Blackbaud: Don't Get Greedy

Summary

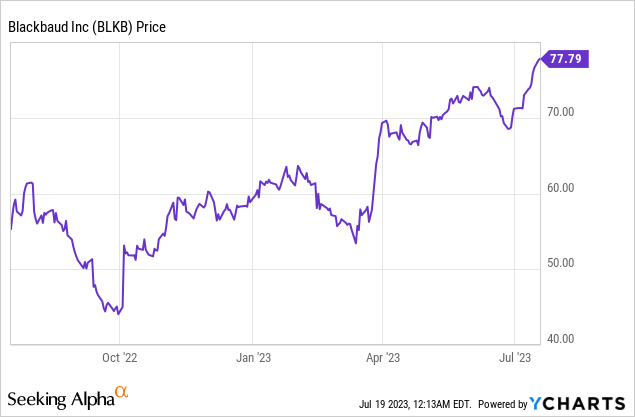

- Shares of Blackbaud have soared 30% year to date, despite weak fundamental performance.

- The company achieved a "beat and raise" in Q1 on low expectations, but don't forget that organic growth is still clocking in the low single digits.

- High debt levels will cap Blackbaud's ability to use M&A to pursue future growth opportunities.

- Over time, more shares will likely shift out of BLKB and into more mainstream CRMs like Salesforce.

SDI Productions/E+ via Getty Images

It's a commonplace saying: don't count your chickens before they hatch. Such is the case in the stock market as well; we shouldn't take one strong quarter of performance in a struggling company to signify a turnaround. Especially in this risk-averse market environment with the S&P 500 trading at YTD highs, it's time to be choosy in stock-picking.

Year to date, shares of Blackbaud (NASDAQ:BLKB) are up 30%. This donations management and social benefit-focused CRM provider is spinning up a turnaround story based on stronger Q1 performance, driven by a combination of stronger sales productivity plus a revised renewal pricing plan.

In spite of recent upside, I'm firmly holding a bearish opinion on Blackbaud. My top concerns on the company still remain:

- Blackbaud is a software company with low single-digit organic growth, and in the software space low growth is usually a short step away from obsolescence

- The company also competes with more generalized CRM platforms like Salesforce (CRM). From a buyer perspective, the very real possibility that Blackbaud faces financial difficulty and can't support / provide software updates a large upfront IT investment may be a compelling reason to choose a sturdier competitor

- Blackbaud is also still quite indebted, with more than $1 billion of debt on its balance sheet (versus ~$341 million in expected adjusted EBITDA this year)

It's also worth pointing out that with Blackbaud's recent rally, its previous status as a value stock is diminished. At current share prices near $78, Blackbaud trades at a current-year P/E multiple of 21x based on consensus pro forma EPS expectations of $3.76 this year (data from Yahoo Finance).

Blackbaud's current market cap is $4.19 billion, and after netting off the $24.1 million of cash and $878.1 of debt on the company's latest balance sheet, the company's resulting enterprise value is $5.04 billion.

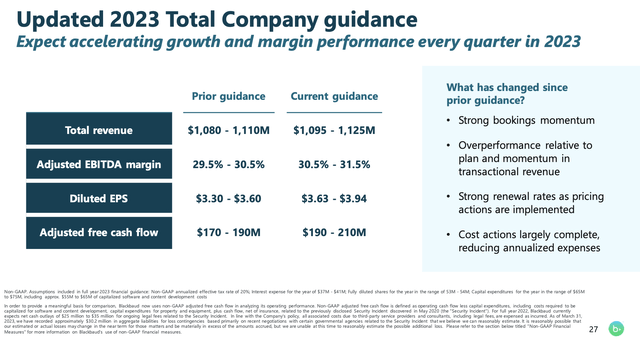

Meanwhile, for the current fiscal year the company has guided to ~$341 million of adjusted EBITDA at the midpoint of its margin and revenue ranges, which are slightly boosted from the company's initial 2023 outlook.

Blackbaud outlook (Blackbaud Q1 earnings deck)

So from an adjusted EBITDA standpoint, Blackbaud's valuation multiple stands at 14.8x EV/FY23 adjusted EBITDA - again, not quite cheap for a company with very limited growth prospects.

The bottom line here: don't buy into the "head fake" here. Blackbaud is experiencing a dead cat bounce, in my view, based on a single quarter of performance that wasn't truly great, but just not as terrible as prior quarters. Stay on the sidelines and invest elsewhere.

