Altria Q2 Earnings Preview: Watch The Volume Decline

Summary

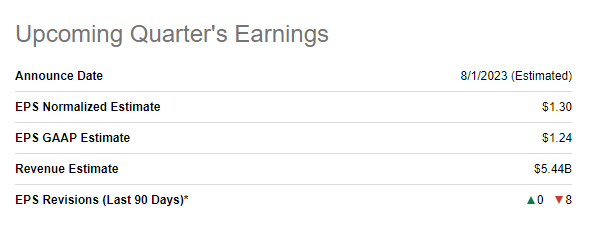

- Altria Group is set to report Q2 results on August 1, with analysts expecting an EPS of $1.30 on revenue of $5.44 billion, representing an EPS growth of 3.34% and revenue growth of 1.30% YoY.

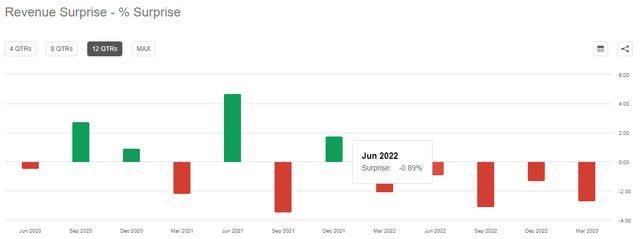

- The company has consistently beaten EPS estimates but has struggled with revenue estimates, with declines in shipment volume being a significant concern.

- Despite challenges, the stock is undervalued and the company's upcoming dividend increase and diversification efforts, including its NJOY acquisition, are positives.

Mario Tama

Altria Group, Inc. (NYSE:MO) is expected to report results for its Q2 that ended June 30th, 2023, pre-market on Tuesday, August 1st. Analysts expect Altria to report an EPS of $1.30 on revenue of $5.44 billion. Should Altria meet these numbers, that would represent an EPS growth of 3.34% and revenue growth of 1.30% on YoY basis. Right off the bat, that concerns me a little given Altria's revised mid-single digit dividend growth.

Altria Q2 Earnings Preview (Seekingalpha.com)

My last coverage on Altria Group was about its (likely) upcoming dividend increase. And the one before that was reviewing the company's Q1 earnings. I had rated the stock a "Hold" after Q1, citing concerns over revenue and a higher than expected volume decline. The stock has since returned just about 1% (including dividend) while the market has returned nearly 12%.

With that background out of the way, let's preview Altria Group's Q2 without any further ado.

Steadily Declining Expectations

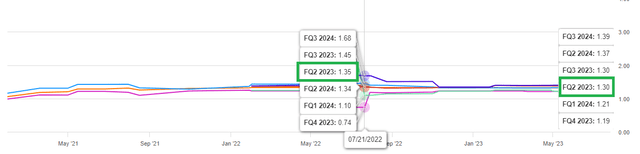

About a year ago, analysts expected Altria to report $1.35/share in Q2 2023. Obviously, one year is a long time but this shows how murky things can get even for something as (relatively) predictable as a consumer staple. As things stand now, Altria is expected to report $1.30/share on August 1st. That's a decline of about 4%, which is significant for a company that is struggling to grow above 3% as mentioned in the introductory paragraph.

Altria Q2 EPS History (Seekingalpha.com)

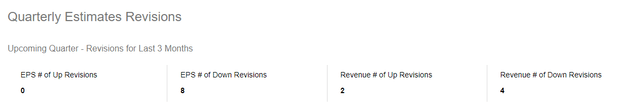

As an extension, 100% of EPS revisions for this upcoming quarter have been to the downside while 66% of revenue revisions have been to the downside as well. Ouch!

MO Revisions (Seekingalpha.com)

However, in a nod to "bad news is good news", lower expectations heading into earnings may set the stock up for a rally if Altria does just a little better than expected.

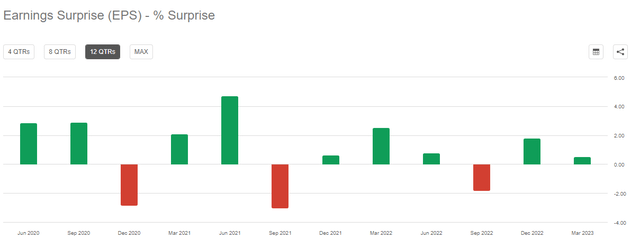

Beat or Miss? I Say EPS Beat and Revenue Miss

In the last 12 quarters, Altria Group has beaten EPS estimates 9 times and revenue estimates just 4 times. To put those into context, Altria has beaten EPS estimates 75% of the times in the last 3 years while beating revenue estimates just 33%. That's quite worrying heading into earnings and I expect the same trend to continue. That is, a small beat on EPS due to operational excellence and a miss on revenue due to decline in shipment volume. That the company is operating in a declining industry is no secret but the extent of decline is to be monitored, which brings us to the next section.

