The AZEK Company Faces Commercial Segment Softness

Summary

- The AZEK Company provides engineered products for outdoor spaces in residential and commercial settings in the United States.

- Management has not provided full fiscal year 2023 revenue guidance, but my estimate is growth of 5.6%, which, if achieved, would represent a material drop from fiscal 2022's growth rate.

- The firm is seeing destocking in its commercial channel and the stock looks pricey compared to peers in the wider Seeking Alpha Industrial Products index.

- Given growth risks and the stock not exactly being cheap, I'm Neutral (Hold) for AZEK in the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

AleksandarNakic/E+ via Getty Images

A Quick Take On The AZEK Company

The AZEK Company (NYSE:AZEK) develops and sells products for home and commercial outdoor construction and related areas.

I previously wrote about AZEK in December 2022 with a Hold outlook.

Given ongoing demand softness in its commercial segment and the firm’s pricey valuation compared to its broader industry peers, I remain Neutral (Hold) on AZEK in the near term.

AZEK Company Overview

Chicago-based AZEK was founded to provide homeowners and commercial installers with a wide range of engineered products for outdoor spaces, including decks, rails, trims and accessories.

Management is headed by Chief Executive Officer Mr. Jesse Singh, who has been with the firm since 2016 and was previously an executive at the 3M company and CEO of 3M's joint venture entity in Japan.

The company's primary offerings include:

Residential outdoor products

Commercial outdoor products

For its residential segment, the company distributes its products through more than 4,200 dealers, 35 distributors and multiple home improvement retailers in the U.S. and Canada.

For its commercial segment, it sells through distributors and directly to OEMs (Original Equipment Manufacturers).

AZEK's Market

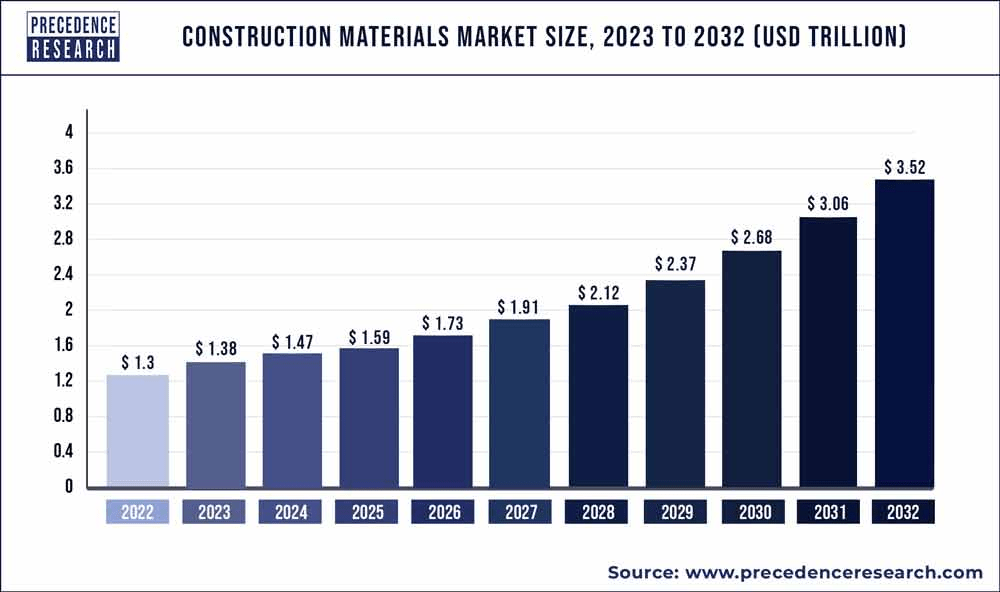

According to a 2023 market research report by Precedence Research, the global market for construction materials was an estimated $1.3 trillion in 2022 and is expected to exceed $3.5 trillion by 2032.

If achieved, this would represent a CAGR (Compound Annual Growth Rate) of 10.97% from 2023 to 2032, as the chart shows below:

Construction Materials Market (Precedence Research)

The outdoor materials market is a subset of the total construction materials market.

The upward trend in construction material market growth is expected to be driven by increasing urbanization worldwide, not only in emerging markets but also in developed nations as well.

The Asia Pacific market will likely represent the fastest-growing region during the period, with China remaining the leading construction market in the region.

