PEY: High Yield, Attractive Valuation, Bullish Seasonal Trends Make It A Buy

Summary

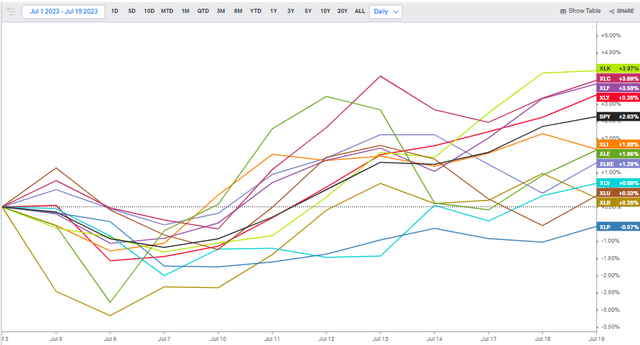

- The domestic stock market is seeing more bullish participation, with sectors like Financials and Industrials playing catchup since June 1. High-yield strategies could benefit if this trend continues.

- The Invesco High Yield Equity Dividend Achievers ETF is recommended for its diversification potential, valuation, and seasonal bullishness. The fund invests at least 90% of its assets in dividend-paying stocks.

- PEY's portfolio has a high exposure to both the value style and to domestic small and mid-sized companies despite potential short-term technical headwinds.

- I outline key price levels on the chart to monitor as Q3 progresses.

hobo_018

There are signs that more bullish participation is taking place in the domestic stock market. Since June 1, the S&P 500 has not been dominated by mega-cap tech/growth sectors. Rather, areas like Financials and Industrials have played a bit of catchup. Should value and cyclical areas continue to bounce back versus the SPX, high-yield strategies will likely do well.

I am initiating coverage of the Invesco High Yield Equity Dividend Achievers ETF (NASDAQ:PEY) with a buy rating for its diversification potential, valuation, and some seasonal bullishness I will detail later.

Stock Market Rally Broadens Since June 1

According to the issuer, PEY is based on the Nasdaq US Dividend Achievers 50 Index. The fund will normally invest at least 90% of its total assets in dividend-paying common stocks that comprise the Index. The index is made up of 50 stocks selected principally on the basis of dividend yield and consistent growth in dividends. The fund and the Index are reconstituted annually in March and rebalanced quarterly in March, June, September, and December.

PEY's portfolio of 50 securities features a moderate total expense ratio of 0.52% while its trailing 12-month dividend yield is high at 4.43% as of July 18, 2023. With total assets under management of more than $1.3 billion, 30-day average trading volume of about 420,000 shares, and a 30-day median bid/ask spread of just five basis points, tradeability and liquidity are decent in my view. What’s more appealing is PEY’s low forward price-to-earnings ratio of 11.5 (as of June 30, 2023) and the portfolio’s weighted-average return on equity is listed at 10.4%. With a price-to-book ratio barely higher than 1, there is a strong value case for owning the fund.

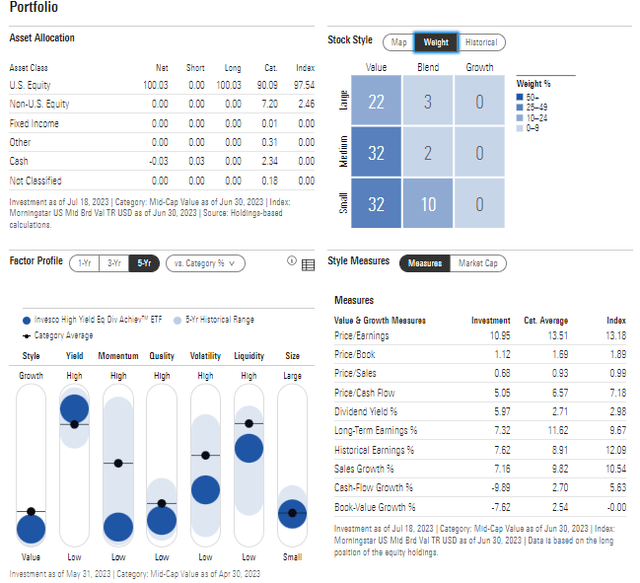

Digging into the portfolio, data from Morningstar show that going long PEY would be a deviation from the S&P 500’s construct. When analyzing the Style Box below, you will find that there’s a high exposure to both the value style and to domestic small and mid-sized companies. That characteristic hurt relative performance over the first half of the year. But the value factor and high yield factor could come back into vogue should a broadening out of the market’s performance breadth continue to increase. The wrinkle is that a turn lower in US real GDP growth expectations could result in relative underperformance of cyclical sectors and small caps later this year.