Altria EPS Surprise History (Seekingalpha.com) Altria Revenue Surprise History (Seekingalpha.com)

Volume Decline - The Main Story

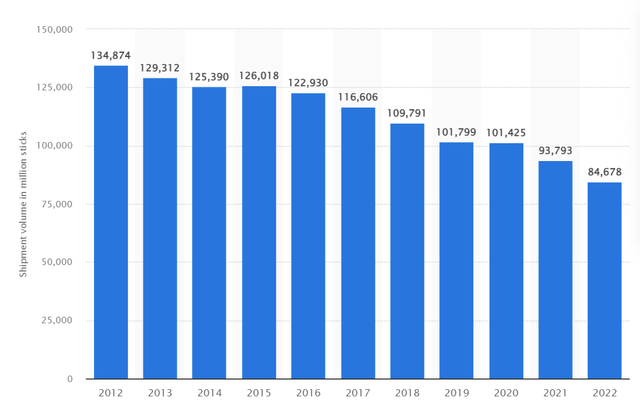

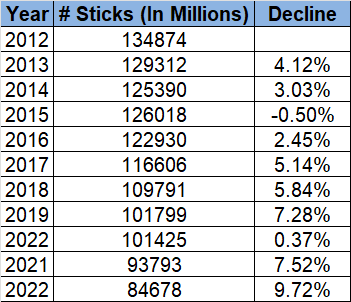

In my Q1 review, I noted that the company used inflationary pressure as one of the reasons for higher than expected volume decline. I did not buy that from a company that sells the best-in-breed of an addictive, inelastic product. However, the fact that Altria is facing a gradual decline in volume is undeniable, as shown below.

Altria Shipment Volume (statista.com)

What is concerning of late is the acceleration in decline as shown by the 7.52% and 9.72% in the last two years. I will be keenly looking at the shipment volume reported in Q2 to see if the decline gets worse.

Decline in % (Compiled by author)

Valuation and Yield - Lone Bright Spots

From a stock fundamental perspective, the stock is undervalued any which ways you cut it. For example,

- a forward multiple of 9 places the valuation at close to its lowest level since COVID peak. As a comparison, Philip Morris International Inc. (PM) has a forward multiple of 16 despite a disappointing decade where its expected out-performance over Altria never materialized.

- with the expected dividend increase, Altria's yield will be super close to 9% if the company even manages a 5% dividend increase. Okay, I am aware that Altria has moved on from the previous policy of paying 80% of earnings as dividends but it is not so easy for a company as deep-rooted as Altria to completely move away from it. I expect the company to stay close enough to that policy, although with the revised dividend policy, the company is lowering expectations. With an expected EPS for $4.97, Altria has room to go up to 99 cents for its new dividend (from the current 94 cents/qtr.). I am not saying it will go that high but that there is room.

- the stock's current yield is 20% higher than the 5-year average of 6.93%.

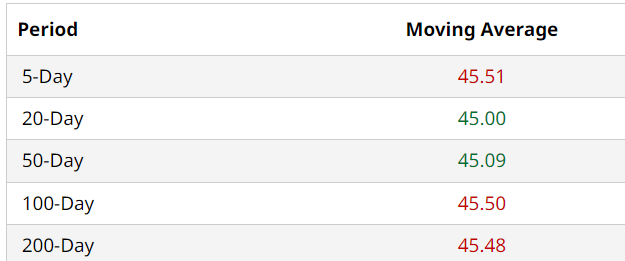

Technical Strength - Sitting On A Solid Base

Based on the stock's moving averages shown below, I believe the stock has formed a very solid base in the $45 level. If the stock takes out the 200-Day moving average given the recent market rally and then the company ends up reporting even moderate earnings, the stock may have enough momentum to reach new 52-week highs.

MO Moving Avgs (Barchart.com)

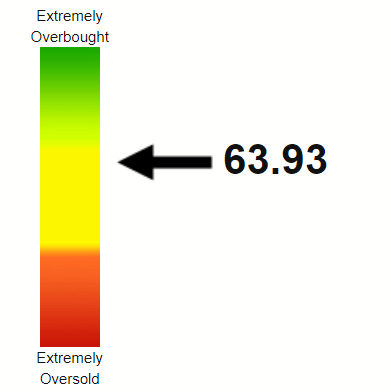

The stock's Relative Strength Index ("RSI") is in my favorite spot - the 60s. At this level, I believe the stock has enough momentum in its favor but also has enough room to the upside.

Altria RSI (Stockrsi.com)

Conclusion

Altria Group has indeed been trying its best to diversify from its declining primary business. However, in hindsight, those moves turned out to be di-worsifications. Not one to give up, the company recently closed its NJOY acquisition and the report that E-cigarette sales increased by 50% in two years should encourage the company and investors a little.

As far as Q2 is concerned, pricing power is expected to save the day once again and I firmly agree with that. I believe with lower expectations, the company just needs to do a little better to take the stock higher. I still rate the stock a "Buy" citing undervaluation and the upcoming dividend increase.

What's your take on Altria's upcoming Q2 and its future in general?

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (9)