Ryanair's Strength Lies In Its Balance Sheet And Smart Capital Allocation

Summary

- Ryanair, Europe's largest airline, has a strong balance sheet and minimal debt. This positions them to grow sustainably even in a situation where interest rates remain high.

- The company is set to continue its expansion following a deal to purchase 300 Boeing MAX 10 aircraft.

- Cash generated from operational activities is likely enough to fund the purchase of new aircraft while simultaneously paying down existing debt.

Boarding1Now/iStock Editorial via Getty Images

Introduction

Ryanair Holdings plc (NASDAQ:RYAAY) is an Irish low-cost airline group that operates several low-cost airlines in Europe. In addition to Ryanair, the company also owns Buzz, Lauda Europe Limited and Malta Air. In this article, we will use the simple name "Ryanair" when referring to Ryanair Holdings plc, though all data and financials include all of the airlines under Ryanair Holdings plc unless stated otherwise. Please also note that Ryanair's fiscal year is not the same as a calendar year. There is a 9 month difference, so for example the current fiscal year 2024 started on the first of April 2023, and fiscal year 2025 will start in April 2024 etc. Both fiscal years and calendar years will be discussed in this article, and it is important to understand the difference between the two.

I have previously written an article about Ryanair and the negative effects the grounding and delayed deliveries of Boeing's (BA) 737 MAX aircraft had in the year 2019. My previous article discussed how these delays put Ryanair at a disadvantage compared to its peers that mainly use the Airbus (OTCPK:EADSY) A320 for their European short-haul operations. The 737 MAX was declared safe to return to service by the European Union Aviation Safety Agency in January 2021, and Ryanair took delivery of the first 737 MAX 8 in June 2021, roughly 2 years behind schedule. The deliveries of the 737 MAX 8, which are still ongoing, enabled Ryanair to continue their expansion in Europe with new, more fuel efficient aircraft.

Ryanair has experienced significant growth over the years and expanded its route network drastically inside of Europe. Ryanair is already Europe's biggest airline (measured by number of passengers) and following its recent deal to purchase a total of 300 (150 firm and 150 options) Boeing MAX 10 aircraft, we can expect its expansion to continue. Ryanair is known for its extremely affordable prices, but unlike some competitors, Ryanair manages to still be very profitable due to very efficient cost controls.

This article will not provide an extensive overview of the company's business operations, instead, it will focus on a few very specific details. We will look into the balance sheet, cash flow generation and capital allocation, after which we will use that data and management statements to try and predict future trends for Ryanair.

Balance Sheet Overview

Bold statement to start with: Ryanair has one of the most pristine balance sheets in European aviation. The whole sector has suffered heavily in recent years due to events outside of its control: the Covid-19 lockdowns and more recently the ongoing war in Ukraine. During Covid-19 lockdowns the large majority of European government-owned airlines (which Ryanair is not) received government money in one form or another in order to improve balance sheets. If you are interested in the details of how certain governments participated in funding airlines during Covid-19, you can read the following report by the OECD from 2021 here.

The bottom line is that even with the influx of government money, many large European airlines are still loaded with debt. Together with rapidly rising interest rates this puts many of the large European airlines in a tough spot, especially considering how price sensitive some consumers are following the recent increase in inflation.

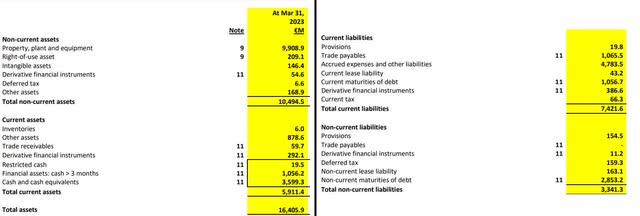

Ryanair is a different story though. Ryanair, unlike many of its competitors, owns the very large majority of its airplanes and has minimal debt on the balance sheet. The only aircrafts in Ryanair's inventory not owned by them are the 29 Airbus A320's which have been leased by its subsidiary Lauda Europe limited. This is a small percentage of the 565 aircraft operated by Ryanair, and indeed the rest are fully owned with essentially no debt tied to them. Not surprisingly, the aircraft make up the majority of Ryanair's assets. As of 31st of March 2023 Ryanair had 16.4 billion euros in assets, including almost 4.7 billion euros in cash and other liquid assets.

On the liability side, we can straight away notice the lack of any large debts. The main portion of the current maturities of debt is a Eurobond from 2017. This bond is for 750 million euros and will mature on the 15th of August 2023. Ryanair has continuously stated that it will repay this bond with cash on hand, something that is easily doable based on the cash balance discussed above. The remaining approximately 300 million euros is a combination of approximately 230 million euros of promissory notes (maturing in October 2023, likely to also be paid with cash on hand) and 70 million euros of short-term debt.

