PPT: Amortizing Return Of Principal Fund

Summary

- The Putnam Premier Income Trust pays an 8.8% distribution yield but only earns 10-year average annual returns of 2.1%.

- The fund, which has $370 million in assets, also has an unusually high turnover rate of over 1600%.

- The author recommends that investors avoid the PPT fund and other similar 'return of principal' funds, as they risk losing both principal and income in the long term.

MicroStockHub

Readers often ask why I am so negative on closed-end funds. The problem I find is that many closed-end funds lure unsuspecting investors with high distribution yields that are not supported by the fund's returns. Investors end up losing out in the long-run after many years of NAV declines and shrinking distributions.

While other analysts may turn a blind eye and write bullish articles touting these '8% yields to fund my retirement', my conscience demands I shine a light on funds that do not earn their distribution yields when I come across them.

The Putnam Premier Income Trust (NYSE:PPT) is a classic example of one of these amortizing 'return of principal' funds. It promises a monthly distribution that yields 8.8%. However, it has a 10Yr average annual return of only 2.1%. The distribution is clearly unsustainable.

I recommend investors avoid the PPT fund and other similar 'return of principal' funds.

Fund Overview

The Putnam Premier Income Trust is a closed-end fund ("CEF") that aims to deliver high current income from a diversified portfolio of fixed income securities. The PPT fund allocates between U.S. government bonds, high yield corporate securities, international bonds, and asset backed securities.

The PPT fund dynamically allocates risk exposures rather than having set sector exposures and actively manages its duration risk.

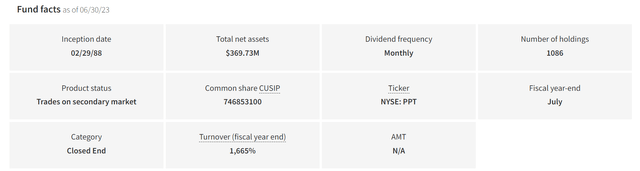

The PPT fund has $370 million in assets and charged a 0.96% expense ratio in fiscal 2022.

Portfolio Holdings

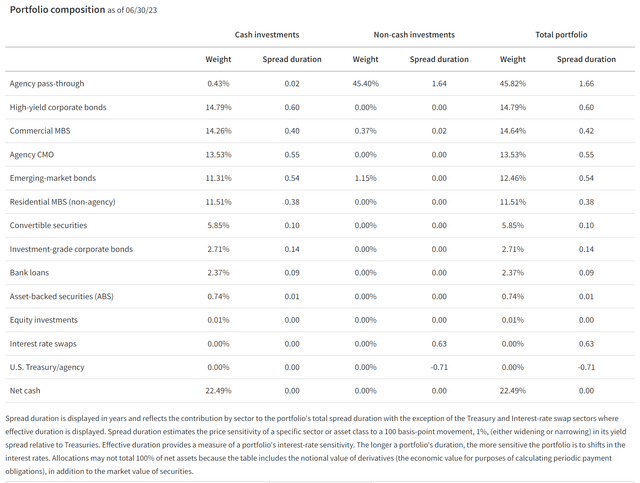

Figure 1 shows the PPT fund's sector allocation as of June 30, 2023. The PPT fund has 45.8% allocated to Agency pass-through securities, 14.8% in high-yield corporate bonds, 14.6% in CMBS, 13.5% in agency CMO securities and 12.5% in emerging market bonds.

Figure 1 - PPT sector allocation (putnam.com)

Three facts stand out about PPT's portfolio. First, investors should note that the sector weights sum to more than 100%. This is indicative of the fund using leverage to 'enhance' returns. Second, the fund quote spread duration, which implies the fund actively hedges away interest rate risk (i.e. buying a corporate bond and hedging out duration to capture the credit spread), as per the fund description above. Finally, the PPT fund had an astonishing 1,665% turnover rate in fiscal 2022 (Figure 2).

Figure 2 - PPT fund facts (putnam.com)

At first, I thought it must be a misprint. However, the figure is repeated in the annual reports. Effectively, PPT's portfolio turns over every 3 weeks! This is one of the highest turnover rates I have seen and is atypical of fixed income funds that I have analyzed.

