Investing Is About Looking Forward, Not Back; We Also Have To Be Realistic

Summary

- We discuss the current investment landscape, focusing on equities, and suggest that future corporate earnings and the macro-environment are more important than past valuations.

- We highlight that the recent market gains are driven by a few tech companies, and for further growth, other companies need to step up or these tech companies need to robustly grow their earnings.

- We also suggest that large-cap U.S. companies with a lot of foreign exposure will probably outperform due to the falling U.S. dollar and warns of the need for structural changes in the developed due to debt loads.

We Are

Main Thesis & Background

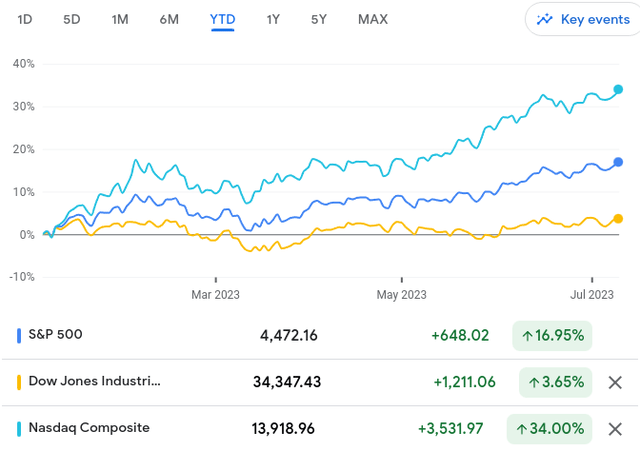

The purpose of this article is to evaluate the broader investment landscape with a particular focus on equities. This is of heightened relevance to me right now for a number of reasons. One, my portfolio is overweight equities so I have a keen interest in whether or not I need to adjust my holdings. Two, the market has been on an impressive run in the short-term. This makes evaluating the potential future returns all the more necessary:

YTD Performance (Google Finance)

Three, we have to remember that volatility has picked up over the past eighteen months. While volatility is low right now - 2022 is not as distinct of a memory as one would like. Markets tumbled last year, only to rise swiftly this year, and that suggests anything could be ahead for the second half of 2023!

What I am going to do for this review is focus on some historical data points, and then detail why these may or may not be the most appropriate metrics for considering where the market will go. We are entering a vastly different investment landscape than we have been in over the last 10-15 years. So a more forward thinking approach is warranted. Still, we have to be realistic in terms of historical norms and how that could impact investor sentiment and the outlook for equity indices. In this light, I will share my thoughts as we move deeper into Q3.

Historical Lookbacks Only One Piece Of The Puzzle

The first point I want to consider is how useful looking at past valuations can be. This is a common attribute investors can consider when deciding if now is a "good" price to buy-in. There is no set formula for when a stock/sector/index is a true buy or not. What is expensive? It is a subjective argument. And that is why we see varying prices for some companies and sectors compared to others. There is no one size fits all approach. So averages and history can guide us, but not necessarily give a concrete answer.

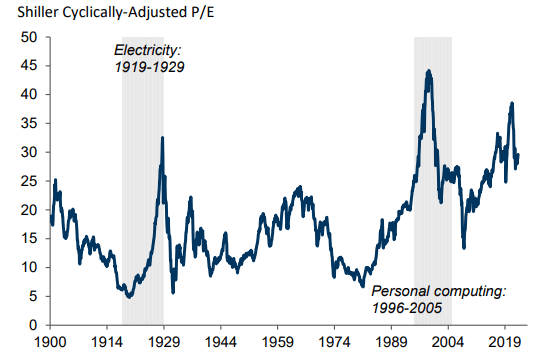

This may sound vague but it has relevance right now. A common benchmark for equity investors is the S&P 500. If we look at the current price to buy the S&P 500, whether it is expensive or not really depends on one's perspective. The current valuation is higher than the average for the past 120 years, but in the shorter term the valuation doesn't seem too outrageous:

Shiller P/E Ratio Over Time (For S&P 500) (Goldman Sachs)

Readers may be asking - so what conclusion can I draw from this? Why is Dividend Seeker highlighting this information?

The simple reason is that it is important because we may not be able to draw a straightforward conclusion from it. That is essentially my whole point. Whether stocks are expensive or not is not clear here. Are they based on the past 120 years? Yes. Are they based on the last 5? No. So which timeframe do we need to use?

My answer to that is perhaps none. What really matters is not past valuations but whether or not U.S. corporations are going to be making more money in the months and years ahead. If earnings go up, or the macro-environment is favorable, or the economy is expanding, then P/E will take care of itself. So evaluating how favorable conditions are going to be for the next few quarters is much more important than trying to decide if stocks are currently expensive based on historical norms. That is the primary message I want to convey here.

