Enbridge: I Am Buying The Downtrend And The 7% Yield

Summary

- Enbridge has been experiencing a downtrend over the past year, but it appears to have established a floor of $35. The company has a diversified portfolio, including a utility company and a large renewable portfolio.

- I believe that oil and gas will remain a dominant component of the global energy mix for decades to come, and Enbridge is well-positioned to benefit from this due to its extensive infrastructure.

- Enbridge has a strong track record of dividend growth, with 28 years of consecutive increases. The company is projecting continued growth in EBITDA and DCF, which should translate.

PM Images

Enbridge (NYSE:ENB) has been caught in a downtrend over the past year, declining -10.51% and forming a pattern of lower monthly highs. It looks like a floor of $35 has been established as each time ENB has been caught in a downtrend approaching $35, it bounces off the new 52-week lows. This happened on 10/12/22 when ENB hit $35.62 and rallied to $41.82 on 11/11/22 and again when shares closed at $35.20 on 5/31/23 and jumped to $38.22 on 6/8/22. Shares have been selling off, and over the past month, ENB has made several attempts at retracing through the $36 level, but it’s held, and shares have been trading between $36 - $38 since 6/9/23. I think this is a long-term opportunity to start a position or acquire more shares of ENB if you’re a shareholder. I have been adding to my position under $40, and with shares under $37, I will take this opportunity to grab more.

I have often called ENB the trifecta of energy infrastructure because it’s the only pipeline company that owns a utility company, and its renewable portfolio is massive. I love income investing, and ENB has been an income champion for investors, having increased the dividend on an annual basis for 28 consecutive years. I feel the energy infrastructure space is out of favor and misunderstood, creating an opportunity for investors with a long-time horizon and nerves of steel.

Seeking Alpha

Energy Infrastructure is misunderstood and is a requirement for modern civilization

Before discussing why I am bullish on ENB, I wanted to provide the facts about the oil and gas industry. All the data I am going to cite come from the following places:

- 72nd Edition of the Statistical Review of World Energy (can be read here)

- International Energy Agency Oil 2023 Analysis and Forecast to 2028 (can be read here)

- U.S. Energy Information Administration Annual Energy Outlook 2023 (can be read here)

- U.S. Energy Information Administration Short-Term Energy Outlook July 2023 (can be read here)

- BP Energy Outlook 2023 (can be read here)

I don’t base my investment decisions on headlines from news outlets, as I conduct a lot of due diligence. Sometimes I am correct, and sometimes I am wrong. Before making any investment, I have reviewed the numbers and projections with the company and the industry to form my investment thesis and decide if the investment makes sense. Traditional energy has been a battleground for years as renewable energy increases in popularity. I am not against renewables, and I feel they will play an important role in meeting the future energy demand decades in the future.

While I believe renewables will increase the percentage of energy consumption they are utilized for, I don’t see oil and gas being eradicated or displaced by 2050. This is because I have read through many energy publications from the EIA and IEA, and neither agency is projecting that society will be off fossil fuels by 2050. I will review the main points from all the reports I linked above and condense the information to create a picture of the current oil and gas industry and the projections going forward.