AZEK’s Recent Financial Trends

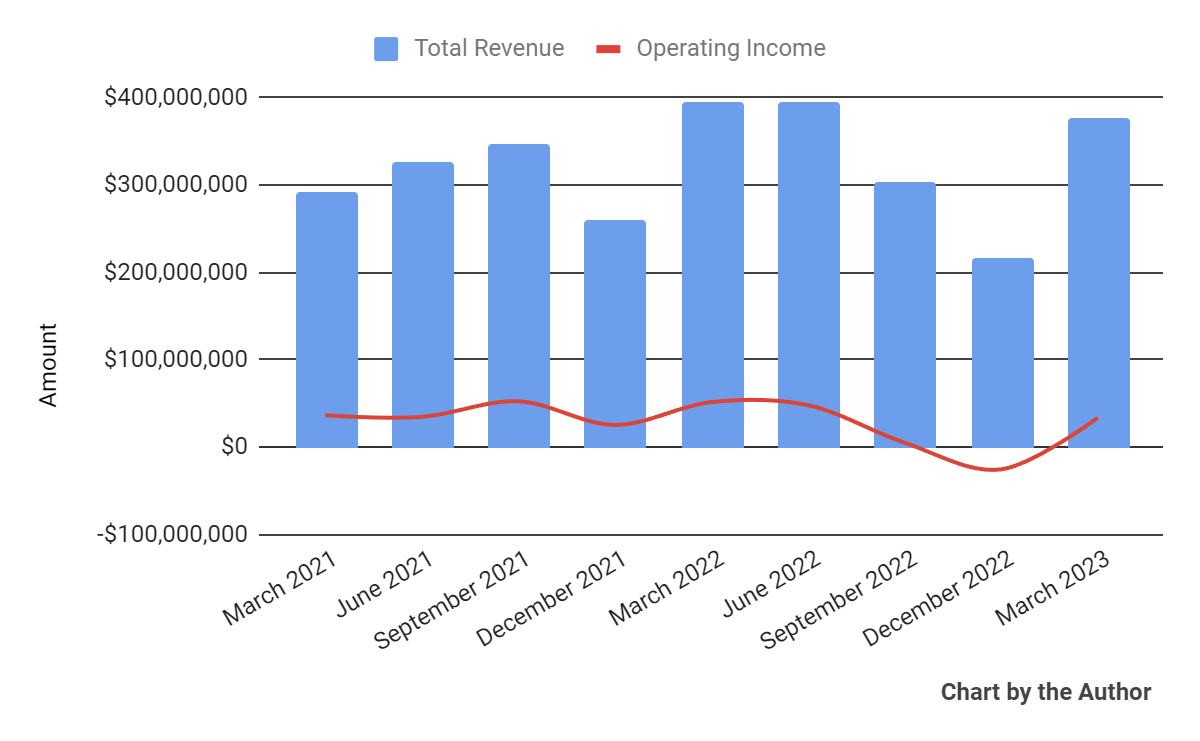

Total revenue by quarter has fallen in recent quarters. Operating income by quarter has turned higher in the most recent quarter.

Total Revenue and Operating Income (Seeking Alpha)

