Why Alcoa Could Double If Demand Improves

Summary

- Alcoa Corporation reported a net loss of $102 million in 2Q23, mainly due to lower metal prices and higher production costs.

- The company's outlook remains positive, with limited supply growth and improving demand trends in the global aluminum market.

- Despite economic uncertainty, Alcoa's risk/reward has become attractive, with a potential rally to $80-$90 if aluminum demand rebounds, but caution is advised due to high volatility.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Jeff Swensen

Introduction

The Alcoa Corporation (NYSE:AA) just reported its second-quarter earnings. The stock has been on my radar for many years due to its major footprint in the global aluminum industry. Not only does this make the AA ticker a good proxy for economic growth, but it also tells us a lot about the health of the global economy.

Since mid-2022, I had AA shares on my radar as a potential recovery play. After all, the energy situation in Europe and pollution reduction in China have put this Pittsburgh-based player in a much better spot.

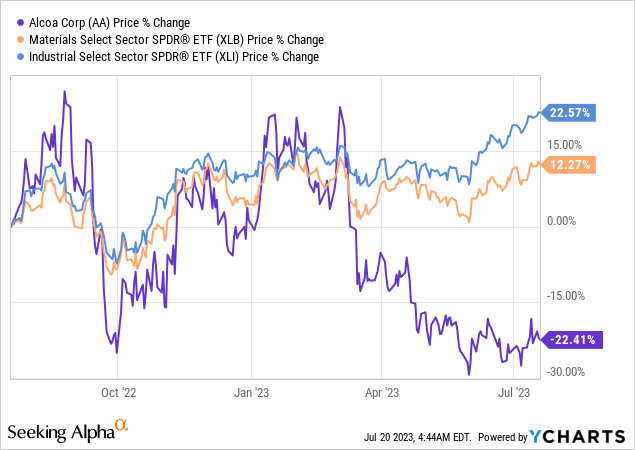

Unfortunately, since my February article, shares have continued to decline.

AA shares are down 23% year-to-date and more than 60% below last year's highs. Not only that, but Alcoa has completely ignored the uptrend in basic material and industrial stocks.

In this article, we'll dive into its results and its outlook for the future, including what this means for the risk/reward.

So, let's get to it!

What Happened In 2Q23?

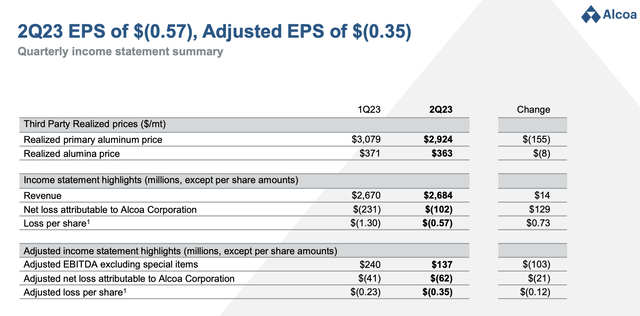

Alcoa's second-quarter revenues increased by 1% despite slight declines in both alumina and aluminum third-party realized prices. The net loss attributable to Alcoa improved significantly, decreasing by $129 million to $102 million. This translates to $0.57 per share.

This improvement was primarily due to the non-recurrence of charges taken in the first quarter, including the $101 million charge related to the closure of the Intalco smelter and a $41 million utility settlement charge at Ma'aden, which is a joint venture between Alcoa and the Saudi Arabian Mining Company.

Related to that, Alcoa faced operational challenges in Q2, including a failure in a ship-to-shore conveyance system in Brazil, which was successfully repaired.

The San Ciprián refinery in Spain is operating at about 50% capacity due to unfavorable market conditions. The Aluminum segment has seen some smelters operating at full capacity while others have reduced production due to curtailments.

Going back to the financial numbers, on an adjusted basis, the net loss was $62 million, or $0.35 per share, and adjusted EBITDA, excluding special items, declined by $103 million to $137 million.

