Zoetis: My Dog Approves Of This Dividend Compounder

Summary

- Zoetis Inc., a leading veterinary health company, is expected to continue delivering strong earnings growth due to its dominant market position and increasing demand for pet and livestock healthcare.

- Despite a low dividend yield of 0.9%, Zoetis' impressive net income growth and steady margin expansion make it an attractive investment for long-term gains.

- The company's future growth is supported by innovation, strong collaborations, and a focus on addressing unmet needs in animal health, making it a compelling choice for investors seeking steady long-term returns.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

PK-Photos

Introduction

Over the last few months, we have discussed a wide variety of healthcare companies in my quest to expand my exposure in this sector. This included large-cap biotech companies, producers of advanced surgical tools, respiratory support companies, and so much more.

One of the stocks I want to highlight again is Zoetis Inc. (NYSE:ZTS), the veterinarian health giant I previously discussed two months ago.

In this article, I want to take a closer look at the company and assess how likely it is that it will continue to deliver outperforming earnings growth. After all, with a dividend yield of just 0.9%, Zoetis is not suitable for income-focused investors.

We need to assess it as a total return investment. With a yield this low, it needs to come with consistent growth to be worthy of an investment.

(Spoiler alert) the good news is that Zoetis is indeed in a terrific spot to continue what it does best: outperforming its peers and delivering anti-cyclical returns for its investors.

So, without further ado, let me give you the details!

The Vet-Health Total Return Star

Before I continue, please note that I wrote an article on IDEXX Laboratories (IDXX) last month. This is a company focused on veterinary health diagnostics and research. If you like ZTS, you may also like that one.

I believe there are three main reasons why I am increasingly interested in veterinarian health.

- Reason number one is a slight bias, as I am a big fan of dogs. So, needless to say, anything that helps to improve their quality of life is something I support.

This is my dog, Kira:

- Reason two is related to number one. As we'll discuss in this article, I'm not the only one who likes pets, as we have never been in a situation where more people opt to adopt dogs, cats, and other companion animals.

- Reason three is about the animals we eat. Given the rapidly growing demand for proteins, especially from emerging middle classes in nations like China and India, it is key to find a way to sustainably raise animals without exposing them to the ever-increasing threat of diseases.

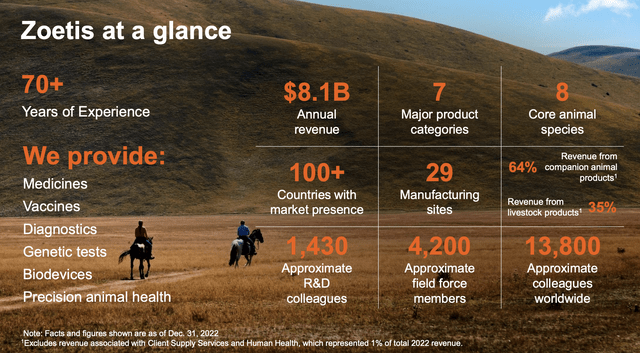

Having said that, Zoetis isn't a niche player. With a market cap of $80 billion, this New Jersey-based drug manufacturer is the world's largest producer of medicines and vaccinations for pets and livestock.

The company was spun off from Pfizer (PFE) in 2013. However, its roots go back to the 1950s when Pfizer started to accelerate investments in agriculture-related areas.

Not only is the company large with the capacity to outspend peers when it comes to R&D, but it is also enjoying a large market share.

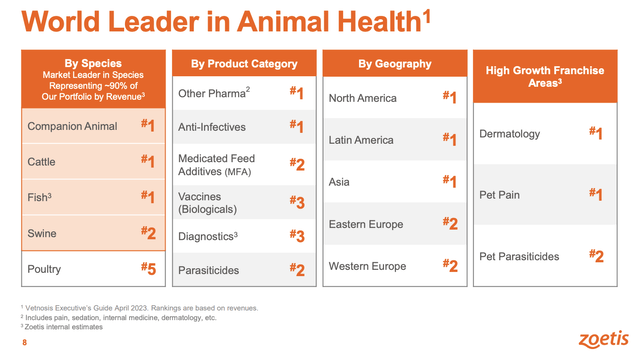

The company has the number one market share in companion animals, cattle, and fish. It's also the largest player in North America, Latin America, and Asia, which I believe are key growth markets.

