HubSpot: Buying A Good Company At A Fair Price

Summary

- HubSpot's valuation is high, but the premium is fair, given the company's stellar performance and bright future prospects.

- The company's financial performance has been impressive, with massive revenue growth and stellar profitability metrics.

- As an aggressive growth company, HubSpot's stock is vulnerable to short-term volatility, so I recommend potential investors to dollar-average.

hapabapa

Investment thesis

HubSpot (NYSE:HUBS) is a very generously valued company, but I am buying into my long-term portfolio. The company demonstrates stellar revenue growth and profitability expansion. My analysis suggests there is still plenty of room to improve the operating margin and the free cash flow. For aggressively growing companies like HUBS, there is always a substantial risk of a rapid revenue growth deceleration, but the company is well-positioned to enjoy favorable tailwinds over the long-term.

Company information

HubSpot offers its customers a cloud-based customer relationship management [CRM] platform. The platform includes marketing, sales, service, operations, a content management system [CMS], other tools, integrations, and a native payment solution. The company aims to sell to mid-market B2B companies. According to the latest 10-K report, by the end of FY 2022, the company had more than 167 thousand clients across 120 countries.

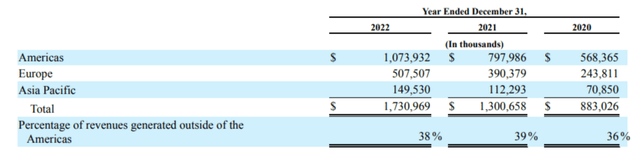

The company's fiscal year ends on December 31. HUBS operates as a single segment and disaggregates its revenues by geographic area. About 40% of the company's sales are generated outside the Americas.

Financials

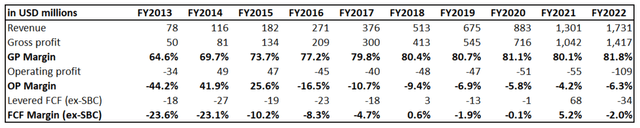

HubSpot's financial performance has been stellar over the past decade. The company delivered both significant trends I seek in growth companies: rapidly growing revenue [36% CAGR over the past decade] and expanding profitability metrics as the business scaled up.

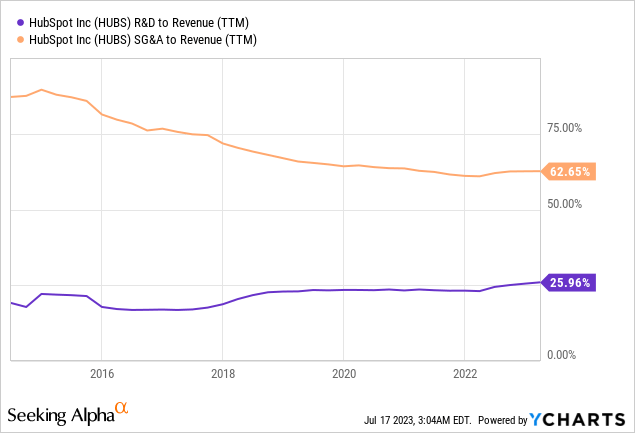

I like that the company reinvests about a quarter of its revenues in innovation. A high R&D revenue signals that the management is committed to creating long-term value and expanding the competitive advantages of HubSpot. The SG&A to revenue ratio is substantial but has decreased significantly as the business scaled up. That said, the company still has vast room for improvement in the operating margin. Important to emphasize that the company's gross margin is about twice higher than the sector median. So is the levered FCF margin.

The management executes a very prudent capital allocation strategy with healthy liquidity metrics. The leverage ratio might look slightly high, but HUBS is still in a solid net cash position.

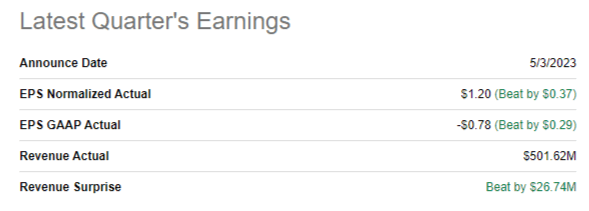

HubSpot released its latest quarterly earnings on May 3, delivering higher-than-expected results. Revenue growth momentum is still strong, with a 27% YoY increase. The adjusted EPS more than doubled, from $0.54 to $1.20.

Seeking Alpha

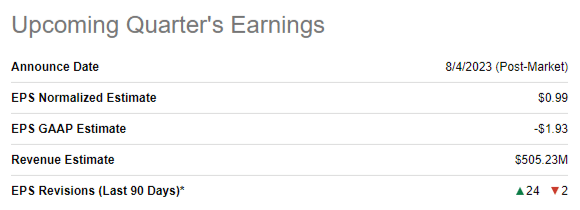

The gross margin continued expansion, from 81.6% to 83.6%. The operating income was still slightly negative, though. The levered FCF more than doubled YoY. The upcoming quarter's earnings release is scheduled on August 4, revenue is expected by consensus to increase 19% YoY. The adjusted EPS is poised to follow the top line with more than double expansion. This is a high-quality EPS growth because the company does not repurchase much of its own shares.