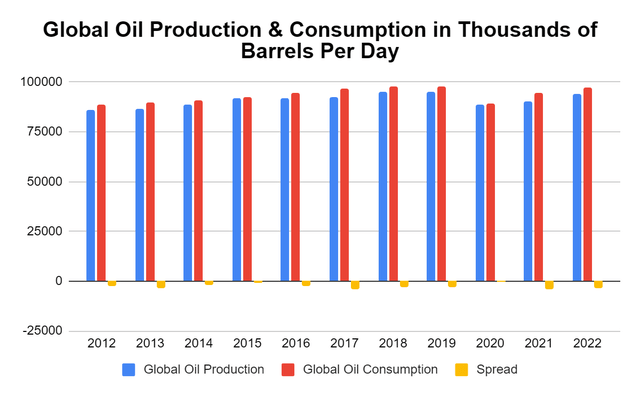

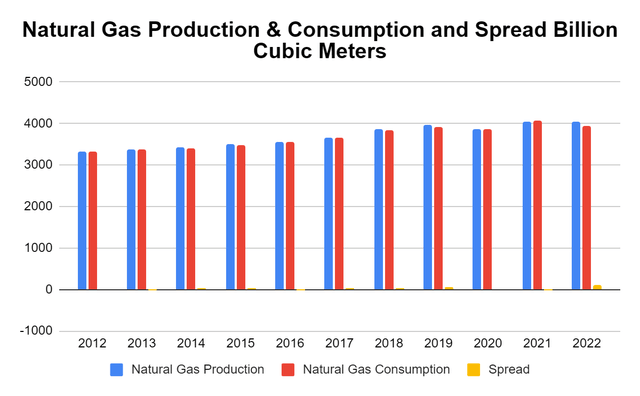

The Statistical Review of World Energy breaks out every nation’s production and consumption levels for fossil fuels. On a global scale, there hasn’t been a year in the past 11 years where production has exceeded demand. Oil production and consumption steadily increased, then declined when the pandemic occurred. In 2022, the global production level for oil was 93,848,000 Bpd, while the economy consumed 97,309,000 Bpd. There was a negative spread of -3,461,000 Bpd. On the natural gas side, the spread is much tighter. In 2022, the global natural gas production was 4,043.8 Bcm, and the economy consumed 3,941.3 Bcm. Production in 2022 of natural gas exceeded consumption by 102.5 Bcm, while it was -13.7 Bcm in 2021.

Steven Fiorillo, Energy Institute

Steven Fiorillo, Energy Institute

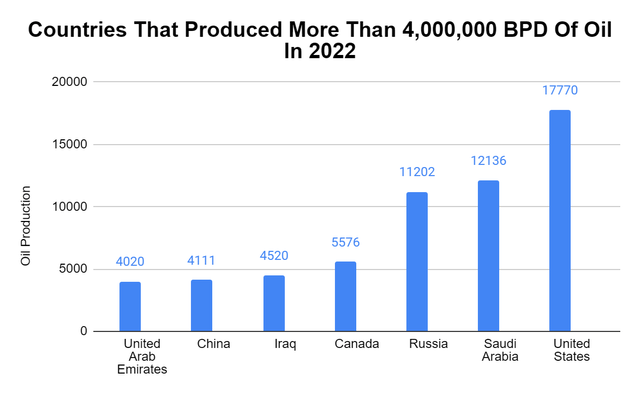

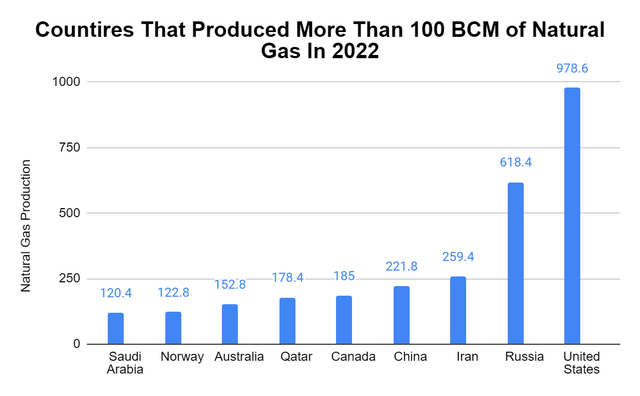

After understanding where production and consumption numbers are, I looked at the largest oil and gas-producing nations. The U.S. is the dominant producer in both oil and gas, while Canada is the 4th largest producer of oil and the 5th largest in natural gas production. In 2022, the U.S. produced 18.93% of the global oil production, while Canada accounted for 5.94%. On the natural gas side, the U.S. produced 24.2% of the global production of natural gas, while Canada accounted for 4.57%.

Steven Fiorillo, Energy Institute

Steven Fiorillo, Energy Institute

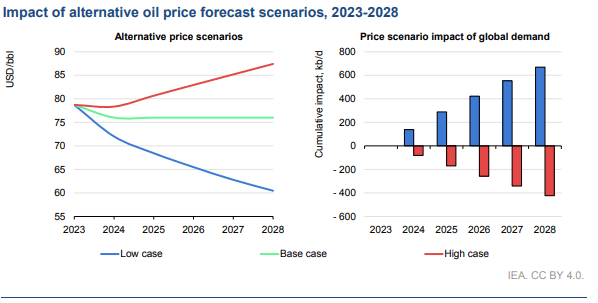

Next, I look at what the IEA and the EIA are projecting out into the future for the oil & gas industry. The latest oil 2023 analysis and forecast to 2028 from the IEA indicates that their reference case for oil pricing remains above $75 thru 2028. In their low case, they see oil declining through 2028 but staying above $60, and on the high side, oil is around $87.