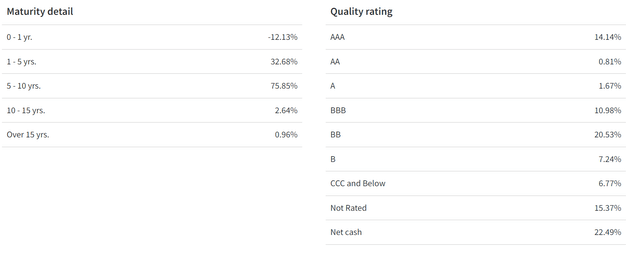

Figure 3 shows the PPT fund's maturity allocation and credit quality allocation. The fund primarily invests in medium term securities between 5-10 years. About 1/4 of the portfolio is rated investment grade (>BBB), with 35% rated non-investment grade and 15% unrated. The fund also has an unusually high cash allocation at 22.5% of the portfolio.

Figure 3 - PPT maturity and credit quality allocation (putnam.com)

Returns

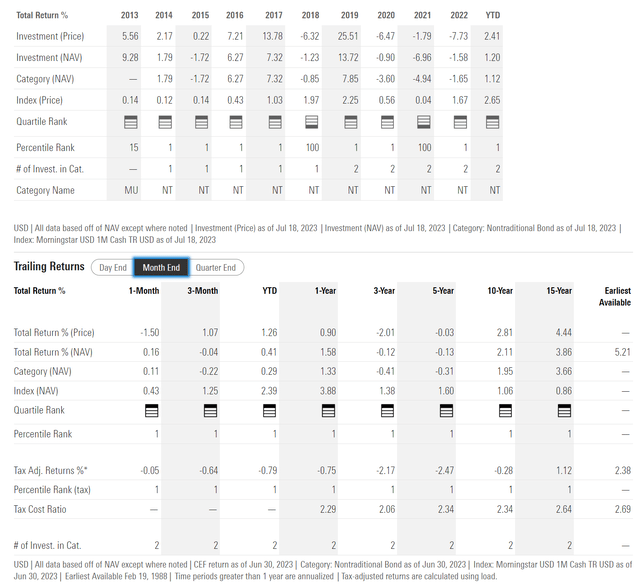

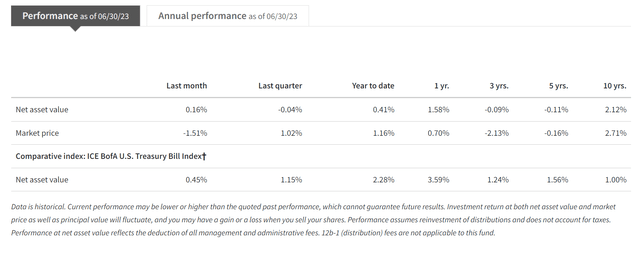

Figure 4 details the PPT fund's historical returns. Unlike other fixed income funds with high portfolio duration, the PPT fund navigated 2022 well, losing only 1.6%. However, PPT's long-term track record leaves much to be desired as it has 3/5/10/15Yr average annual returns of -0.1%/-0.1%/2.1%/3.9% respectively to June 30, 2023. Effectively, the fund had been dead money for 5 years.

Figure 4 - PPT historical returns (morningstar.com)

PPT's performance is incredibly bad when we consider that treasury bills, as measured by the ICE BofA U.S. Treasury Bill Index returned 1.6% over 5 years (Figure 5). So PPT is underperforming cash.

Figure 5 - PPT underperforms cash (putnam.com)

Distribution & Yield

However, despite poor investment returns, the PPT fund maintains a monthly distribution of $0.026 which annualizes to a forward yield of 8.8%. On NAV, the PPT fund is yielding 8.1%.

