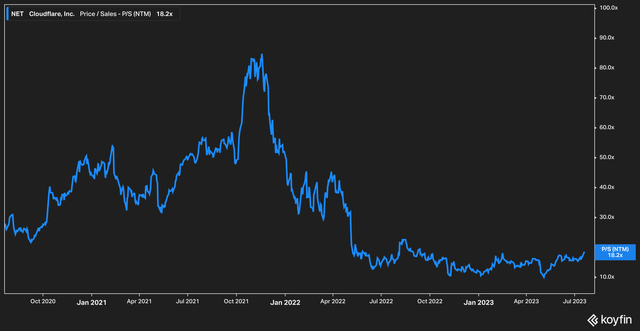

Because of the company's GAAP unprofitability, we will assess the company based on forward price to sales.

Today the company trades at 18x forward sales estimates, down from as much at 80x forward estimates at the stock's 2021 high. While 18x may seem a bit rich for some investors, we note that the valuation has remained relatively steady since July 2022. This means that the assigned value from the market has remained in place throughout rising inflation and interest rates while other tech companies have seen valuations crumble--something we believe is worth considerable note.

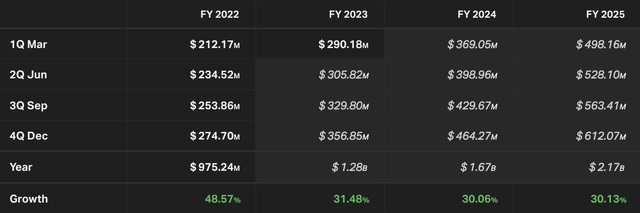

Analysts, for their part, seem to think that the company's sales growth will remain stellar over the next few years.

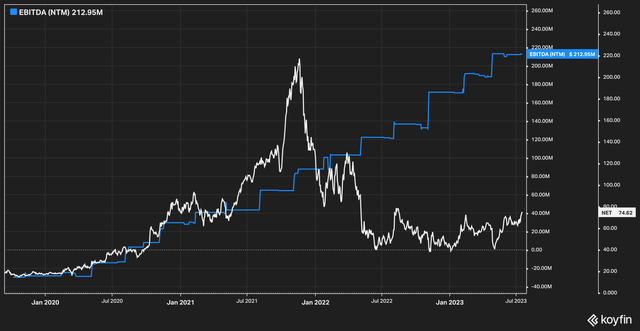

Average estimates for Cloudflare sales growth looking out to 2025 is a very impressive 30% each year. Further, we point out that while the stock price has plummeted from highs, it is not only sales that continue to climb, but EBITDA as well.

The above chart details Cloudflare's stock price against the forward EBITDA projections. While the stock clearly ran out ahead of its skis in 2021 with the massive run-up, the subsequent fall and consistent ranging in the $40-$80 area doesn't quite make sense to us given the consistent, stair-stepping growth estimates.

These estimates, we think, are not likely to be revised downward anytime soon, since the internet is one of the few industries not negatively impacted by work from home, rising goods inflation, or most of the other macro-economic headwinds and headlines of today. In Cloudflare's end of 2022 investor presentation the company outlined what it views as its total addressable market in the near future.

With the introduction of Cloudflare One in 2021 and R2 Object Storage, Cloudflare estimates that the total addressable market for its services will be $135 billion in 2024.

Further, Cloudflare is a market leader. Kinsta recently estimated that almost 80% of websites that utilize Content Delivery Networks [CDNs], which are a core part of Cloudflare's business, utilize Cloudflare. This is an important gateway as well for growth, since businesses that utilize a CDN with a particular provider are much more likely to onboard other services from that provider.

The Bottom Line

While we are not fans of the company's stock based compensation profile or the fact that it spends so much money on sales and marketing as a percentage of revenue, Cloudflare presents a rare case where the expenses may--in the short term--be warranted given the large total addressable market, the growing indispensability of the internet, and the company's position as a market leader.

It is especially notable to us that Cloudflare is able to retain its elevated value in a non-zero interest rate environment while still being able to hold on to many of the trappings of a zero interest rate environment growth company, like elevated sales and marketing and stock based compensation expense. This is, we think, a testament to the service provided by the company itself.

Risks to our thesis include major attack disruptions to Cloudflare's network that would cause erosion of trust in the company, or a sudden shakeup in the competitive landscape that calls Cloudflare's place as an industry leader into question.

Lastly, we think the breakdown in the stock's price versus its EBITDA estimates represents a degree of mispricing from the market, and that any re-rating to restore the relationship even to a fraction of its previous level would present significant upside to the stock. For all these reasons, we are bullish on Cloudflare's future.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.