Expensive Stocks Are Driving Index Gains

But looking ahead does mean considering where we are now. How realistic are more gains in this market? With inflation easing, a possibility for less Fed tightening, and a recession that remains "delayed" (it is possible it won't even happen this year at all), the macro-outlook isn't terrible. In fact, the labor market is strong, consumer spending remains supportive, and geo-political tensions with Russia and China have moved away from alarmist headlines. This is all good news for equities as a whole.

But we have to be aware of what has been driving the market already in 2023 to understand if more gains are really sustainable. While the "market" is up big - this is actually being driven by a handful of names - and those are mostly Tech names responsible for the gains. This is why the NASDAQ is up by so much more than the DOW and the S&P 500 as I illustrated in the opening paragraph.

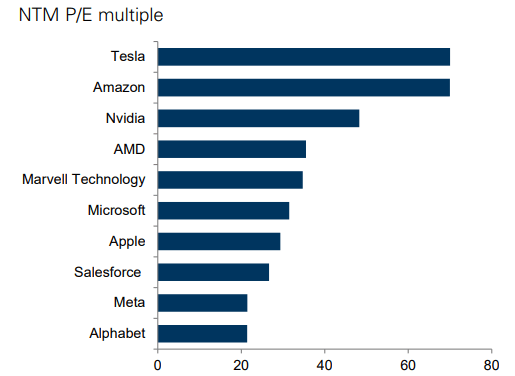

With this in mind, I want to emphasis that these names are nowhere near cheap. The P/E levels are very high for some, and moderately high for others, but none of them are in bargain territory:

Top Market Drivers - P/E Ratios (FactSet)

I takeaway two things from this. One, for indices to go up, these companies need to grow their earnings robustly in order to keep P/E ratios in check. There is a limit to what investors will pay, even for the likes to Tesla and Amazon. Two, if the first point doesn't happen, then we need the other 475+ stocks in the S&P 500 to step up. This has not been a broad market rally and that concerns me that it isn't truly supported. Once we see broader participation, I can see confidence on a go-forward basis. Until then, the future outlook has to be cautious in my opinion.

U.S. Large-Caps Benefit From A Falling Dollar

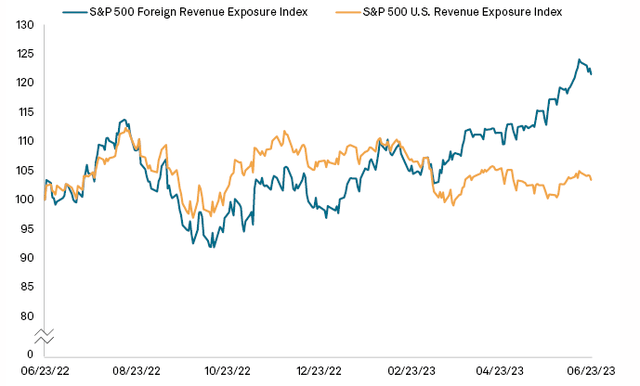

I will now examine a reason why stocks can go higher. And when I refer to "stocks" in this case I mean the S&P 500. I am looking at the large-cap U.S. equity market because that is a primary benchmark and is also the bulk of my personal exposure. So I look at the market from the perspective of: can U.S. corporates perform well both domestically and overseas. Large U.S. corporations often have a fair deal of foreign revenue exposure, so evaluating the global environment is key to U.S. large-cap centric investors (like myself).

One metric to look at to understand this is the value of the U.S. dollar. Despite a general rising rate environment domestically, the U.S. dollar has been falling against a number of world currencies. This has occurred since inflation began to ease in America and expectations for a Fed "pause" began to rise. This has led to a boon for domestic companies with a lot of foreign exposure because those foreign currencies, when converted to US dollars, become worth more. As a result, large-cap companies in the S&P 500 with more foreign revenue have been out-performing their domestic-oriented peers:

Stock Divergence Based on Origination of Revenue (S&P Global)

I do want to manage expectations a bit here. If I am being honest, I am surprised at the drop in the U.S. dollar at a time when interest rates are rising, but that ties back to my title of "looking forward, not back" thesis.

When we look ahead, the fact is the Federal Reserve has likely already enacted its largest increases to benchmark interest rates. This is true even with future rate hikes expected later this year. The big moves are done, and investors are looking forward. In the future, aside from the immediate next few months, interest rates are likely to be lower. At the end of 2023 and in to 2024, the U.S. dollar will remain under pressure as the market begins to price in cuts. Whether those happen or not will remain to be see, but it will impact the equity market on a consistent basis regardless.

From that point of view, large-cap U.S. companies with a lot of foreign exposure will probably out-perform as they have been. This makes me comfortable owning a disproportionate amount of funds like SPDR Dow Jones Industrial Average ETF (DIA), Vanguard S&P 500 ETF (VOO) and the Invesco QQQ ETF (QQQ).

Developed World Is Going To Have To Make Structural Changes

My final thought takes a look at debt levels. This is actually forward-looking despite the data being real-time. What I mean is - debt levels are high and since I expect an elevated rate environment to persist through the remainder of 2023, this has an out-sized economic impact.

