Ferrari's Premium Valuation Explained

Summary

- In this article, I will try to explain why Ferrari N.V. has a very rich valuation and why long-term investors should not fear it.

- The very high valuation of the company is in its maintenance of high margins compared to other peers against the background of a general decline in the industry.

- However, the upside potential I calculated [~15%] seems quite low given the numerous risks surrounding the stock.

- Looking for a helping hand in the market? Members of Beyond the Wall Investing get exclusive ideas and guidance to navigate any climate. Learn More »

Brandon Woyshnis

In this article, I will try to explain why Ferrari N.V. (NYSE:RACE) has a very rich valuation and why long-term investors should not fear it.

The Company's Expensiveness Explained

Founded in 1947 and headquartered in Maranello, Italy, Ferrari N.V. is a $59-billion market cap company that specializes in the design, engineering, production, and sale of luxury performance sports cars worldwide. They offer a variety of car models, including range, special series, Icona, and supercars, as well as limited edition and one-off cars.

Ferrari's FY2022 IR presentation

Additionally, they provide racing cars, spare parts, engines, and various after-sales services such as repairs, maintenance, and restoration. The Ferrari brand is also licensed to other luxury and lifestyle goods producers and retailers. The company operates museums, restaurants, and theme parks related to the Ferrari brand. They offer finance and leasing services, manage racetracks, develop and sell apparel and accessories, and operate both franchised and owned Ferrari stores. The company distributes its products through authorized dealerships and its website.

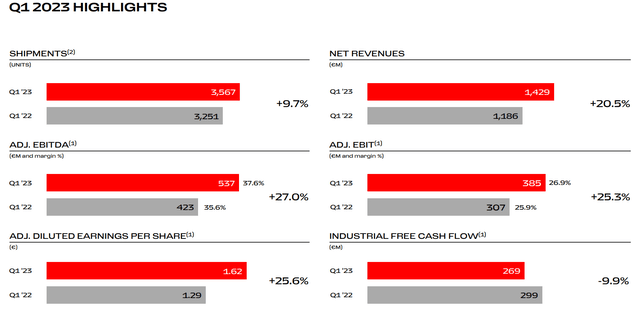

Despite seemingly hard macro conditions, Ferrari announced excellent results for Q1 FY23, with double-digit growth and record-breaking levels in some main financial indicators. They saw a 9.7% YoY increase in total shipments, reaching 3,567 units compared to the same period in FY2021. Net revenues rose by 20.5%, totaling €1,429 million. Ferrari's adjusted EBITDA increased by 27% to €537 million, resulting in an impressive EBITDA margin of 37.32%. Adjusted EBIT showed a growth of 25.3%, reaching €385 million, with an adj. EBIT margin of 26.75%. Net profit amounted to €287 million [NI margin = 24.26%], and diluted adj. EPS stood at €1.62 [+25.58% YoY].

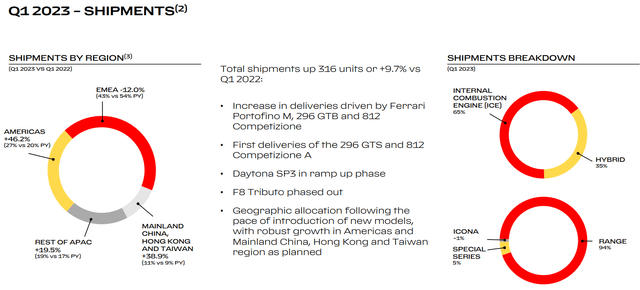

As far as I can tell, Ferrari is actively building up lost sales in Europe by increasing deliveries in high-growth markets - especially Asia and North America, where demand for Ferrari's hybrid cars is soaring:

The Ferrari brand is proving to be more resilient than ever in the current period of deteriorating macroeconomic conditions in the world. Seemingly the management team is targeting affluent customers who have a more stable purchasing power enabling RACE to sustain sales even during a recession. Generally, luxury products offer a perceived value of exceptional quality and craftsmanship, providing a sense of longevity and durability that consumers seek in uncertain times - perhaps this is the explanation for the margin strength of RACE's business despite macro headwinds.

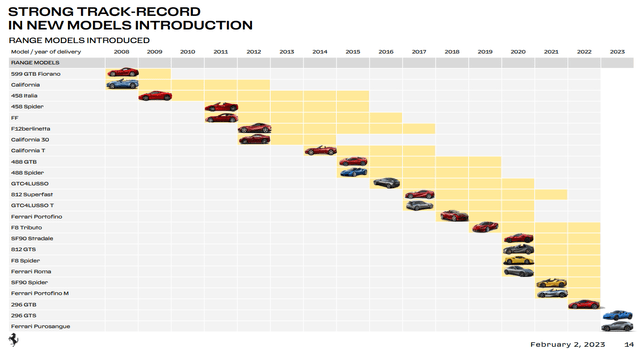

Ferrari's management is doing a great job in employing various strategies to leverage the increasing customer demand. First off, as it follows from the Q1 FY23 press release, they introduced a new organizational structure focused on nurturing the brand's exclusivity, enhancing product excellence, and aiming for carbon neutrality by 2030. This should allow the company to keep up with the general EV trend and maintain its reputation in developed countries (and not only).

