Hyundai's AI-Powered Robots Will Redefine The Future

Summary

- Joe Rogan, American podcast host and comedian, expressed concern over the development of humanoid robots, particularly Kengoro, which can sweat to cool down.

- Robots developed by Boston Dynamics, such as Atlas and Spot, have potential applications in military, law enforcement, emergency services, logistics, inspection services, agriculture, healthcare, and domestic services.

- The integration of artificial intelligence, machine learning, computer vision, natural language processing, decision-making algorithms, Internet of Things, and robotics process automation could enhance the capabilities of these robots, potentially making many human professions obsolete.

Jason Mendez/Getty Images Entertainment

Thesis

In this comprehensive analysis, I delve into the transformative potential of the merger between Artificial Intelligence (AI) and Boston Dynamics, propelled by Hyundai's (OTCPK:HYMTF) pioneering vision. This fusion holds the promise to revolutionize robotics, amplifying their capabilities and efficiency through key components such as Machine Learning, Computer Vision, Natural Language Processing, Decision-making algorithms, Internet of Things, and Robotics Process Automation. As Boston Dynamics strives to create robots that mirror human abilities, this transformation could bring staggering changes across various industries. As Hyundai's market position strengthens, the immense potential and risks of this innovative frontier are assessed, bringing to light the profound implications of a world where robots are "more like people".

Humanoid Robots

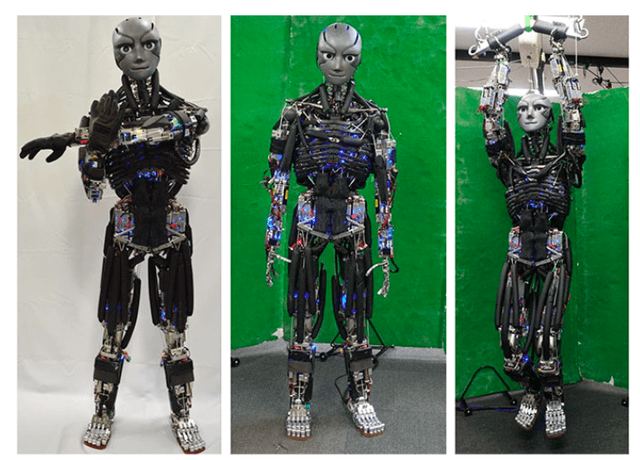

American podcast host, comedian, and MMA commentator Joe Rogan, known for his candid and comprehensive discussions on a broad spectrum of topics, expressed deep concern upon his first encounter with Kengoro, the human mimetic humanoid. His Instagram post distilled his apprehensions into a single, impactful takeaway: Humanity is facing serious risks.

His expression, though slightly alarmist, reflects his direct approach to the rapid advancements in technology, especially robotics.

"Boy robot passes agility tests" (Science News)

That was 2017.