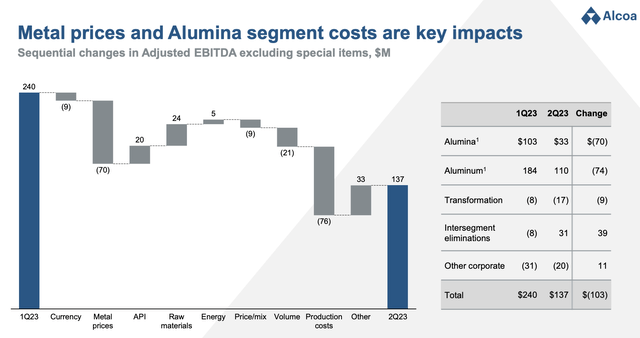

As the overview above shows, the major drivers of the sequential decline in adjusted EBITDA were higher production costs, lower metal prices, and lower volume. These items totaled $167 million.

- The Alumina segment was primarily affected by increased production costs and lower volume, with $45 million attributed to lower Australian bauxite grades and the remainder due to higher maintenance outages and related costs at the company's Alumar and Wagerup refineries.

- The Aluminum segment, however, saw favorable production costs of $14 million, mainly due to improvements at both Norway operations and Alumar. Other factors contributing to the improvement totaled $64 million, including lower raw material costs in both segments and higher API (Aluminum Price Index), partially offset by an unfavorable product mix in the Alumina segment.

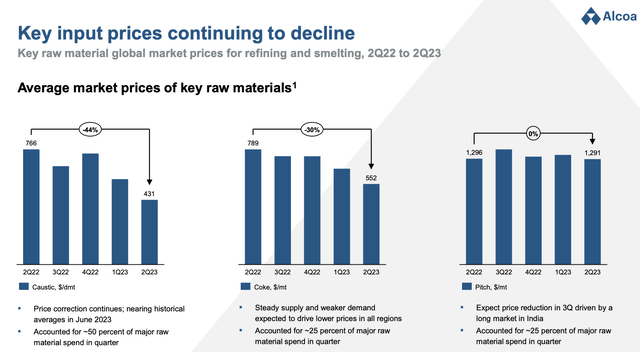

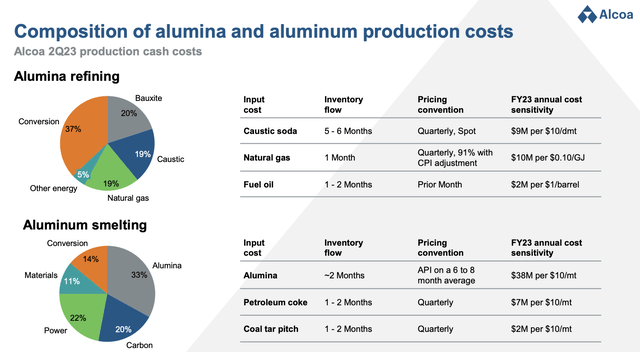

With regard to production costs, the company experienced declining purchase prices for key raw materials, including caustic soda for the Alumina segment and calcined petroleum coke and coal tar pitch for the Aluminum segment.

However, despite these declines, the improvements haven't yet fully worked their way through to the income and cash flow statements.

The good news is that the company expects that if these raw material price trends continue, they will be rewarded with lower inventory valuations, reduced COGS (Cost of Goods Sold) related to raw materials, and improved cash flow.

Having said that, I'm not focused too much on the decline in raw material prices. I believe that in a sustainable economic upswing, these prices will rapidly rise again. However, this should also boost aluminum prices and allow the company to grow its margins again - despite potentially rising input costs.

Cost savings on raw materials are usually just minor tailwinds during poor economic times.

Outlook & Market Conditions

This brings me to the company's outlook.

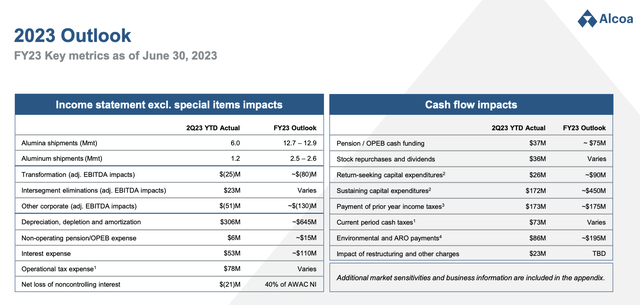

For the third quarter, the Alumina segment EBITDA is expected to improve by approximately $65 million due to lower raw material prices, better production costs, and higher volumes as elevated maintenance during the second quarter concludes.