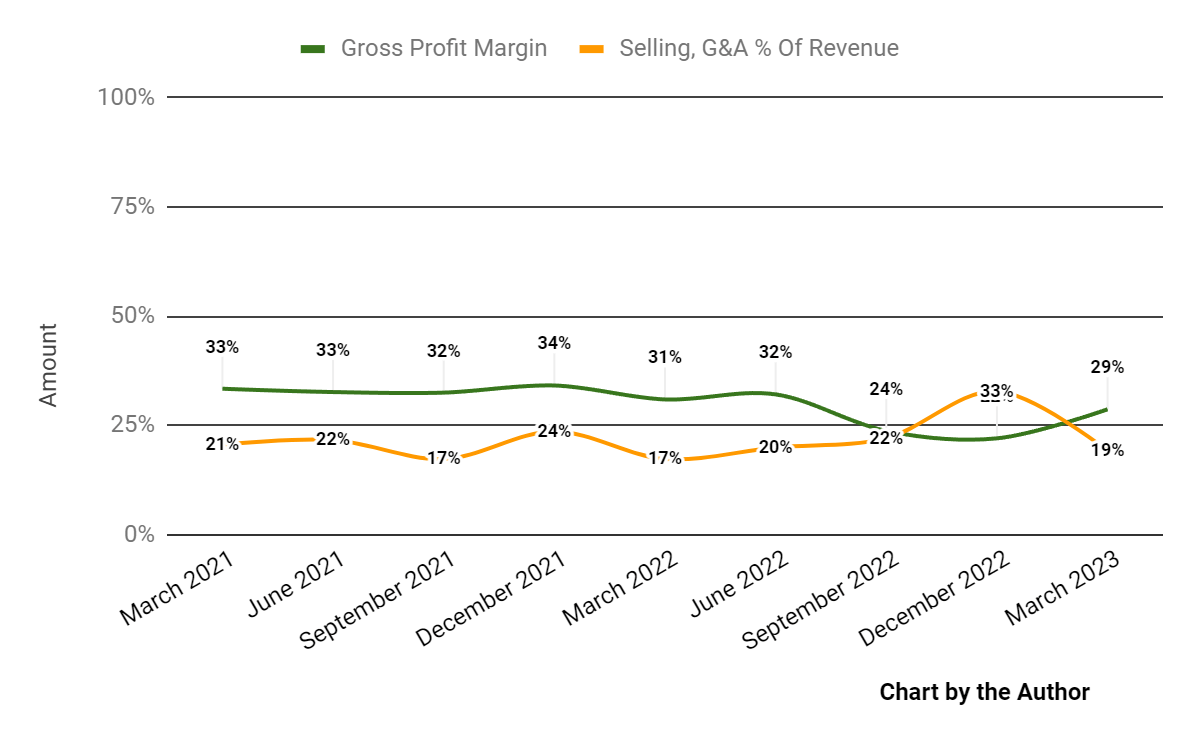

Gross profit margin by quarter has trended lower. Selling, G&A expenses as a percentage of total revenue by quarter have moved higher recently.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

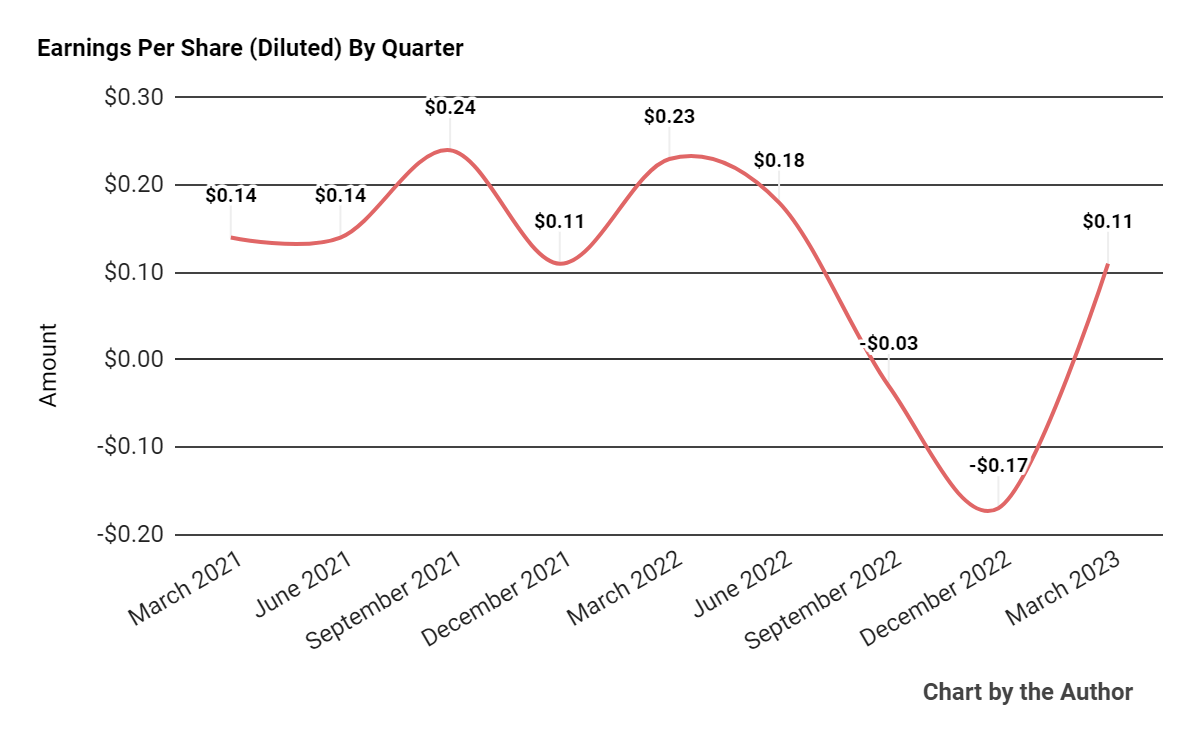

Earnings per share (diluted) have been volatile in recent quarters, as the chart shows below.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

