Verizon: The Dividends Remain Attractive, But Be Aware Of The Free Cash Flow

Summary

- VZ's stock is currently yielding 7.7% annually, and the firm has a long history of returning value to its shareholders in the form of dividends.

- Our updated valuation using multi-stage dividend discount models and scenario analysis suggests a fair value of $39 per share on the high-end and $33 on the low-end.

- Based on our valuation and the latest developments around VZ's business, we believe that our previously established "buy" rating is still justified.

Bruce Bennett

Verizon Communications Inc. (NYSE:VZ), through its subsidiaries, provides communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

Many investors have VZ on their radars due to the firm's strong commitment of returning value to its shareholders in form of dividends. Currently Verizon is paying a quarterly dividend of $0.6525, equivalent to an annual yield of 7.7%.

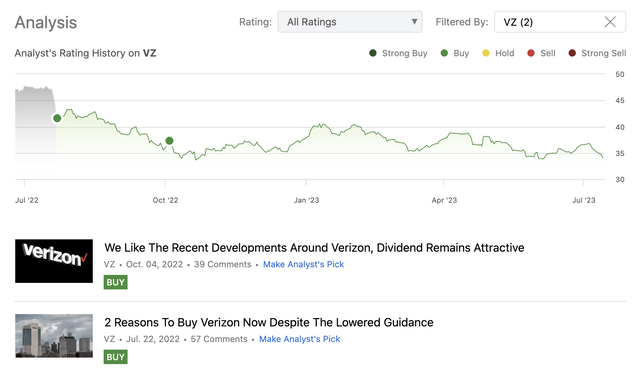

We have initiated coverage on Verizon's stock about a year ago and we have published two articles about the firm on Seeking Alpha so far. In both of these instances we have assigned a bullish rating to the company's stock, primarily due to the attractive dividends and the relatively low valuation. Back then, we have estimated the stock's fair value to be in the range of $44 to $53, based on the Gordon Growth model, using a required rate of return of 8% and a perpetual dividend growth rate of 2% - 3%.

Analysis history (Author)

Since these writings however, VZ's stock has significantly underperformed the broader market. Today, we have decided to take an updated view on the valuation, and use multi stage dividend discount models, along with scenario analysis to come up with a range of fair values.

Valuation update

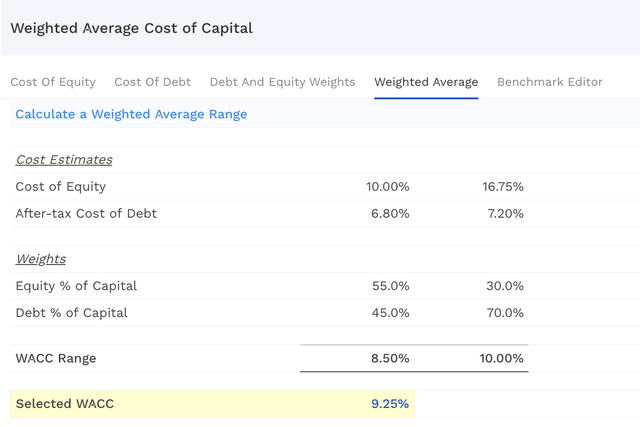

First and foremost, it is important to see whether our previously defined required rate of return (8%) is still applicable. It is a crucial step as the interest rate environment has changed substantially in the past 12 months and as VZ has substantial amount of debt on its balance sheet, it can have a meaningful impact on the weighted average cost of capital (WACC) and therefore on the required rate of return.

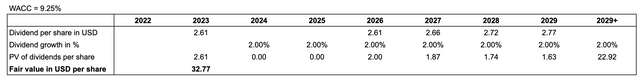

The following table displays the latest estimate of the WACC. For all our scenarios, we will be using the 9.25% figure instead of the 8% last time.

WACC (finbox.com)

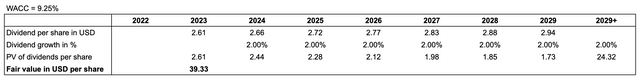

Scenario 1.

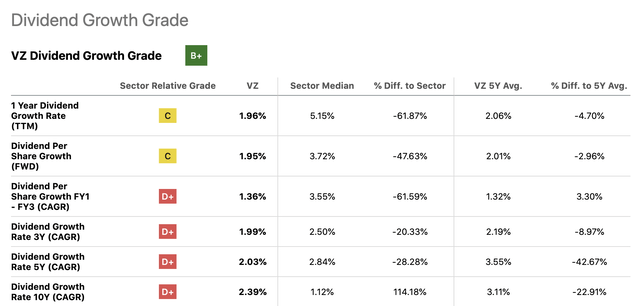

In this scenario, we will be using a single stage dividend discount model. We assume that VZ will be able to sustain its dividend payments and its long-term dividend growth rate (2%) in the future.

