Employment Back And Prices Sliding In New York

Summary

- The index remained in positive territory at 1.1 which implies the New York region’s manufacturing economy grew modestly in July.

- On a net basis, businesses are once again hiring and increasing hours worked.

- Businesses appeared to have slowed down their expected spending plans for technology and capex.

Wasan Tita

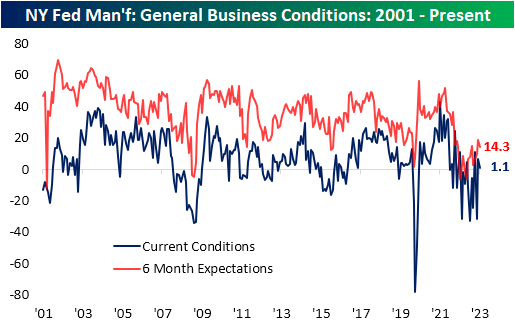

The economic calendar is having a quiet start to the week with only the Empire State Manufacturing Survey from the New York Fed released on Monday. The headline reading was expected to fall from an expansionary reading of 6.6 back into contraction in July. Instead, the index remained in positive territory at 1.1 which implies the New York region's manufacturing economy grew modestly in July.

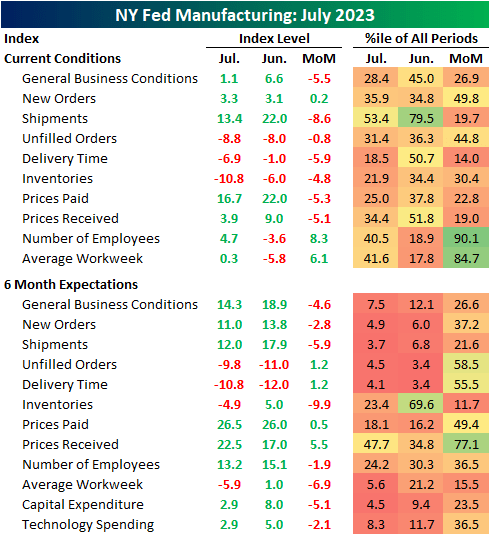

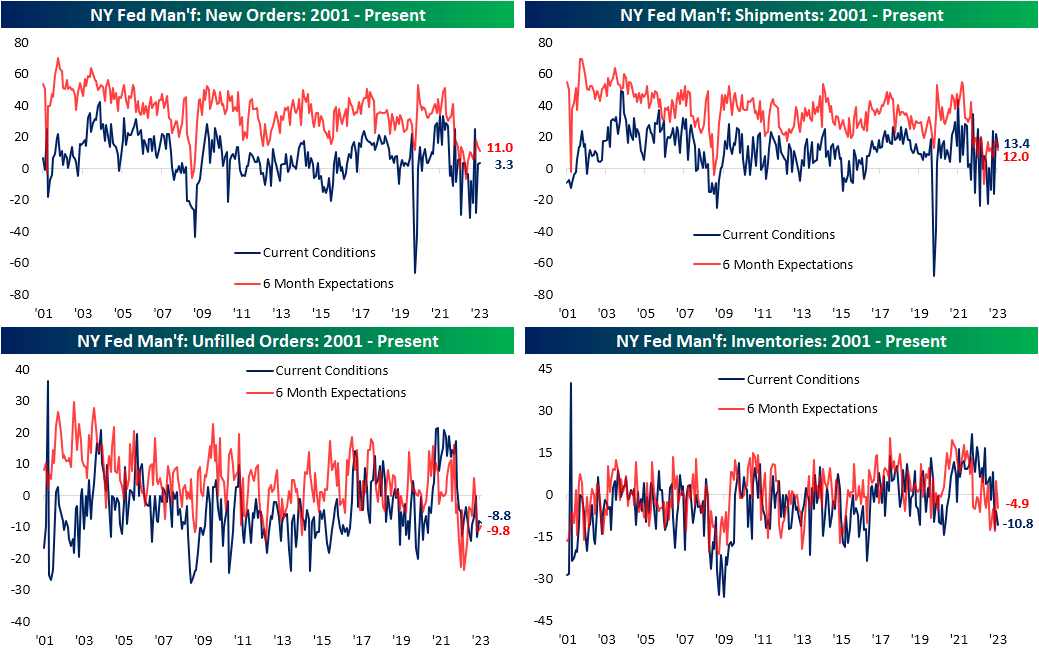

Albeit growing, activity is weak with this month's reading registering in the 28th percentile of all months in the survey's history dating back to 2001. The month-over-month decline was driven by broad weakness across categories. In fact, only three moved higher month over month: New Orders, Number of Employees, and Average Workweek. Expectations indices similarly weakened with most categories at far more depressed levels by historical standards. Of the twelve categories, eight are in the bottom decline of readings.

