AT&T Stock: Consider Buying The Panic

Summary

- AT&T stock has been underperforming, but its low valuation could present an attractive opportunity for investors. The telecom company's high yield and potential for total returns could appeal to those seeking income or value investments.

- AT&T's cash flows are crucial for financing dividends and reducing debt. The company has guided for at least $16 billion in free cash generation for 2023, but its Q1 performance was weaker than expected, causing concern among investors.

- Despite a slowdown in growth in its mobility segment, AT&T's low valuation and high earnings yield could make it a good investment.

- Looking for more investing ideas like this one? Get them exclusively at Cash Flow Club. Learn More »

FG Trade

Article Thesis

AT&T (NYSE:T) has been a battleground stock for a while, and in the recent past, it seems like bears are winning. But the stock has now become so cheap that there is a good chance for attractive total returns, even if growth remains weak. Investors that want a telecom stock may want to use this buying opportunity to lock in a high yield at a very low valuation.

What Happened?

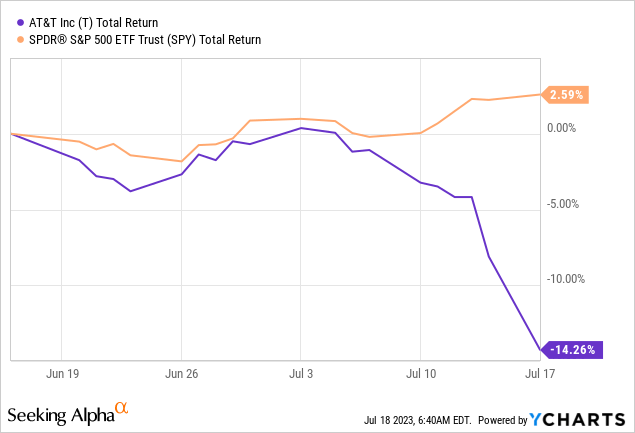

AT&T Inc. has underperformed the broad market for a while, but selling pressure accelerated in the very recent past, as we can see in the following chart:

While the S&P 500 (SP500) rose by 3% over the last month, or more than 30% annualized, AT&T has dropped by 14% over the same time frame. To some degree, the underperformance of AT&T was driven by the market's interest in AI-themed stocks, but AT&T also underperformed versus other stable blue chips. Selling pressure was driven by facts such as AT&T's CEO stating that subscriber additions during the second quarter were likely below estimates (this statement was made in June at a Bank of America (BAC) conference). Downgrades by analysts also played a role in the weak share price performance, such as JPMorgan (JPM) downgrading from Buy to Neutral, or Citi (C) downgrading AT&T along with some other telecom companies.

Of course, AT&T's shares were already down quite a lot from the recent highs around $20 when these banks downgraded AT&T, meaning these weren't very helpful downgrades -- if they had downgraded the stock at the top in order to help investors lock in gains, that would have been impressive. But downgrading a stock after a huge decline only adds to the selling pressure -- and, in this case, makes the buying opportunity even better.

AT&T's Cash Flow: Time To Deliver

AT&T is, like other telecom companies, not a growth investment, and it will never turn into one. Instead, it is an income investment for many and a valuation/value investment for others. After all, when shares trade at a too-low valuation and that valuation discount vanishes over time, then investors would benefit from share price appreciation, even if there is not a lot of underlying business growth. On top of that, AT&T is also a deleveraging story: The company has a pretty high debt load in absolute terms, and when that debt is being paid down, value is being transferred from debt holders to equity investors, assuming the enterprise value stays more or less the same.

For income investors, value investors, and for those investors that like the deleveraging story, AT&T's cash flows are extremely important: Cash flows are needed to finance the dividend, cash flow is needed to pay down debt, and AT&T's cash flows are also important for valuing the company, as many like to use a free cash flow yield (or free cash flow multiple) approach here.

In the past, there were some questions about AT&T's cash flow generation ability, especially when it comes to generating free cash flows, i.e., that portion of the company's cash flows that is available for debt reduction, dividends, buybacks, and acquisitions once organic capital expenditures have been paid for. After all, new technologies such as 5G require AT&T to invest heavily in its asset base, with capital expenditures totaling $19 billion over the last year. AT&T has been guiding for strong free cash flow generation nevertheless, but the company had to reduce its free cash flow guidance in the past.

Some investors worry that the same will happen this year, as AT&T's free cash flows during the first quarter were rather weak. The company has guided for at least $16 billion in free cash generation for 2023, but generated just $1 billion in free cash during the first quarter, staying well below the forecasted average for the year. At the time, AT&T's management maintained their free cash flow guidance, arguing that things would improve meaningfully during the year and that working capital would move in investors' favor, thereby boosting free cash flow during the remainder of the year. But AT&T will have to experience a pretty large improvement in its cash generation in order to hit the FY 2023 guidance, as that requires around $5 billion of free cash per quarter during Q2 to Q4.

AT&T will report its second-quarter earnings results soon, and that is when the company will have to deliver a pretty solid free cash flow number. I believe that everything under $4 billion would be seen as a reason for concern by the market, as that would make it rather unlikely that AT&T will hit $16 billion of free cash this year. Since AT&T has not made any changes to its free cash flow forecast at recent conferences, thus I believe that management still believes in its forecast -- otherwise, not announcing new guidance would be an unsound move.