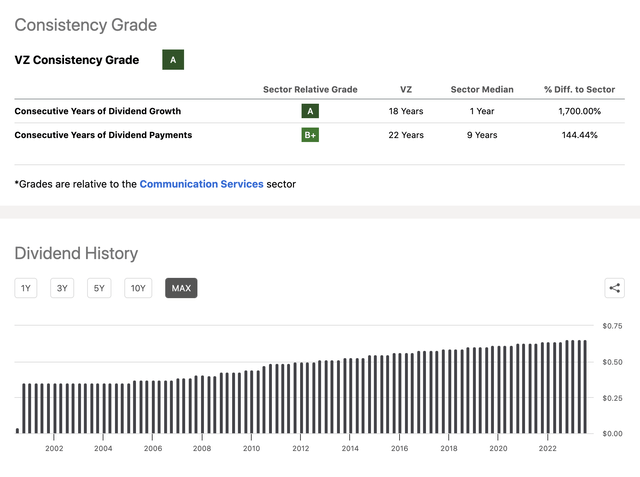

Historic dividend growth (Seeking Alpha)

Using these inputs, we get a fair value estimate of $39 per share, indicating a roughly 15% upside compared to the current market price.

Results (Author)

In our opinion, this is a reasonable scenario. As mentioned earlier, VZ has a long track record of paying and increasing its dividends.

Dividend history (Seeking Alpha)

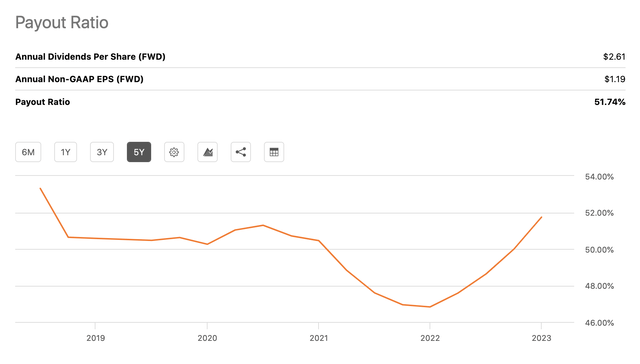

Also, based on the payout ratio, the dividends in the near future appear to be safe and sustainable.

Payout ratio (Seeking Alpha)

However, there are many arguments why these assumptions may be too optimistic and this takes us to our second scenario, which is somewhat more pessimistic.

Scenario 2.

In this case, our required rate of return will remain the same, 9.25%, but we assume that the dividend payments will need to be paused for a certain period of time. So why this assumption?

In the previous quarters, VZ's free cash flow figures have not been too impressive, despite their improvements YoY.

- Verizon ended Q1 with free cash flow of $2.3B, an increase from $1B in Q1 2022.

- Cash flow from operations $8.3B, an increase from $6.8B in Q1 2022.

In the quarters ending in December 2022 and March 2023, the firm has not generated enough free cash flow to cover its dividend payments, despite having relatively strong earnings figures. Also Biden's latest announcement regarding infrastructure spending to provide internet to more Americans may also negatively impact VZ's margins.

Cash flow statement (Seeking Alpha)

For our calculation now, we will assume first a 2-year dividend pause starting from 2024. Dividends will be resumed in 2026 at the same level as today and from then onwards a perpetual growth rate of 2% is foreseen.

These assumptions result in a fair value of $33 per share, representing a roughly 3% downside from the current levels.

Results (Author)

We believe that these assumptions may be overly pessimistic. First of all, we cannot ignore that VZ has added more than 600.000 new subscribers in Q1. Further, Verizon together with T-Mobile also appear to have gained market share, as they "continue to be promotional and competitive". Also, Verizon has recently signed a deal with USPS "to upgrade the United States Postal Service's infrastructure, offer cloud migration and solutions, and enhance its equipment", worth $146M.

Conclusion

Assuming that VZ will be able to sustain its dividend and dividend growth rate in-line with the historic averages, the stock's fair value is estimated to be $39, using an updated required rate of return of 9.25%. This represents a roughly 15% upside from the current price levels.

If we decide to be more pessimistic based on free cash flow generation abilities, and assume a dividend pause for two years starting in 2024, we get a fair value estimate of $33 per share, only slightly below the current share price.

In our opinion, VZ's stock remains attractive from a valuation point of view for dividend and dividend growth investors.

For these reasons we maintain our bullish rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)