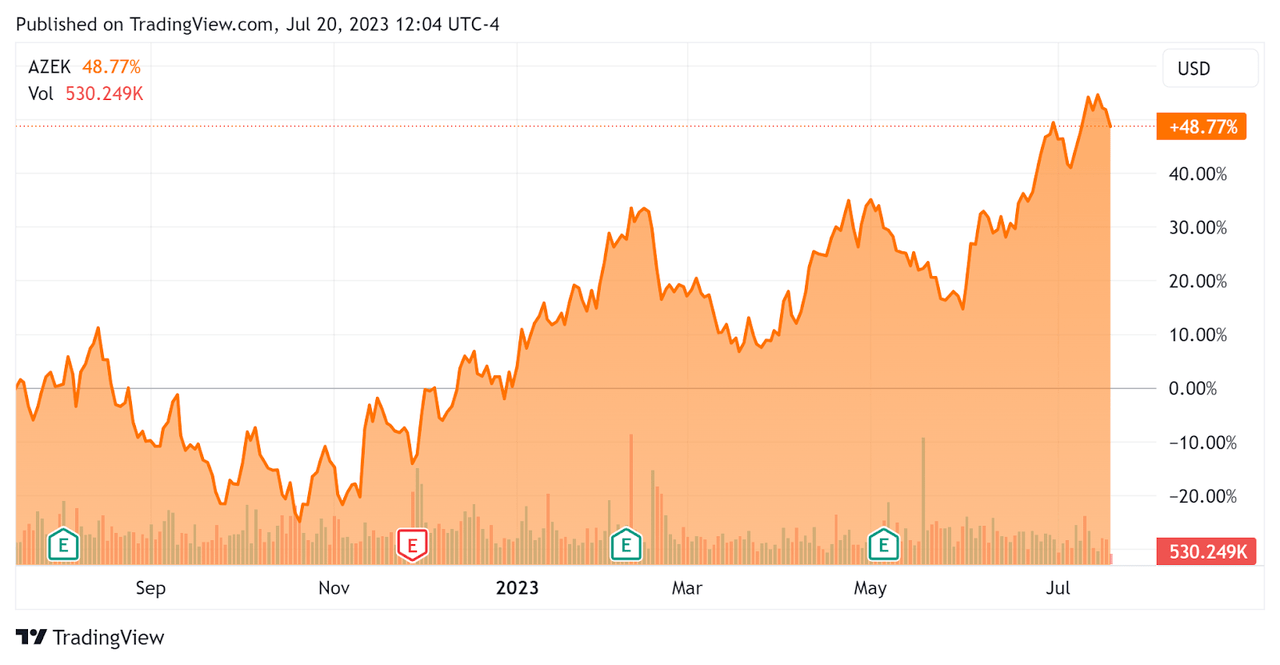

In the past 12 months, AZEK’s stock price has risen 48.77%, as the chart indicates below.

52-Week Stock Price Percentage Change (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $126.8 million in cash, equivalents and trading asset securities and $593.6 million in total debt, of which only $6.0 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was an impressive $132.3 million, during which capital expenditures were a hefty $104.2 million. The company paid $28.4 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For The AZEK Company

Below is a table of relevant capitalization and valuation figures for the company.

Measure [TTM] | Amount |

Enterprise Value / Sales | 4.0 |

Enterprise Value / EBITDA | 27.6 |

Price / Sales | 3.6 |

Revenue Growth Rate | -2.7% |

Net Income Margin | 1.0% |

EBITDA % | 14.6% |

Net Debt To Annual EBITDA | 2.5 |

Market Capitalization | $4,650,000,000 |

Enterprise Value | $5,220,000,000 |

Operating Cash Flow | $236,520,000 |

Earnings Per Share (Fully Diluted) | $0.09 |

(Source - Seeking Alpha)

Commentary On The AZEK Company

In its last earnings call (source - Seeking Alpha), covering FQ2 2023’s results, management highlighted the company's efforts to produce further cost savings to improve operating results.

Into fiscal 2024, leadership intends to "continue to focus on free cash flow generation, via working capital initiatives and a disciplined approach to capital expenditures after the heavy investment period over the last few years."

Its residential channel saw "stable demand," but its commercial channel is suffering from a "more challenging environment resulting from a combination of channel destocking and softer demand in certain commercial and markets, which we expect will be a headwind versus our original planning assumptions."

Overall, total revenue for FQ2 2023 dropped 4.7% year-over-year and gross profit margin fell 2.3%.

Selling, G&A expenses as a percentage of revenue rose 1.9% year-over-year, a negative signal, while operating income declined sharply by 34.7% YoY.

