Porch Group: Fully Valued And High Risk

Summary

- Porch Group share price has declined by 85% since going public. Aggressive inorganic growth strategy has exposed it to financial and integration risks.

- Expansion into insurance underwriting has helped maintain strong growth and resilience.

- I give PRCH stock a neutral rating. The stock appears fully-valued today.

skynesher

Porch Group (NASDAQ:PRCH) is a company developing vertical software platforms for home service industries. The company aims to simplify and streamline the home improvement and maintenance process by providing homeowners with access to various services and connecting them with qualified professionals.

Since going public in 2020, the stock has not performed well. It reached an all-time high of ~$24 sometime in 2021, but then gradually declined to reach ~$1.4 per share today, an ~85% decline from the initial price when it went public, and a ~26% decline YTD.

I give PRCH a neutral rating. My target price model suggests that PRCH is fully valued. Given the inorganic growth strategy, I also believe that PRCH is exposed to undesirable risk factors.

Risk

Since going public, PRCH has never turned profitable or cash flow positive despite delivering double-digit growth. Looking at where it is today, the company also seems to be far away from breakeven.

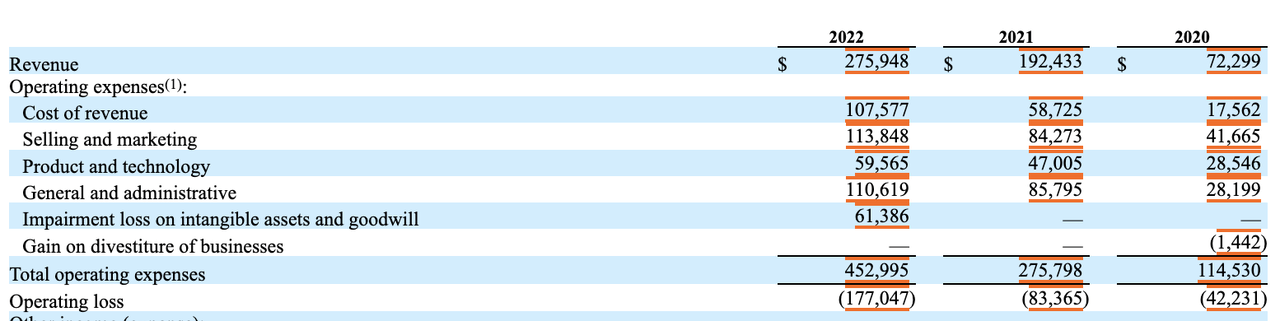

Revenue more than doubled in FY 2021, and last year alone, revenue grew by ~43%, a rather solid figure. In the meantime, operating loss margin has widened from negative 43% in FY 2021 to 64% last year. The significant increase in the cost of revenue and general and administrative / G&A expenses were two key drivers for the operating losses.

The situation has not changed much in Q1. Revenue grew by 37%, which was a good growth rate. However, the operating loss margin was still negative at 43%. G&A reduction was almost negligible while the cost of revenue more than doubled.

Though I believe that there is a lot of room for improvements in the cost structure that the management will likely explore in the next twelve months, PRCH’s weak profitability today importantly exhibits the high risk associated with its inorganic aggressive growth strategy. After going public in 2020, PRCH spent ~$256 million to acquire five different companies. PRCH continued to make a similar move in 2022 when it acquired RWS.

