Trinseo PLC: Poor Margins And Lacking Growth Make Downside Risk Large

Summary

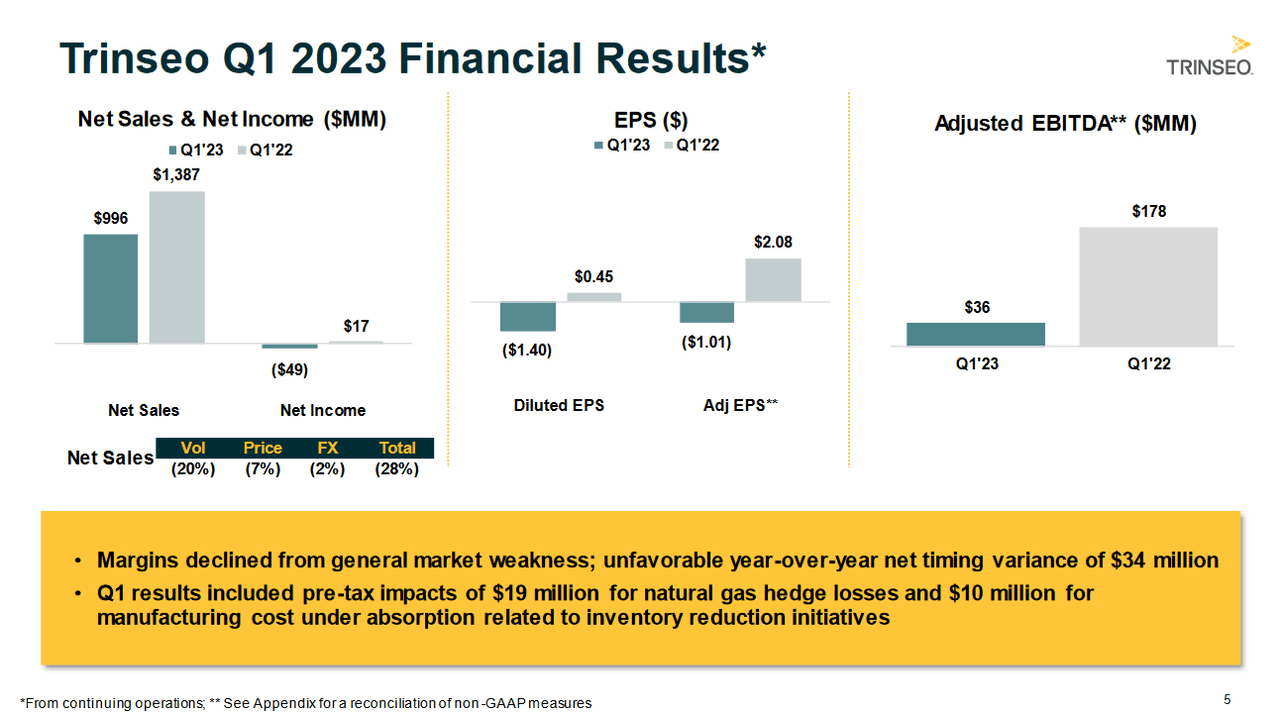

- Trinseo PLC has seen a negative revenue CAGR of 1.73% over the past decade and poor margins, making it a risky investment. The company's net sales dropped nearly 40% to under $1 billion recently.

- The company's largest revenue-generating segment, Plastic Solutions, faced significant challenges due to decreased demand, particularly in the building and construction, and consumer durable applications markets.

- Despite these challenges, Trinseo has taken steps to improve its financial situation, including cutting dividends and repurchasing shares.

Group4 Studio

Investment Rundown

Trinseo PLC (NYSE:TSE) hasn't grown that impressively over the last decade. The revenue CAGR is negative 1.73% in the last 10 years, and with quite poor margins, the business doesn't look that appealing to be investing in right now to be completely honest. I find the lacking growth and poor margins to be a good reason for TSE to continue trading at a low multiple.

There might be a long time until we see them growing into a business worthy of a p/e of 14 or a p/s of 1.17, which is what the materials sector is valued at. Sales were down a significant amount in Q1 to 2023 and for the coming quarters, I don't see a strong case for a catalyst happening. That means the downside risk seems quite large here. I think exiting a position now and only perhaps entering one when there have been several consecutive quarters with positive EPS posted makes sense. For now, TSE seems too risky, and I am rating them a sell.

Company Segments

Trinseo focuses on manufacturing and selling plastics and latex binders in a variety of different markets all around the world. The recent earnings report showed continued challenges for the business as net sales dropped nearly 40% to under $1 billion. Throughout all of the segments in the company, the revenues were down. The company has divided the business into 6 different segments which are the following, Engineered Materials, Latex Binders, Base Plastics, Polystyrene, Feedstocks, and lastly Americas Styrenics.