Q1 download

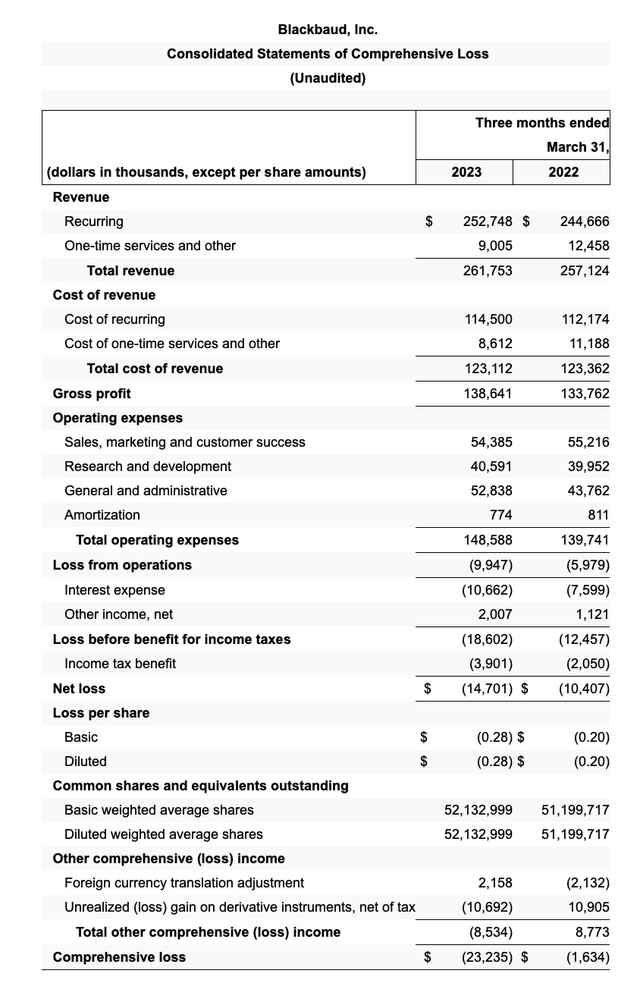

Let's now go through Blackbaud's latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Blackbaud Q1 results (Blackbaud Q1 earnings deck)

Blackbaud's revenue in Q1 grew just 2% y/y to $261.8 million, beating Wall Street's expectations of $261.0 million (+1% y/y) but decelerating from 11% y/y growth in Q4, driven by now lapping past year acquisitions - as a reminder here, Blackbaud is heavily reliant on M&A to drive growth, and one key risk for the company that investors should be aware of is that its balance sheet leverage limits its ability to chase M&A opportunities down the line.

Still, organic growth - stripping out the impact of acquisitions both this year and in the prior year - saw 170bps of sequential improvement from 1.7% y/y in Q4 to 3.4% y/y in Q1, which is the major catalyst behind the guidance boost and stock upside.

Blackbaud Q1 performance drivers (Blackbaud Q1 earnings deck)

This was driven by a combination of sales rep productivity gains driving higher bookings, higher transactional (donation-based) revenue streams, and a renewal pricing strategy update that has driven strong renewal rates.

Speaking on the impact of the renewal policy changes on the Q1 earnings call, CEO Mike Gianoni noted as follows:

Following the implementation of our five point plan last summer, we put in place an updated pricing policy that directly reflects the value we provide to customers is in line with the broader market and reflects the inflationary pressures that all businesses are facing.

In November of last year, we started notifying customers with a March 2023 contract renewal that we'd be making two important contract changes. First, we'd be offering a three year contract renewal terms as our standard, replacing one year renewal terms. This process was already being implemented outside of the pricing changes. Second, we'll be implementing a more material rate increase on the one year option versus the three year option. And third, the three year option includes annual rate increases that will compound. For context our three year options did not historically include annual compounding rate increases.

You can think of the rate increase for year one of both the one year and three year renewals as catch up in nature with a subsequent annual rate increases in years two and three as above inflation. Through April, we have already renewed over 25% of the customers that are up for renewal in our 2023 cohort. In terms of our process, we notify customers about five months in advance of their renewal expiration date and we require contract changes 45 days ahead of that renewal date.

So we have very good visibility into the coming months. In fact, we have largely completed the contract renewals through mid-June and have notified customers of the rate increase through the end of September and are now working into October."

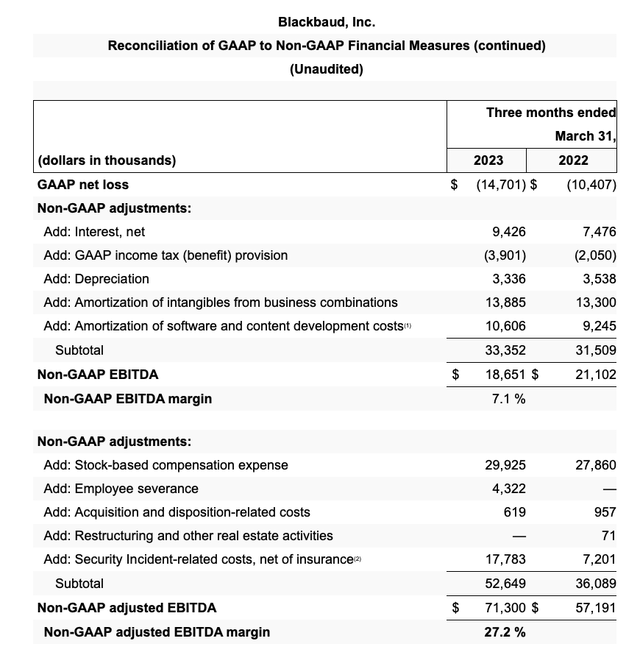

Profitability improved as well, with adjusted EBITDA growing 25% y/y to $71.3 million and representing a 27.2% margin, versus a 22.2% margin in the year-ago quarter. This was driven primarily by a 14% reduction in headcount that the company had been embarking on since the back half of 2022.

Blackbaud adjusted EBITDA (Blackbaud Q1 earnings deck)

Key takeaways

I'm hesitant to believe that a two-point acceleration in organic growth rates, and a relatively minor one-point y/y boost in revenue guidance for the year, merits Blackbaud's ~30% stock price rise since the past quarter. Outside of short-term execution changes, this company doesn't have a bright long-term future and a ~21x P/E certainly doesn't compensate for that risk. Steer clear here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.