IEA

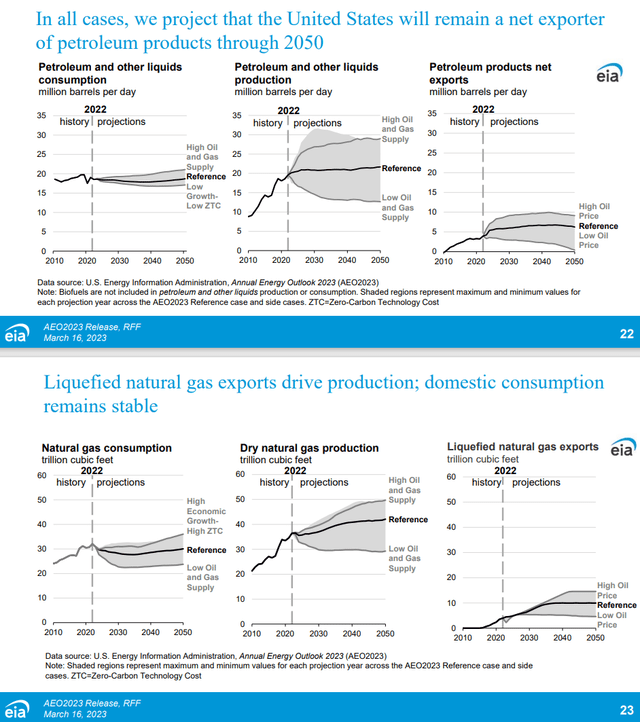

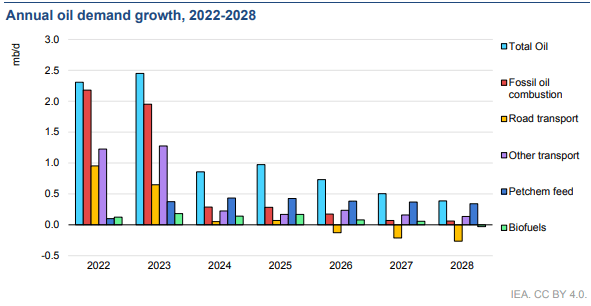

The 2023 Annual Energy Outlook from the EIA indicates that production levels in their reference cases for petroleum and other liquids, and natural gas will increase through 2050. They are also indicating that the U.S. will remain a net positive exporter in petroleum products and liquified natural gas (LNG). In the IEA Oil analysis and forecast to 2028, they indicate that while total oil demand growth is reaching a peak, it will continue to grow annually YoY, which supports the EIA projections.

EIA

IEA

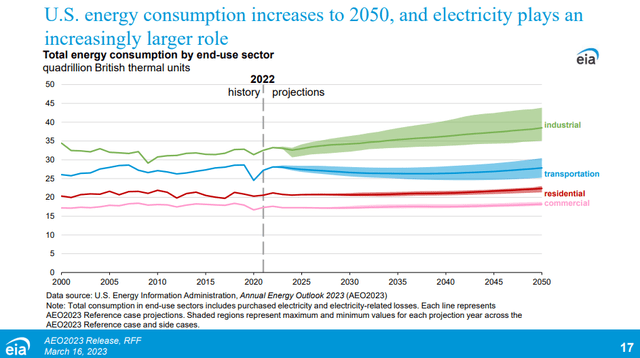

The EIA is also projecting that U.S. energy consumption will increase through 2050. I am waiting for the IEA to publish their next energy outlook in September, and since their report is published every 2 years, I will not use data from 2021. Everything I have presented is part of the information I use to make my investment decisions within the oil and gas sector. These are not my projections; these are the outlooks and numbers delivered by the most credible sources. Everything in this section has been factual public information that has not been distorted by my opinion.

With that being said, this paragraph will be my opinion. Based on everything I have read, my assumption is that oil and gas will remain a dominant component of the global energy mix for decades to come. The U.S. is the largest producer of oil and gas, while Canada is in the top-5 in both categories. The projections indicate that oil and gas production in the U.S. will continue to increase and that the U.S. will remain a net exporter in petroleum and LNG. If this plays out the way these agencies indicate, my assumption is that the current capacity for pipelines, storage, exporting, and everything else throughout the energy infrastructure value chain will be contracted, and additional capacity will be needed to transport future production levels. When I look at the sector through this lens, I want to buy great energy infrastructure companies because they are the tollbooths collecting fees for transporting fossil fuels from their originations to destinations, and business looks to be increasing.