Let's still be conservative and assume that AT&T will miss its guidance and that the company will generate just $15 billion of free cash this year. The dividend eats up $7.9 billion per year at the current level of $1.11 per share per year. That means that the dividend would be well-covered with a rate of 1.90, or a payout ratio of 53%. Many well-liked income stocks have dividend payout ratios that are way higher than this, such as Coca-Cola (KO) with a 64% payout ratio, or AT&T's peer Verizon Communications (VZ), which has paid out around 80% of its free cash flows over the last year. At the same time, AT&T's $1.11 annual dividend translates into a dividend yield of 8.2%, which is very strong. A company offering an 8% plus yield that is covered almost two times by post-capex free cash flows is a pretty rare thing -- and that estimate already assumes that AT&T will miss its free cash flow guidance for the current year.

In this scenario, AT&T has around $7 billion of free cash left over after paying its dividend, which can be used for several things, including debt reduction and acquisitions. Of course, with a debt load of more than $100 billion, AT&T will not pay down a massive portion of its debt in a short period of time. But its debt is well-laddered, meaning there is not a lot of debt maturing per year. This is a very good thing during times of rising interest rates, as the company does not have to worry about having to refinance large portions of its debt at way higher rates. And with comparatively little debt maturing per year, the company can pay down a significant portion (or, in some years, all of that) via its organic cash flows.

AT&T: Growth And Valuation

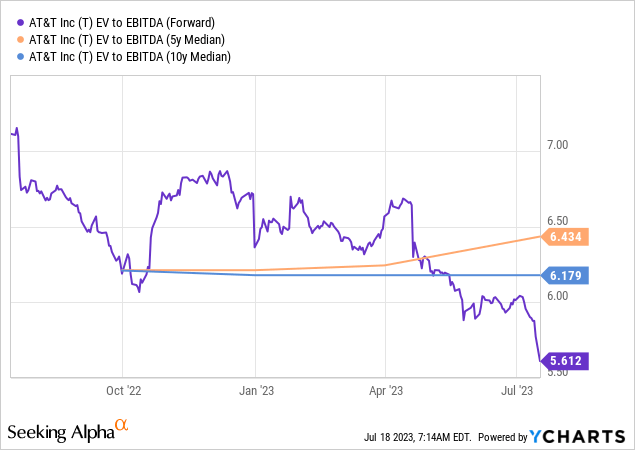

AT&T has guided for growth in its mobility segment to slow down to 2% to 3% this year, versus 5% and 4% in 2021 and 2022, respectively. While slowing growth isn't great, it is, I believe, not a disaster. In fact, AT&T is valued as if the company was in perpetual decline -- it is so cheap, that even a low-single-digits growth rate is pretty good. At current prices, AT&T is trading at just 5.6x EBITDA:

This represents a meaningful discount versus the 5-year and 10-year median EBITDA multiples of 6.4 and 6.2, respectively. While one might think that this means that AT&T has around 15% upside potential towards the longer-term valuation average, the potential for AT&T's shares is much larger. Enterprise value includes net debt, and that is a very meaningful factor at AT&T. If AT&T's enterprise value to EBITDA multiple would climb to 6.2, its shares would rally by 26%, to around $17.00. If AT&T's enterprise value to EBITDA were to revert to the 5-year median of 6.2, its shares would rally by 35% to $18.20. We see that a reversal to the longer-term average valuation would allow for substantial share price gains for shareholders that buy AT&T at the current price. This does not yet factor in that deleveraging efforts will shift additional value to equity investors from debt investors over time.

Another way to look at AT&T's valuation is its earnings multiple, which stands at just 5.6 today -- which translates into a very high earnings yield of 18%. Buying a company at an 18% earnings yield means that not a lot of growth is needed for this investment to work out -- I'd argue that no growth is needed at all. If AT&T were to earn the forecasted $2.43 in 2023 and every year beyond, that would justify a higher share price than $13.50, as AT&T could just continue to pay its current dividend forever while getting rid of all of its debt over time, thereby making AT&T an investment with declining risk, which would result in increased demand for its shares at some point, which, in turn, would drive share price gains.

Takeaway

AT&T has not been a great investment for long-term holders, but its shares have been pretty volatile in the past, and those that bought at the lows were usually able to benefit from nice gains. We recommended AT&T last September, for example, at $15.80 -- by January, they rose to more than $20, as the market became more eager to AT&T (without fundamentals changing meaningfully), which made for nice gains of more than 30% and some additional dividends on top of that.

Today, AT&T stock trades at an ultra-low valuation, and I believe that we have a good buying opportunity here. The dividend looks sustainable, there is ample free cash for deleveraging, and the discount to AT&T's historic valuation suggests that shares have considerable upside potential. Is AT&T a great company? No. But it is so cheap that not many things have to go right for this high-yielder to deliver compelling total returns.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

This article was written by

If you want to reach out, you can send a direct message here on Seeking Alpha, or an email to jonathandavidweber@gmail.com.

Disclosure:

I work together with Darren McCammon on his Marketplace Service Cash Flow Club.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (26)

Now, ask me what I'll do when it hits the $18 range.