Revvity: New Name - But New Investment Outlook? Reiterate Buy

Summary

- Revvity, formerly PerkinElmer, has changed its name and made several updates to its investment outlook.

- It now has ~$2Bn to put to work following the sale of recent business units.

- I am still eyeing a price range of $137-145 following the latest investment updates.

- Net-net, reiterate buy.

Pgiam/iStock via Getty Images

Investment updates

There's been multiple updates to the investment debate since my April publication on Revvity, Inc. (NYSE:RVTY). Revvity, formerly known as PerkinElmer with the ticker "PKI", changed its name in May, ending a name legacy that started back in 1937. I must admit, I was a bit surprised with the sudden name change, but there is a nice ring to it at the very least. Plus, the meaning is pretty cool as well- quoting from the press release:

Born from two words, "revolutionize" ('rev') and "vita" ('vit') meaning "life" in Latin, Revvity delivers end-to-end expertise and solutions from research discovery to development, and diagnosis to cure.

On face value, not too much has changed for the company in terms of operations, end markets, customers, and so forth. Aside from the new company name, it still operates in much the same fashion. In saying that, however, these major updates have been made to the outfit:

- The successful divestiture of its analytical and enterprise solutions division (I had talked about this extensively in the last report).

- Changes to business names for its Informatics and Genomics sections- these are now "Revvity Signals Software" and "Revvity Omics", respectively.

- A handful of the company's portfolio companies will also fall under the new brand of Revvity, whilst keeping their specific product branding.

Further, after the newly-named company's latest numbers, there are multiple investment updates to discuss, which I'll do here today. What has changed, is the sentiment and various fundamentals in the stock. Net-net, I reiterate RVTY as a buy, still eyeing the $137-$145 price range outlined in the previous publication.

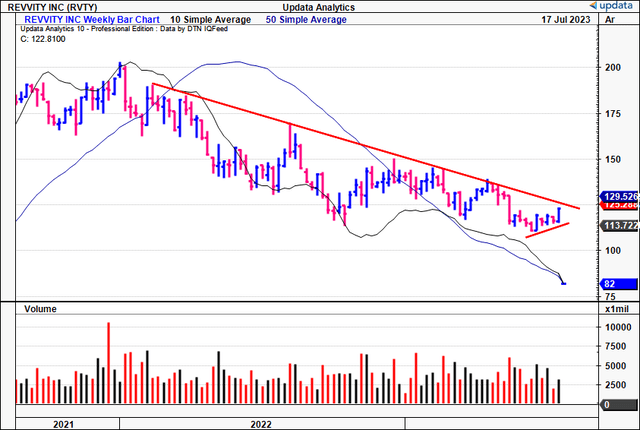

Figure 1. RVTY equity line (Previously trading under "PKI" prior to May 16, 2023)

Risks to investment thesis:

Before proceeding, investors must recognize the following set of risks in full:

- There is risk RVTY may not grow profitability after the restructuring, clamping the potential upside.

- We can't discount the broader macroeconomic and geopolitical risks still at play, as these are systemic and may hurt equity markets.

- Should RVTY not hit its guidance numbers this would be a downside surprise and potentially see investors re-evaluate their positions.

- If the company's sales grow primarily as a function of pricing vs. demand, this would be a risk as well for the longer-term growth of the company.

Investors must realize these risks, that could nullify the investment thesis, in full before proceeding any further.

Changes to critical investment facts

Aside from the name changes, there are many updates that need to be folded into the investment pie here. For one, the performance of RVTY's (still getting used to typing this over PKI) equity stock has been underwhelming in YTD. Whilst the benchmarks have thrust higher, dragging a good bulk of high-beta names with them, RVTY has languished down 12% to date. Investing is in fact a long and patient man/woman's game. However, and honest appraisal of the facts is still needed. Is RVTY more attractive to the market with the name changes?

1. Latest numbers show no change to forecasts

RVTY announced the divestiture of its analytics earlier in the year. Quoting from my last analysis, the company said "...we will have more than $2 billion of additional unencumbered cash available to deploy over the next three years without taking on any new debt".

