Carvana: The Bankruptcy That Wasn't

Summary

- Carvana Co. has announced a major restructuring of its capital base, including a debt restructuring that will lower cash interest expense by over $430 million per year for the next two years.

- The company is also offering 35 million shares, expected to raise over $350 million, which will further bolster the company's cash balance and stave off bankruptcy for the foreseeable future.

- Despite weak fundamentals, the massive liquidity and cash infusion will prop-up the company for at least another 12 months, which is expected to lead to increasing short-covering and a rise in equity price.

Joe Raedle/Getty Images News

Thesis

Just like a crafty feline, Carvana Co. (NYSE:CVNA) has proven it has nine lives. The company has announced two major capital restructuring actions, that are set to take bankruptcy off the table for the foreseeable future. These actions are a major win for the Carvana management, and are set to further bolster the company's cash balance.

The company just announced the following:

- A substantial debt restructuring that lowers cash interest expense by over $430 million per year for the next two years

- An equity offering of 35 million shares, which will raise in excess of $350 million.

In this article, we are going to analyze what these actions actually mean for the company and our viewpoint on the share price given its massive short interest of 49% of float.

A car company is not a regional bank

One of the most surprising aspects for market participants was the swiftness of the regional banks' downfall in March and April of this year. It did not take much time since problems surfaced with their "Held to Maturity" and "Available for Sale" books until the problem institutions were taken over by the FDIC. The reason behind the swift downfall was the bank model, where liquidity relies on the depositor base. Once the depositor base disappears, the bank needs to find an alternative funding source or it goes bust.

Conversely, an operating company like Carvana does not have this issue. The company manages its funding via its issued debt and cash available on the balance sheet. Investors losing faith in the company does not impact the corporate as long as they do not need to access new debt via the capital markets. Basically, the funding piece is already set.

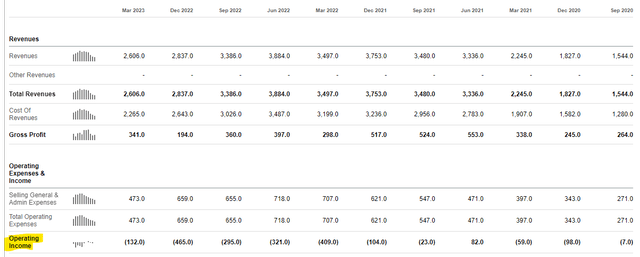

The problem with Carvana is that it is cash flow negative, meaning its operations consume cash rather than produce it:

Operating Income (Seeking Alpha)

For a company to be considered a viable long-term entity, one needs to see positive figures in the "Operating Income" line. What happens eventually when you do not generate positive operational cash flow, you go into bankruptcy, because you end up burning all the cash on the balance sheet. The process, however, is slow and prolonged.

What does the Carvana restructuring actually mean and some details

1. The Debt Restructuring

Carvana has restructured its debt load to preserve cash. In effect, the restructuring consists of transforming interest payments for the next two years into principal on the bonds:

the exchange of the Existing Unsecured Notes for up to $4.376 billion of the following three tranches of senior secured notes: (A) up to $1.0 billion of new 9.0%/12.0% cash/payment-in-kind ("PIK") toggle senior secured notes due December 2028 (with interest per annum payable 12% in PIK in the first year, 12% in PIK and 9% in cash toggle in the second year, and 9% in cash thereafter); (B) up to $1.5 billion of new 11.0%/13.0% cash/PIK toggle senior secured second lien notes due June 2030 (with interest per annum payable 13% in PIK in the first year, 13% in PIK and 11% in cash toggle in the second year, and 9% in cash thereafter); and (C) up to $1.876 billion of new 9.0%/14.0% cash/PIK toggle senior secured notes due June 2031 (with interest per annum payable 14% in PIK in the first year, 14% in PIK in the second year, and 9% in cash thereafter) (tranches (A), (B), and (C) referred to collectively as the "New Senior Secured Notes" and the exchanges thereof referred to as the "Exchange Offers");

Source: The SEC.

The main feature of the restructuring is the introduction of PIK debt that does not require cash interest to be paid in the first two years. PIK stands for payment-in-kind, and basically references a bond feature whereas the due interest payment becomes part of the outstanding principal balance. As a reference to the above restructuring for example, the 12% December 2028 notes will accrue $120 million in interest per year (for $1 billion balance), which instead of being paid out will be added to the $1 billion balance. The company's interest expense the year after will be calculated on the new balance of $1.12 billion.

In effect, the company is deferring this cash component to a later date, and is paying a high interest rate in order to do so. If the market normalizes and Carvana is able to be operationally profitable again, then it will be able to generate the cash to cover the debt load. The liability is not disappearing from the balance sheet.

2. The Equity Offering

This piece of the restructuring is just a cash raising endeavor. The company is issuing new shares, thus diluting existing shareholders, in order to raise capital. It is a smart play because the company is taking advantage of the current euphoria in the equities markets, which has seen many short seller darlings being bid up to unprecedented levels. From a shareholder stand-point this is not a good action because you are getting diluted. However, from a pure solvency perspective the equity offering is golden since it purely adds cash to the balance sheet in exchange for the promise of future profitability.

Carvana becoming a short-seller widow maker

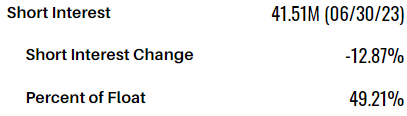

Technicals matter more than fundamentals sometimes. This is one of those times. With a very high short percentage of almost 50%, Carvana is in the top shorted equity names:

Short Interest (Barchart)

There is a cost of short-selling (borrowing fee), and the longer you are shorting a name without your thesis coming to fruition, the higher the cost. One of the main thought processes behind shorting the name was the idea of an imminent bankruptcy on the back of the cash burn from operations. Well, we can take that off the table for now. The equity cash raise and the deferment in the debenture cash interest will basically kick the can down the road for at least another 12 months. We anticipate seeing a brutal short covering here, not on fundamentals, but on the cessation of liquidity concerns for the company in the short term.

Conclusion

Carvana just announced a major restructuring of its capital base, which sees a new cash infusion via an equity raise, and a deferment of interest costs via a PIK debenture restructuring. Ultimately, these actions end up buying the company time, thus deferring any prospects of an imminent bankruptcy.

For this entity to be a successful long-term story, we need to see its operating income line turn positive, which might be still a distant prospect. However, the massive liquidity and cash infusion will prop-up the company for at least another 12 months, bringing into question one of the primary short-seller thesis, namely an imminent bankruptcy.

We feel we are going to see increasing short-covering here, and despite its weak fundamentals CVNA is going to move higher here on those flows. In our mind, a conservative and safe bet here is via out of the money calls, which can safely capture this technical move higher in the equity price.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (9)

Best,