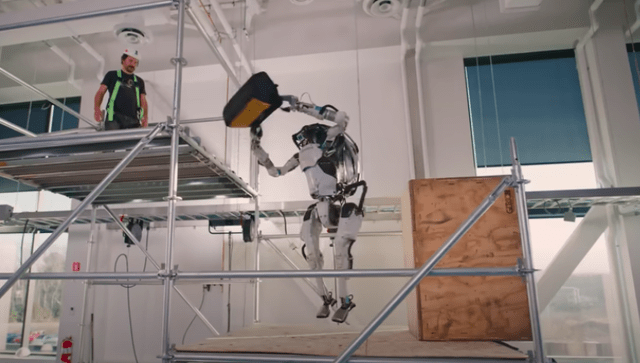

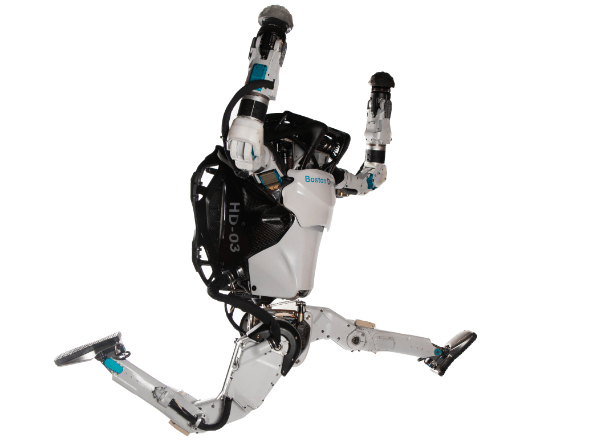

Today, assuming there aren't any private or government funded secret labs or research facilities (insert sarcasm) working on something much more exotic and advanced, we have Hyundai's ATLAS, considered to be the "world's most dynamic humanoid robot" that was created by Boston Dynamics, a company they saw fit to purchase an 80% from SoftBank for $921M in cash, during the bank's "asset sale spree" after major losses due to write-offs for its Uber and WeWork investments.

YouTube/Boston Dynamics: Author's snapshot

In my experience, when I introduce individuals, who are largely unfamiliar with the rapid pace of technological innovation, to any one of the awe-inspiring YouTube videos by Boston Dynamics, showcasing extraordinary robots like Atlas, Sand Flea, WildCat, or Spot, the response I typically get can be best summarized as: "No way, this has to be fake."

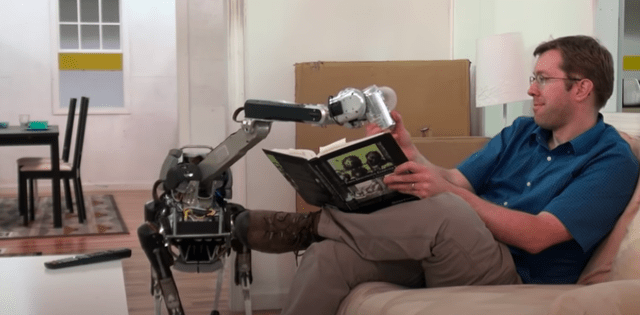

Spot handing someone a cold one. (YouTube/Boston Dynamics)

Rise of the Machines

You don't have to be a futurist to grasp the momentous societal shift looming on our horizon once you take a glimpse at the astounding capabilities of these robots in action. Their implications extend to a sweeping array of human professions that seem destined to be affected, if not made obsolete. Let's dive into a few specific sectors and applications:

In the domains of the Military and Law Enforcement, machines like Hyundai's (Boston Dynamics) Atlas and Spot possess the potential to usurp human roles, especially those entailing danger or exposure to hazardous environments. Think along the lines of bomb disposal, reconnaissance in war zones, or negotiating hostage situations. The utility of these robots doesn't end there - patrols, surveillance and direct combat will most likely fall under their domain.

With respect to Emergency Services, robots of this caliber could be dispatched to conduct search-and-rescue operations, reaching locales deemed too dangerous for humans, such as fire-stricken regions, contaminated zones, or collapsed structures. As a result, we may find positions involving these high-stake activities gradually handed over to robotic intervention.

Turning to Logistics and Warehouse Operations, robots like Atlas present an opportunity to fully automate warehouse tasks, inclusive of goods transportation, sorting, and stacking. In the same breath, Atlas, given its advanced bipedal maneuverability and dexterity, could potentially usurp more intricate logistics tasks presently necessitating human involvement like those within the construction industry.

Paris Underground: Spot Inspects Transportation Infrastructure with RATP Group (YouTube/Boston Dynamics)

Inspection Services seems destined to also experience a major shift. Spot's mobility and durability position it perfectly for roles involving the inspection of infrastructure, encompassing pipelines, power lines, and even construction sites. This could diminish the demand for human inspectors, particularly those working in hazardous or inaccessible areas.

In the realm of Agriculture, Spot, armed with the right equipment, could undertake functions such as crop surveillance, animal herding, or even planting and harvesting. This mechanization could reduce the demand for manual labor in this sector.

Moving on to Healthcare, while not directly eliminating jobs, in my view, robots like Spot and Atlas could bolster healthcare services, executing tasks like sterilizing rooms, distributing medication, or even aiding in patient care in contaminated zones (think of how they could be deployed in the unthinkable "next" pandemic), thereby mitigating risk to healthcare professionals.