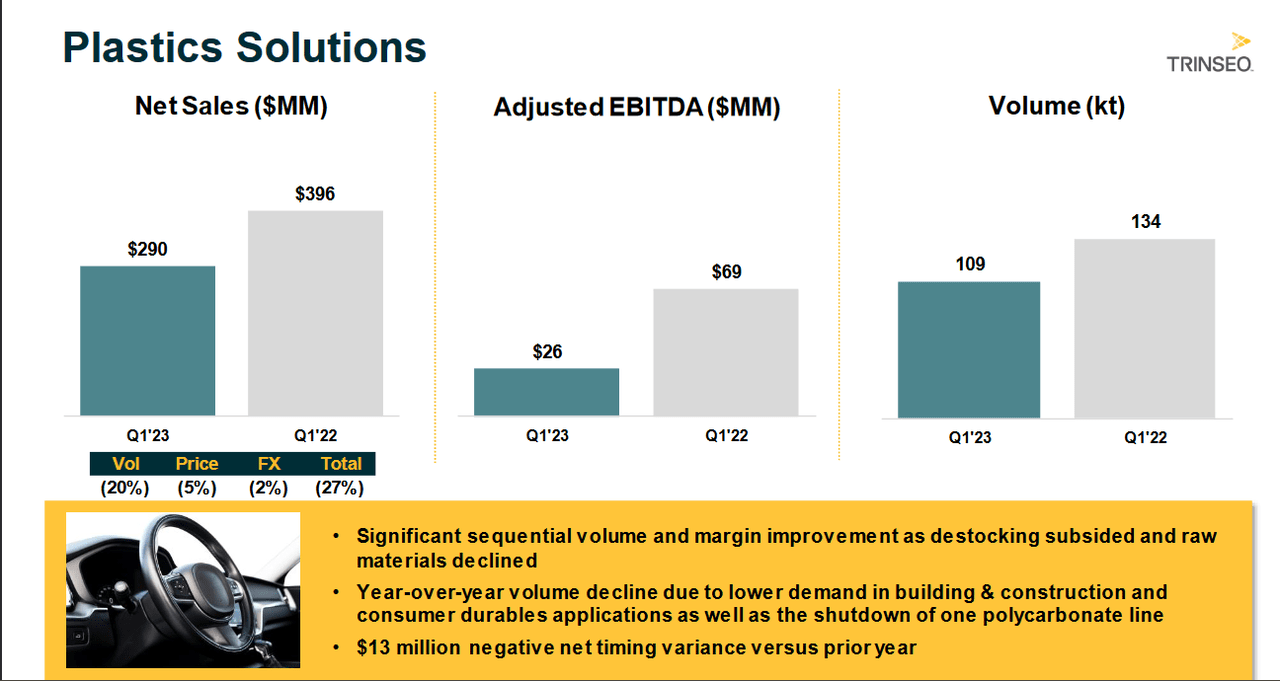

Plastic Solutions (Earnings Presentation)

The segment generating the largest amount of revenue right now is Plastic Solutions. Here revenues reached $290 million in Q1 2023 but still faced a lot of difficulties. The significant volume decrease as demand lessened resulted in disappointing results. The primary markets with lower demand were "building and construction" but also "consumer durable applications". The shutdown of one of the polycarbonate lines didn't exactly add anything positive either. But the management noted they did manage to keep some margins in the quarter, but it's not nearly enough to make for a buy case with TSE.

