QuickLogic: Avoid For Now - A Financial Overview

Summary

- QuickLogic's 74% YTD rally is concerning given the company's history of operating losses and 75% value drop over the last decade, despite promising eFPGA IP revenue growth.

- The company's management predicts positive non-GAAP operating income by Q3 2023, continued shareholder dilution, and potential insolvency due to negative operating cash flow and income.

- I suggest avoiding QuickLogic until it demonstrates profitability and efficiency, and stops diluting its shareholders.

bluebay2014/iStock via Getty Images

Investment Thesis

I wanted to take a look at QuickLogic (NASDAQ:QUIK) after its rally of over 74% YTD to see what the reason behind it was and to look at its financials to see how it has performed historically. For a company that has been around for many decades now and still not turned a profit is quite concerning and I guess that because the company dropped 75% in the last 10 years, it is having a slight bounce that is fueled by the company's promising eFPGA IP revenue growth and mentions of ML/AI, which I think is not enough to justify an investment until it starts to make GAAP profits in my opinion.

Outlook

The company has been around since the late 80s and I'm very surprised that in the last decade at least it has been operating with massive losses. Operating expenses have been through the roof all these years and revenues have been much higher in FY13 than in FY22, so I am not surprised the company has lost around 75% of its value in the last decade.

In the recent quarter and FY22 annual report, I can see that the potential for eFPGA IP contracts is quite promising, which is growing very quickly y-o-y, however, I don’t think it’s going to be enough to justify a company’s share price skyrocket over 74% YTD just because the company expects to reach 30% annual growth, especially if those operating expenses are not going to be tamed in the long-run.

Since they are the leading provider of open reconfigurable computing solutions on fully open-source software and hardware, I thought that this would come with some sort of profit margin. I guess I was wrong.

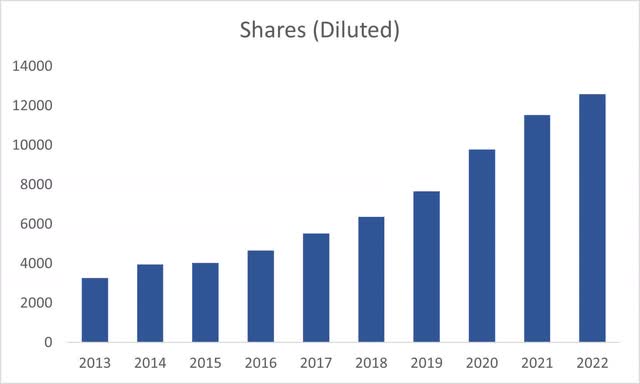

The management mentioned that the company will achieve positive non-GAAP operating income in the third quarter of ’23 and the difference between GAAP and non-GAPP is stock-based compensation. Looking at the shares outstanding in the last decade, we can see that the company has been very liberal at diluting its shareholders. That is one of the things I don’t like about companies when I first start to look at my next investment. I don’t think this behavior is going to stop anytime soon and that is a big red flag for me. For example, if a company's share price doubled but shares outstanding also doubled that means your holdings essentially went nowhere. In this case, the stock price lost 75% while the company diluted your shares by around 400%.

Dilution of Shares (Author)

Financials

As of Q1 ’23, the company had around $21m in cash and equivalents, against no long-term debt and around $15m in short-term revolving credit facility debt, which has around 8% interest rate attached to it. Since the company is not able to come up with positive operating cash flow and operating income is negative for a long time now, the only way I can see it can cover the interest expense on debt is to issue more stock to raise capital, and that is a big red flag as I mentioned. This is not a good situation to be in and it is at high risk of being insolvent in my opinion. It will run out of cash in no time.

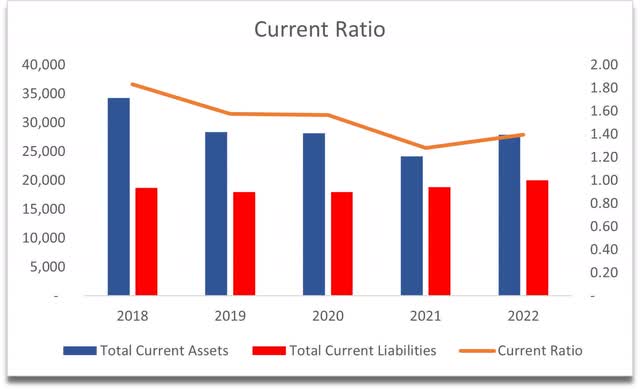

Continuing with liquidity, one positive at least is that its current ratio is somewhat healthy at around 1.4 as of FY22, so if the company had to pay off all its short-term obligations at once, it would be able to for now.

