Science Applications International: A Solid Buy With Growth Potential

Summary

- Science Applications International Corporation has had a promising start to the fiscal year with a pro-forma revenue increase of 3.5%, reaching $2 billion, and a robust pipeline and backlog of proposals.

- The company's outlook for the rest of the fiscal year is steady, targeting a low to mid-single digit expansion rate, and an adjusted EBITDA margin prediction of 9.2% to 9.4%.

- Despite potential volatility in cash flows and an impending leadership transition, SAIC's promising outlook, consistent dividend policy, and strong past performance contribute to "Buy" rating.

BlackJack3D

Thesis

Science Applications International Corporation (NYSE:SAIC), a prominent provider of technical, engineering, and enterprise IT services, continues to exhibit a robust business model backed by a diverse array of offerings and a substantial client base. In my analysis, I point out their promising start to the fiscal year, evidenced by encouraging Q1 financial results and optimistic growth projections, and how it underscores the company's strong financial health which culminates into a comprehensive review of SAIC's performance, valuation, risks, and future outlook, ultimately suggesting a "Buy" rating for the stock.

Company Profile

Science Applications International Corporation is a multifaceted player in the field of technical, engineering, and enterprise IT services, with a core focus on the US market. The array of offerings that the company presents is comprehensive, spanning from engineering to technology integration, modernizing IT infrastructure, maintaining ground and maritime systems, logistics, and training and simulation services.

Overall, their data management platform solutions stand out as a key strength, as they offer an increasingly essential service in our ever-growing digital landscape. Their diverse client base includes not only the entirety of the U.S. military (Army, Air Force, Navy, Marines, and Coast Guard) but also various Department of Defense agencies, Space Development Agency, NASA, the State Department, the Department of Justice, the Department of Homeland Security, U.S. Department of Treasury and a slew of intelligence community agencies. Furthermore, they also serve various U.S. federal civilian agencies, displaying an impressive reach across multiple sectors.

Promising Start to the Year

Let's check in first with Science Applications International's latest financial results. Overall, the key takeaway on the conference call was expressed optimism for future growth following a strong Q1 performance. Key highlights include a pro-forma revenue increase of 3.5%, reaching $2 billion, which they expect to increase further in Q2 and Q3. The company's EBITDA margin was 9.3% for the quarter, with plans to improve margins by at least 50 basis points in FY24, driven by portfolio shaping and organic initiatives.

SAIC's net bookings included $766 million from the re-awarded DCSA One IT program, which has started ramping up, while the TCloud contract was not included. Their pipeline and backlog of proposals remain robust, with a 10% YoY growth in submitted proposal values, at $26 billion, and an 8% YoY increase in their total qualified pipeline.

Half of their contract award pipeline is focused on higher-margin GTAs, indicating strategic alignment towards profitability. Their talent retention and acquisition metrics show positive trends, outpacing the industry average turnover rate and surpassing their yearly plan for new hires.

Q1 free cash flow was $76 million, better than planned, maintaining the cash collection momentum from FY23. This figure is expected to fluctuate in FY24 due to payroll cycle timing, presenting an approximate $100 million challenge in Q1, expected to reverse in Q2, then again pose a challenge in Q3, before turning beneficial in Q4. The Q1 adjusted diluted earnings per share of $2.14, bolstered by strong operating performance and a lower tax rate, also signal a positive start to the year.

Outlook

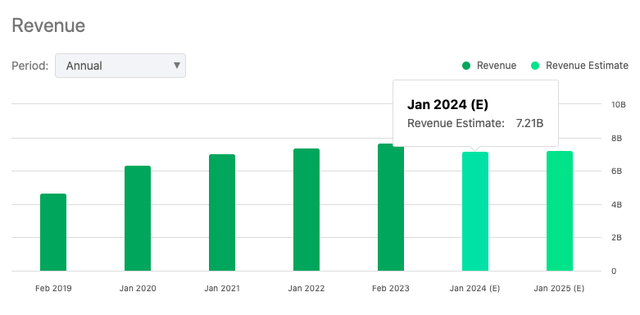

Science Applications International Corporation has upped its forecast (something we may expect to see reiterated - or updated? - in their next Q2 report slated to be released on August 30) for annual revenue, with the expected range now pegged between $7.125 billion and $7.225 billion.

That's a commendable 4% YoY increase, an optimistic revision buoyed by a stellar performance from their supply chain arm (to the tune of $35 million in Q1) and a further $15 million courtesy of other sectors within the enterprise.

The company's growth map for the rest of the fiscal year is notably steady, targeting a low to mid-single digit expansion rate. And even though the company's opening gambit this year has been impressive, SAIC continues to hedge its bets with an adjusted EBITDA margin prediction sticking to the 9.2% to 9.4% corridor. That said, they do envisage possibilities for broader margin enhancements down the line. An impressive operational scorecard and anticipated reductions in interest expenses have nudged the company's adjusted diluted earnings per share forecast upwards, the new figure being $7 to $7.20.

The company's free cash flow estimates stand pat at a range of $460 million to $480 million, factoring in an estimated $350 million to $400 million earmarked for share buybacks. A chunky $70 million was already funneled towards share repurchases in Q1, a pace SAIC is keen on maintaining in Q2.

However, these cash flow calculations do sidestep a projected $82 million bill linked to the sale of their supply chain business – a sum which encompasses cash taxes and transaction costs. With these payments likely to appear predominantly in 3Q and 4Q operational cash flow, according to management, they've been left off the forecast to offer investors a cleaner view of the firm's fundamental cash flow strength.