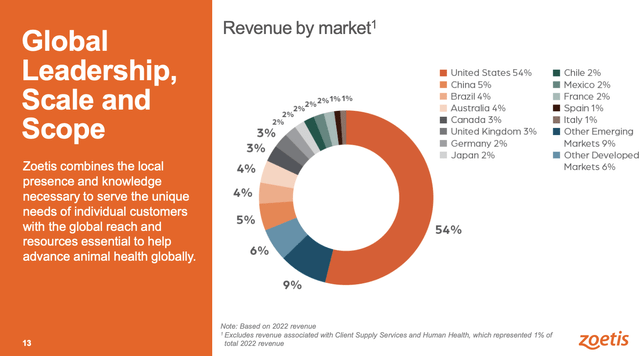

The company's global footprint is well-diversified. The US is its largest market, followed by emerging markets, other developed markets, and China.

With regard to my prior comments, the company sees a number of strong tailwinds that should support its business on a long-term basis:

- Gen-Z and Millennials are fueling the humanization of pets (pets are a part of the family like never before) - I'm guilty of that as well.

- Higher household income supports higher spending on animal care. After all, animal healthcare isn't cheap in most cases.

- It's a somewhat anti-cyclical business, as most people will not spend less on their pets, even if their budget falls by 20%.

- With regard to livestock, the world will have to feed two billion more people by 2050, which increases the demand for proteins and the need to manage issues like health concerns that are often related to the mass production of proteins.

Not only does this sound promising, but ZTS is already reaping the benefits of its great position in this market.

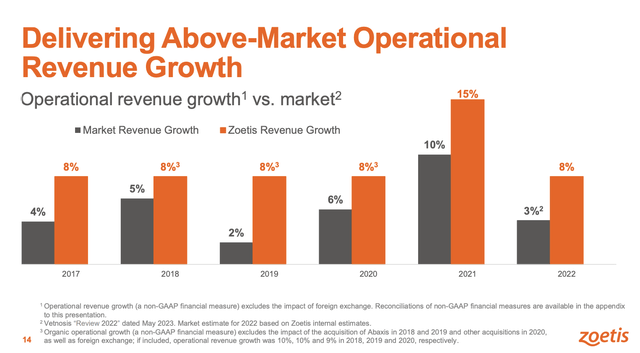

Over the past few years, the company has outperformed its market by a wide margin and on a consistent basis.

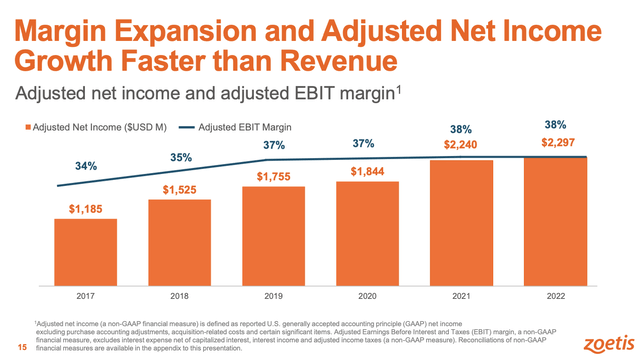

Even better, the company has reported outperforming net income thanks to improving margins. While the margin expansion slowed after the pandemic, the company kept improving its EBIT margin to 38% in 2022, up from 34% in 2017.

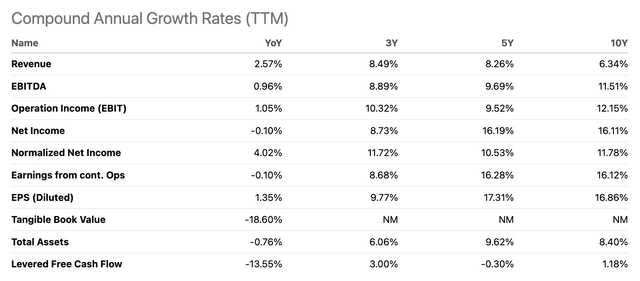

Using Seeking Alpha data, we see that the company has grown its revenue by 6.3% per year over the past ten years. Thanks to higher margins, net income has been compounding at 16.1% per year, which is truly mind-blowing.

Having said that, ZTS has everything to remain a compounder.

This is what it takes to be a compounder, according to Morgan Stanley (MS):

We define compounders as companies with high-quality, franchise businesses, ideally with recurring revenues, built on dominant and durable intangible assets, which possess pricing power and low capital intensity. When evaluating these companies, we focus on franchise quality and durability, financial strength, industry position, and management quality.

