Booking Holdings: AI, A Key Growth Driver

Summary

- Booking Holdings Inc. has seen impressive growth in revenue and free cash flow over the past decade, largely due to the growth of online travel and strategic acquisitions.

- Despite the impact of the COVID-19 pandemic, BKNG's profitability outshines competitors, with strong growth projections for the coming years and a focus on AI technology to enhance customer experience.

- Based on a discounted cash flow analysis, BKNG's stock appears undervalued, potentially offering investors a return of 70.52% compared to the current market price.

Noam Galai

Intro

Booking Holdings Inc. is a global company that provides various online reservation and travel-related services. It operates multiple platforms, including Booking.com for accommodation reservations, Rentalcars.com for rental car bookings, and Priceline for hotel, flight, and vacation package reservations. Additionally, it runs Agoda for accommodation and travel services, KAYAK for comparing travel itineraries and prices, and OpenTable for restaurant reservations. The company also offers travel-related insurance products and restaurant management services. Formerly known as The Priceline Group Inc., it changed its name to Booking Holdings Inc. in February 2018.

In this article, we will take a close look at BKNG's financial performance and growth prospects. We'll explore how much money the company makes, how profitable it is, and its ability to generate cash. By understanding these important factors, investors can get a better idea of whether BKNG could be a good investment in the current market.

Growth

Continuous revenue and free cash flow growth are essential for a company's success. They signify expanding market presence, improved profitability, and financial stability. Growing cash flows enable companies to invest in innovation, acquisitions, and shareholder returns, while attracting investor confidence and supporting future expansion.

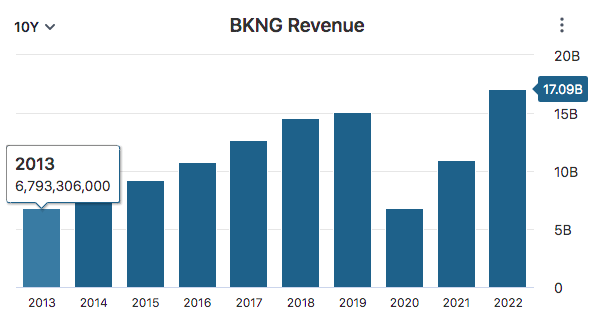

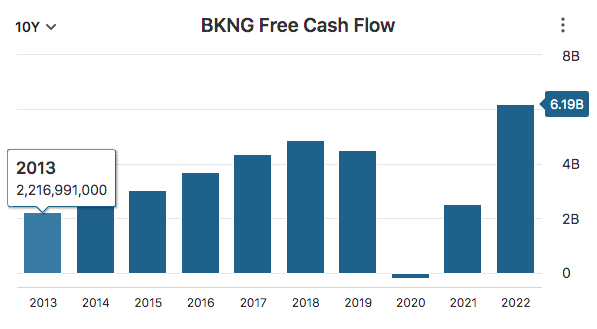

Over the past decade, BKNG has demonstrated impressive growth in both revenue and free cash flow. From 2013 to 2022, the company's revenue increased by 151.57%, with a compounded annual growth rate (CAGR) of 9.66%. Similarly, its free cash flow grew significantly by 179.03%, with a CAGR of 10.81%. This substantial growth showcases BKNG's ability to expand its market presence and effectively capitalize on business opportunities over the years.

Data by Stock Analysis Data by Stock Analysis

BKNG's revenue and free cash flow have grown significantly over the last decade, and this can be attributed to several factors. One major factor is the growth of online travel, as more people are using the internet to book their trips. In the U.S., around 92% of individuals have internet access as of 2023, compared to 75% in 2012. This surge in internet users has been a big boost for the online travel industry, and BKNG has effectively taken advantage of this trend to fuel its growth.

Another reason for BKNG's impressive growth is its widespread presence, operating in over 200 countries and territories. This means they have a big customer base and can serve travelers from all over the world. BKNG has also made strategic acquisitions like Open Table in 2014 and Kayak in 2013, which have contributed to their expansion and success.

BKNG's strategic acquisitions of Open Table in 2014 and Kayak in 2013 played a significant role in their growth and success. Open Table is a popular online restaurant reservation platform, and its integration into BKNG's services expanded their offerings to include dining reservations, complementing their travel services.

