ANZ Group: Shelter From The Australian Banking Storm

Summary

- Amid an increasingly competitive banking environment in Australia, ANZ Group stands out.

- While the bank isn’t immune from retail headwinds, its skew toward the institutional side offers valuable support to the P&L.

- At the current relative discount to the other major Australian banks, ANZ is worth a look here.

Philhillphotography/iStock Editorial via Getty Images

Major Australian bank ANZ Group (OTCPK:ANZGY), like its peers, has predictably benefited from the Reserve Bank of Australia's (RBA) tightening cycle, posting expanded net interest margins across its consumer and institutional businesses. But with Australian homeowners nearing a 'mortgage cliff' (i.e., the point where a big chunk of mortgage rates reset) and deposit competition heating up, ANZ stands out for its lower Australian retail banking exposure (vs. institutional). Having transitioned its institutional lending operation into a leaner return-focused division (as reflected in the rising returns as a % of risk-weighted assets) with best-in-class asset quality, ANZ screens favorably ahead of potential banking turbulence. Also positive is its relative overweight on New Zealand banking, where the asset quality of the mortgage book is less of an issue due to the substantially higher % of fixed-rate loans.

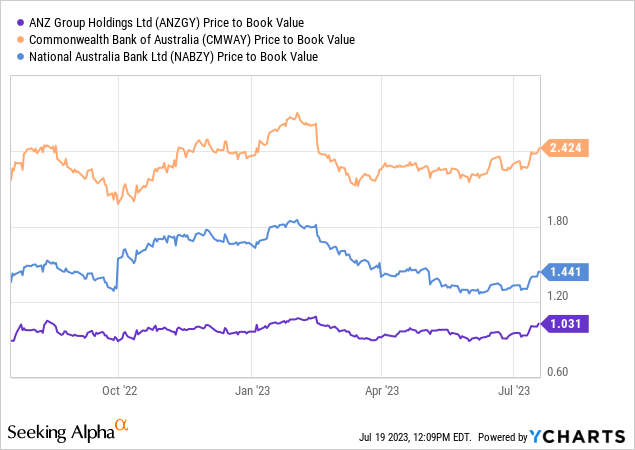

Yet, ANZ trades at a relative discount to the other major Australian banks at ~1x book, presenting a potential re-rating opportunity from here. The upcoming decision by the Australian competition regulator on the proposed ANZ/Suncorp Bank merger is a potential catalyst - per the independent expert report, a 'no' outcome is likely on the cards, and that should free up >110bps of capital currently on hold for the acquisition.

A Picture of Resilience as Mortgages Reset Significantly Higher

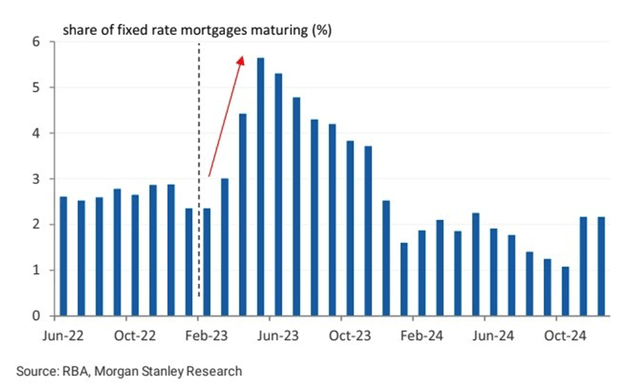

Despite going through a steep tightening cycle, Australia has seen its property prices remain resilient through the headwinds. Per CoreLogic data, house prices in the five capital cities (Sydney, Melbourne, Brisbane, Adelaide, and Perth) rose yet again in July, bringing the YTD figure to +3.5%. Similarly, May data from the Australian Bureau of Statistics showed a rebound in new loan commitments at +4.8% for housing (+4.3% for personal fixed-term loans). While bullish on the surface, I wouldn't underwrite a sustained improvement in house prices or credit growth just yet. Instead, I would focus more on the fixed rate mortgage reset (also 'mortgage cliff'), which has only just started to really kick in last month. Monetary policy works with a sizeable lag, so we likely haven't seen the full effect of monetary tightening as its transmission to the real economy gains pace. The RBA is similarly cautious - having continuously hiked throughout the year, the central bank is on pause this month, citing "considerable uncertainty surrounding the economic outlook."