The non-current debt is comprised of approximately 800 million euros of long-term debt, mostly in the form of a revolving credit facility, and two bonds. The first is a 850 million euro bond maturing in September 2025, and the second is a 1.2 billion euro bond maturing in May 2026.

So, to summarize it, here are Ryanair's main debt obligations in:

-750 million euros - August 2023.

-230 million euros - October 2023.

-850 million euros - September 2025.

-1.2 billion euros - May 2026.

-800 million euros - revolving credit facility.

Cash flow and capital allocation

For the fiscal year ended 31st of March 2023, Ryanair generated cash from operating activities of roughly 3.9 billion euros. This is a sharp increase to the fiscal year ended 31st of March 2022, when it generated "only" 1.9 billion euros. Ryanair has not provided cash flow guidance for the fiscal year starting 1st of April 2023, however, the management stated that despite the fuel bill estimated to increase by over 1 billion euros, they are cautiously optimistic that revenue will grow sufficiently to still deliver a year-on-year profit increase. (Ryanair FY 2023 results, page 3) It is extremely difficult to predict cash flows accurately, however, it's clear that Ryanair is capable of producing around 4 billion euros per year of operating cash flow in the current situation. We can expect operating cash flow to slightly increase over the long term as Ryanair receives new aircraft deliveries which result in more capacity and decreased fuel usage per seat.

Regarding capital allocation, it's a relatively straightforward plan. As discussed above in the liability section, there is a couple billion euros of debt that will mature in the coming years. More importantly, Ryanair currently has two deals with Boeing to acquire more 737 MAX aircraft.

The first deal is for 210 737 MAX 8 aircraft. Deliveries for this order are ongoing since 2021 and the final delivery is expected for December 2024. Fiscal year 2024 is the most capital intensive year of this deal, and capital expenditures are expected to be 2.6 billion euros. Management has not indicated potential capital expenditures for fiscal year 2025, however, it is expected to be lower than the 2.6 billion in fiscal year 2024.

In a more recent deal, Ryanair ordered 300 (150 firm, 150 options) 737 MAX 10 aircraft to be delivered between 2027 and 2033. Management anticipates that this will be funded primarily from internal resources, although they said that they will remain opportunistic in financing decisions. The deal is valued at about $40 billion at list prices, however, it is almost certain that Ryanair has a significantly better deal than the list price.

Potential future trends

The way I see it, as long as there aren't any significant adverse events such as a strong recession, Ryanair will continue to generate significant amounts of cash each year. The future of capital allocation for Ryanair is almost set in stone and it can be broken into three distinct phases.

First, for the next year and a half, it's almost certain that the large majority of cash flow will be used to pay for the current aircraft order and to take care of the almost 1 billion euros of loans maturing in 2023.

The second phase starts once the last 737 MAX 8 has been delivered, sometime around December 2024. Ryanair will have roughly two years of time before the next batch of deliveries. These two years coincide with the total of 2 billion euros of bonds that mature in late 2025 and early 2026. Regardless of the interest rate environment, I believe it is the goal of Ryanair to pay these bonds off with its cash flow and to use any remaining cash to bolster its balance sheet.

The above would essentially mean that Ryanair would enter the third phase, the deliveries of 300 Boeing 737 MAX 10 aircraft in the years 2027-2033, with zero debt and a decent pile of cash. It's too early to predict what will happen in the years 2027-2033, however depending on Ryanair's cash generation, the general economic situation and interest rates, as well as Boeing's delivery schedule, it is entirely possible that Ryanair will come out of this period of significant capital expenditure with little or no debt on its balance sheet.

Conclusion

The past few years have been extremely challenging for airlines. Ryanair has managed to navigate through these difficulties and grown to be the largest airline in Europe without damaging its own profitability. Even more importantly, this growth has been very sustainable in the sense that they have not sacrificed their aircraft fleet quality or their balance sheet in order to be able to provide more capacity.

Ryanair already has a significant cost advantage compared to its low-cost competitors. Data from page 4 of Ryanair's FY 2023 presentation shows that its average cost per passenger was 31 euros, compared to 46 euros for Wizz Air (OTCPK:WZZAF) and 76 euros for EasyJet. (OTCQX:EJTTF) This cost advantage, Ryanair's constant 90%+ load factor (latest figure is 95% for June 2023), and the future aircraft purchases place the company in an exceptionally good position to increase market share in Europe.

Ryanair's stock is not particularly cheap, trading at P/E of around 14 and relatively close to its all-time high from 5 years ago. However, as discussed throughout this article, Ryanair is extremely well-positioned to keep growing in the European market while maintaining a good level of profitability, excellent cash flow metrics and a pristine balance sheet. In my opinion this level of operational excellence is worth the price for investors with a long-term view.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RYAAY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.