Similarly, Kayak is a leading travel metasearch engine, and by acquiring them, BKNG gained access to a broader audience of travelers searching for the best travel deals, further solidifying their position in the online travel market. These acquisitions have not only increased BKNG's customer base but also enriched their platform with additional services, enhancing the overall travel experience for users.

The COVID-19 pandemic had a significant impact on BKNG's business, as shown in the charts above. During 2020 and 2021, travel demand dropped as people were concerned about the pandemic. This led to a decline in BKNG's revenue and free cash flow. However, as COVID-19 fears eased in 2022, BKNG's growth reached all-time highs in both revenue and free cash flow, demonstrating the strength of their business model.

Profitability

Being more profitable than competitors is crucial for a company because it means they can invest in new ideas and stay ahead in the market. It also helps the company stay strong during tough economic times and attracts more investors, which can lead to higher stock prices and more opportunities for growth.

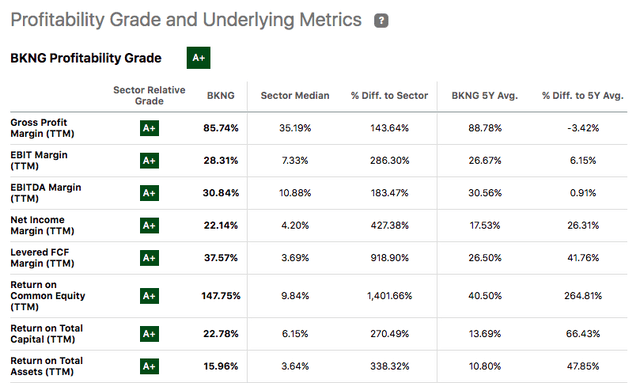

BKNG stands out in the consumer discretionary sector for its impressive profitability compared to its peers. The company boasts better margins and higher returns on equity, capital, and assets than its competitors. This indicates that BKNG is managing its resources effectively and generating more profits for its investors, making it a promising investment opportunity in the sector.

BKNG's profitability outshines its competitors due to several factors. Firstly, it operates in a relatively monopolistic market with few major online travel companies, providing it with a substantial market share which grants the company greater bargaining power with hotels and suppliers, allowing for lower commissions and strong pricing power to charge higher prices for its services.

With relatively few competitors, BKNG benefits from economies of scale, as its large customer base allows it to spread fixed costs over numerous bookings, leading to higher profit margins. These factors contribute to BKNG's impressive profitability in the online travel industry.

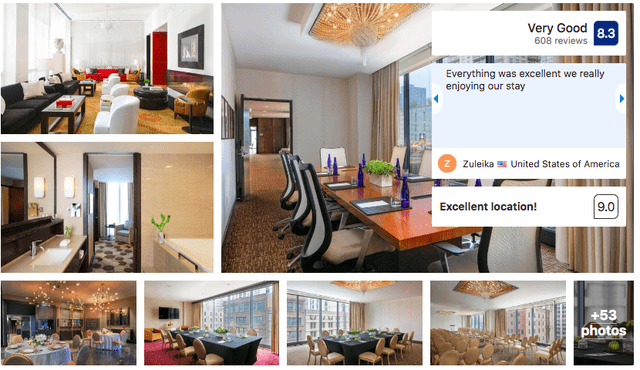

Another strength for the company is its relentless focus on the customer experience. BKNG's focus is on providing consumers with intuitive and user-friendly online travel services, offering a comprehensive selection of travel and payment options. BKNG also strives to offer valuable content, such as pictures, accommodation and restaurant details, reviews, and sustainability information, etc.

Their commitment to excellent customer service, competitive prices, special rate programs, and loyalty programs ensures that they make travel easy, seamless, and personalized for their customers. BKNG's ultimate goal is to offer consumers the most trusted brands and a diverse array of travel choices in every part of the world, delivering the utmost value to their customers.

Outlook

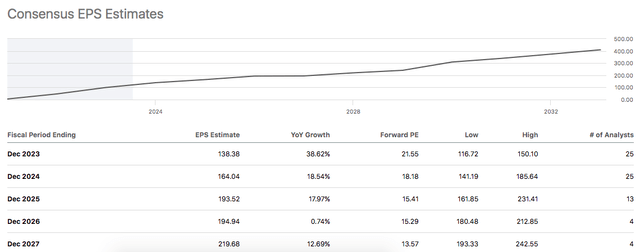

For the rest of 2023, BKNG is estimated to have earnings per share (EPS) of $138.38, which represents a year-over-year growth of approximately 38.62%. Additionally, the revenue estimate for the same period is expected to reach $20.67 billion, reflecting a year-over-year growth of around 20.92%. These estimates suggest positive growth in both earnings and revenue for BKNG, indicating potential financial strength and promising performance for the company in the latter part of 2023.