As noted above, New Orders stood out as one of the only readings to move higher. At 3.3, that reading is far from elevated or at a new high by any stretch. Meanwhile, Shipments indicated a major moderation compared to last month. In June, Shipments registered a reading of 22, which was surprisingly elevated relative to other categories. Falling 8.6 points month over month, now that index is more in line with other areas.

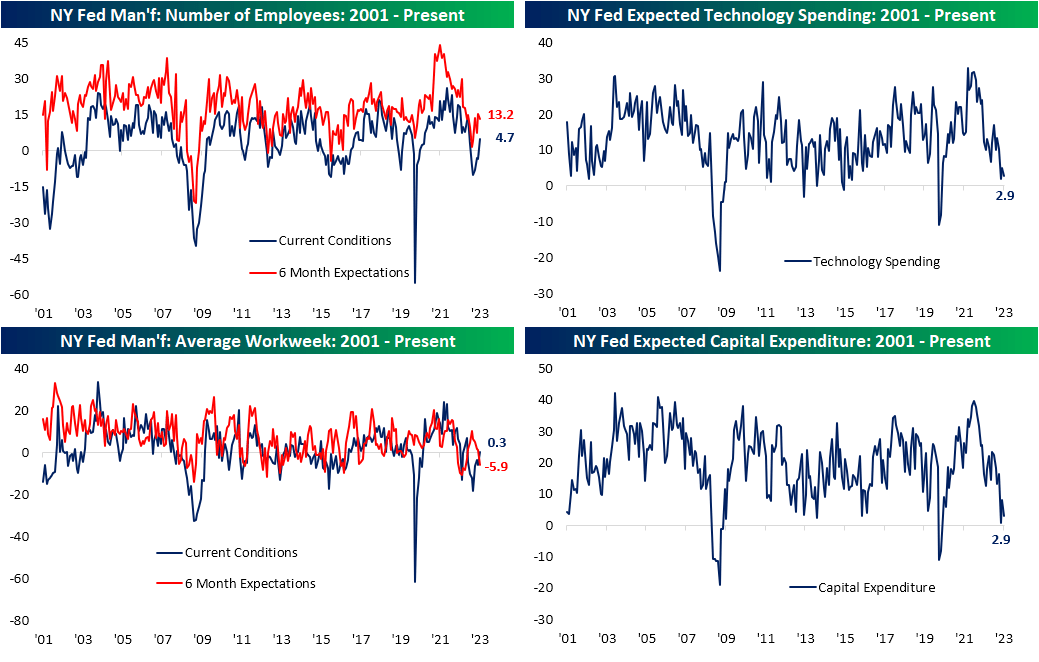

The two other notably strong readings were with regard to employment. Since the end of the first quarter, the Number of Employees and the Average Workweek have both been making their way higher with the July readings tipping back into expansionary territory. In other words, on a net basis, businesses are once again hiring and increasing hours worked. However, businesses have also appeared to have slowed down their expected spending plans for technology and capex.

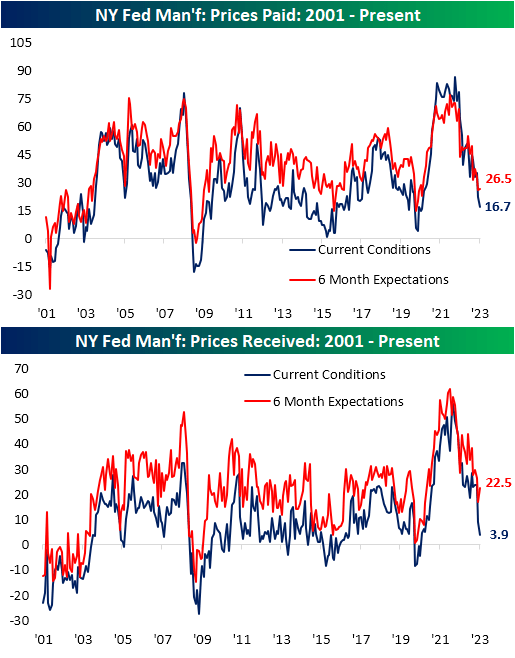

On the back of cooling inflation data last week that sent stocks higher in hopes of a more dovish monetary policy, the Empire Manufacturing survey also provided a cheery look into the region's inflation picture. Both Prices Paid and Prices Received have continued to fall dropping over 5 points month over month resulting in new lows for each one. With regards to Prices Paid, the index is now at its lowest level since August 2020. Prices Received is similarly at the lowest reading in three years.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by