However, there is an anticipated $10 million unfavorable impact from lower bauxite grades in Australia, which is expected to continue through at least mid-2024.

In the Aluminum segment, a net improvement of roughly $25 million is expected, with unfavorable raw materials and lower production costs partially offset by unfavorable price/mix, primarily due to softer billet demand.

Alumina costs in the Aluminum segment are expected to be favorable by $5 million.

The company also highlighted an unusually large favorable foreign currency impact of $40 million in other expenses during the second quarter, which may not recur.

The operational tax expense for the third quarter is projected to be between $10 million to $20 million based on recent pricing.

Having said that, most of this article so far has focused on smaller issues like pricing headwinds and tailwinds, production developments, and related.

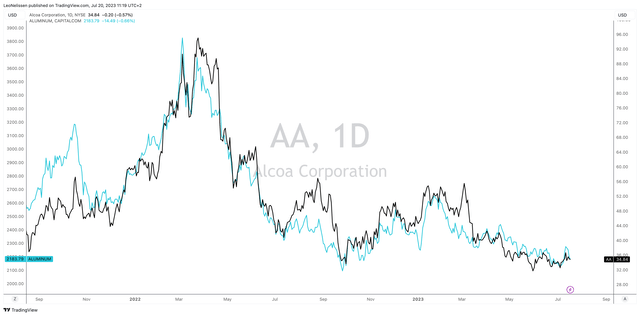

While these issues are important, nothing is more important than the price of aluminum, which continues to drive Alcoa's stock price. The chart below shows this high correlation.

During the 1Q23 earnings call, the company provided some insights into the global aluminum market.

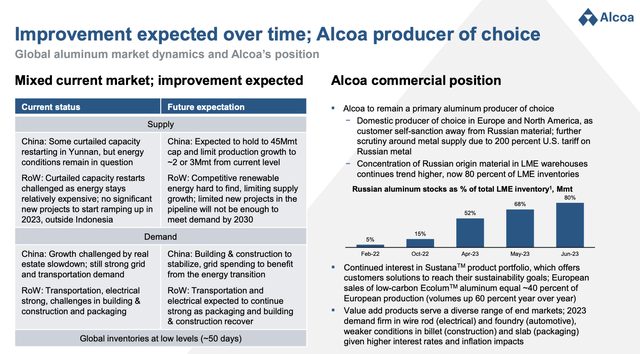

Essentially, the market is displaying mixed signals, with limited supply growth and varying demand trends across different regions and end markets.

- In China, previously curtailed capacity is restarting in Yunnan province, but concerns exist regarding hydroelectric power availability and stability in Yunnan and Sichuan provinces, where low-carbon aluminum suppliers are concentrated.

- In the rest of the world, conditions are not favorable for restarts, and new capacity expansion is minimal.

- China is expected to experience growth in aluminum demand for electrical grid investments and vehicle production, but weaker demand in the construction sector due to the real estate market slowdown.

The good news is that strong year-on-year growth is observed in the automotive market, especially in Europe and North America.

Electrical applications also show positive trends, although construction and packaging sectors have slowed due to higher interest rates, inflation, and destocking trends.

Based on these developments, the long-term outlook for aluminum remains positive, driven by the global need for more aluminum from primary and recycled sources.

Demand growth will come from existing users and global decarbonization efforts, including the transition to renewable energy, electric vehicles, and recyclable packaging.

A further recovery is expected in the construction market as developing markets witness stabilized interest rates and continued urbanization.

In other words, the bigger picture isn't half bad. Supply growth is expected to remain subdued - which was my base case - while demand growth is improving, despite ongoing macroeconomic challenges.

In the rest of the world, we also see limited supply growth, especially in the production of aluminum made with lower carbon emissions. The announced projects in the pipeline are not expected to be enough to meet demand of our critical metal. Market conditions are expected to be favorable for aluminum in the future and Alcoa will also remain well-positioned as a low-carbon primary aluminum producer of choice in key regions.