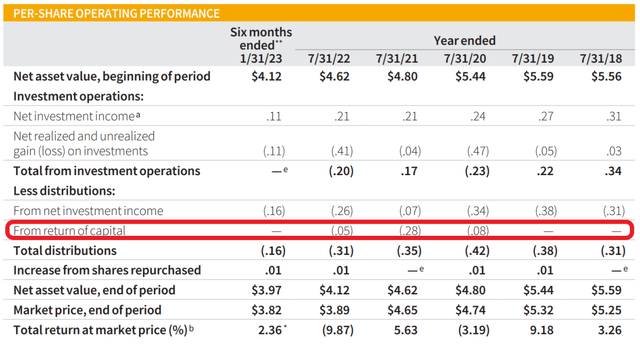

However, given the fund's poor investment returns, I fear the distribution yield is not sustainable. Historically, the PPT fund has utilized return of capital ("ROC") to fund part of its distribution (Figure 6).

Figure 6 - PPT financial summary (PPT semi-annual report)

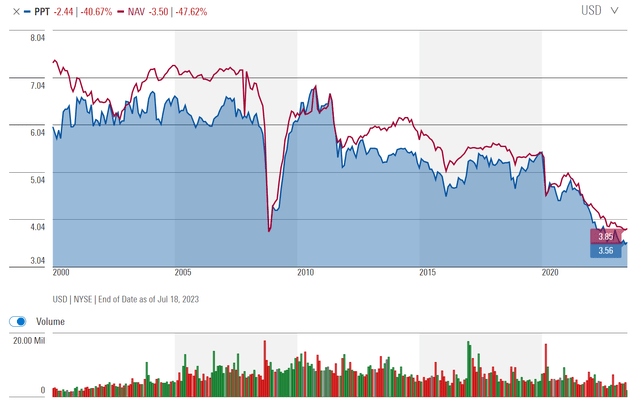

More importantly, the PPT fund shows all the hallmarks of being an amortizing 'return of principal' fund that cannot earn its yield.

Investors in 'return of principal' funds end up losing on both principal, as market price tracks a shrinking NAV, and income, as inevitably, unsustainable distributions are cut.

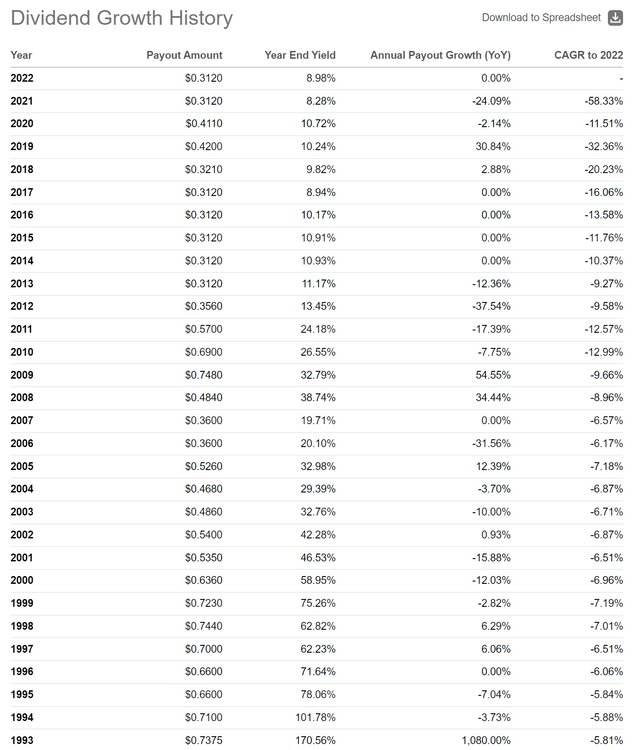

Figure 7 shows PPT's historical NAV and market price while figure 8 shows PPT's shrinking annual distributions.

Figure 7 - PPT historical NAV (morningstar.com)

Figure 8 - PPT historical distribution (Seeking Alpha)

Conclusion

In my opinion, there is nothing 'premier' about the Putnam Premier Income Trust. It appears to be a classic example of an amortizing 'return of principal' fund where investors are lured with an attractive distribution yield that is not supported by the fund's earnings. The PPT fund pays 8.8% but earns only 2.1% over 10 years. Long-term investors end up losing both principal and income when they invest in 'return of principal funds'. I would avoid the PPT fund.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.