The company's financial position is moderate, with ample liquidity, nearly $600 million in total debt but strong free cash flow.

Looking ahead, management is targeting ‘incremental balance sheet inventory reductions’ as part of its increased focus on working capital management.

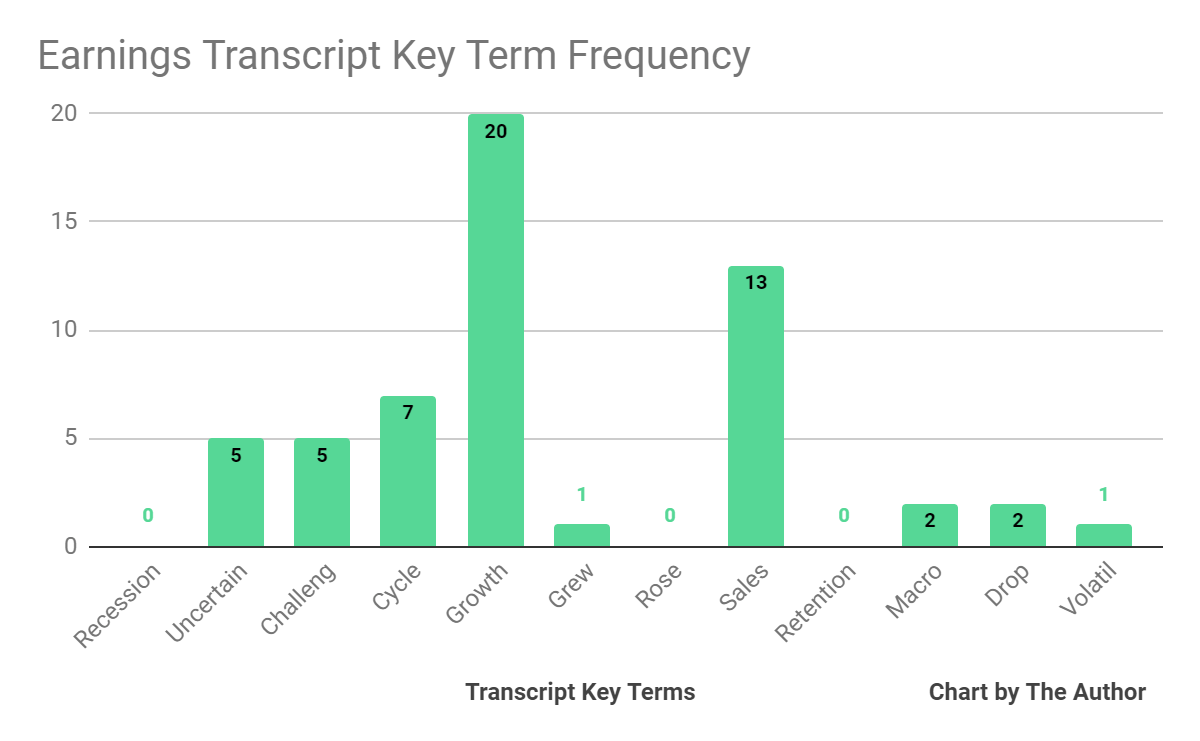

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited "uncertain" five times, "challeng[es][ing]" five times, "macro" two times, "drop" two times and "volatil[e][ity]" once.

Analysts questioned company leadership about growth for the second half of the year, and management is proceeding conservatively with its assumptions.

Regarding valuation, as a reference to Seeking Alpha’s index of Top Building Products stocks, a valuation comparison shows the index at an average EV/revenue multiple of 2.54x vs. AZEK’s multiple of 4.0x. The Index’s EV/EBITDA multiple was 12.82x vs. AZEK’s multiple of 27.6x.

These comparisons indicate AZEK appears to be currently valued at a premium to the broader building products sector as contained in the referenced index.

My growth estimate for AZEK for the remainder of the current fiscal year is 5.6%. If achieved, this would be materially less than the firm’s nearly 15% growth in the previous fiscal year.

The potential risk to my forward estimate is management’s forecasted deflation of $50 million in the current year.

The primary business risk to the company’s outlook is a "higher for longer" interest rate regime that would lead to reduced construction and remodeling activity in the coming quarters.

Its commercial segment also is under pressure as many economic analysts question the resiliency of the commercial real estate market in the U.S. due to changing capital availability and worsening fundamentals.

Given ongoing demand softness in its commercial segment and the firm’s pricey valuation in comparison to its broader industry peers, I remain Neutral (Hold) on AZEK in the near term.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.