RQI: Securing Safe 8% Yield And Elevating Exposure To Interest Rate Declines

Summary

- The Cohen & Steers Quality Income Realty Fund aims to provide attractive income streams and potential for capital appreciation through investments in U.S. equity REIT common stocks and preferred shares.

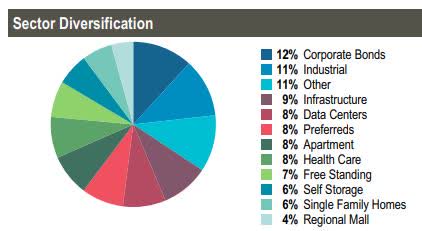

- RQI is permitted to invest in non-REIT sectors if they offer greater income and price appreciation potential; currently, about 12% of its portfolio is in corporate bonds, primarily from banking and insurance companies.

- RQI's 8% yield is backed by resilient investments, which in most cases carry investment-grade balance sheets and are structurally protected from the looming office meltdown.

- RQI also offers an elevated exposure to interest rate risk via external leverage and exposure to preferred & fixed income securities, which should benefit the Fund once rates start to normalize.

Michael Edwards

The Cohen & Steers Quality Income Realty Fund (NYSE:RQI) is a real estate focused fund with an investment objective to deliver attractive streams of current income, while leaving some room for further capital appreciation.

RQI invests primarily in the U.S. equity REIT common stocks (of any market cap) and preferred shares that are also issued by the U.S. REITs. Interestingly, the Fund is allowed to make tactical bets in other non-REIT related sectors provided that such allocations offer more pronounced current income and price appreciation potential. As of now, RQI has allocated ~12% of its portfolio value in corporate bonds, which are mostly issued by the banking, insurance and telco companies.

Cohen and Steers

Yet, the lion's share of total assets under management is directed towards a diversified set of REITs via common equity and preferred share exposures.

Cohen and Steers

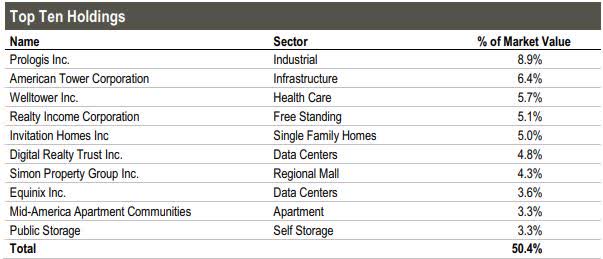

As of Q1, 2023, RQI's top ten holdings explained half of the total exposure, which optically might seem to imply a potentially unfavourable concentration risk. The offsetting factor for this is, however, the fact that all of the top ten names carry investment grade balance sheets and possess characteristics, which are relatively resistant to financial crisis.

Apart from the top positions, RQI has invested in other 206 instruments, where really the focus is put on the large cap, blue-chip companies that are providing dividend yields above the market average.

Currently, RQI offers a juicy yield of 8%, which, historically, has explained all of the returns generated by the Fund. For shareholders (or rather unit holders) this means that RQI should be considered as a pure play income stock, where expectations pertaining to the capital appreciation should be kept very low.

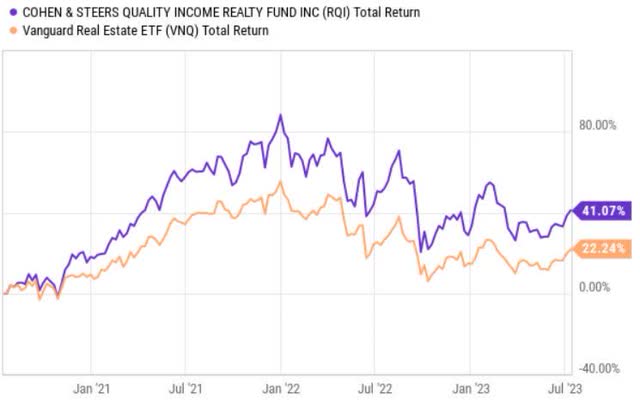

In the past 3-year period, RQI has outperformed a comparable REIT benchmark that is in line with the Fund's historical track record of delivering slightly better results than the overall REIT market.