Added to this, from the Q1 FY'23 earnings call, note the CEO's language on the planned use of the sale proceeds:

First, now that we have received the proceeds from our recent divestiture, we are actively working on repatriating those funds to the most appropriate geographic jurisdictions to be effectively redeployed in the future. This process is already underway and is likely to take at least through the end of the year to be fully complete."

I'll cover where it intends to invest the money a little later.

Turning to the Q1 numbers, sales were up 6% YoY when considering "organic growth"-that is, excluding Covid-19-related sales.

Adjusted revenues came to $675mm, down 30% with all Covid sales from Q1 FY'22 and FY'23 included, and ~300bps of FX headwind baked in [for reference, RVTY clipped just $3mm in Covid-related sales last quarter]. It pulled this to gross of 62.4%, a 510bps YoY compression, and earnings of $1.01.

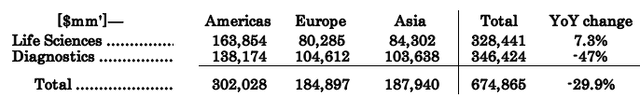

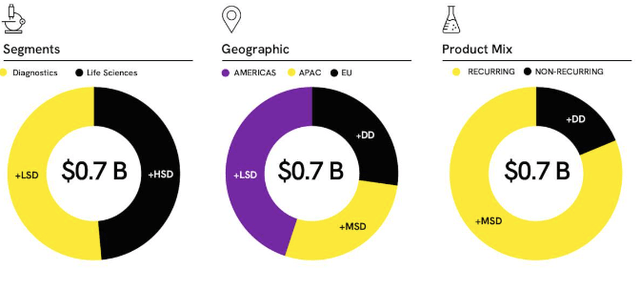

Divisional takeouts are as follows:

- There were imminent challenges faced by RVTY's amino diagnostic business in the Chinese market from its pandemic recovery, but these are not unique to the company.

- This represents ~5%-6% of the company's top line, with the APAC market comprising 30% of Q1 total revenues.

- Sales in the Life Sciences segment were up ~7% to $328mm (9% ex-Covid).

- Total diagnostics revenues were down 47%, and to me this is the interesting number going forward. No longer will you see Covid-19 related sales being booked on a meaningful basis in the healthcare industry. We're done with that. So stripping this out of RVTY's Q1 figures gets you to 300bps adj. YoY growth from Q1. Further, if you normalize for the China situation, and its pandemic headwinds over the last year, I get to 6% organic growth in diagnostics. This serves as good info going forward. It clips another 6-7% growth in Q2, it will have matched the Life Sciences division, whilst potentially contributing ~50% to overall turnover.

Figure 2. RVTY Q1 segment and geographic performance

Breaking down the numbers further, I've discovered that some of the revenue upside came from the 200bps in price increases from last year. RVTY looks to add another 100bps of net pricing across its portfolio for the remainder of FY'23. Hence, the growth was not so "organic" as claimed by management, as 1/3rd of the revenue upside (200bps of 600bps) stemmed from pricing and not demand (volume). I'm calling for RVTY to show us an uptick in demand vs. just pricing alone in the next few quarters to show that revenue growth is being driven by the market, and not by the company. This would be a major kink in my investment thesis, if demand for RVTY's offerings were to stagnate, and revenue increases came from price increases alone- so keep a close eye on this moving forward.

Figure 3. Further breakdown of RVTY's top line in Q1 FY'23

Data: RVTY investor presentation

2. Clarifications on capital budgeting

Added to this, the company produced $51mm in Q1 free cash flow (defining FCF as NOPAT less investments and cash expenditures made for the quarter). However, when you bake in the transaction proceeds, it clipped another $2Bn in cash from the disposal, thus c.$1.7Bn in free cash to the firm. Keep in mind, RVTY didn't 'produce' this amount from operations.

Nevertheless, the sale provides a much needed injection of liquidity, and the firm has been busy deploying the funds so far:

- It has put over $800mm to work this YTD.

- This includes $130mm in buybacks. The firm has authorized another $600mm for repurchases going forward.

