The Consumer Continues To Be The Backbone Of This Expansion

Summary

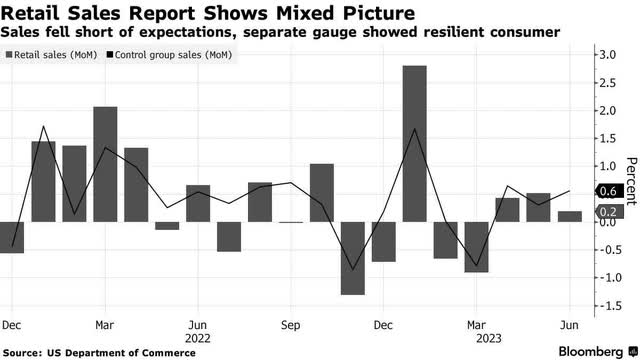

- Retail sales fell short of expectations, which may have raised some concerns.

- The core sales figure used to calculate GDP was better than expected, which suggests the economy continued to grow in the second quarter.

- Retail sales are predominantly goods, while consumers have been spending more on services.

- Therefore, the personal income and spending report is a better gauge of consumer health than retail sales.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect. Learn More »

LordHenriVoton

The bulls keep running, as breadth continues to improve with yesterday’s surge led by the Russell 2000 small-cap index, which rose 1.2%. As for the S&P 500, the financial sector led the charge on earnings reports from Bank of America, Morgan Stanley, and Charles Schwab that all bested expectations. BAC's CEO Brian Moynihan noted during his bank’s conference call that “we continue to see a healthy US economy that is growing at a slower pace, with a resilient job market.” That is music to a soft landing’s ears. A consensus is building that the Fed will end its rate-hike cycle this month, inflation will fall within range of the Fed’s 2% target, and the economy will avoid a recession this year.

Finviz

It is the consumer who keeps this expansion alive, and yesterday’s retail sales report for June showed consumers are continuing to spend, but at a slower pace than in prior months for obvious reasons. Overall sales lagged expectations with just a 0.2% gain for the month and an increase of 1.5% over the past year. Yet control group sales, or “core” sales, which exclude the categories of autos, building materials, and gasoline, came in at twice the expectation for the month at 0.6%. This is the figure used to calculate GDP, and it rose 2.2% in the second quarter when compared to the first quarter, which indicates the expansion continued in the second quarter.

Bloomberg

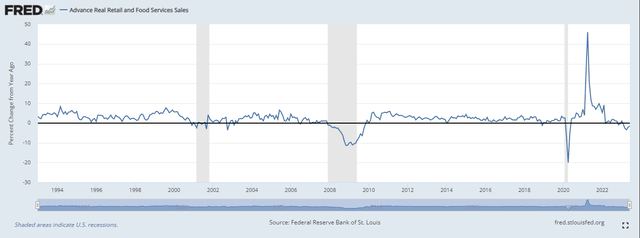

What I follow most closely when it comes to retail sales is the real, or inflation adjusted, rate of year-over-year growth. Prior recessions started when this measure turned negative in a range of 1-3%, as can be seen below.

FRED

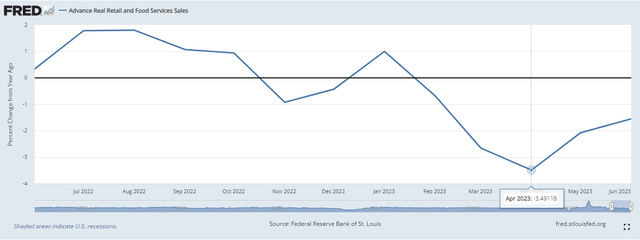

At first glance, there appears to be reason for serious concern, as real retail sales have declined within a 1-3% range for several months now with a trough of -3.5% in April. In prior cycles, this would be a huge red flag, but we must consider the anomaly of consumers shifting their spending to services over the past two years.

FRED

The only category of the retail sales report that covers services is sales at restaurants and bars. We did see a slowdown to just 0.1% growth monthly, but the year-over-year increase was 8.4%, which handily exceeds the rate of inflation. Consumers are still spending far more on services than goods, which is why I am not concerned about this red flag for now. The personal income and spending report, which covers goods and services, is more relevant.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

This article was written by

Lawrence is the publisher of The Portfolio Architect. He has been managing portfolios for individual investors for 30 years, starting his career as a Financial Consultant in 1993 with Merrill Lynch and working in the same capacity for several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. In addition to writing for Seeking Alpha, he is also a Leader on the new fintech platform at Follow.co.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice. Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)