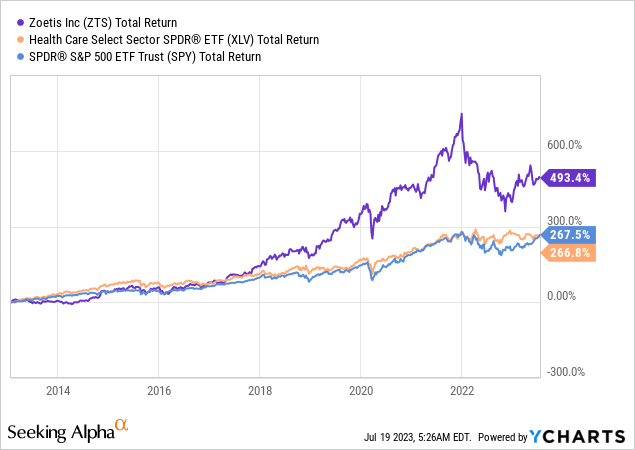

This is confirmed by its stock price. Since its spin-off, the company has returned more than 490%, including dividends. This beats the S&P 500 and the Health Care Sector (XLV) by a wide margin.

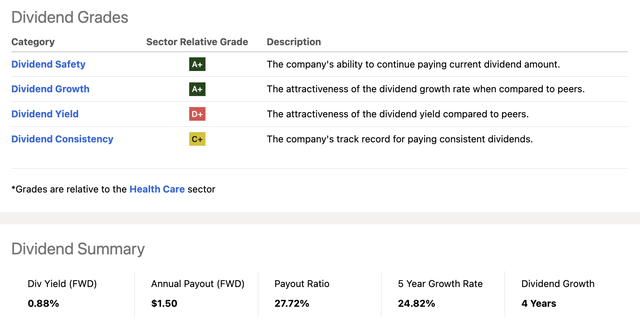

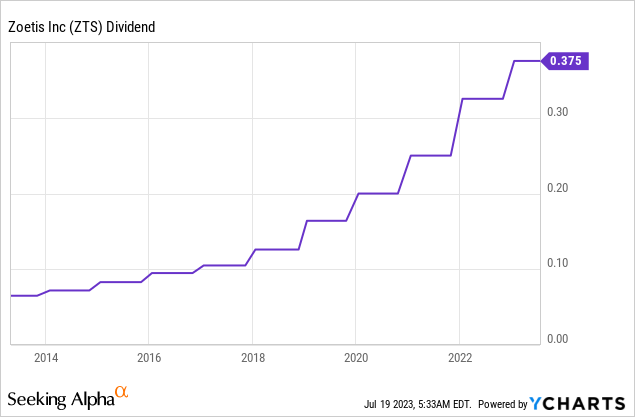

The dividend growth performance isn't bad either.

While the company yields only 0.9%, it has a payout ratio of less than 28% and an average annual dividend growth rate of 25% over the past five years. The most recent hike was 15.4% on December 8, 2022.

This is what the dividend history looks like:

As we already briefly discussed, we cannot make the case that ZTS is a good income vehicle, as even aggressive dividend growth will keep the yield subdued for a while.

Hence, in order to make the case that ZTS is a good investment, the company needs to be able to sustain high earnings growth. If that is the case, we have a tool that (can potentially) quickly boost the yield on cost for its investors with a side of outperforming capital gains.

Why Zoetis Has A Bright Future

During this year's Stifel 2023 Jaws & Paws Conference (what a great name for a conference!), the company elaborated on its future growth plans.

The company clarified that while the market is expected to grow in the range of 4-6%, Zoetis historically has performed 2-6 points above that.

While Zoetis refrained from providing an exact revenue range, the company indicated that its growth is likely to remain above the market's rate.

Zoetis expects to focus on a 3 to 5-year horizon, which should benefit from its pipeline, innovation engine, and collaborations with customers, which have contributed to the company's past and future financial performance.

Another discussion point was whether Zoetis' 300 basis point premium growth above the market would compress in the future.

Zoetis asserted that there is no reason to believe it would. The company highlighted its robust innovation in addressing the greatest unmet needs in animal health, including areas like osteoarthritis pain (OA pain), which they expect to become a $1 billion franchise within the next 3-5 years.

The company also reiterated its guidance for 6-8% operational revenue growth for 2023.

Note that there is a big gap between companion and farm animal expectations.

While farm animal or livestock is expected to be around 0% growth, companion animal growth is anticipated to be around 10-11%, primarily driven by products like atopic derm and Trio.

Farm animal revenues, which account for roughly one-third of total revenues, are suffering from elevated inventory levels, which I expect to turn into a tailwind after 2023.