Current Ratio (Author)

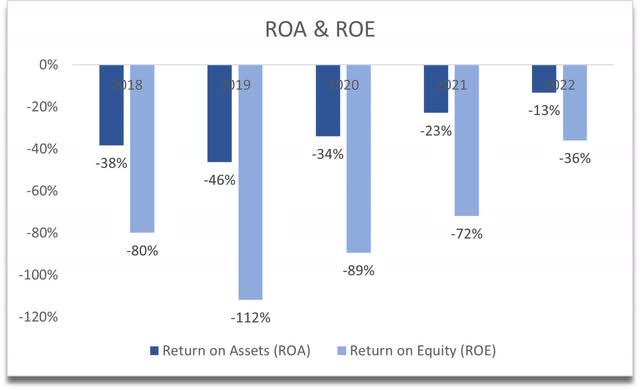

If we look at efficiency and profitability, we can see some more bad news that would prompt me to avoid the company for now. ROA and ROE have been in the negatives for at least a decade, meaning the management is not utilizing the company’s assets and is not creating value for shareholders, which is very true.

ROA and ROE (Author)

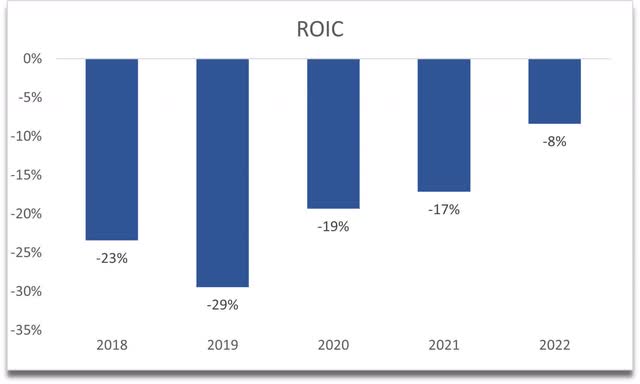

The same story can be seen in return on invested capital. It is well in the negatives and well below the minimum of 10% that I look for in a company. This tells me that the company, being a leader in the field, still has no competitive advantage or moat.

ROIC (Author)

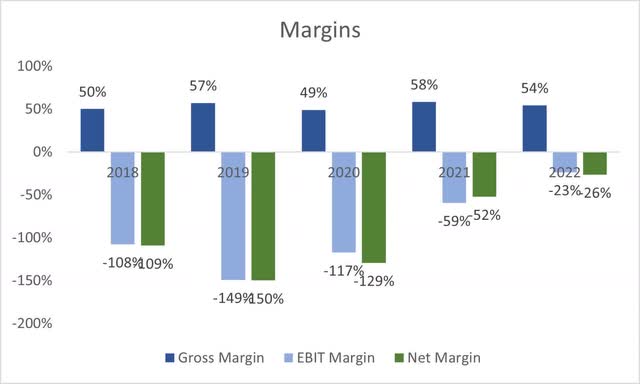

In terms of margins, we already knew that the company is operating at a loss, so it is not surprising to see that at all. But I guess what you can extrapolate from these metrics is that they seem to be improving from the very deep hole they’ve been in 2019. I would like to see the company becoming profitable and efficient in the next couple of years or it’s going to be a hard pass for me.

Margins (Author)

Closing Comments

I usually end all my analysis with an intrinsic value calculation; however, I don’t think I can even begin to assume any sort of improvement in the future to where the company is going to be profitable. It would be pure speculation on my part and a what-if-type of a situation which is not very ideal.

I would avoid the company for now, until the management stops diluting its shareholders and starts to make a profit by increasing efficiency. I think that the YTD rally the share price saw is fueled by AI/ML speculation buzz which is very shortsighted in my opinion. There will be a lot of companies that will benefit a lot from these technologies, however, we cannot quantify how much these will help in the end. I wouldn't be surprised if there will be some profit-taking soon by someone who got on board right around the AI buzz.

I wanted to give a quick analysis of the company's fundamentals because there hasn't been an article written about the company in years and I thought it would be of value to someone to read my opinion on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.