Lastly, in Domestic Services, as this technology gradually becomes more accessible, we might see these robots adopted for household use. Their potential tasks could range from routine cleaning and grocery transport to more intricate chores, thereby diminishing the demand for domestic help.

The Fusion of Artificial Intelligence (AI) and Boston Dynamics

In August 2022, Hyundai took the next logical leap in the evolution of its robots by launching the Boston Dynamics AI Institute.

The mission is fairly straightforward and highlighted by Marc Raibert, Executive Director:

We need to make robots smarter, more agile and dexterous, and generally easier to use - more like people.

Essentially, unless you've been living under a rock, Artificial Intelligence (AI) has proven to be an essential catalyst and massive disrupter in the evolution of numerous industries, and the realm of robotics bears no exception. Especially notable is AI's ongoing merger with the robotics technology fashioned by Boston Dynamics, which holds the power to significantly enhance the potential operations and proficiency of their robots, namely Atlas and Spot in the following ways:

Machine Learning

A paramount stride towards amplifying the prowess of Boston Dynamics robots necessitates the implementation of Machine Learning (ML) methodologies. While most investors have been consumed with Tesla, Hyundai's advancements have largely gone unnoticed. While Tesla (NASDAQ:TSLA) commands a following of 38 Wall Street analysts, according to Seeking Alpha, Hyundai has zero (Wall Street) coverage.

Speaking of unnoticed, take, for example, the company's development of the world's first Machine Learning based Smart Cruise Control (SCC-ML) Technology. In the realm of its Boston Dynamics unit, ML has the potential to fundamentally morph these robots' locomotion and engagement with their environment, by amplifying their versatility to various terrains and harnessing learning from their own missteps.

Specifically, reinforcement learning - an ML offshoot where the system acquires optimal actions through the process of trial and error, could prove pivotal. This approach enables the robots to progressively refine their movements rooted in past performance, spawning a feedback cycle that promotes relentless enhancement.

Computer Vision

An additional crucial component of AI that can usher a revolution in Boston Dynamics robots is Computer Vision (CV). Once again, Hyundai had already been ahead of the curve when back in 2018 the company probably flew under most investors radars when it announced its strategic investment in allegro.ai, a leading technology company specializing in deep learning (DL) - based computer vision.

Essentially, when we're thinking of robots and AI, CV equips those machines with the capacity to decipher visual data, permitting them to identify objects, comprehend their social environment, and navigate with amplified competency.

Looking forward, the integration of advanced deep learning algorithms can culminate in high-achieving CV models, boosting Boston Dynamics robots' environmental cognizance and autonomous movement like handing you a hot cup of Joe without spilling a drop.

Natural Language Processing

The incorporation of Natural Language Processing (NLP) could markedly heighten the user-experience of Boston Dynamics robots. By deciphering voice directives, comprehending text guidelines, or even generating progress reports, NLP can render these robots more approachable and effortless to operate. It essentially fills the communication void, manifesting a more innate interaction between humans and robots.

As Boston Dynamics charts its course towards a future where its machines bear a closer resemblance "more like people", think about the changes that will reverberate through numerous industries and occupations: imagine the roles of customer service reps, data entry clerks, and personal assistants or secretaries undergoing a seismic shift. Not to mention the impact on translators or interpreters, technical support, and even the realms of telemarketing and sales. The potential, in my humble opinion, is both staggering and unsettling

Decision-making Algorithms

Decision-making algorithms will most likely end up forming the bedrock for Boston Dynamics robots' autonomy. These algorithms, drawing upon AI planning and scheduling tactics, empower robots to take autonomous decisions, such as path design to circumvent obstacles. The integration of these AI-propelled methods could dramatically enhance these robots' productivity, self-sufficiency, and problem-solving abilities.