PEY: Portfolio & Factor Profiles

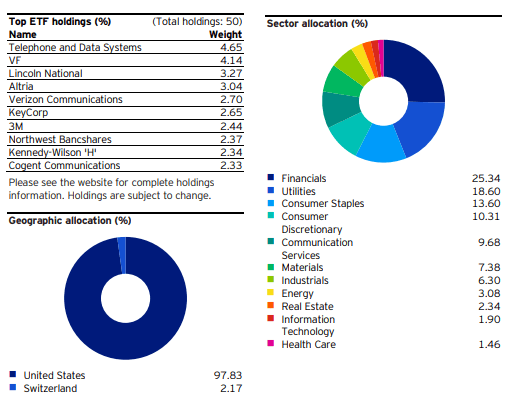

The cyclical nature of the fund is evidenced by the sector breakdown below. More than one-quarter of the ETF is comprised of Financials sector equities while less than two percent of the allocation is in the high-growth Information Technology sector. There is a bit of a safety bent via a very high position in the Utilities sector and an overweight to the Consumer Staples space.

PEY: Financials & Utilities Sectors Command A Large Chunk

Invesco

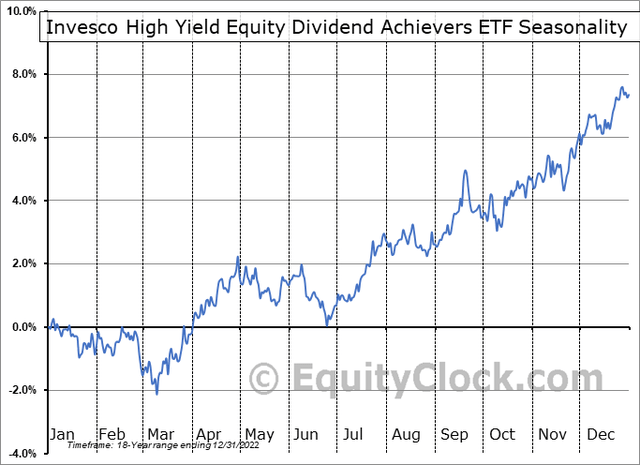

Seasonally, PEY tends to rally steadily from late June through year-end, according to data from Equity Clock. So, while the broad market often encounters volatility in Q3, PEY has historically been a source of tranquility, making it a place to be overweight in the months ahead if the trend holds.

PEY: Bullish Seasonal Trend Through December

The Technical Take

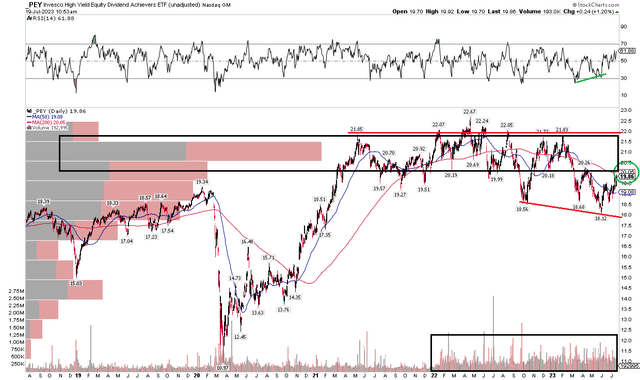

With a compelling valuation, cyclical but also somewhat defensive sector allocation, the chart is lukewarm. Notice in the graph below that shares notched a lower low in early June relative to the trough in mid-March of 2023. The bullish aspect of that price action was that the RSI momentum indicator at the top of the chart made a higher low – otherwise known as a bullish momentum divergence.

Bigger picture, I spot a high amount of volume by price from $20 up to $22. I marked that congestion zone in black in the technical chart, and PEY is just now encroaching on that area. It is also where the flat 200-day moving average comes into play, so we have a confluence of potential resistance here.

Overall, it is a neutral chart, but long-term investors should appreciate the relatively modest total return drawdown compared to the growth-heavy S&P 500.

PEY: High Volume Lies Above, But Bullish RSI Divergence

The Bottom Line

I have a buy rating on PEY. I like its exceptionally low valuation while seasonal trends support being overweight the factor-based fund compared to the broad market despite some technical headwinds that may come about in the very short term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)