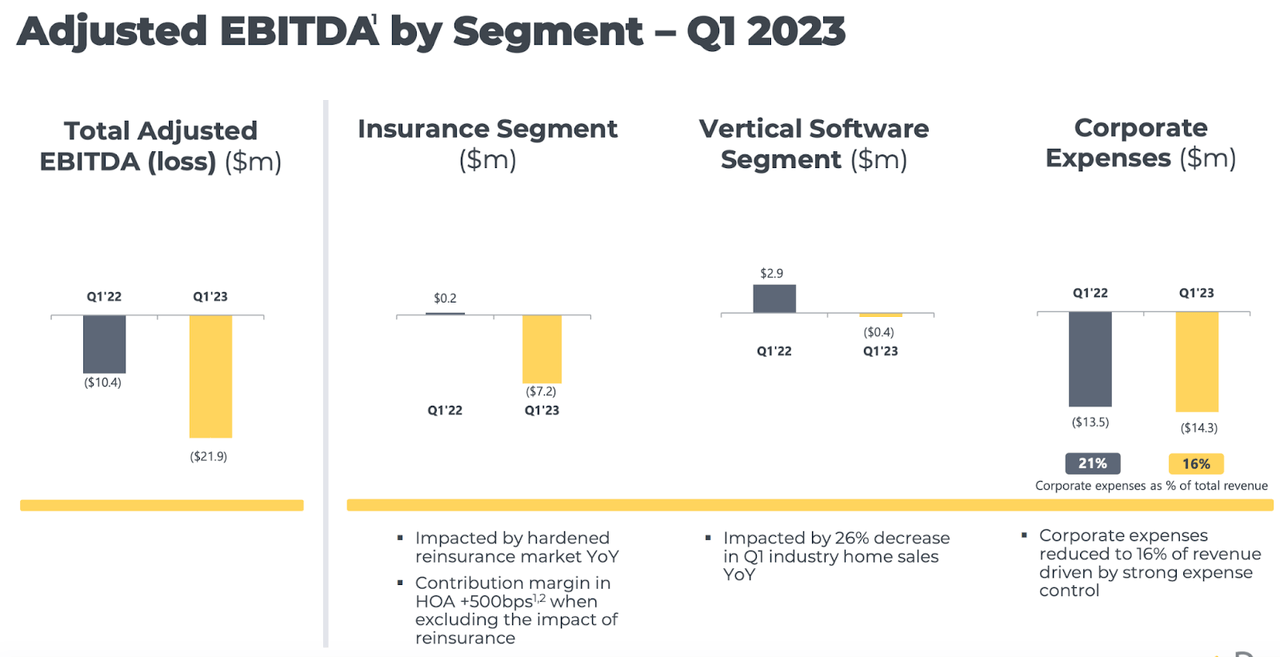

Some of these acquisitions are highly strategic for PRCH. For instance, the acquisition of HOA / Homeowners of America has enabled PRCH to strengthen its insurance business, and in Q1, insurance generated 67% of PRCH’s total revenue and became the largest business for the company.

On the flip side, I will remain cautious of the unexpected post-acquisition consequences, as the inorganic growth strategy may continue to expose PRCH to higher financial and integration risks. The debt-to-equity ratio has increased to 5.5x - a rather unhealthy level - since last year, due to the debt issuance to help finance the acquisitions. Given the high-interest rate environment today, such risk may intensify.

Moreover, as highlighted by the still weak fundamentals as of Q1, unlocking synergies from a single acquisition is not a straightforward process - it has now been two years after the major acquisitions. The fact that PRCH made five acquisitions in a single FY may complicate the situation further.

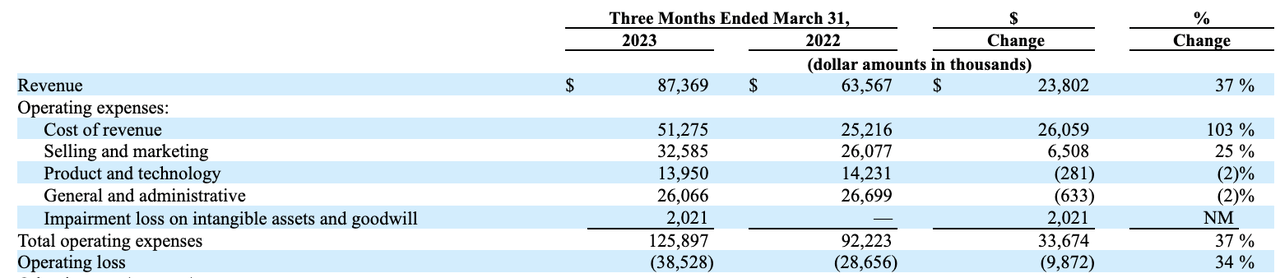

As it stands, while the insurance segment drove the 37% growth in revenue in Q1, it appears that the segment was unprofitable. It was in fact the second-largest contributor to widened adjusted EBITDA loss in Q1.

Catalyst

I think that there are two factors that investors may not want to overlook in evaluating PRCH. First, it appears that the expansion into other businesses, such as insurance, has helped PRCH to remain resilient during today’s challenging macro situation.

PRCH did not only display resilience but also strong performance in the insurance segment. With a 101% YoY growth in Q1, it appears that there is still a lot of growth opportunity in the warranty business to capture going forward. I would note that despite the 37% revenue growth in Q1, PRCH had to realize the impact of the macro headwinds that resulted in a 17% decline in its core vertical software business. Suffice it to say that PRCH may even see growth acceleration when the headwinds subside and the vertical software business rebounds.