Internet of Things

Through the assimilation of IoT technologies, Boston Dynamics robots can augment their functionality by networking with other devices. For instance, IoT connectivity could allow these robots to transmit data to remote servers for in-depth analysis, receive updates, adhere to directives, or even engage with other IoT devices in their vicinity. This could lead to a more unified, reactive, and intelligent robotic system.

Robotics Process Automation

Lastly, the dawning of Robotics Process Automation (RPA) is poised to trigger a seismic shift in how we deploy Boston Dynamics robots. We're looking at a transition that will catapult these machines from being mere digital task automators to the efficient executors of physical tasks. By breathing life into the AI-backed RPA, robots such as Atlas and Spot are slated to evolve into high-octane workhorses, shouldering the burden of humdrum, repetitive tasks, and thus, in an ideal future (I hope) set humans free to tackle the more sophisticated, thought-intensive operations.

The slew of professions possibly in the crosshairs of this change include warehouse workers, manufacturing line workers, construction workers, janitors/cleaners, farm workers, security guards, delivery personnel, and home care workers.

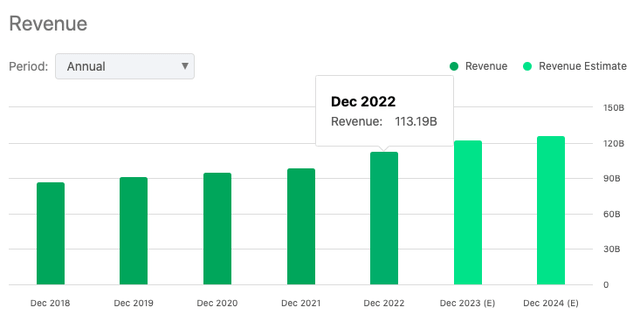

Hyundai's Market Share Accelerates

Taking a brief break from Hyundai's Boston Dynamics AI visions, the South Korean auto giant has made significant strides, with global wholesale expanding 13.2% YoY to over a million units, and retail sales also showing a healthy uptick of 3.6% YoY. It seems the stabilization of the semiconductor supply, among other components, has enabled a strong production boost - a key driver behind these numbers.

The worldwide sales volume, in general, progressed YoY in Q1 2023 due to ramped-up production and high-demand models like the Grandeur, existing SUVs, and Genesis. SUV sales took a 0.7 percentage point YoY leap to 52.7%, while Genesis also chipped in with a 10.2% YoY sales expansion in Q1. Notably, eco-friendly vehicle sales, particularly hybrids and EVs, skyrocketed by 40% YoY.

From a financial perspective, consolidated revenue bloomed by 24.7% YoY to KRW37,788.7 billion, with operating income flourishing by 86.3% YoY, and net income following suit with a 92.4% YoY hike. A surge in sales volume, a more profitable sales mix, and a fortuitous won-dollar exchange rate were the chief catalysts here.

Going forward, Hyundai remains optimistic about its Q2 report on Aug 15, 2023, forecasting continued robust performance particularly around the in-demand Genesis and SUV models, leading to an improved product mix. And with the advent of IONIQ 6, EV sales growth is projected to keep up its pace along with the global release of the all-new Kona and Santa Fe slated for the second half of the year.

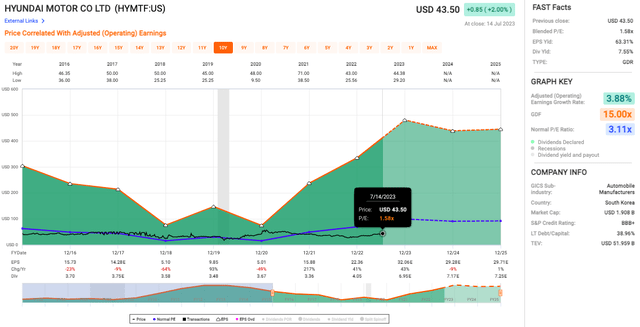

Hyundai's Valuation

Let's start with the Price-to-Earnings (P/E) ratio (see chart below), currently sitting at 1.58x, which is significantly below the market average and thereby implying that investors are undervaluing Hyundai, which, in my opinion, is indicative of an attractive investment opportunity.