BKNG's growth prospects remain strong, with expected double-digit earnings growth in all but one year over the next five years. This positive outlook suggests that the company is likely to continue expanding its profits and performing well in the coming years.

One of the main growth drivers for BKNG moving forward will be its connected trip strategy. This strategy is built on using data and technology to tailor the travel experience for each customer. This involves recommending hotels and activities based on individual interests and providing real-time updates on travel plans.

Additionally, BKNG aims to simplify the booking and management of travel by integrating its platform with other travel providers like airlines and rental car companies, and offering centralized customer service, they strive to create a hassle-free experience for travelers. Through this data driven approach BKNG's connected trip strategy aims to offer a seamless, personalized, and efficient travel experience for its customers.

When considering an investment in BKNG, it's important to be aware of some risks associated with their business model. As a travel-focused company, BKNG's success is heavily tied to the travel industry's performance. Economic downturns may lead to reduced travel spending, impacting BKNG's business. While we remain positive about the travel industry's long-term potential, it is susceptible to unforeseen events like the COVID-19 pandemic, which could disrupt travel again.

Despite these risks there are plenty of catalyst for future growth. BKNG has been investing heavily in AI technology for a few years now which further demonstrates their commitment to delivering a more personalized and connected trip experience for customers. By leveraging AI, BKNG aims to optimize interactions with travelers and partners, offering personalized recommendations and analyzing content in various languages.

Some of BKNG's brands, including KAYAK and OpenTable, are actively experimenting with generative AI plug-ins, while others are working on integrating this technology into their respective offerings. With a strong AI foundation, BKNG is well-positioned to deliver a compelling and distinctive booking experience, tailored to meet the diverse needs of its users. By harnessing the power of AI, we believe BKNG will remain at the forefront of the travel industry, continuously improving its services to provide the best possible experience for its customers and fostering substantial growth for shareholders for years to come.

Valuation

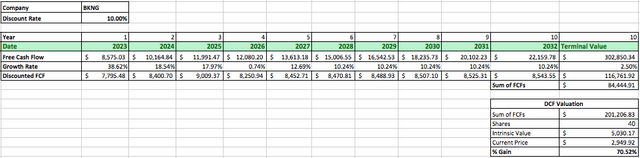

To evaluate BKNG's intrinsic value, we will employ the discounted cash flow (DCF) analysis. Starting with BKNG's starting free cash flow of $6.18 billion, we will apply an initial growth rate of 38.62% for 2023, followed by growth rates of 18.54% for 2024, 17.97% for 2025, 0.74% for 2026, and 12.69% for 2027 based on the provided data above.

For the subsequent period, we will use a growth rate of 10.24% for years 6-10, derived from the average compound annual growth rate of BKNG's revenue and free cash flow over the last decade. Utilizing a discount rate of 10%, based on the average return of the S&P 500 with dividends reinvested, and a conservative perpetual growth rate of 2.5%, we calculate the intrinsic value of BKNG to be $5,030.17. This suggests that BKNG may be currently undervalued, presenting investors with a potential return of 70.52% compared to the company's current market price.

Final Thoughts

BKNG has demonstrated impressive growth over the past decade, with consistent increases in both revenue and free cash flow. Their widespread global presence, strategic acquisitions, and relentless focus on customer experience have contributed to their success.

Considering the strong growth projections, track record for growth and profitability, and the current valuation, we recommend a buy rating for BKNG's stock. The company's continuous investments in AI technology further strengthen its position in the industry and offer personalized and efficient travel experiences for customers.

While there are some risks associated with the travel industry's dependence on economic conditions and unforeseen events like the COVID-19 pandemic, we believe BKNG's strategic focus on innovation and AI technology will continue to drive growth and create value for shareholders in the years to come. Investors may find BKNG's stock undervalued, presenting a potential return of 70.52% compared to the current market price.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BKNG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.