Also note that growth throughout the year might be impacted by supply recovery timing from 2022, which could lead to some variability in specific aspects of the business.

Nonetheless, Zoetis remains confident in achieving more normalized growth and expects to have consistent performance when considering a 2-year stack, factoring in both year-over-year comparisons and supply recovery impacts.

On top of consistent revenue growth above the industry average, the company is also positive it can continue to grow its margins.

The company sees potential for operating margin expansion as it highlighted several areas of potential leverage, including general and administrative efficiencies, sales and marketing, and positive mix shifts.

Hence, the company expects growth at the bottom line to be 2-5 percentage points above revenue growth, which would mean a continuation of strong earnings growth on a prolonged basis.

Valuation

Finding a company with strong (potential) growth is great. However, the valuation is always a critical part of the thesis. After all, consistently overpaying for great companies is a great way to underperform the market.

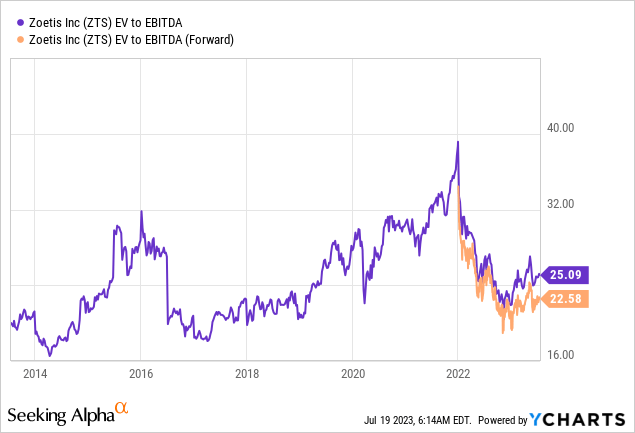

The company is trading at 22.6x NTM EBITDA.

This valuation indicates that it's back at its 10-year median.

While we're now in an environment of elevated interest rates, the company is expected to boost EBITDA growth again. In 2022, EBITDA growth was 3.7%. This year, it's expected to be 3.8%. Next year, it's expected to be 10%.

Especially with the (potential) return of farm animal strength after 2023, I believe the company is in a good spot to maintain high-single-digit annual EBITDA growth.

Although I cannot make the case that ZTS offers deep value, I believe that it's a fairly valued compounder with a high likelihood of long-term outperformance and double-digit dividend growth.

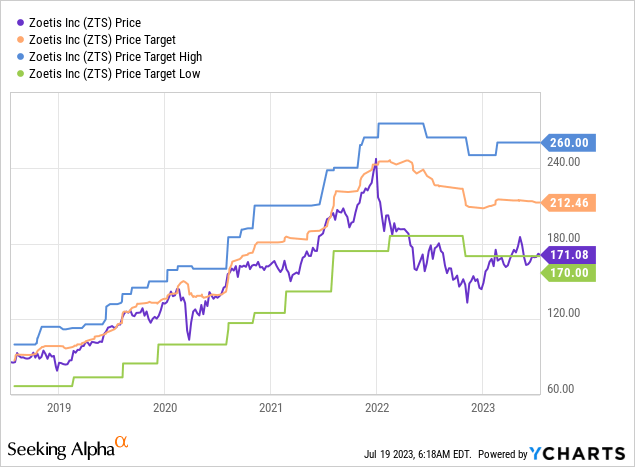

Shares are currently 9% below their 52-week high and up 17% year-to-date.

The stock price is currently trading 24% below the consensus price target, which I believe is fair.

Hence, I stick to what I wrote in my prior article:

On a long-term basis, I expect ZTS shares to return more than 12% per year.

Takeaway

Zoetis stands out as a compelling compounder in the veterinarian health sector. With a market cap of $80 billion, it is the world's largest producer of medicines and vaccinations for pets and livestock, boasting a diversified global footprint. The company's strength lies in its ability to outperform its peers consistently, thanks to robust tailwinds supporting its business.

Zoetis benefits from Gen-Z and Millennial-driven trends toward pet humanization and increasing household income, leading to higher spending on animal care. Additionally, as the world's population grows, the demand for proteins rises, making sustainable animal health management critical.

While Zoetis' dividend yield is low, its impressive net income growth and steady margin expansion make it an attractive investment for long-term gains.

The company's focus on innovation, strong collaborations, and addressing unmet needs in animal health contribute to its bright future.

Although not offering deep value, Zoetis is a fairly valued compounder with a high likelihood of outperformance and double-digit dividend growth, making it a compelling choice for investors seeking steady long-term returns.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)