Norwegian Air Shuttle Mixes In European Airline Consolidation

Summary

- Norwegian Air Shuttle is set to acquire domestic carrier Widerøe for NOK1,125 million ($112 million), enhancing its connectivity and network efficiency.

- Widerøe, with its fleet of turboprops and small single aisle jets, will provide the feeding function to Norwegian's hubs on routes where it currently doesn't operate.

- The acquisition, which will cost Norwegian around $200 million in total, is expected to generate more income at an attractive acquisition price.

- Acquisition also is another step in the consolidation of the fragmented European airline market.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

Boarding1Now

The European airline industry is one that's a highly fragmented industry, of which, one can argue that it requires some consolidation or some form of "survival of the fittest". In recent years, we saw some airlines fail such as Monarch Airlines, WOW Air, Thomas Cook, and Primera Air.

At the same time, Ryanair (RYAAY) took over Lauda Air and the Lufthansa (OTCQX:DLAKF) Group has been shopping around for stakes in ITA with the intention to fully acquire the airline while the International Consolidated Airlines Group (OTCPK:ICAGY) agreed earlier this year to acquire Air Europa. One airline that was a potential acquisition target was Norwegian Air Shuttle (OTCPK:NWARF). In a 2020 report, I detailed how the airline expanded its fleet and revenues compounding debt but did not build a strong cost or revenue structure which left the airline vulnerable. The situation at Norwegian Air Shuttle was so bad that no airline was interested in acquiring it, and the company ended up cutting its fleet and focusing on the Nordic markets. Now, three years later the company is making its way back and is actually acquiring another airline as I discuss in this report.

Details Of The Acquisition

Norwegian will acquire Widerøe for a cash consideration of NOK1,125 million. The purchase price is subject to certain adjustments after closing, including in respect to the profitability of Widerøe in 2023. Widerøe has a fleet of close to 50 aircraft and holds a market share of approximately 20% in the Norwegian domestic market measured by number of passengers. In 2022, Widerøe reported group revenues of NOK5.7 billion.

Norwegian Air Shuttle And Widerøe: Different But Complementary

The strength of the combination of both airlines is not necessarily beneficial in terms of fleet growth or fleet enhancement. Norwegian has a fleet of 81 Boeing 737 airplanes, including 13 Boeing 737 MAX airplanes. Widerøe has a fleet of 45 DHC-8 Dash 8 turboprops and three Embraer E190-E2 airplanes. So, from a fleet cost perspective, there's nothing to gain here and that also makes sense since Norwegian operates a European network while Widerøe is a domestic carrier and that is where the strength of this combination lies.

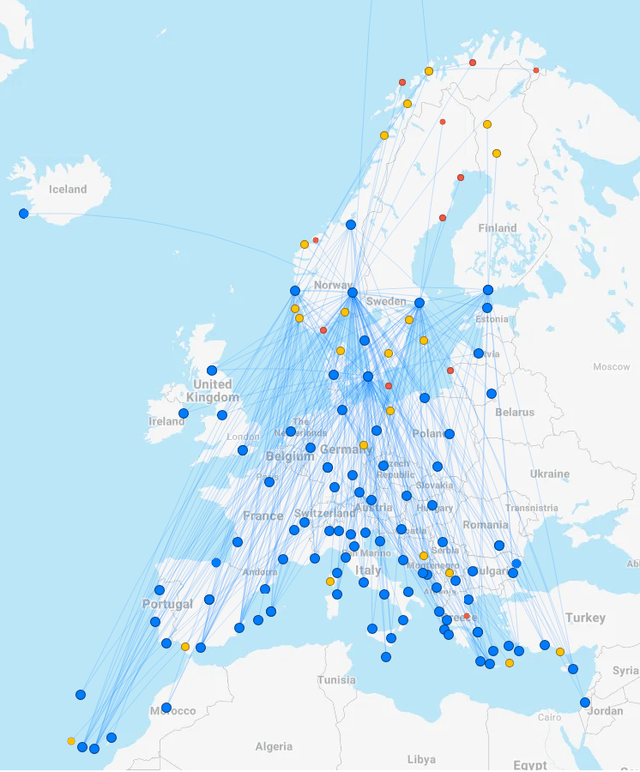

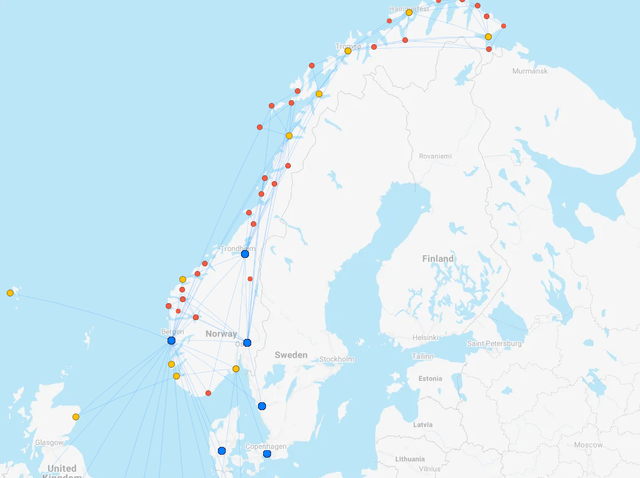

Norwegian has its hubs in Trondheim, Oslo, and Bergen in Norway, Copenhagen in Denmark, and Helsinki in Finland. In Norway, the connectivity is rather thin and that makes sense since apart from the hubs there are only a few smaller airports in the north of the country which Norwegian uses to feed passengers into its hub, and it does not have the airplanes to efficiently operate feeding operations from smaller secondary airports.

That's where the power of Widerøe lies. With its fleet of turboprops and small single aisle jets, it operates from effectively the same hubs as Norwegian but to smaller airports. What this means is that the combination of Norwegian and Widerøe allows both airlines to better match schedules and optimize the network, where Norwegian will serve the European network while Widerøe will provide the feeding function to the hubs on routes where Norwegian is not doing this already.

There will be no rebranding of Widerøe or a change to the products and services. That's not what this combination about, it's not about providing a unified experience, but it is about improving connectivity and getting more Norwegian on Norwegian Air Shuttle airplanes to their destinations.

All of that comes at the price of €100 million or around $112 million. To put that into perspective: The three E190-E2 jets are worth between $65 million and $100 million and 36 owned turboprops could be worth around $125 million. Norwegian also will assume a net debt of around $87 million. So, in total, the transaction will be around $200 million, and in return, Norwegian will have around $190 million in additional flight equipment and can improve the efficiency of its schedule and network to generate more income. I think that is a pretty good deal.

Conclusion: Norwegian Air Shuttle Stock Could Be A Nice Recovery Buy

In November last year, I marked Norwegian Air Shuttle stock a buy and since then the stock has outperformed the broader markets with a >20% return compared to 15% for the broader markets. The latest move to acquire Widerøe by the end of this year should provide the company with a better toolbox to better serve and generate value from the Norwegian network into Europe as the company will continue growing its fleet with a focus on value generation rather than non-performing growth of the fleet that we saw before the transformation.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.