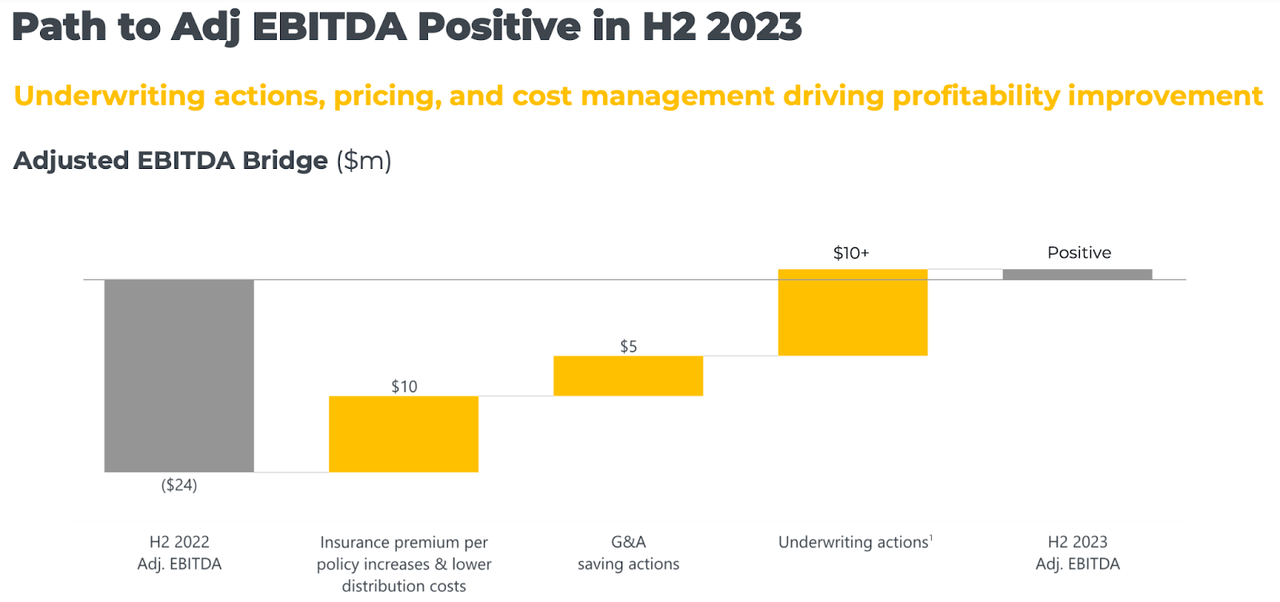

The focus on improving the profitability outlook will also help create upside potential from the adjusted EBITDA expansion. The company aims to reach an adjusted EBITDA positive in the second half of FY 2023.

It is probably too early to tell if PRCH will succeed in reaching adjusted EBITDA breakeven by the end of FY 2023. Nonetheless, PRCH seems to have the right puzzle pieces to improve unit economics. The HOA acquisition, for instance, led to PRCH having the ability to underwrite policies in addition to distribution, giving it better control of pricing and risk management.

Valuation / Pricing

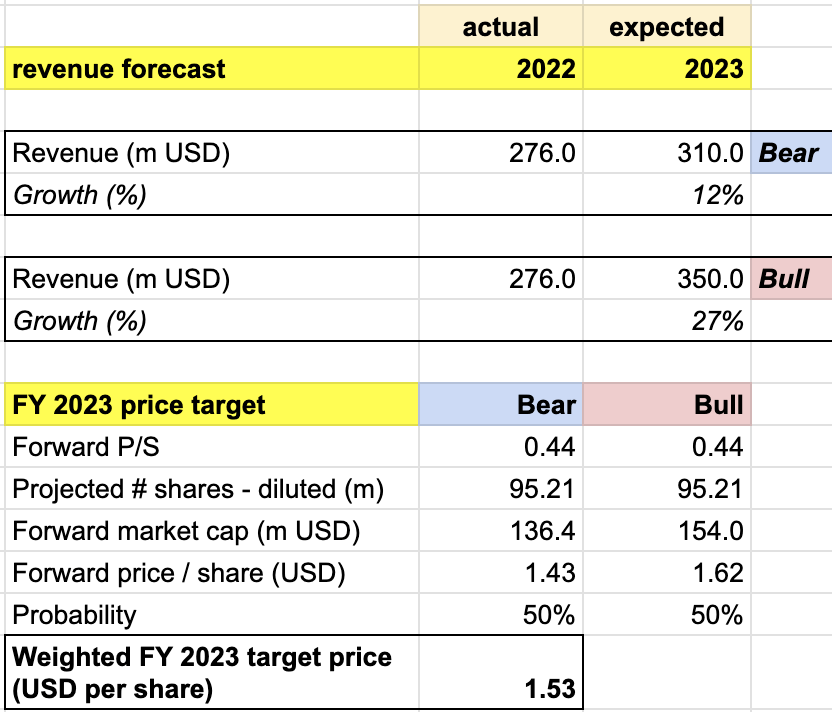

My target price for PRCH is driven by the following assumptions for the bull vs bear scenarios of the FY 2023 target price model:

Bull scenario (50% probability) assumptions - PRCH to deliver $350 million of revenue in FY 2023, a ~27% growth, in line with the highest end of PRCH’s guidance. I assign a P/S of 0.44x, the level where PRCH is currently trading, across both scenarios.

Bear scenario (50% probability) assumptions - PRCH to deliver $310 million of revenue in FY 2023, a ~12% growth. This means PRCH will miss its revenue guidance for FY 2023.

author's own analysis

Consolidating all the information above into my model, I arrived at an FY 2023 weighted target price of ~$1.53 per share. Since PRCH is trading at $1.38 but has been in between the $1.38 - $1.5 range, the stock appears fully valued in my opinion. Even if the stock trends upwards from the $1.38 level today to $1.53, the ~9% upside potential does not seem to outweigh the risks.

Conclusion

I give a neutral rating for PRCH. My target price analysis indicates that the stock is fairly valued, but there are concerning risk factors involved. PRCH's fundamentals have shown some improvement, but they have not been strong. Despite experiencing growth, the company has not achieved profitability or positive cash flow since going public. It seems that PRCH still has a long way to go to reach breakeven. However, PRCH's diversification into other sectors like insurance has helped it withstand the challenges of the current macroeconomic environment. This expansion into different businesses has provided some resilience for the company.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.