Further, SAIC expects a windfall from this transaction in the second quarter, but this too will be omitted from their adjusted results. Riding on their Q1 successes, the company maintains a bullish outlook on hitting their announced financial goals. This ambitious slate includes robust top-line growth, adjusted EBITDA margins north of 9.5%, and a free cash flow per share hovering around $11 come FY 2026 - all this while adhering to their lean business approach.

Expectations

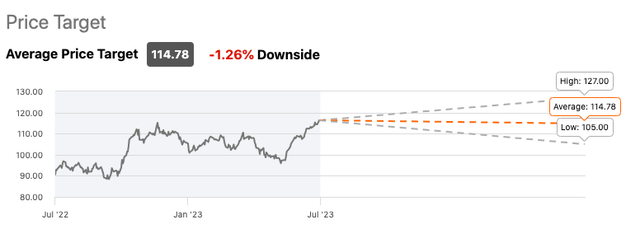

Science Applications International is covered by ten Wall Street analysts marked by a wide range of opinions from "Sell" to "Strong Buy" that culminate into an average "Hold" rating and an uninspiring -1.26% downside price target for the stock.

Performance

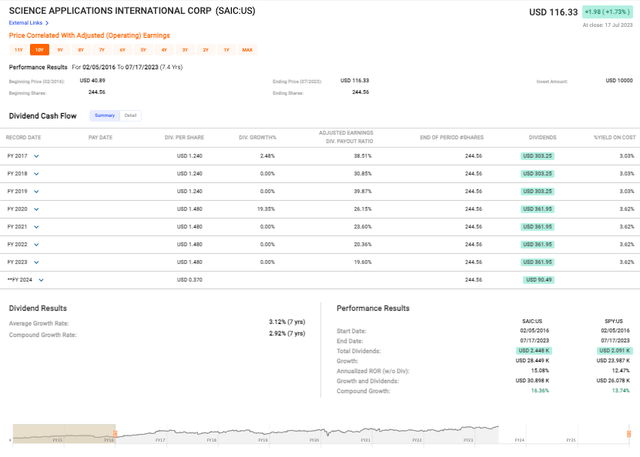

Looking at the data (see below) for Science Applications International's stock performance in the medium-term and you can immediately appreciate the firm's strong track record over the past 7.4 years. The impressive growth is evident, with the stock price catapulting from a mere USD 40.89 in February 2016 to a commendable USD 116.33 by July 2023, representing a return on investment of more than 184%.

SAIC stands out with its consistency of dividend payments; from 2017-2023, their average dividend growth rate over seven years averaged 3.12% with compound growth rates of 2.92% over that same time frame - clearly demonstrating their stable dividend policy.

Also, when we look at the overall performance, including dividends and growth, SAIC has outperformed the S&P 500 Index with a compound growth of 16.36% versus 13.74% over the period. Additionally, the annualized ROR excluding dividends of 15.08% vs. SPY's 12.47% reinforces SAIC's solid performance.

Valuation

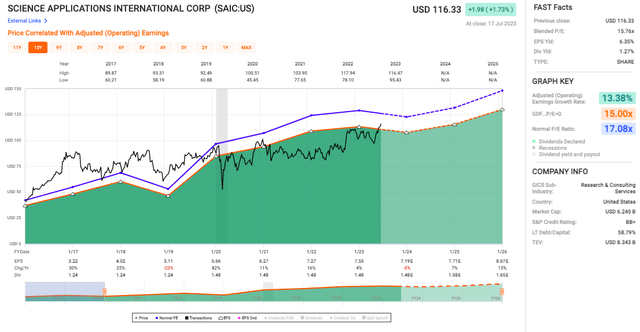

Let's start with the P/E ratio, standing at 15.76x (see chart below). This is marginally lower than the normal P/E ratio of 17.08x. So, is the stock undervalued? I'd lean towards yes. The average investor may view this as a sign to buy, given that it's potentially underpriced compared to historical valuations.

The Earnings Per Share [EPS] Yield is a healthy 6.35%. So, another tick in the 'positives' column for SAIC. And growth? The Adjusted Earnings Growth Rate is a respectable 13.38%. This suggests that SAIC's earnings are on a strong growth trajectory, which is definitely a good sign for investors who are looking for long-term growth and stability.

Risks & Headwinds

Let's start off with the company's cash flow timing, a factor that many might underestimate. For FY '24, SAIC has made it clear that the payroll cycle timing will impact its cash flow. This means we might see considerable variability in their quarterly cash flows. Volatility in cash flows can challenge liquidity management and possibly affect the company's ability to meet its short-term obligations and investment opportunities.

Then, of course, there are the macro risks. Even though SAIC has kicked off the year with strong results, they themselves have highlighted potential industry-wide risks. We're living in a highly unpredictable and rapidly changing global economy. Risks related to trade tensions, geopolitical instability, or changes in government spending can all become a thorn in the company's side. The question remains: how resilient is SAIC in the face of these potential headwinds?

Lastly, we're on the brink of a significant change in SAIC's executive leadership. Nazzic Keene, the CEO, is scheduled to retire, passing the reins to Toni Townes-Whitley. Any change at the top tends to be accompanied by uncertainty. While Townes-Whitley undoubtedly brings her own strengths to the table, the transition period can be rocky. It'll be interesting to see how this change in leadership impacts the strategic direction, operations, and, ultimately, the financial performance of the company.

Final Takeaway

Based on the data provided, I would rate the stock of Science Applications International Corporation a "Buy." The company's strong start to the year, with encouraging top-line growth, optimism for future growth, and a robust pipeline and backlog of proposals, signifies an upward trend. SAIC's recent contract wins with their diverse client base further provides stability and opens room for more growth. Overall, despite potential volatility in cash flows and the impending leadership transition, the company's promising outlook, consistent dividend policy, and strong past performance contribute to my "Buy" rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SAIC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.