EIA

Why Enbridge is one of my top picks in the Energy Infrastructure sector

It’s really a toss-up between Enbridge and Energy Transfer (ET) as to which energy infrastructure company is my favorite. While I write a lot about ET, and I feel it’s the most undervalued energy infrastructure company, there is a high probability that I would say ENB is my favorite all-around energy infrastructure company. I often refer to ENB as the triple threat or the trifecta of energy infrastructure because it has an unmatched portfolio diversification, as they operate a largescale renewable portfolio and gas utility company in addition to a world-class pipeline network.

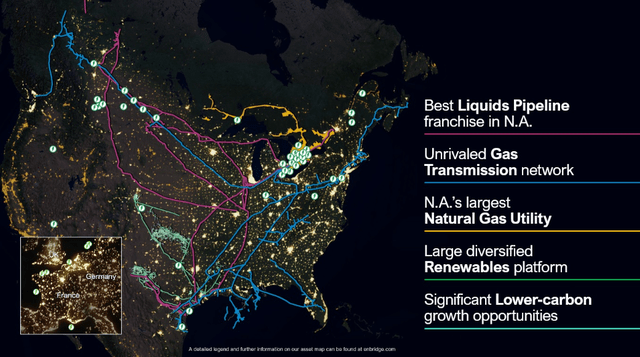

Based on my research, oil & gas are not going away anytime soon, so there will be a continuous need for transportation. ENB has one of the most dynamic energy infrastructure portfolios in North America. ENB operates 73,796 miles of natural gas pipeline across 30 states, 5 Canadian provinces, and offshore in the Gulf of Mexico. ENB moves 20% of all gas consumed in the U.S. and transports roughly 25.7 Bcf/D with 196.8 Bcf of working storage. On the oil side, ENB operates the world’s longest crude and liquids transportation system with 17,809 miles of pipeline. ENB delivers more than 3 million bpd of crude and liquids each day, and in 2022, ENB delivered more than 4.3 million barrels in its annual operations. ENB transports 30% of the crude produced in the U.S., 65% of Canadian-bound exports, and 40% of the crude imported through the U.S.

Outside of transporting through pipelines, ENB has built a large export business. The Enbridge Ingleside Energy Center is the largest crude oil storage and export terminal by volume in the U.S. This export facility connects the production from the Permian and Eagle Ford basins to international markets. On the storage side, ENB has 15.3 MMBbls of capacity at this location, with an additional 2 million barrel capacity under construction. There are 3 deep-water vessel berths with current operations capable of loading 2 VLCC and 1 Suezmax with dual VLCC loading capabilities.

I consider ENB the triple threat because they also operate in the utility and renewable space. ENB operates North America’s largest natural gas utility by volume and the third largest by customer count. Enbridge Gas delivers service to about 15 million people in Ontario and Quebec through 3.9 million residential, commercial, institutional, and industrial meter connections. On average, Enbridge Gas distributes 5.9Bcf/d of natural gas. On the renewable side, ENB is invested in 23 wind farms, and 16 solar projects. ENB has committed more than $8 billion in Canadian dollars to its renewable portfolio, and its portfolio has the capacity to generate 5,180 megawatts of energy.

Enbridge

ENB is allocating capital to support electric generation growth in its gas transmission business while expanding storage and transportation in the natural gas segment. On the Crude and liquids portion, ENB is building out additional exporting capacity. When I overlay in my mind ENBs network with where the government agencies expect oil and gas to be in 2030 or even as far out as 2050, I see ENB as a dominant force in the sector. Unlike technology companies with IP, ENB has physical assets that are critical to our way of life, and replacing the infrastructure within ENB’s network is next to impossible. ENB is positioned to benefit from future energy trends, and even as renewables increase their position in the global energy mix, ENB will be a beneficiary.

ENB’s guidance for 2023 is more growth in the critical key performance indicators ((KPIs)). Its Adjusted EBITDA is expected to be $15.9 - $16.5 billion, while its distributable cash flow (DCF) per share is expected to be $5.25 - $5.65. If the low metrics are met, ENB will see 13.57% of Adjusted EBITDA growth since 2021 with 5.85% additional DCF per share. If the high range is met, ENB will have generated 17.86% of Adjusted EBITDA growth and 13.91% in DCF per share growth over the past 2 years. The financial trends indicate that ENB is becoming more profitable, and when I look at the underlying information about future energy trends, I believe ENB will continue to grow its profits.