- Nearly $700mm has also been set aside for the $1.2Bn of remaining short-term liabilities set to mature over the next 12-16 months.

- Speaking of leverage, RVTY left the quarter with net leverage (net debt to adj. EBITDA) of 1.9x, down from 2.7x at the end of FY'22 and 2.3x a year ago.

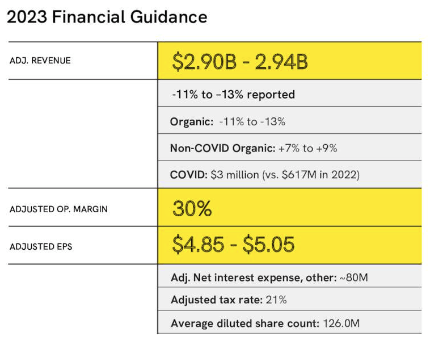

Management project $2.9-$2.95Bn at the top line this year and my numbers aren't too off this number, looking for $3-$3.1Bn [see: previous publication, "Fig.6"; Appendix 1 in this report]. That's a ~37% YoY decline, and the question is how much of this is already baked into the price? Consensus has 18% earnings growth in FY'24, then 16% the year after, versus 9.2% and 9.7% in sales growth. Hence, the view is that the leaner cost structure won't add anything much to turnover, but it will reduce OpEx and CapEx requirements, ultimately benefitting earnings. This is bullish in my opinion.

Figure 4.

Data: RVTY investor presentation

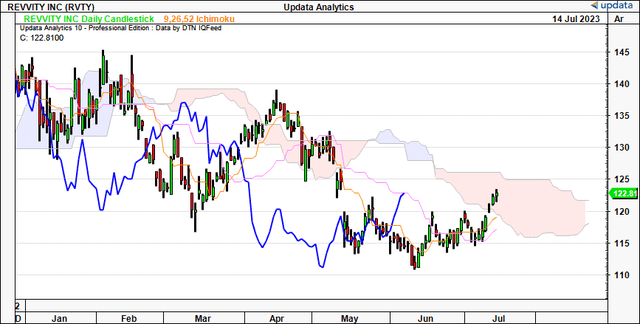

3. Technicals improving following recent updates

Market-generated data is showing us more attractive positioning as well. Much can be gleaned from the short to mid-term outlook on a company's equity stock from gauging the actions of market participants.

For one, on the daily cloud chart below, the stock has punched up through the base of the cloud and the price line is racing to break the top of the cloud. We need the lagging line (in blue) to follow suit. If it does, this is bullish in trend terms, and a good opportunity to allocate to RVTY in my opinion. I'd be looking to a break above $125 by the end of July as bullish confirmation of a trend reversal.

Figure 5. Pushing up into the cloud

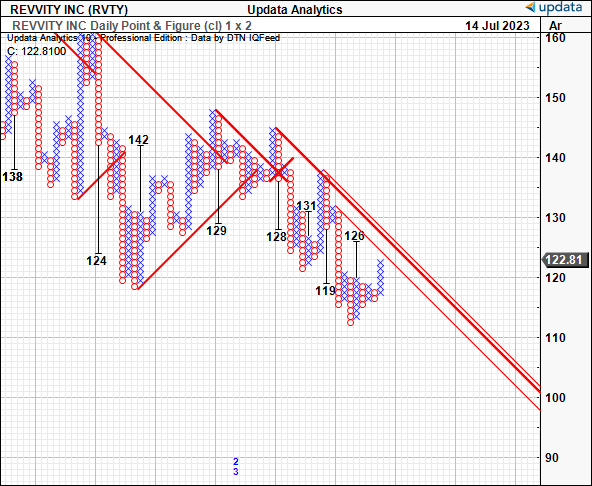

We also have price targets up to $126 on the point and figure studies below, adding a level of confidence to that $125 mark discussed just above. These studies are magnificent for removing the short-term machinations of the market, by avoiding the intra-trend volatilities and focusing on directional 'thrusts' instead. I'm looking to $125-$126 as the next price objective in this case.