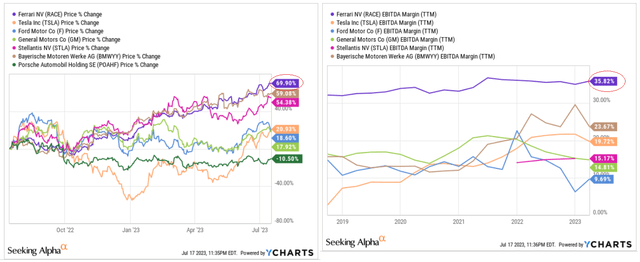

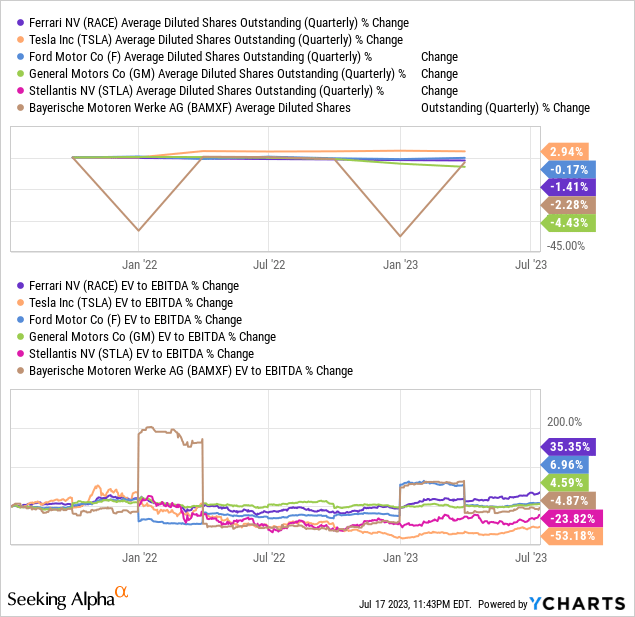

So the first reason for the very high valuation of the company is the maintenance of high margins compared to other car manufacturers against the background of a general decline in the industry:

YCharts, author's notes Seeking Alpha, RACE and its peers [author's notes]

![Seeking Alpha, RACE and its peers [author's notes]](https://static.seekingalpha.com/uploads/2023/7/17/49513514-16896527733263838.png)

If you visit the company's official IR website, you will find a wealth of reports on how and in what quantity the firm buys back its shares on the open market. This is the second reason for the widening of the multiple, which helps the stock to rise despite the already high valuation metrics.

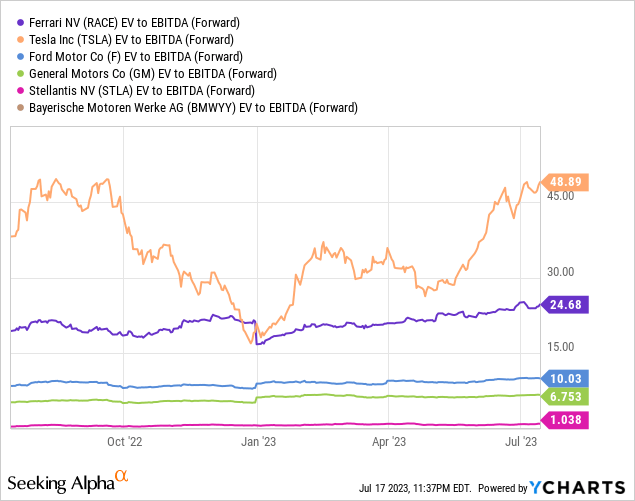

Ultimately, I think investors assess RACE's current margins and compare them to the rapidly declining industry averages. Based on this analysis, they conclude that the RACE stock warrants a significant premium over the industry because its margins expand, not contract. Additionally, the management's commitment to maintaining a favorable return policy for shareholders further strengthens this perspective.

Aside from the fact that RACE's margin appears to be the most stable in the industry, its forwarding growth rates also promise excellent expansion (especially given the size of the firm). Looking at how the Asia and Americas regions have saved Ferrari in recent months, I am willing to believe that these forecast values may actually be a bit understated as the European customers will be willing to come back at some point in time.

Seeking Alpha, RACE and its peers [growth rates], author's notes![Seeking Alpha, RACE and its peers [growth rates], author's notes](https://static.seekingalpha.com/uploads/2023/7/17/49513514-16896521671842895.png)

So What's Next For RACE?