The EPS yield is a whopping 63.31%, which is tremendously high by any standard. Coupled with the fact that the P/E ratio is quite low, this indicates that Hyundai is currently very profitable and its stock is quite cheap - figures that we don't often see in tandem.

The dividend yield is another attractive number standing at 7.55% However, the adjusted operating earnings growth rate is a somewhat modest 3.88%. While it shows that Hyundai is indeed growing, the growth is not exactly breathtaking over this period.

On balance, I'd say that Hyundai seems to be a value play with high income potential. The low P/E ratio and high EPS yield suggest that the market may be overlooking the intrinsic value of the company.

What About the Service Robots Market?

Boston Dynamics

It's difficult to put exact projections of Hyundai's current, and future, position within the service robots market. Often, futurists, science fiction enthusiasts and visionaries can often overshoot the mark when forecasting the fruition of technologies borrowed from the realm of science fiction. Two fundamental factors come into play:

Firstly, The Paradox of Progress: From the standpoint of technological evolution, we see certain sectors, like the microprocessor industry, exemplified by Moore's Law, experience an explosive, exponential growth. Conversely, other fields witness a more gradual, linear progression, or even slower. The innate human difficulty in discerning the nuances between these contrasting rates of development often feeds into inflated expectations.

Secondly, The Complexity Conundrum: A common tendency is to downplay the intricate nature and the colossal resource investment necessary to morph a figment of science fiction into an actual, tangible technology. Each novel invention or improvement must undertake an extensive journey through research, concept development, prototype construction, rigorous testing, before finally making its way into production and earning market endorsement.

A palpable illustration from the world of pop culture is "Back to the Future Part II" (1989). This film sketched a vision of 2015 punctuated by flying cars, auto-lacing sneakers, and hoverboards. Despite witnessing the birth of rudimentary versions of these innovations - Nike's auto-lacing shoes or assorted hoverboard designs, for instance - their ubiquity and sophistication are nowhere near what the film had prophesied. The movie conveniently bypassed the gargantuan technical, practical, and legislative hurdles in fabricating and establishing these technologies.

With that noted, the service robots market, by some estimates, were valued at USD 19.52 billion in 2022 and are expected to grow to only USD 57.35 billion by 2029, at a CAGR of 16.6%.

The total 2029 projection puts it at only half of Hyundai's current revenue, assuming they conquer the entire market share and don't grow their revenue - two very unlikely situations. Additionally, the robots still need to prove they're worth the hefty price tag they carry. Take a single SPOT "Enterprise" robot dog, for example, which recently sold for £181,492 ($204,840) excluding VAT, to UK's Atomic Energy Authority (UKAEA).

In all, the UKAEA now owns three SPOTs and essentially, "if successful," it seems likely that the Nuclear Decommissioning Authority's £3 billion yearly government budget could be spent on more SPOTs and/or its offsprings.

This is just one example of one product at one organization with billions to spend. Assuming that a 16.6% CAGR is vastly too conservative, and if Hyundai/Boston Dynamics gained only 1% share of a conservatively projected $57.35 billion market, it would potentially generate additional revenue of USD $458.8 million (573.5 million X 80% stake).

Again, keeping in mind that market projections vary wide, ranging as low as $34.69 billion and up to $84.8 billion by 2028; hence, a two percent stake or higher in an already conservative mid-range forecast and we would just begin to crack revenue in the billions.

Risks & Headwinds

Interestingly, the journey of robotics integration into the manufacturing world started with the automotive industry. The sector bravely championed the use of industrial robots, setting the stage with the Unimate model. This 2,700-pound colossus, conceived by Joseph Engelberger, often hailed as the godfather of robotics, first graced the factory floors of a General Motors plant in 1959, dutifully performing diecasting tasks.