Figure 6. Upsides to $126

Data: Updata

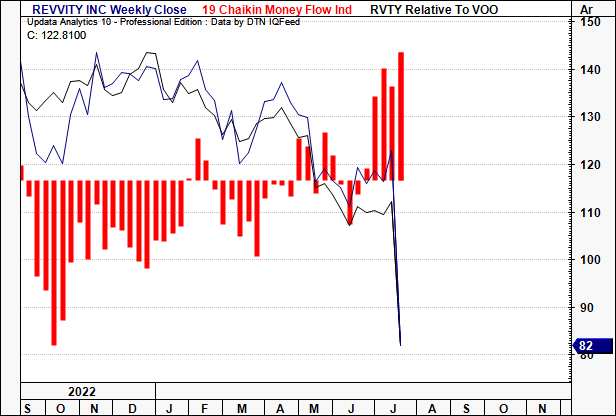

Meanwhile, weekly money flows have started to ride on in for the company over the last month or so. There wasn't an immediate reaction to the latest numbers or the name change, but the latency seems to have caught up and these latest money flows tell me of an accumulation of size, especially seeing the weekly volume bars over the last 3-4 weeks showing fairly high-volume buying, above the 10-week average. I would opine things are turning constructive in the near-term for RVTY's equity stock on this basis, given 1) improving price trends, 2) objective upside targets, and 3) heavy capital inflows into the stock over the last month.

Figure 7

Data: Updata

Valuation and conclusion

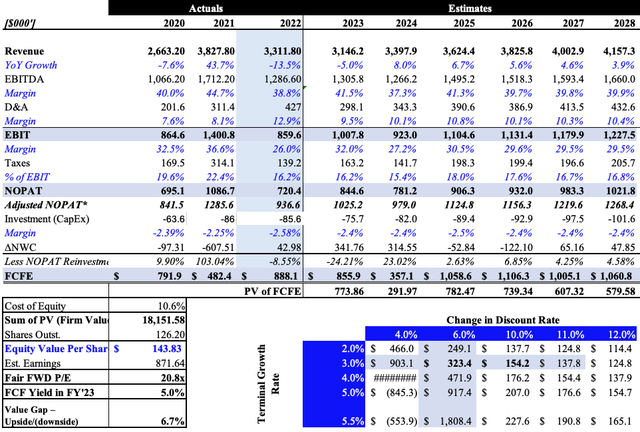

Investors are selling RVTY at 24x forward earnings and 18x forward EBITDA, both respective premiums to the sector. In my previous publication, I laid out the case for RVTY to push $3-$3.1Bn at the top line for FY'23, pulling this down to $855mm in FCF for the year. This I argued could stretch to $1.06Bn by FY'25 with the drivers discussed in that report and what's been discussed today. Getting me there is the reduction in maintenance CapEx and a large increase in NWC (thus tying up cash) from FY'243-'24, dropping substantially from there. I see no major changes to these estimates, as I had 1) already baked in the segment changes, and 2) management's language confirming previous guidance range.

Hence, that would mean no change to the $137-$145 price range obtained from these estimates either, valuing RVTY at a market value of $18.15Bn, discounting the stream of estimated FCF's rolling in to FY'28 at 10-12% [all of this is observed in Appendix 1, below].

Appendix 1. RVTY forward estimates, taken from previous publication.

As such, the major changes I see to the RVTY investment debate are sentiment and fundamentally related. Primarily, investor positioning, and RVTY's latest numbers, tell me a few things:

- Capital inflows into RVTY stock have been heavy and at a high magnitude over the last month of trade.

- The leaner cost structure and proceeds from its business sales have opened up a $600mm buyback funding window, plus, it will deploy remaining funds to pay down debt, and bolster its various geographical footprints.

- Covid-19 revenues finally diminished, and we can have a more accurate comps period from year-to-year going forward.

Subsequently I remain bullish on the long-term prospects of RVTY, and still look to the $137-$145 range as the next price objectives. Given the data presented here, there is scope for investors to trade it this high in my view. Net-net, reiterate buy.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RVTY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.