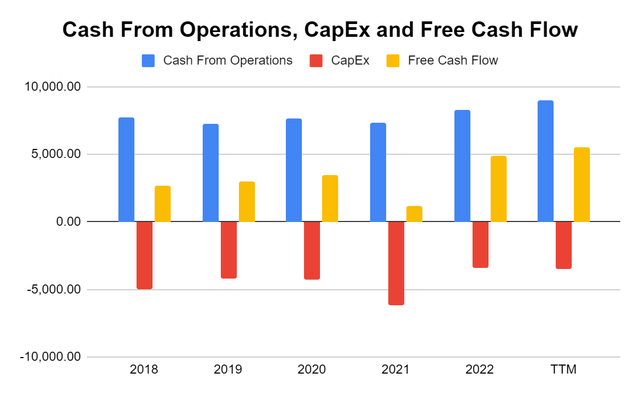

ENB was deploying a substantial amount of CapEx in 2018 – 2021 into its growth projects, and its paying off. In 2022, ENB generated $8.29 billion in cash from operations while its CapEx declined to its lowest level in the past 5-years. ENB’s FCF was $4.86 billion in 2022, 61.63% larger than its 2019 pre-pandemic level of $3.01 billion. Since 2021, ENB is projecting that it will achieve a 8% CAGR in Adjusted EBITDA and a 5% CAGR on DCF per share. This should correlate to larger cash from operations and FCF in the fiscal year of 2023. We are already seeing the TTM numbers indicate this will occur, as on a TTM basis ENB has generated $9 billion of cash from operations and $5.5 billion in FCF.

Steven Fiorillo, Seeking Alpha

Enbridge delivers a dividend that is hard to match and its outlook suggests more growth ahead

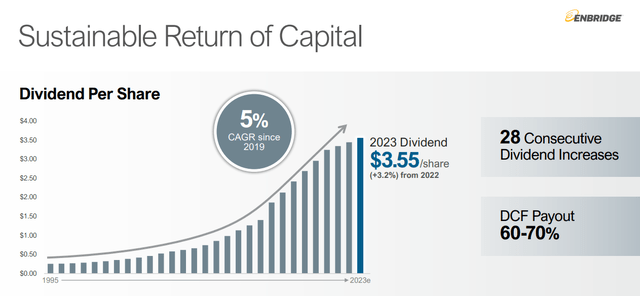

As an income investor, I want to invest in companies that generate strong yields that are secure while the dividend is growing. Not every company can accomplish this, and ENB has established a track record that is hard to match. ENB has provided investors with 28 years of consecutive dividend increases with a 5% CAGR since 2019. ENB is a true dividend growth company that puts a large emphasis on growing its dividend to create shareholder value.

ENB is expected to generate between $4.96 - $565 in DCF for 2023. On the low side, this would create a dividend payout ratio of 71.57%, and at the high end of the DCF range, the dividend payout ratio would be 62.83%. ENB is making all the capital investments to grow its business to support the growing demand for energy, and the investments will translate to EBITDA and DCF growth. From 2022 – 2025 ENB is expecting its EBITDA to have a CAGR of 4-6% while its DCF grows at a 3% CAGR. In a post-2025 environment, ENB is projecting that its EBITDA will grow at 5% and its DCF will also grow at 5%. Based on these projections, ENB has stated in its investor day presentation that the dividend could continue growing at a 5% CAGR. ENB is yielding just over 7%, and with a 5% future CAGR, this is an income investor’s dream.

Enbridge

Conclusion

I have been going against the grain, and while there is elevated excitement around tech, I see an opportunity to invest in companies with physical assets that produce large amounts of cash. The global demand for energy is expected to increase, and oil and gas are projected to be critical to the global energy mix in 2050. I believe that many energy infrastructure companies, such as ENB, are undervalued due to a misunderstood narrative around energy. ENB has a gigantic moat around its business because it’s next to impossible to replicate what they have built, providing a level of protection to its profits. ENB has projected that it will continue to grow its EBITDA and DCF into 2025 and beyond at roughly a 5% CAGR, which will also translate to continued YoY dividend growth. I feel ENB is undervalued, and with a 7% yield, I think this opportunity may not last.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ENB, ET either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)