So, what does this mean for the valuation?

Valuation

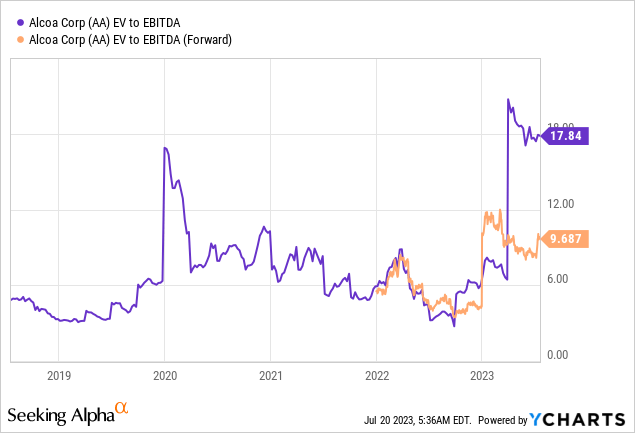

Putting a fair valuation on basic material or energy companies is tricky. After all, they are highly influenced by the commodities they produce. In the case of AA, we're dealing with a forward EV/EBITDA multiple of 9.7x, which is fair but nothing to write home about.

However, this doesn't mean a lot. If economic conditions bottom, we could see a significant improvement in expectations.

For example, in September of last year, analysts expected Alcoa to generate close to $13.5 billion in annual sales. That number has now fallen to $11 billion.

Earnings per share estimates have fallen from $8 to -$2 during this period.

In other words, if analysts expect demand to improve, we will more than likely see a significant upswing in expectations, reducing valuation ratios like the ones I just used.

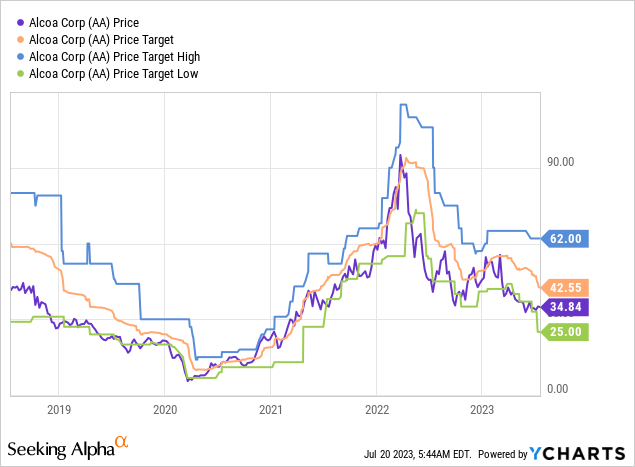

Needless to say, the same goes for the company's price targets. The consensus is $43.

With all of this in mind, I believe that the risk/reward of Alcoa has become attractive.

While demand uncertainty remains an issue, a lot has been priced in.

At this point, the bull case is bottoming economic demand. If that were to occur, we would see a situation of rebounding aluminum demand and further subdued supply growth.

I believe that such an event could fuel a rally to the $80 to $90 range.

However, I do not advise anyone to go overweight Alcoa. It's a highly volatile play that is still in an early phase. Given the tricky economic environment, we could see more downside before we get a bottom in growth expectations.

Takeaway

Alcoa's recent second-quarter earnings report reflects a mixed bag of challenges and opportunities. While revenues increased by 1%, the stock has been on a downward trend, falling 23% year-to-date and more than 60% from last year's highs. The company faced operational challenges, but improvements in raw material costs turned into financial tailwinds.

The outlook for the global aluminum market is positive, with demand growth expected from renewable energy, electric vehicles, and recyclable packaging.

Additionally, Alcoa's position as a low-carbon primary aluminum producer is an advantage in key regions.

Considering the current valuation and the potential for demand to improve, the risk/reward of Alcoa has become attractive.

However, given the volatile economic environment, caution is advised, and a bottoming-out of economic demand is crucial for a potential rally in the stock price, which could reach the $80 to $90 range.

It's a cautious play, and further downside could occur before a growth bottom is reached.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.