Avantis U.S. Small Cap Value ETF Looks Promising So Far

Summary

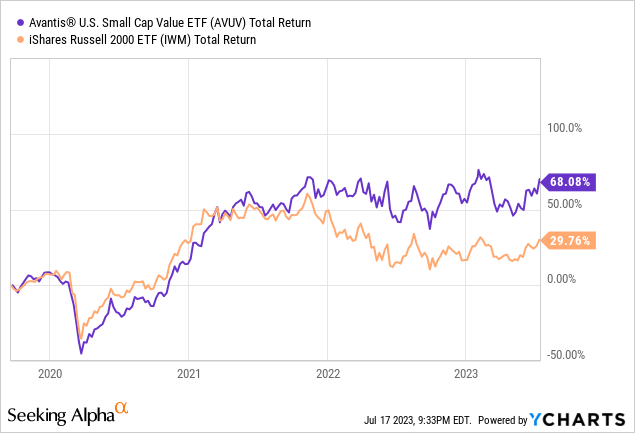

- Avantis U.S. Small Cap Value ETF offers investors exposure to small caps with low valuations and has delivered compounded annual returns of 14.2% over three years, beating its benchmark's annual return of 6.7%.

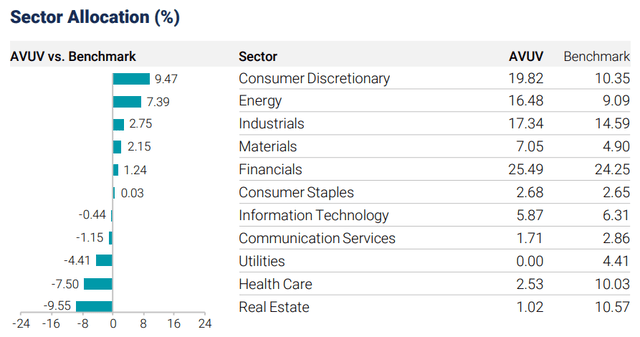

- The fund invests in profitable American small cap stocks, avoiding start-ups and struggling companies, and is overweight in consumer discretionary and energy sectors while underweight in healthcare and real estate sectors.

- Despite the limitations of small cap funds, including the need to sell high performers as they graduate to higher caps, the fund continues to offer value to investors.

baona

Avantis U.S. Small Cap Value ETF (NYSEARCA:AVUV) offers investors exposure to small caps with low valuations as the name of the fund implies. The fund's long term goal is to deliver returns better than small cap indices such as Russell 2000. The fund has only been around for 3 years and so far has beaten its indices by delivering compounded annual returns of 14.2% versus its benchmark's annual return of 6.7% during the same period. The fund doesn't have a long history but if the fund can keep this performance up, it can become one of the top small cap funds out there.

AVUV performance since inception (Avantis)

The fund holds 741 American (and a very small number of Canadian) small cap stocks with an average market cap of $3.0 billion and average price to book value of 0.75. The fund specifically invests into companies that are already profitable, enjoying positive cash flows. It avoids start-ups, struggling companies or turnaround stories for the most part.

The fund doesn't have the same sector allocation as its benchmark. In fact, the fund is overweight in some sectors and underweight in others due to its specific method of selecting only profitable stocks that enjoy low valuations (based on profitability metrics as well as price to book value metric). As you can see below, the fund is overweight in consumer discretionary and energy sectors while underweight in healthcare and real estate sectors as compared to its benchmark. Still, the fund's biggest sector allocation is financials which can be worrisome to some investors since it will be mostly regional banks. While things have been quiet for a few months in regional banks, we saw how quickly things can turn sour in this sector back in March.

AVUV sector allocation vs benchmarks (Avantis)

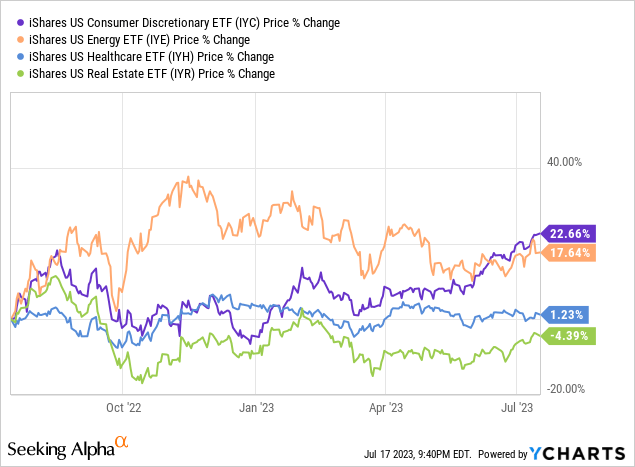

In hindsight, avoiding healthcare and real estate was a good bet since these two sectors have been performing pretty poorly lately and this is not only limited to small caps either. Below is performance comparison of these four sectors YoY and it's clear that healthcare and real estate haven't performed that well. Meanwhile, consumer discretionary and energy sectors did pretty well in the last 52 weeks, fueling the fund's overperformance. Keep in mind that the sector performance chart below is not limited to small caps only but it gives you a pretty good idea about performances of these sectors overall.

