Lamb Weston Holdings: Attractive Business, But Too Expensive

Summary

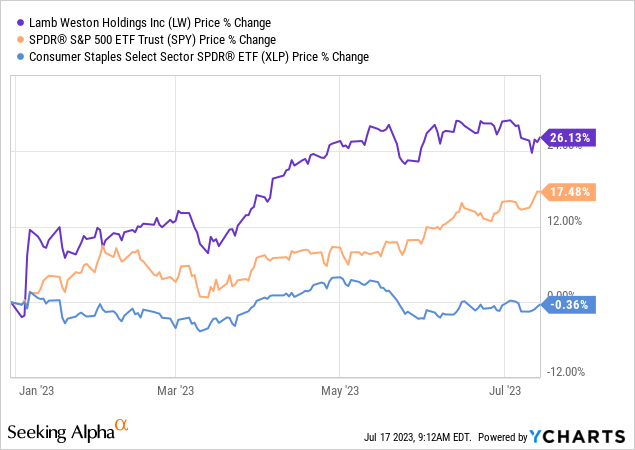

- Lamb Weston Holdings' stock has outperformed both the SPY and the consumer staples sector year-to-date, due to strong financial performance and expanding margins.

- The company's profitability and efficiency metrics have improved, but management warns of continued volatility due to higher costs and inflationary pressures.

- After the recent rally, the company's stock appears overvalued compared to its peers, leading to a "hold" rating for the firm.

Richard Drury/DigitalVision via Getty Images

Lamb Weston Holdings, Inc. (NYSE:LW) produces, distributes, and markets value-added frozen potato products worldwide. It operates through four segments: Global, Foodservice, Retail, and Other.

Year-to-date, LW's stock has significantly outperformed both the SPY and the consumer staples sector. For this reason, we have decided to take a closer look what could be behind this strong performance, and whether it is expected to be sustainable going forward.

To answer these questions, we will be focusing on the firm's profitability and efficiency metrics. To conclude our analysis, we will also give our thoughts on the current valuation and whether it could be an attractive entry point or not.

Profitability

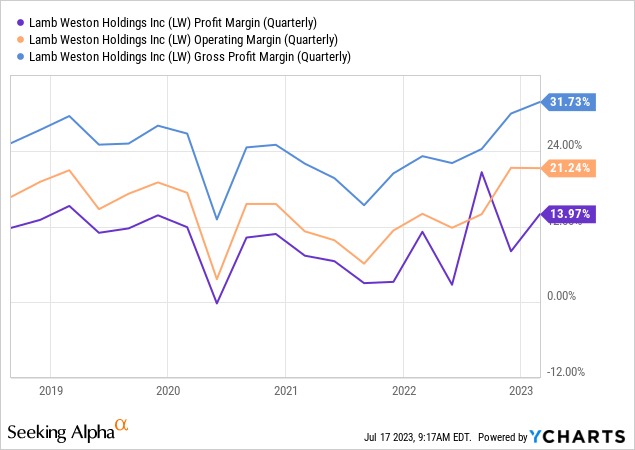

To assess the firm's profitability, we will be primarily referring to the net profit margin and its development over the past five years.

The chart above shows that since the bottom in 2021 the net profit margin, along with the operating margin and the gross profit margin, has kept increasing, despite some volatility. This positive development justifies, at least partially, why the stock price has been performing well this year.

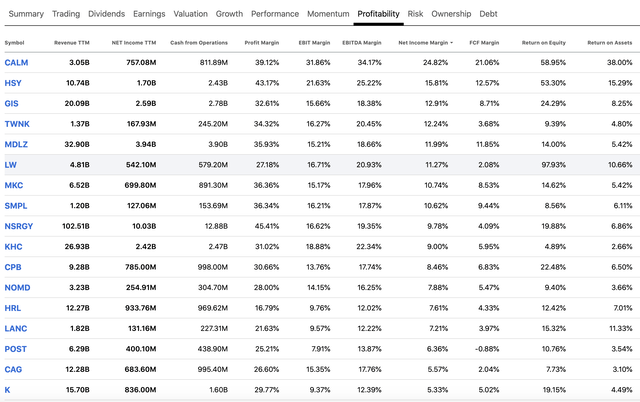

To put these figures into perspective, the following table summarizes the profitability measures of several firms in the packaged food and meats industry. Based on most metrics, LW ranks in the upper part of the peer group.

At this point important to note that in the near term the margins are likely to remain volatile. Management has also given cautious comments about what to expect going forward, despite the strong financial performance in the previous quarter, based on both revenue and earnings results:

Our performance was broad-based, with strong sales and earnings growth across each of our core business segments that were in line with or exceeded our projections for the quarter, [...] We expect this momentum will continue through this fiscal year and provide a solid foundation for fiscal 2024. However, we continue to believe that the near-term macroenvironment in North America and Europe will remain volatile as we face higher costs for raw potatoes and other key inputs, and as consumer demand and restaurant traffic continue to be affected by inflationary pressures.

All in all, we find the company's financial performance appealing so far this year, but to assess whether it is the right investment now, we have to look at a few other factors to form a full picture.