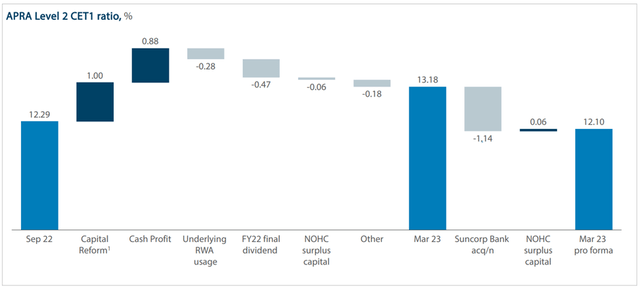

Either way, ANZ is one of the best-positioned Australian banks ahead of the fixed-rate adjustment. Per its H1 2023 results, the bank has sustained minimal bad debts (as a % of gross loans) and a continued decline in group net loans and advances past due. At ~13%, the capital position is also industry-leading, mainly a result of the +100bps benefit from this year's banking sector capital reforms due to its higher institutional mix. While >110bps of capital is currently being held back for the Suncorp bank deal, the pro-forma CET1 still amounts to a solid ~12%. In the event that the deal falls through (likely given the recent Australian Competition and Consumer Commission (ACCC) pushback), the bank would be equipped with an even bigger capital buffer as well. Alongside its relative insulation from the household lending business, which faces an increasingly competitive deposit landscape in addition to asset quality risks, ANZ screens favorably.

Suncorp Deal Falling Through but More Positives Than Negatives

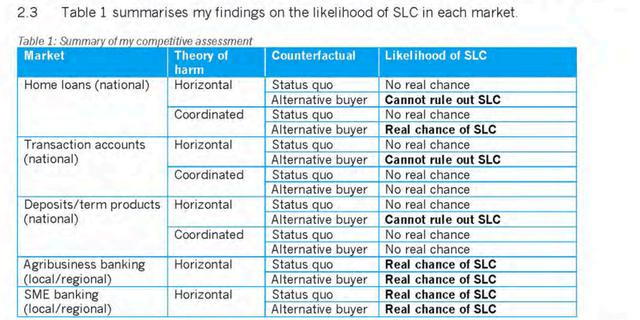

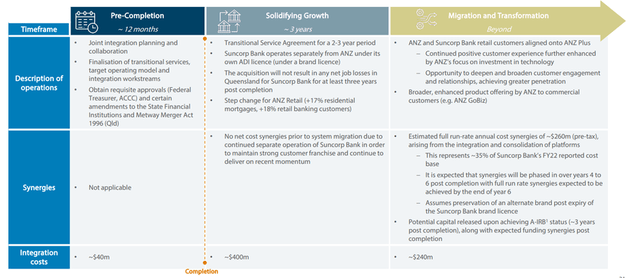

Having long trailed its peers on the growth of its retail loan book, ANZ is attempting to address its lack of scale in this area via the A$4.9bn acquisition of Suncorp Bank, a regional Queensland-based franchise. But since announcing the deal in July last year, ANZ has run into some major hurdles - not only from competing regional Bendigo and Adelaide Bank but also the ACCC. If the competition regulator's published independent expert reports are anything to go by (see graphic below noting the potential for a 'substantial lessening of competition' or 'SLC' for several key market categories), the ANZ/Suncorp tie-up is set to be challenged on anti-competitive grounds.

Ironically, shareholders could come out ahead from a deal-break scenario. Per ANZ management, the deal is expected to yield A$260m of pre-tax synergies by the end of year six, but realizing this will also entail massive integration costs of ~A$40m upfront, ~A400m in the next three years, and another ~A240m beyond that. The deal economics also rests on getting all of Suncorp's 1.2m customers onboard the digital banking platform ('ANZ Plus'), so any post-merger attrition (a likely scenario) will weigh on accretion targets. Finally, a premium 1.3x net tangible asset valuation (vs. Bendigo and Adelaide Bank at ~1x) seems a tad high for a $47bn home loan book, particularly in light of the housing market challenges ahead.