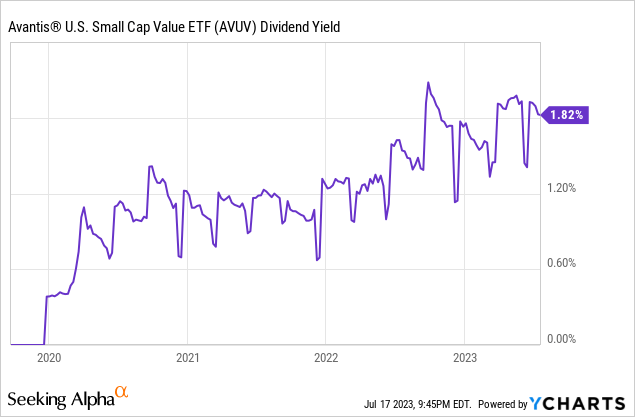

The fund currently has a dividend yield of 1.84% and this has been on the rise since the fund's inception. The only source of AVUV's dividends are the dividends it receives from its holdings. The fund generally doesn't do dividends based on return of capital or capital gains. Since the fund generally invests into companies that are profitable with cheap valuations, it makes sense for many of its holdings to have dividends but this is not guaranteed and moving forward dividends are expected to make a small portion of its total returns.

Investing in small cap funds is always tricky because gains are capped in a way that is not always visible or obvious to most investors. Since funds specifically focusing on small caps can't invest into mid-cap and large-cap stocks, this creates an artificial cap for how high these funds go because they constantly have to sell their highest performers since they are more likely to "graduate" from being small caps to higher caps. Meanwhile, low performing small caps remain small caps forever which creates an artificial headwind for overall performance of these funds. In investing there is a famous saying that says "don't sell your winners, hold onto them for as long as you can and let them run and carry your portfolio" because those stocks could provide outsized returns for your portfolio. When a fund has a rule of only investing in small caps, it has to sell its winners and hold onto its losing positions even if it doesn't want to do so. The fund is also forced to sell its positions if a company it in its portfolio gets acquired by a larger company even if the transaction was in all stock.

This is a problem small cap funds constantly have to worry about but individual investors holding a basket of small cap stocks rarely even think about this since they don't have to follow certain arbitrary rules when they are investing their money and have more flexibility.

Still, even with this big headwind, the fund seems to be performing well so far so maybe it is doing some things correctly. The fund also has a surprisingly low turnover ratio of 14%. Turnover ratio refers to how often a fund changes its positions and usually weighted by size of each position. For example, if a fund had a large position which made up 10% of its total assets and sold this position, this sale alone would give it a turnover rate of 10% even without changing any other positions. A fund could keep most of its positions intact and show turnover simply by changing weighing of its existing positions so most funds will show at least 10-20% turnover and most actively managed funds will show turnover rates well above 25%. Keep in mind that a fund can have a turnover ratio above 100% if it trades in and out of positions frequently. This fund seems to be pretty stable with its relatively low turnover.

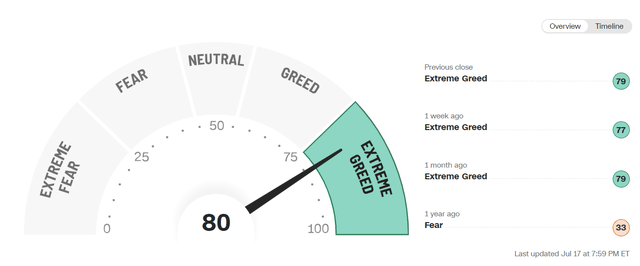

Lately market sentiment has been exceptionally strong with CNN's Fear & Greed index hitting extreme greed levels. They usually say that when this index is very high, markets might be overheated and overdue for a correction.

CNN Fear & Greed Index (CNN)

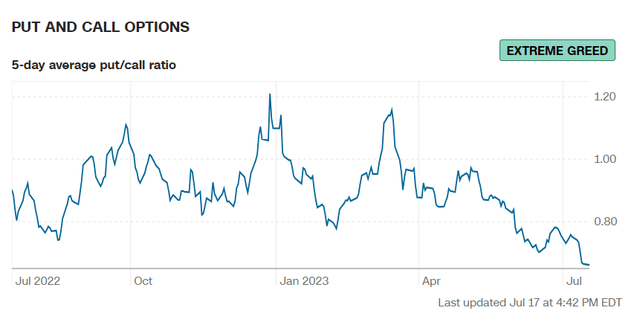

Meanwhile, put/call ratios are also telling us that all fear from markets have been removed and people aren't even buying puts as insurance. This is one of the reasons VIX has been so low lately.

Put call ratios (CNN)

This makes me cautious about initiating any new positions but if I were to initiate a new position a good place might be value plays, especially small caps that haven't been receiving much love lately when everyone has been piling on mega caps and large caps, pushing indices higher. If we are going to see a rotation as we usually do in the markets, AVUV might be a good place to get some exposure especially if you don't already have much exposure to small caps.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.