International Flavors & Fragrances Stock: A Compelling Long Idea

Summary

- International Flavors & Fragrances stock is down by 20% YTD, While the S&P 500 is up by double digits.

- IFF's dominant market position and heavy R&D spending should fuel future growth.

- According to my valuation, IFF is currently trading at a 31% discount.

jonpanoff/iStock via Getty Images

Thesis

International Flavors & Fragrances Inc. (NYSE:IFF) is the world's leading producer of ingredients that are used in food, beverages, fragrances, and more. I believe the firm's exposure to emerging markets and heavy R&D spending will help them promote future growth. 63% of the industry's market share is controlled by four companies, with IFF being the market leader. I will explain my thesis's key point in the sections that follow.

Company Overview

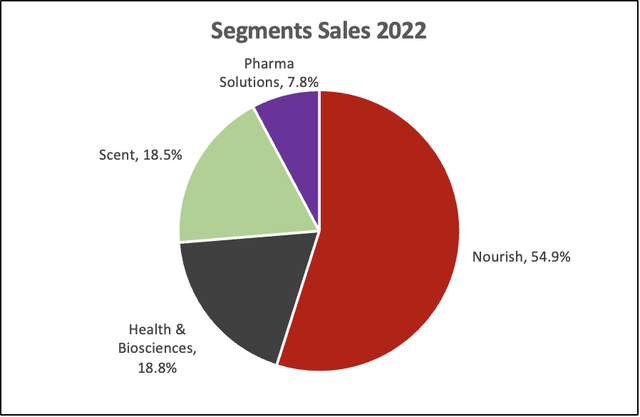

IFF sells ingredients that are used in food, beverages, personal products, pharmaceutical solutions, and more. The firm is highly diversified, with +50K customers in +10 end markets. U.S. sales represent 29% of sales, and no other country represents more than 6%. The company derives revenue from four segments: Nourish, Health and Biosciences, Scent, and Pharmaceutical Solutions. IFF, along with its competitors, controls about 63% of the flavor and fragrance market. According to Statista, IFF has a 22% market share, Givaudan has 18%, Firmenich has 11%, and Symrise has 12%.

Business Segments

Nourish (55% of revenue, 17% of ADJ EBITDA Margin)

The nourish segment includes a variety of natural-based ingredients used in beverages, dairy, baking, confectionery, and other applications. Ingredients, Flavors, and Food Designs are the three business divisions under the category.

Health & Biosciences (18.8% of revenue, 27% of ADJ EBITDA Margin)

The Health & Biosciences division develops and manufactures a range of sophisticated biotechnology-derived enzymes, food cultures, and probiotics, among other things. The five business units in this area are health, cultures and food enzymes, home and personal care, animal nutrition, and grain processing.

Scent (18.5% of revenue, 18% of ADJ EBITDA Margin)

The Scent segment creates fragrance compounds, fragrance ingredients, and cosmetic ingredients that are used in the world's finest perfumes and personal care products. Fragrance Compounds, Fragrance Ingredients, and Cosmetic Actives are the three business units of the segments.

Pharma Solutions (7.8% of revenue, 23% of ADJ EBITDA Margin)

Pharma Solutions has a vast portfolio of cellulosic and seaweed-based pharmaceutical excipients used to improve pharmaceutical ingredients, including controlled or modified drug release. These products are used in prescription and over-the-counter pharmaceuticals and dietary supplements.

Financial Analysis

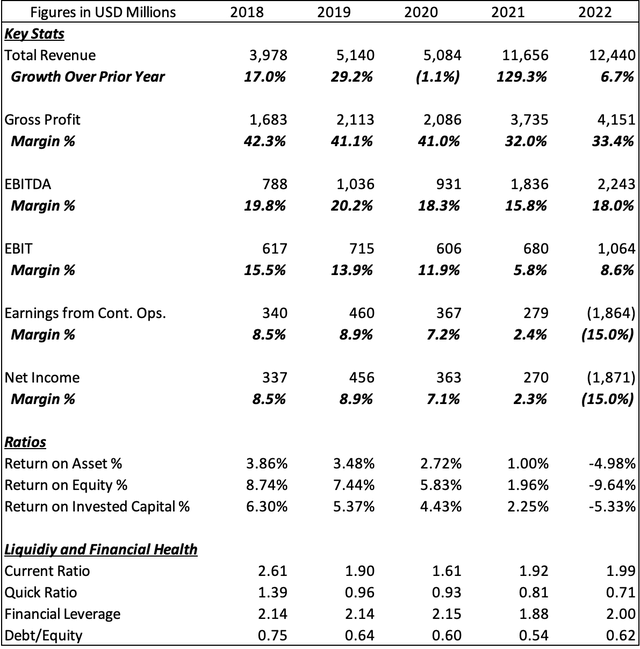

Created by the author using Capital IQ

IFF's revenue has grown at a CAGR of 36% over the past five years. This growth isn't all organic. The reason for the revenue jump in 2021 was due to the completed merger With DuPont's Nutrition and Biosciences Business. This merger more than doubled the revenue of the nourish segment and health biosciences. The same thing happened in 2019, when revenue grew by 29%. Some of that growth was attributed to the acquisition of Frutarom. From 2018 to 2022, The firm averaged a gross margin of 38% in the same time period. As for the balance sheet, I consider it healthy. I know the company is leveraged, but that is to be expected due to the recent acquisitions. I will discuss debt more in the risks section.