There are several factors, which have contributed to the alpha performance of RQI, but the two key ones are the following:

- Superior stock allocation. The chart above captures the story of top 5 positions (it is the exact same pattern with the remaining top 10 holdings), where since the inception of RQI the main holdings have considerably outperformed the Vanguard Real Estate ETF (NYSEARCA:VNQ). In other words, the Management has been skillful enough to identify and allocate sufficient weights for a handful of REITs that have generated strong and consistent performance.

- Leverage. From the date of RQI's inception to up until now, REITs have on average trended upwards with only some temporary drops such as in the COVID-19 period. This in combination with an external leverage factor have boosted the beta exposure, thereby resulting in more favourable returns. On average, RQI has applied 30% of leverage as of total assets under management.

Thesis

Now, once we have a clear understanding of how RQI is structured and what are the key exposure points, the question becomes whether RQI is an attractive investment on a go forward basis.

In my humble opinion, RQI is one of the best funds, which seeks to outperform the U.S. equity REIT market. I believe that RQI is well positioned to continue generating alpha for its shareholders. And here is why.

As briefly mentioned before, RQI has managed to devise a superior security allocation strategy, which has yielded remarkable results. Looking at the current composition of the portfolio, the allocations seem resilient and with a notable growth component attached.

The underlying resiliency stems from both sector and security diversification, where the total proceeds are distributed among 216 holdings.

Currently, the key area of concern in the overall commercial real estate market is the office space - due to structurally reduced demand, temporarily downward pressure on the leases and looming debt refinancings, which the lenders are not that eager to roll over.

In the RQI's case, this risk is completely mitigated by having almost no exposure towards office segment (0.1% of the total allocation are made in the office REITs).

Furthermore, the fact that top ten holdings of RQI are of an investment grade nature comes in handy against the backdrop of the prevailing market conditions and recessionary risks.

One of the main issues in the REIT space is that because of the higher interest rates and tighter financing markets, weaker REITs face the risk of notable decline in the FFO results and in the worst case scenario a risk of an assumption of structurally unfavourable financing to refinance forthcoming debt maturities.

REITs with strong balance sheets and meaningful market cap levels can actually leverage this situation to not only safely finance the existing operations, but also to capture more attractive cap rates stemming from transactions where the sellers are forced to sell in order to de-risk their balance sheets. Investment grade status helps also on the spread front (i.e., holding the WACC low), which is the essence of value creation within the REIT space.

Last but not least, RQI is exposed to a leverage factor, which in this situation is very favourable. Usually, funds, which seek to generate abnormal yields apply leverage on top of the positions that are inherently volatile and high yielding. This is necessary to compensate for the cost of financing associated with the external leverage. As a result, while this might work during the upward trending markets, when the markets decline, the losses come in a magnified fashion.

In my opinion, such strategy is not optimal considering the current macro dynamics. However, in RQI's case, the assumed leverage does not introduce too much of a risk.

First, the underlying allocations are safe and in most cases with fortress balance sheets. These kinds of REITs are less prone to market risk, and even if punished, they tend to recover mainly due to their safe balance sheets.

Second, currently, the common to preferred & fixed income ratio at RQI portfolio is 79:21, respectively. The presence of preferred and fixed income securities strengthens the RQI profile as such exposures are per definition less risky than common equities. Well, they can imply elevated risk, but not in this case as RQI has not made allocation to junk or speculative securities.

Third, the leverage itself is perfectly structured. As of Q1, 2023, RQI had 81% of the external financing fixed at a weighted average maturity of ~3.4 years and at an interest rate of 2%. The aggregate weighted average financing rate stood at a very favourable level of 2.7% that, ultimately, offers notable tailwinds for RQI to generate juicy dividend yield for at least 3-4 years ahead (provided that the market conditions do not change).

The bottom line

RQI is a clear buy for investors, who want to capture predictable and very attractive dividend yield, which stems from resilient investments. RQI is also a perfect fit for investors, who want to have a more pronounced exposure to interest rate risk to potentially enjoy outsized returns from the decreasing interest rates that should send the RQI value significantly higher via interest rate sensitive preferreds and REIT portfolio, which is enhanced by external leverage.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.