Efficiency

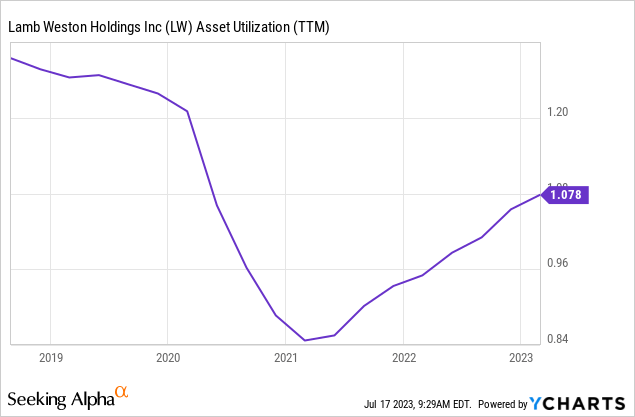

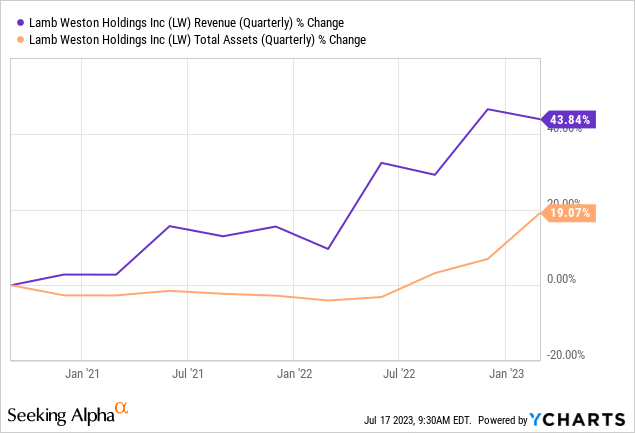

A common metric that is used to measure the efficiency of the firm is the so-called asset turnover. It shows how much revenue a firm can generate with its asset base. In general, we like to see stable or improving efficiency.

Just like to profitability measures, the firm's efficiency has been also gradually improving since it has bottomed in 2021. The following graph illustrates that the reason for this improvement has been the much faster growth of revenue than total assets in the past years.

In our view, from this perspective, the firm also appears to be a relatively attractive investment candidate.

Valuation

But now the most important question comes? Is it worth buying the stock after the rally?

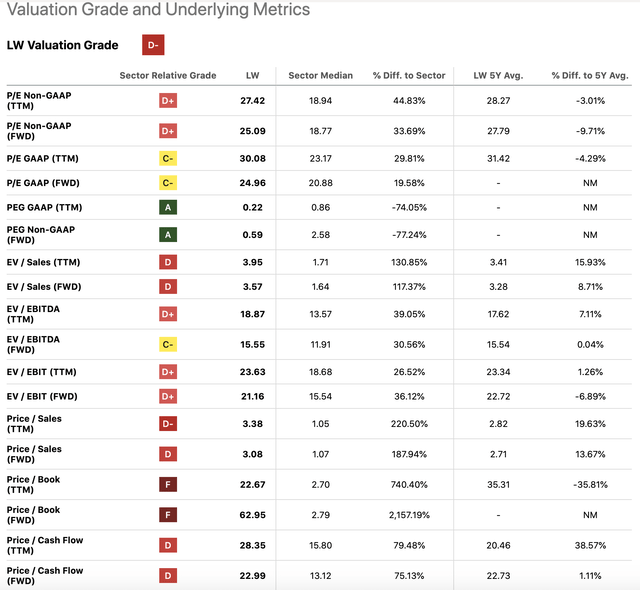

The following table summarizes a set of traditional price multiples, which can help us gauge whether the stock is under-, fairly- or overvalued.

Based on these metrics, the firm appears to be overvalued, compared to the consumer staples sector median, and it appears to be more or less in-line with its own 5Y averages. Now, one might say that this is not a fair comparison because the consumer staples sector is very broad, containing businesses whose activities may not be similar to LW's at all, and therefore the median may not be relevant for comparison.

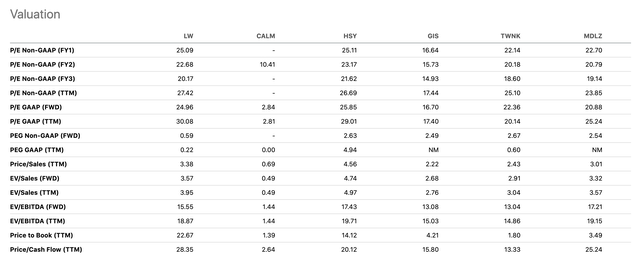

So we decided to create a much narrower peer group, containing firms from the packaged food and meats industry, which had better profitability metrics than LW.

All these firms have similar, or better valuation metrics than LW. Important to mention however that LW's PEG ratio, which capture the expected growth, is the lowest among these firms. For us, this is an indication that the growth expectations are quite high compared to that of the other firms. But whether these expectations can be realised or not is highly uncertain, especially if we refer once again to the CEO's comment about the macroeconomic environment in the near term. For these reasons, we believe that LW is currently not attractive from a valuation point of view.

But before we conclude our writing, it is important to note that LW is scheduled to report earnings the coming week. These figures are likely going to give us some more indication about the strength of the consumer. The revenue or revenue growth figure is going to give us some indication about the demand for LW's products in the current market environment, but our main focus will be on the development of the margins, along with the cost of raw materials. As we do not expect significant positive surprises, this is another reason to wait with any investment decisions now.

Conclusion

Year-to-date, LW's stock has outperformed both the SPY and the XLP. This outperformance has been primarily driven by the strong financial performance, including revenue- and earnings growth, as well as the expanding margins.

The firm has not only showed improvement in terms of profitability, but also in terms of efficiency.

On the other hand, we believe that after the recent rally, there is no significant upside potential left. The most traditional price multiples are indicating that LW is trading in-line or at a slight premium compared to its peers, which have better profitability metrics.

For these reasons, we assign the firm a "hold" rating now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.