Markets They Are In

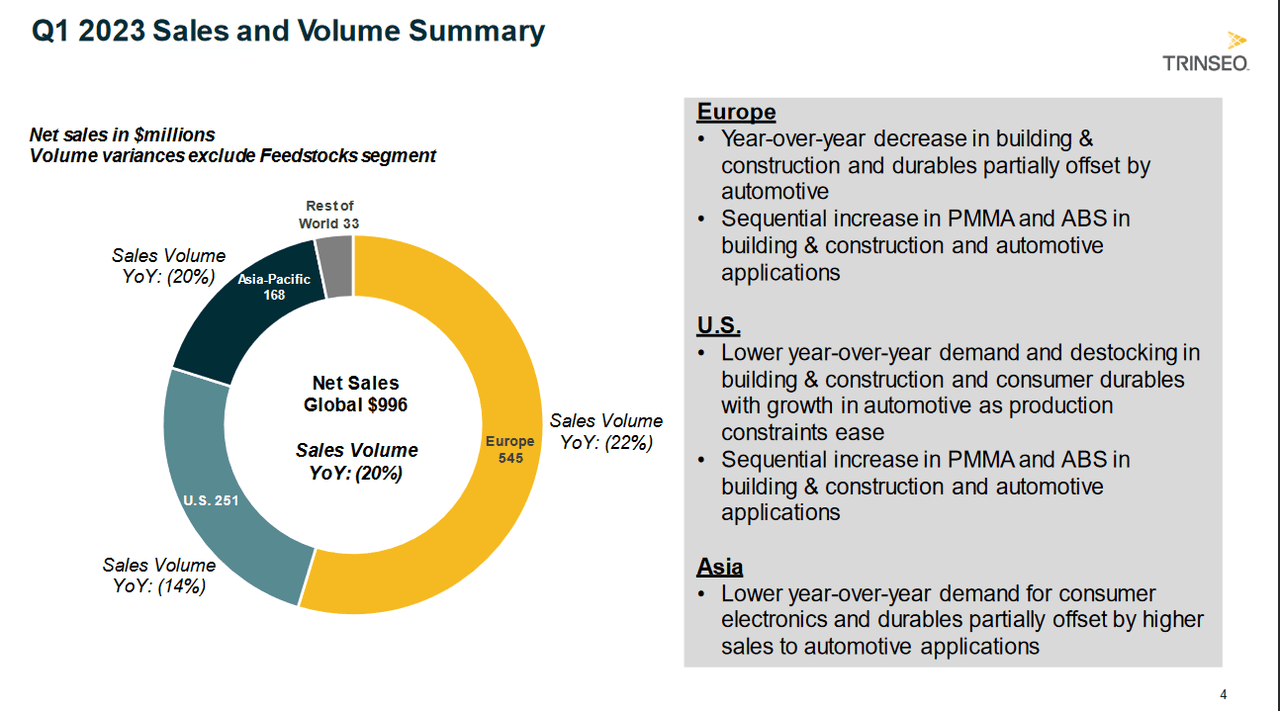

As we have discussed here, TSE serves a variety of different markets and keeps a diversified set of revenue mixes.

Q1 Sales Volume (Q1 Report 2023)

For Q1 in 2023, the majority of the revenues came from Europe, which is also where the largest amount of volumes was lost when compared to Q1 of 2022, 22% less. The decrease in building and construction in the European market helped contribute to this result. But some might see TSE still as a potential buy as the rebuilding of Ukraine after the war could provide plenty of opportunities to grow revenues.

I find it important however now for TSE to set themselves up the best they can to either upgrade and invest into more production capabilities, but with 10x more debt than cash right now I think they will be stuck spending capital paying that down, rather than making significant investments.

Earnings Highlights

As discussed here already, starting in 2023 TSE was faced with significant challenges, that seem to have persisted from Q4 2022. The miss they had in Q4 2022 came on the back of lower demand, and that lower demand persisted in Q1 2022 as well.

On an adjusted basis, the EPS for TSE is positive, but the difference is quite large and doesn't bring any confidence to me that TSE is trading based on fundamentals. Rather, the business faced a significant setback and now needs to quickly return to previous performances to regain the market's trust. For Q2 2023 an important note to watch out for will be the margins. In Q1 2022 the EBITDA margins were above 8% and for Q1 2023 they went far lower to under 3%. That of course impacted the final results as no larger amount of revenues or volumes helped offset it.

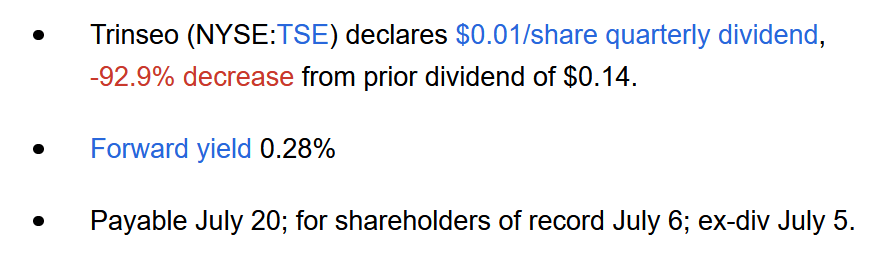

Dividend News (Seeking Alpha)

The management has taken steps however to rectify their financial situation and cutting the dividend significantly helped them have a better financial position and less leverage in my view. I think it will be a long time until we see the dividend raised again. In 2022 the company spent nearly $60 million in dividends and $155 million in repurchasing shares. That will most likely stop or significantly decrease in 2023. I think investors who are interested in TSE are looking at 2025 and beyond perhaps as when TSE can return to its former self. But that leaves a lot of dead time where capital might be better held elsewhere.

Risks

In 2023, TSE faces three significant challenges that warrant attention. Firstly, the soaring energy costs in Europe could impact the company's operations and overall profitability, necessitating efficient management of resources to mitigate potential adverse effects.

Secondly, closely monitoring China's recovery from economic fluctuations becomes crucial. The pace at which the Chinese market bounces back will undoubtedly influence TSE's global business outlook, as China plays a pivotal role in the company's supply chain and customer base.

Lastly, the pace of destocking by TSE's customers will be a crucial factor in determining future demand and order sizes. Striking a delicate balance between maintaining sufficient inventory levels and meeting customers' needs becomes essential to navigate potential fluctuations in demand.

Final Words

I am right now viewing TSE as a very risky investment given the significant decline in volumes the company experienced in both Q4 2022 and Q1 2023. I am not confident they will see a quick recovery, and they are bleeding money as a result. The dividend got cut and buybacks are likely to slow down, which were some of the large benefits that came with investing into TSE previously in 2022. I am rating TSE a sell right now, and I want to see several quarters of positive EPS posted before considering a higher rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.