Seeking Alpha

Overall, I think that the company will be able to sustain strong momentum in the nearest future. The secular trend toward an increased level of digitalization for small and medium businesses is favorable for HUBS. The company's stellar profitability means it is very efficient in its operations. HubSpot constantly works on improving its platform which we see from the high R&D to revenue ratio. What is important is that the company strives to expand its reach, investing in the platform to make it more suitable for companies with up to 2,000 employees.

I like the company's "Freemium" strategy, which means attracting customers who begin using the platform through free products and then have the option to upgrade to the paid suite. The company has a massive customer base of more than 167 thousand, meaning there is a vast potential for upselling and cross-selling.

Valuation

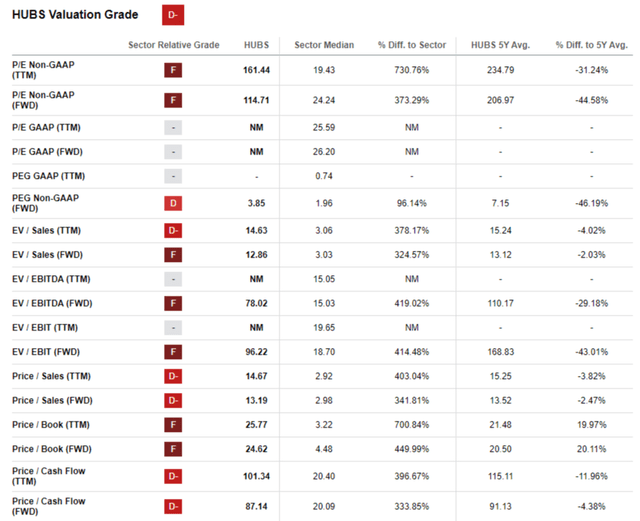

HubSpot stock rallied more than 90% year-to-date, a significant outperformance of the broad market. Seeking Alpha Quant assigned the stock a poor "D-" valuation grade due to multiples substantially higher than the sector median. On the other hand, current multiples are lower than historical averages.

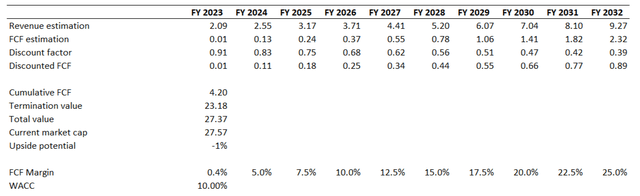

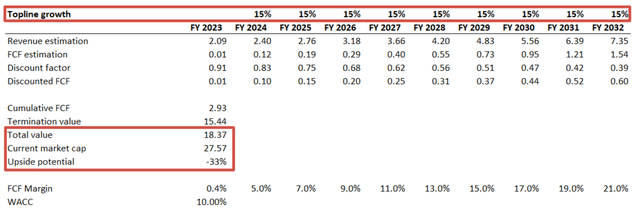

Now let me proceed with the discounted cash flow [DCF] analysis. I use a 10% WACC as a discount rate. Earnings consensus estimates forecast an 18% revenue CAGR over the next decade. I expect almost zero FCF margin in the fiscal year 2023 and 5% for the following year. For the years beyond, I expect the FCF margin to expand by 250 basis points, peaking at 25%.

The stock looks fairly valued at current levels, but the assumptions I used are very aggressive. Sustaining an 18% CAGR over the decade is a challenging task. So is the rapid expansion of the FCF margin and peaking at 25%. I want to simulate a slightly more conservative scenario where revenue grows at a 15% CAGR, and the FCF margin expands by 200 basis points yearly.

As you can see, the DCF model is susceptible to growth rate and FCF margin expansion rate changes. The stock now looks about 33% overvalued. To sum up, the stock looks overvalued at the current share price.

Risks to consider

The company's generous valuation is the biggest risk for the stock price over the short term. Any disappointment for investors from the revenue growth perspective will highly likely lead to a massive sell-off. The risk of short and middle-term volatility is very high, so I recommend investors to the dollar average growth companies like HUBS to mitigate the risk.

Another major risk that I see is the fierce competition. The major competitor is Salesforce (CRM), another wonderful company with exceptional execution. Giants like Microsoft (MSFT) and Oracle (ORCL) are not direct competitors to HubSpot, but there is no guarantee that their offerings in CRM and addressable markets will not overlap with HubSpot in the future.

Lastly, HUBS aims to serve mid-size businesses, but this category tends to have higher churn rates due to more flexibility than large enterprises. HUBS should ensure it is able to retain customers over the long term.

Bottom line

To conclude, the stock is a "Strong Buy" for long-term investors. Yes, the valuation looks very high, but let me quote Warren Buffett:

It's far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.

I do not doubt that HubSpot is a wonderful company, and I am ready to pay a premium to the stock price. There definitely will be drawdowns if the broad market will decline, or any of the quarters will deliver disappointing revenue growth. The best decision here would be to dollar-average and buy the stock every month because it is highly likely to deliver massive value to shareholders over the long term.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in HUBS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.