Talaris Therapeutics: Cashing Out Ahead Of Tourmaline Merger

Summary

- Failed biopharma Talaris Therapeutics has finally reached a strategic review conclusion, delivering a 37% return to us over the last two months.

- The company has agreed to merge with a late-stage biopharma Tourmaline Bio.

- There might still be further upside for TALS shareholders as part of the combined entity.

- However, at current prices, I am inclined to stay on the sidelines.

- This idea was discussed in more depth with members of my private investing community, Special Situation Investing. Learn More »

Alina Lyssenko

Talaris Therapeutics (NASDAQ:TALS) initially attracted my attention several months ago. At the time, TALS was a failed biopharma trading at a big discount to its net cash and running a strategic review. After a death of a patent in one of the trials in late 2022, TALS subsequently suspended the development of its clinical pipeline and laid off the vast majority of its workforce which seemed to indicate that the company was laser-focused on minimizing cash burn and maximizing shareholder value. While it was not entirely clear if a liquidation was in the cards, the significant presence of prominent VC/PE firms on TALS's register (including Blackstone with a 25% stake) and their control over the company/management indicated that a value-destroying reverse merger was out of the question. Here's how I described the setup to Special Situation Investing subscribers in April:

What has happened since? Well, given TALS's highly volatile share price, I was able to play the situation successfully more than once. Initially, I exited the position when the shares ran up to $2.90/share and the gap to the estimated net cash narrowed substantially, leading to a 20% gain. The market presented another opportunity to play the situation as TALS share price retraced back to $2.40/share, enticing me to re-enter the position. The anticipated positive announcement came several weeks after the re-entry as TALS concluded the strategic review, agreeing to a merger with a late-stage biopharma Tourmaline Bio. TALS share price jumped as much as 31% on the day, allowing me to close the position at $2.80/share.

Since then, TALS share price has continued their ascent before settling in the $3.03-$3.20/share range ($3.07/share currently), proving my second exit to have been a bit early. Having said that, at current share price levels I am inclined to stay on the sidelines given limited further upside. As part of the announced transaction, TALS equity holders will retain c. 21% ownership in the combined entity and receive a cash dividend of $65m. TALS's management has estimated the value of the 21% stake at $1.92/share which coupled with the $65m or $1.51/share cash dividend would value TALS at $3.43/share. However, I think the management's estimate of the value of 21% stake might be overly optimistic. Here's a breakdown of the combined entity's value as estimated by the management:

- $230m value of Tourmaline.

- $82.5m value of Talaris net of up to $64.8m in cash dividend.

- $75m investment coming from PIPE investors.

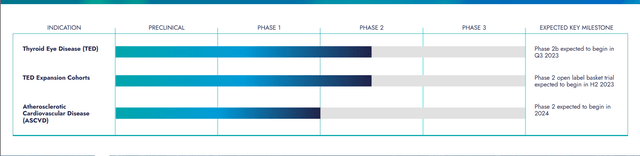

This leads to a total value of $387.5m, implying $82.5m ($1.92/share) attributable to current TALS shareholders. The main uncertainty lies in determining the value of Tourmaline which accounts for the majority of the combined entity's estimated value. Tourmaline's primary asset, TOUR-006, is currently in phase 2 of clinical trials for treating thyroid eye disease (TED), and phase 2b is expected to commence in Q3 2023. Additionally, Tourmaline plans to initiate a phase 2 trial for atherosclerotic cardiovascular disease (ASCVD) in 2024. Estimating TOUR-006's value is clearly not straightforward and I have limited expertise in the field to double-check the management's estimate ($230m). Worth noting that Tourmaline has recently secured $112 million in series A financing led, however, it is unclear how much of the company's ownership stake that funding represents.

I think that the combined Talaris/Tourmaline entity might very well be valued approximately at its net cash levels. A relevant example to consider is the merger of Syros Pharmaceuticals and Tyme Technologies, which was completed in September 2022. In a similar fashion to the Talaris/Tourmaline merger, the transaction involved private investment in public equity (PIPE) from well-regarded biotech investors. However, subsequent to the merger, SYRS stock experienced a significant decline and is currently trading at approximately one-third of the valuation at the time of the private placement. By valuing the combined Talaris/Tourmaline entity at its pro-forma net cash levels of $210 million, the 21% share held by TALS's shareholders would be worth approximately $45 million. This translates to roughly $1 per TALS share. Coupled with the cash dividend of $1.51/share, this sums up to $2.51/share - substantially below current share price levels.

More Details on The Merger And Tourmaline

A bit more details on the merger. The transaction will require shareholder approvals on both sides and is expected to close in Q4'23. I think the merger is highly likely to close successfully given that TALS has been controlled by several reputable PE/VC firms (own 57% of TALS, led by Blackstone) while TALS's management owns a further 17%.

The merger will expand the Tourmaline's cash runway through 2026, allowing it to continue the development of its key program TOUR006. The program has been licensed by Tourmaline from Pfizer in May'22. Interestingly, the company boasts a line-up of reputable executives and investors which suggests the company's pipeline might have high potential:

- Tourmaline's co-founder/CEO has previous experience as the COO at IMVT which is a $2.7bn market cap biotech company.

- The chairman of the merged company will be Tim Anderson, who is currently a partner and co-founder of Cowen Healthcare Investments, an indirect subsidiary of TD Bank, a major Canadian banking institution. Recently, Cowen raised $550 million for its fourth fund.

As part of the transaction, Tourmaline will raise $75m from a group of life sciences investors, including Deep Track Capital and Cowen Healthcare Investments. The investment from current Tourmaline shareholders reflects strong confidence in the company's future prospects. Another positive indicator is that Cowen has chosen to enhance its level of involvement by appointing Tim Anderson as the chairman.

Takeaway

At current share price levels, I am exiting my position in TALS. Given a somewhat similar biopharma merger where the combined company's stock price ended up significantly below management's valuation at the time of the merger, I think there is a good chance the combined TALS-Tourmaline might trade closer to the company's net cash levels. In such a scenario, the combined company would trade at c. $1/share, implying that the value TALS shareholders are receiving with the transaction is below current share price levels.

Highest conviction ideas for Premium subscribers first

Thanks for reading my article. Make sure to also check out my premium service - Special Situation Investing. Now is a perfect time to join - with today's high equity market volatility, there is an abundance of lucrative event-driven opportunities to capitalize on. So far our strategy has generated 30-50% returns annually. We expect the same going forward.

SIGN UP NOW and receive instant access to my highest conviction investment ideas + premium weekly newsletter.

This article was written by

Focused on event-driven trades and special situations. Always looking for an edge.

The last 10 years of my life have been devoted to the investment world, with event-driven opportunities being my bread and butter. I was and still am surprised by the extent the markets are mis-pricing the risks/rewards in some situations - markets are very far from being efficient and your own research can give you a very sizable edge.

I have considerable professional experience in investment banking and strategy consulting, as well as a number of finance degrees under my belt. My entrepreneurial spirit has also enabled me to launch a number of new businesses, some of which have succeeded and some of which have failed. I am lucky enough to have skills in both business development and investment analysis - this is a winning combination that allows me to quickly recognize and filter out the most attractive investment opportunities in the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TALS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.