Yet today, robotic origins aside, Hyundai (Boston Dynamics) isn't the only player in town. In the manufacturing landscape, we're already witnessing an ongoing revolution driven by automation and robotics, a paradigm shift that's elevating productivity, efficiency, and safety to new heights. Most Amazon (NASDAQ:AMZN) investors are already aware of its robust fleet of over 100,000 autonomous machinery - an assortment of mobile robots and robotic arms - as the poster child for robotics at work. Yet, when you cast the net wider, China's electronics manufacturing powerhouse, Foxconn (OTCPK:FXCOF), dwarfs Amazon's efforts, commanding an army of more than 300,000 robots. These mechanized workers assemble an array of electronics for giants like Microsoft, Samsung, and even Amazon itself.

Beyond conventional manufacturing, robots have been penetrating the spheres of agriculture and food production. In farming, robots are not just a future concept but a present reality, involved in everything from planting to crop monitoring. SA analyst James Long writes about the heavyweight Deere & Company (NYSE:DE) that's already investing significantly in robotics, autonomous machinery, and data analytics, seeking enhanced efficiency and productivity while slashing costs. Similarly, food production conglomerates such as Tyson Foods (NYSE:TSN) are harnessing automation and the power of collaborative robots (cobots) to turbocharge output.

Therefore, while Hyundai's Boston Dynamics has garnered substantial attention through viral videos of its innovative robots like Atlas, the actual hurdle is two-fold: Competition with other robot manufacturers and molding these robotic marvels into commercially dependable and resilient entities.

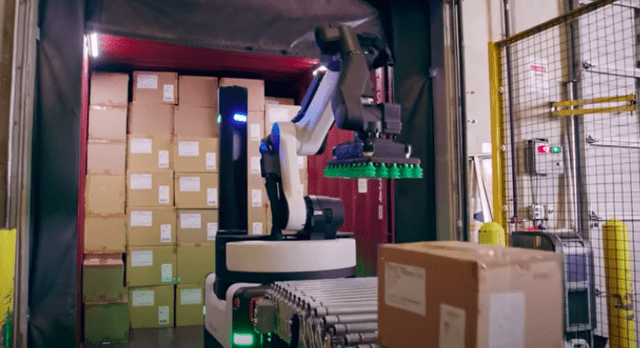

DHL Supply Chain is deploying Stretch to automate trailer unloading and support warehouse associates. (YouTube/Boston Dynamics)

Their most recent commercial venture, Stretch, is a robotic innovation intentionally designed for one primary function - shifting boxes in a warehouse. This robot, unlike its multifunctional predecessor Atlas, is crafted with a precise vision. While it shares various hardware and software aspects with Atlas and Spot, Stretch is notably fine-tuned for warehouse operations.

In my opinion, this narration underscores the significance of commercialization and its inherent challenges. In other words, robots need to be proficient and cost-effective in carrying out specific tasks. According to Tech Crunch, the company's previous robot, Handle, fell short in meeting the speed requirements for truck unloading, hence leading to the conception of Stretch.

Boston Dynamics has plans on the anvil to progressively roll out novel applications for this robot but they also point out the necessity of interoperability, as the future of completely autonomous robots would depend on collaboration among various companies, human "handlers", and their robots.

To summarize, the crux of commercialization lies in ensuring the consistency and reliability of the robots. While stunning demo videos might stir up excitement, the process of developing products that consistently perform reliably and efficiently for customers' demands significant commitment, resources (money), and time. Therefore, at least in the near term, we are not facing the level of adversity Joe Rogan predicted and most of our jobs are safe - for now.

Final Takeaway

Given Hyundai's impressive financial performance, undervalued stock, and its positioning in the rapidly growing service robot market through its Boston Dynamics unit, I would rate the stock as a "Buy". The company has demonstrated robust sales growth, particularly in the SUV and EV segments, along with promising developments in AI and robotics which could potentially disrupt multiple industries. There are inherent risks with competition and commercialization challenges; however, the potential for additional revenue growth, especially if Boston Dynamics manages to secure even a small share of the projected service robots market, outweighs these concerns.

Editor's Note: This article was submitted as part of Seeking Alpha's Best AI Ideas investment competition, which runs through August 15. With cash prizes, this competition -- open to all contributors -- is one you don't want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in HYMTF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.