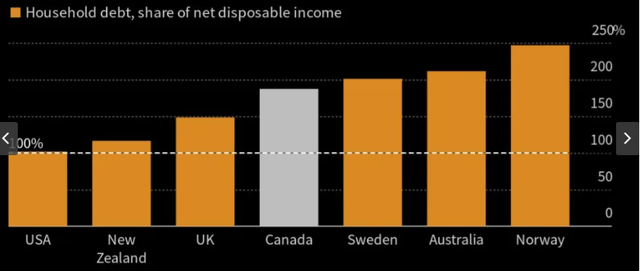

To be clear, this is not unique to the U.S. as other developed countries have the same challenge. Central banks around the world have upped borrowing costs and consumers and households have felt the pinch. Inflation is pushing prices up and higher interest rates make borrowing to pay those higher prices even more difficult to manage. The significance of this on the reality of the world today is shown quite clearly in the following graphic:

Household Debt (Yahoo Finance)

What I draw from this is that change is going to be needed in the future. This is not a sustainable course. Developed names are going to have to find a way to bring down inflation, lower borrowing costs, pump out more stimulus, or some other way to ease the burden to consumers. Developed world households cannot deliver consumption growth with this backdrop. They have been living on prior stimulus, amplified savings rates, and a belief that "in the future" prices will come down. Stimulus has dried up, saving rates are depressed as households dip into prior savings to make ends meet, and central banks are not showing any indication of cutting rates (on average).

For a consumption-driven economy to thrive, this is not a good backdrop. This tells me that I should be monitoring retail/consumer discretionary exposure very closely in the months ahead because - without change - something is going to break.

Bottom-line

The world of investing requires an understanding of the past, but an informed opinion on what the future holds. The future is what will drive returns, so understanding what is going on now that will shape how the world looks over the next few quarters (and years) is of vital importance. In this regard, I see a scenario where stock valuations come under pressure, but large-caps who are overweight with foreign revenue exposure hold up better than others. This is due to my belief that the USD has probably peaked and foreign revenues will help drive profits going forward.

Additionally, yields are also near their peak, although the Fed could move one or two more times on rates. But as inflation eases, there will probably be a lag before treasury yields follow suit. We tend to see the Fed, and by extension the treasury yield curve, be reactionary rather than proactive. This means that while inflation has already started to ease decisively, treasury yields will take longer to come down:

CPI vs. Treasury Yield (Bloomberg)

The impact of this is that consumers (and businesses) will favor higher borrowing costs for the remainder of the year, if not longer. This puts pressure on more discretionary names and also on companies that have less price elasticity with their goods and services. The name of the game will be on quality holdings, selectivity, and amplifying exposure to those names that can benefit from both a falling USD but also who are not priced for perfection (i.e. Tesla). In this way I feel comfortable enough in my long-only equity portfolio, despite the rising market and more challenging economic picture.

Consider the Income Lab

This article was written by

I've been in the Financial Services sector since 2008, which unsurprisingly gives me an invaluable insight in how markets can turn. I was a D1 athlete in college (men's tennis) and my BS and MBA are in Finance.

My readers/followers can trust that I won't pump any investment nor discuss a topic I don't genuinely follow and research. In that spirit, I list my portfolio here for transparency

Broad market: VOO; QQQ; DIA, RSP

Sectors: VPU, BUI; VDE, IXC, RYE; XRT

Non-US: EWC; EWU; EIRL

Dividends: DGRO; SDY, SCHD

Municipals/Debt Funds: NEA, PDO, BBN

Stocks: WMT, JPM, MAA, SWBI, MCD, DG, WM

Cash position: 30%

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QQQ, DIA, VOO, RSP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

1. Yes a few companies have driven growth of the market but for the retail investor if you are stock picking rather than index tracking the opportunity is very different - there are dozens of small to mid cap tech companies achieving huge growth rates YTD and for retail investor these are giving amazing returns. $PAYC and $CRWD would be examples in my portfolio

2. Your thesis that large cap export oriented companies will do well depends on growth in their export markets. The top 3 export markets for US are Canada, Mexico and China so prospects in these markets are key. US exports are also growing strongly to India, due to India being fastest growing major economy (its 5th biggest in world and catching up Germany for 4th place). Therefore I think you need to look at growth prospects in the major export markets. I generally view prospects as strong in EMs but weak in developed markets, which is where bulk of exports go to. So US large cap focused on EMs will do well I think. Overall, world trade is not doing well and growth prospects are not good and I don’t think in general export growth will help large cap that much in the next year or two. The US economic is more dynamic than Europe so domestic growth will drive earnings more than international.

3. I think your argument can actually be better applied to other country stock markets as they are far more export oriented. The U.K. is a good example with stocks near historic lows but very export oriented companies. If one believes China will recover and India will suck in imports while the US escapes recessions I think U.K. stocks and other country stocks with high exports will do well. Also with very low valuations in U.K. as an example if one believes the worst is over there could be substantial upside. I for one am loading up on U.K. mining and financial services stocks