TLTW: The Safety Of Treasuries With A 20% Yield

Summary

- The iShares 20+ Year Treasury Bond BuyWrite Strategy ETF offers investors a yield of 19.6% annually from coupons and income from option sales.

- Since its launch in August 2022, the TLTW has generated 20.4% annualized income, outperforming the TLT by 6.4% annually despite capital losses on TLT holdings.

- The main risks for TLTW are bearish yield curve steepening and inflation, but it offers a great opportunity at current yields due to high income and low downside risk.

Torsten Asmus

The iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (BATS:TLTW) now offers investors a yield of 19.6% on an annualized basis from coupons and income from option sales. Since the ETF was launched in August 2022, its income has actually exceeded this, rising by an annualized 20.4%, and although capital losses on TLT holdings have resulted in a slight loss over this period, it has outperformed the TLT by 6.4% annually. It would take a major rise in yields from already elevated yields for this ETF not to generate positive returns. Stable to lower yields could easily result in long-term real returns of 3-4% annually.

The TLTW ETF

The iShares 20+ Year Treasury Bond BuyWrite Strategy ETF seeks to track the investment results of an index that reflects a strategy of holding the iShares 20+ Year Treasury Bond ETF (TLT) while writing (selling) one-month covered call options to generate income. The TLT itself seeks to track the investment results of an index composed of US Treasury bonds with remaining maturities greater than twenty years. The TLTW sells calls that are 2% out of the money when written. The fund's option adjusted yield of 19.6% reflects the underlying yield on the TLT plus the option premium received in return for limiting monthly capital gains to 2%, while also assuming the risk of capital losses. The TLTW contractually charges a 0.5% expense ratio. However, iShares has agreed to waive certain fees until 2028 thus lowering the net expense ratio to 0.35%. Since I last wrote on the TLTW on March 14 the ETF has posted a slight positive return of 2.5% even as long-term bond yields have risen by around 25bps. With yields now higher, the outlook for the ETF has further improved.

20% Yield Suggests Further Outperformance Vs TLT

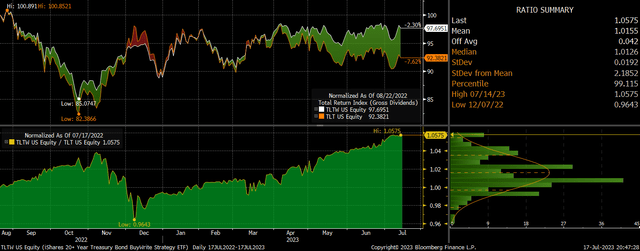

Since its launch in August 2022 the TLTW has generated 20.4% annualized income, 17% higher than the underlying TLT thanks to significant option income. The flip side of this income is that the TLTW has suffered capital losses from its TLT holdings during periods of weakness while not benefitting from as much upside during rallied due to losses on its call sales.

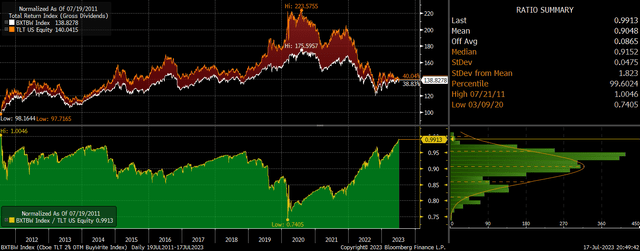

As the TLT itself has fallen over the past 11 months, the TLTW's option income has more than offset its capital losses relative to the TLT. If we look at the performance of the CBOE 2% TLT BuyWrite Index which goes back much further, this strategy has actually outperformed the TLT all the way back to 2011, while exhibiting far less volatility.

CBOE TLT BuyWrite Index Vs TLT (Bloomberg)

With a current option adjusted yield of almost 20%, positive returns on the TLTW are highly likely unless we see a significant rise in bond yields. For instance, over the past 12 months the buywrite strategy has roughly broken even despite 30-year yields rising 75bps over this period as the elevated yield on the TLT and high option premiums have more than outweighed capital losses. With the TLT yield now even higher, it would take an even larger rise in yields for capital losses to exceed income.

Current conditions seem ideal for such a move as falling CPI allows the Fed to focus on slowing economy growth and implement gradual rate cuts. 20-year breakevens currently sit at 2.3%, meaning the TLT itself yields 1.7pp above expected inflation. This is above the historical average and significantly above the potential real GDP growth rate of the US economy. With high debt levels across all sectors, and in particular the government sector, high yields are leading to a surge in interest payments, and I expect the Fed to be forced to move rates lower to prevent a credit crunch. With the additional income from option sales, this could easily see the TLTW post 3-4% real annual returns over the coming years.

Bearish Yield Curve Steepening Is The Main Risk As Curve Deeply Inverted

While the TLTW has much lower volatility than the TLT, it still faces two key risks due to its TLT holdings. The main short-term risk is the potential for bearish yield curve steepening. Long-term bond yields are as low relative to short-term yields as they have been since the early-1980s, which raises the risk that the Fed maintains high rates for longer than expected causing a spike in long-term yields and a fall in the TLT. While inverted yield curves have tended to be bullish for long-term bonds in the past as the curve has normalized via lower short-term rates, this is still a significant short-term risk.

30-Year UST Yield Vs 6-Month UST Yield (Bloomberg)

From a longer-term perspective the main risk is inflation. While I firmly believe that real bond yields will have to fall significantly over the coming years, this could occur through rising inflation, which could actually see nominal yields rise, and the TLT perform poorly in real terms. Nonetheless, from a risk-reward perspective the TLTW offers a great opportunity at current yields to benefit from high income and low downside risk.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TLTW, TLT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)