Yelp: More Valuable To Another Party

Summary

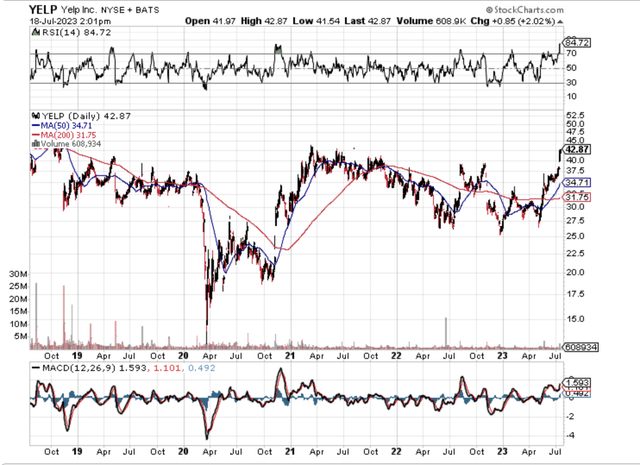

- Yelp Inc. got a Buy call from Goldman Sachs, sending the stock above key resistance around $40.

- An activist had called for the consumer review site to sell the business due to constant stock compensation issues and aggressive stocks sales, keeping a lid on Yelp.

- At 15x EV/EBITDA targets, Yelp stock could be worth up to $80 to an external party.

- This idea was discussed in more depth with members of my private investing community, Out Fox The Street. Learn More »

Spencer Platt/Getty Images News

Despite an activist calling for a far higher stock price, a bullish call from Goldman Sachs is what got Yelp Inc. (NYSE:YELP) above $40. The consumer review site has long been overlooked despite constantly improving financials. My investment thesis remains ultra Bullish on the stock, with a price target more in line with the activist.

Wimpy Goldman Call

Yelp surged 10% on Goldman Sachs only hiking the yearly price target on the stock from $38 to $47. The analysts only suggest the consumer review site produces up to high-single digit advertising revenue growth through 2027.

Outside of a Covid hit in 2020, Yelp has a history of double-digit revenue growth. Activist TCS Capital Management demanded that the company should look at a deal for selling the business in the $70+ range.

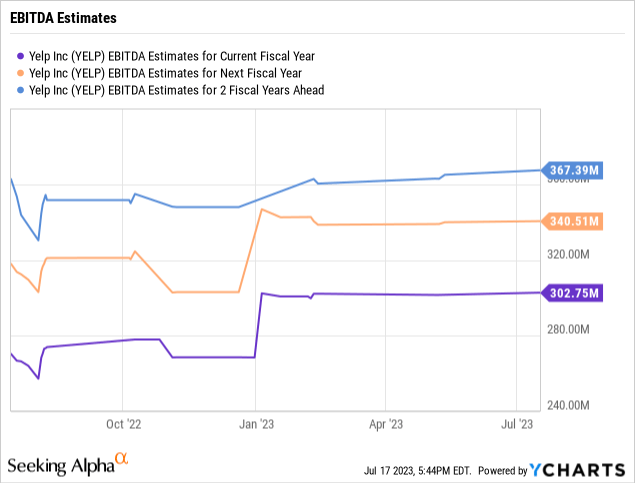

Back in May, TCS Capital suggested the business with 73 million users, 265 million reviews, and 6.3 million businesses should trade with a scarcity value. The stock would be worth $70 based on just 12x 2024 estimated adjusted EBITDA targets, while a scarcity target would value Yelp at 15x 2024 adjusted EBITDA, or closer to $80.

The consensus analyst EBITDA estimates for 2024 is now $341 million, up from around $303 million in 2023. Yelp forecasts a 2023 midpoint of $300 million.

Yelp potentially has a management problem, contributing to the low stock value. Instead of loading up on cheap shares in the low $30s earlier this year, management routinely unloaded shares.

Naturally, these executives have valid reasons to dumping shares, even when the stock might be undervalued. The problem here is that insiders haven't bought shares in years. It is a sign of complacent management with too many stock awards from the business that none of them wanted to buy shares an activist saw with 100%+ upside.

Shareholders want management more tied into stock appreciation while current management appears tied to stock awards. According to TCS Capital, management has sold $120 million worth of stock since 2018 and possibly provided a huge contribution to why Yelp constantly runs up to $40 and struggles to trade higher.

Deep Discount

Yelp guided to 2023 adjusted EBITDA of $300 million, yet the stock only has a market cap of $3.0 billion after the 10% Goldman Sachs rally. Remember, management spent the early part of the year unloading stock at $30 with Yelp trading at $42 today.

TCS Capital probably has a valid point to where management has too much compensation tied to stock options, not stock performance. Yelp spent a rather aggressive $46 million on stock-based compensation ("SBC") in Q1 2023 alone.

Source: Yelp Q1'23 shareholder letter

A company with revenues targeted at $1.3 billion annually shouldn't be spending over $150 million each year on SBC. Product development costs shouldn't top $100 million annually for a company only producing ~10% revenue growth.

For these reasons, Yelp probably has more value as a buyout target. A new management team could make the business far more productive and profitable by stripping out excessive compensation.

At 15x the analysts adjusted EBITDA targets for 2024, the stock would have a valuation of $5.1 billion. Once factoring in the $414 million cash balance, the stock could be worth up to $80 to an external party.

The vast majority of the difference between the GAAP profits and adjusted EBITDA is solely the high levels of SBC a new management team could address. Yelp is highly cash flow positive, producing nearly $200 million in operating cash flows last year alone.

Takeaway

The key investor takeaway is that Yelp remains very compelling at $40. Yelp Inc. stock has a solid case for hitting the activist targets, and a breakout above $40 might draw more investors into the nearly forgotten tech stock.

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written by

Stone Fox Capital launched the Out Fox The Street MarketPlace service in August 2020.

Invest with Stone Fox Capital's model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Net Payout Yields model

Analyst’s Disclosure: I/we have a beneficial long position in the shares of YELP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.