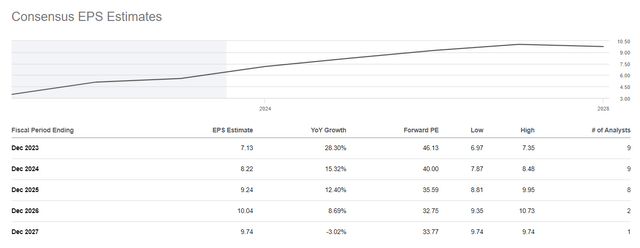

I recently came across forecasts from Morgan Stanley analysts [proprietary source] regarding RACE's EPS figures for FY2023 and FY2024 - both of them are higher than the consensus.

Morgan Stanley [July 7, 2023 - proprietary source], author's notes![Morgan Stanley [July 7, 2023 - proprietary source], author's notes](https://static.seekingalpha.com/uploads/2023/7/17/49513514-16896526088345795.png)

However, according to Seeking Alpha Premium, the consensus numbers are a bit higher today - time is passing quickly, and it looks like the most recent EPS revisions have lifted consensus a bit in the last month.

Seeking Alpha, RACE's EPS estimates

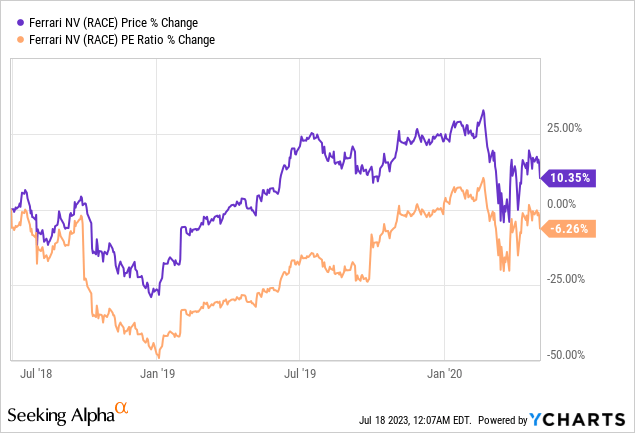

The market is forecasting a multiple contraction - and that is very good. It would be strange if we saw anything else. However, as history shows, it is not wise for investors to worry too much about the stock's momentum. Take, for example, the period when the multiple was declining - from 2H 2018 to 2H 2020 it fell by 6.26%. In the same period, the share rose by over 10%:

Of course, at some point when multiples fell >25%, the stock also corrected sharply. But during the recovery, the stock price rose faster - the company continued to buy shares from the market, and given the company's relative unpopularity in the auto market - compared to Tesla (TSLA) or even Ford (F) - the supply dried up quickly and the stock grew higher and higher on that imbalance.

Right now, the FY 2023 P/E multiple [46.12x] is holding at its local high - I assume it will stay at about the same level a year from now given the unstoppable share buybacks. If RACE earns $8.22 per share under this assumption (the current consensus estimate), then the stock should trade at $379 per share. This calculation gives an upside potential of ~15.3%.

The Bottom Line

RACE is a strong stock because of its momentum, but beyond that, the unidirectional bull move is supported by strong margins and rapid business expansion. All this is happening against the backdrop of a general downward trend in the industry, which can only please Ferrari shareholders.

However, the upside potential I calculated [~15%] seems quite low given the numerous risks surrounding the stock.

First, even if we get why the premium in valuation exists, we should note that the main growth in the stock has been in recent years. Before that, there were clearly long periods of consolidation that lasted several months. Therefore, from a historical perspective, we cannot say that RACE's price is currently protected from a downside.

Second, the automotive market is very competitive. Ferrari has a strong brand and actively uses it - a kind of LVMH Moët Hennessy (OTCPK:LVMHF) among car makers. But demand for such goods is not always sustainable - who knows how high-income customers will react when the current central banks' tightening cycle starts to have a really negative impact on companies' earnings.

Given these risks and against the background of a relatively low upside potential of only 15%, I am issuing a hold recommendation for RACE stock this time.

Thanks for reading!

This article was written by

The chief investment analyst in a small family office registered in Singapore, responsible for developing investment ideas in equities, setting parameters for investment portfolio allocation, and analyzing potential venture capital investments.

A generalist in nature, common sense investing approach. BS in Finance. The thesis description can be found in this article.

During the heyday of the IPO market, I developed an AI model [in the R statistical language] that returned an alpha of around 24% over the IPO market's return in 2021. Currently, I focus on medium-term investment ideas based on cycle analysis and fundamental analysis of individual companies and industries.

Get a free 7-day trial +25% off for up to 12 months on TrendSpider with the coupon code: DS25

**Disclaimer: Associated with Oakoff Investments, another Seeking Alpha Contributor

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.