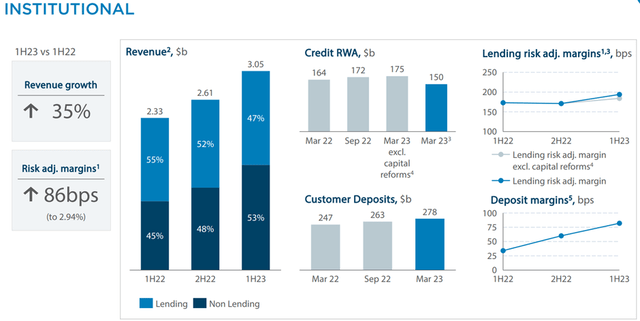

Institutional Focus Shines in a Challenging Retail Environment

In contrast to the other retail-focused banks in Australia, many of which are seeing net interest margin pressures from the liability side, ANZ, helped by its institutional presence, saw its total deposit growth outpace the system in H1 2023. To recap, the bank's institutional deposits were up 13% for the half-year vs. +6% and -3% for Australia retail and commercial, respectively. Alongside its lending momentum, net interest margins expanded to 1.75% for the half-year (1.83% excluding markets and treasury). Expect deposit competition to only further intensify as we move closer to the September 2023 and June 2024 maturities for the RBA's Term Funding Facility ('TFF'), particularly on the retail side. In this regard, ANZ's relatively low TFF repayment, having drawn the least of the major banks, as well as its outsized exposure to the less competitive institutional space, leaves it well-positioned to weather the turbulence.

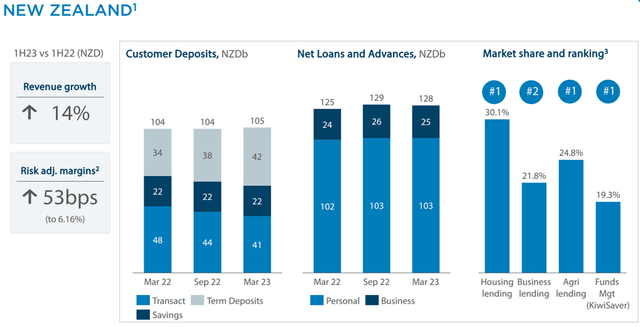

Further boosting ANZ's prospects in the current environment is its institutional presence in the Asian markets (note ~60% of its markets income is from outside Australia/New Zealand), providing it leverage to the higher spread environment overseas as well. In a similar vein, ANZ's presence in New Zealand, where the competitive landscape and housing asset quality risks appear more benign, adds to the bank's resilience. So even in a slower Australian markets scenario, as higher rates start to bite, the ongoing customer franchise rebound likely has legs. Alongside the improving asset quality of its corporate book, ANZ's institutional business offers a valuable tailwind for fundamental outperformance near term.

Shelter from the Australian Banking Storm

Coming off a strong H1 2023 result, ANZ Group looks poised to outperform its sector peers as we move into the latter stages of the RBA's tightening cycle. The key lies in ANZ's business mix, which remains light on consumer lending, where a massive hit to housing asset quality appears to be on the horizon. Instead, ANZ management's pivot in recent years toward a leaner institutional division is paying off, as reflected by its increasing return on RWA. Its geographic diversification into less affected areas like New Zealand also helps, as the higher proportion of fixed-rate mortgages and savings buffers means the risk of asset quality deterioration remains well-contained. At the current relative discount, ANZ's defensives in the face of an Australian 'mortgage cliff' remains underestimated, presenting re-rating potential ahead. Incremental capital benefits from a blocked ANZ/Suncorp merger (the most likely outcome based on the latest ACCC reports) add a timely upside catalyst to the story heading into month-end.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.