Outlook

The company spent 6.36% of its revenue on R&D over the past five years. These investments didn't go unnoticed, as they are crucial to the firm's success because, rather than supplying basic solutions, IFF can deliver innovative solutions to satisfy the needs of its customers. The firm's customers' tastes can and will probably change over time, and in order for the company to keep its leading position, they have to innovate and reinvest in the business. I model R&D spending at 6-7% of revenue over the next five years.

IFF operates in a market that I like to believe has high barriers to entry because it is dominated by four big companies, including IFF. Four companies control 63% of the market, leaving very little room for small companies. In ten or twenty years, this will protect the company from any newcomers willing to disrupt the market in my opinion.

According to Grand View Research, The flavor and fragrance market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2027. I expect IFF to benefit from this growth given their strong presence. Furthermore, About 20% of the company's revenue is derived from emerging markets. I believe this exposure will help the company capitalize on the rapid growth in these markets.

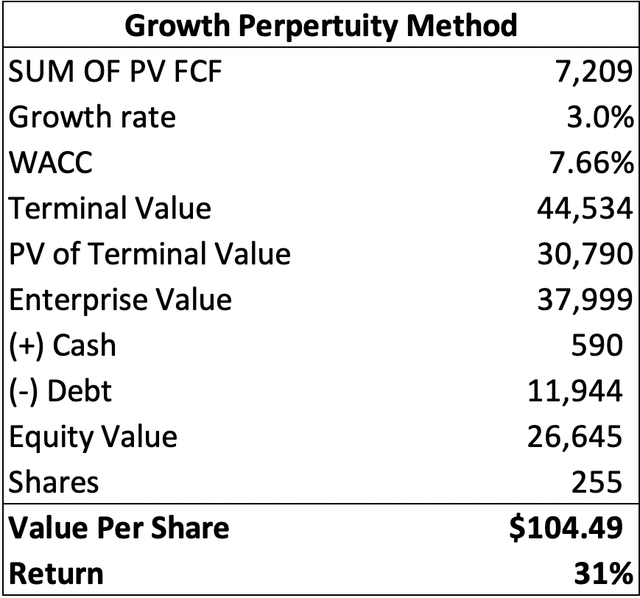

Valuation

IFF is currently trading at an EV/EBITDA of 15.53x. My fair value (Base case) is $104, which equates to a 31% return from the current price of $80. I model revenue to compound at an annual growth rate of 4.07% from 2023 to 2027. With the nourish segment growing at a CAGR of 3.83%, Health & Biosciences at a CAGR of 3.06%, Scent at a CAGR of 5.1%, and Pharma Solutions at a CAGR of 4.4%.

I expect the scent segment to experience the most growth because of the increased demand for fragrance. The fragrance market is forecast to grow at an annual rate of 6% from 2023 to 2028. The nourish segment assumptions are based on population growth and income expansion because those are the factors that drive growth for most food producers. After all, the products of the nourish segment are used in beverages, bakery, food, and more. As for the other two segments, Health care demand grows as the population gets older. Asia and Europe have the oldest populations, and the company is exposed to both of them. I expect the company to average a ~9% net margin over the next five years, with profitability struggling in 2023 as the Nourish and Health & Biosciences segments experience a decline due to the economic slowdown, which decreases demand.

Using a discount rate of 7.22%, I discounted the future cash flow and terminal value. I arrived at an equity value of $30 billion. IFF has 255 million shares outstanding, cash of $590 million, debt of ~$12 billion, a share price of $80, and an enterprise value of ~$27 billion. Furthermore, My best-case scenario indicates a value of $126, which offers a 58% return, and the bear case is $84, which offers a 4% return.

Risks

1) IFF does carry a lot of debt on its balance sheet, $11.9 billion to be precise as of the most recent quarter. This was a result of the capital needed for the merger of DuPont Nutrition and Biosciences and the Frutarom acquisition. Speaking of acquisitions, the company recently wrote off $2.25 billion of goodwill in Q3 2022 in its Health & Biosciences unit, which means it overpaid for some acquisitions. Similar actions in the future can hurt shareholder value.

2) Inflation can pressure costs such as raw materials and shipping, affecting the company's financials.

3) Competition is also one of the major risks to IFF, but I believe the company is managing this well by consistently investing in R&D to innovate and differentiate its products.

The Bottom Line

In conclusion, IFF is a global leader in a growing market. The flavor and fragrance industry is dominated by large companies, which makes it hard for new companies to disrupt the market. The firm is well diversified in terms of customers and revenue by geography. I believe IFF's exposure to the emerging markets will help them capitalize on future growth. According to my valuation, the firm is currently trading at a 31% discount.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not a qualified financial advisor or investing professional. My content and analysis are based on my opinion and are intended to be used and must be used for educational purposes only. No content or analysis constitutes or should be understood as constituting a recommendation to enter into any securities transactions or to engage in any investment strategy. It is very important to do your own analysis before making any investment based on your own personal circumstances. Readers should always seek the advice of a qualified professional before making any investment decision. Past performance is not indicative of future performance. A reader should not make personal financial, or investment decisions based solely upon this analysis.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.