Molina Healthcare: Margins Holding Up Despite Redetermination Fears

Summary

- Healthcare provider stocks have underperformed compared to the S&P 500 over the past nine months, with Molina Healthcare shares currently undervalued.

- MOH, one of the largest Medicaid managed care plans in the U.S., has a mixed technical outlook but is expected to see earnings rise at a fast pace in 2023.

- Despite the underperformance, a buy rating has been initiated on MOH as the shares are considered more than 10% undervalued, with a potential fair price of $336.

- I outline key price levels to watch on the chart ahead of Q2 results due out next week.

ljubaphoto

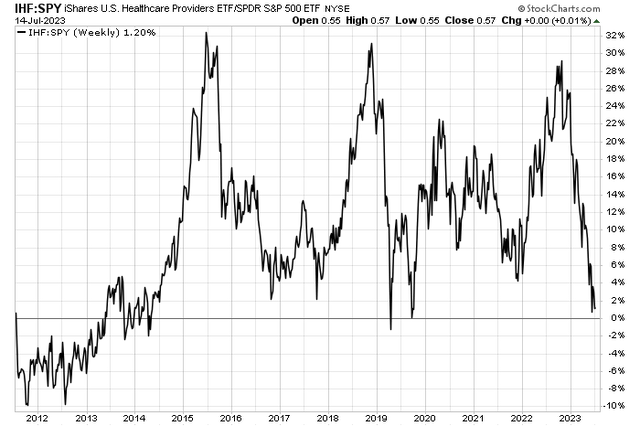

Healthcare provider stocks have stumbled compared to the robust performance of the S&P 500 over the past 9 months. The iShares U.S. Healthcare Providers ETF (IHF) has given up nearly 30 percentage points of alpha to the SPX (total returns) since Q4 2023, and the ETF now threatens to break down to fresh 9-year relative lows. So, is there value in this sagging space?

I assert that shares of Molina Healthcare (NYSE:MOH) are undervalued today, though the technical outlook is mixed. Overall, I am initiating a buy rating on this MOH.

Healthcare Providers Near Decade-Lows Versus The S&P 500

According to Bank of America Global Research, MOH is one of the largest Medicaid managed care plans in the U.S., administering programs in over a dozen states. Additionally, MOH targets low-income beneficiaries in Medicare Advantage as well as the public exchanges.

The California-based $17.4 billion market cap Managed Health Care industry company within the Health Care sector trades at a near-market 20.4 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend yield, according to Seeking Alpha. Ahead of earnings on the 26th, implied volatility is moderate at 29% while the stock has a material, but not high short interest percentage of 4.1% as of July 14, 2023.

Back in late April. MOH reported an impressive bottom-line beat though it missed top-line estimates. Sales rose 5% year-on-year and the full-year earnings guidance figure of "at least $20.25" was considerably better than the $19.79 EPS consensus. Shares did not rally much, though. MOH eventually retreated from $300 resistance, and the stock is about unchanged since then. In focus among shareholders is the firm's redetermination situation.

While the Q1 beat was primarily driven by Marketplace operations, MOH's Medicaid margins could be at risk should the Medicaid risk pool turn worse. Centene hinted at larger problems with redeterminations earlier this year, so it is a clear risk in the sub-industry. Still, Molina's valuation appears to bake in this reality. On the bright side, MOH's management team said it expects no impact from redeterminations on its risk pool during the Q1 earnings call. Ergo, the firm reiterated its long-term earnings guidance last May, underscoring that it continues to project industry-leading margins in the 4-5% pre-tax range.

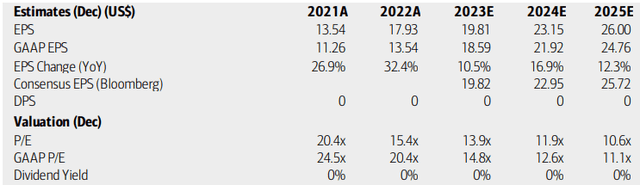

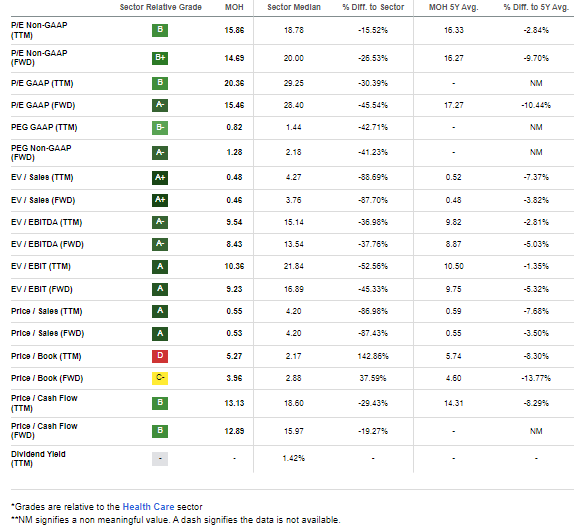

On valuation, analysts at BofA see earnings rising at a fast pace in 2023 while out-year EPS growth is expected to accelerate to nearly 17% before growth ebbs to 12% by 2025. The Bloomberg consensus forecast is about on par with what BofA projects. Even with very strong profitability trends, the stock is not expected to pay dividends in the coming quarters. The company's P/E ratios appear attractive on an absolute basis, but let's dig deeper to see what a fair price for MOH might be.

Molina: Earnings and Valuation Outlooks

The company has historically traded with an earnings multiple slightly below that of the broad market and the Health Care sector median, and the gap is wider than usual today. With ample growth levers though uncertainty around the redetermination case, I assert that shares are undervalued. If we assume the next-12-month EPS of $21 and apply a 16 P/E, then shares should be near $336, suggesting that the stock is more than 10% undervalued today.

MOH: Compelling Valuation Multiples

Seeking Alpha

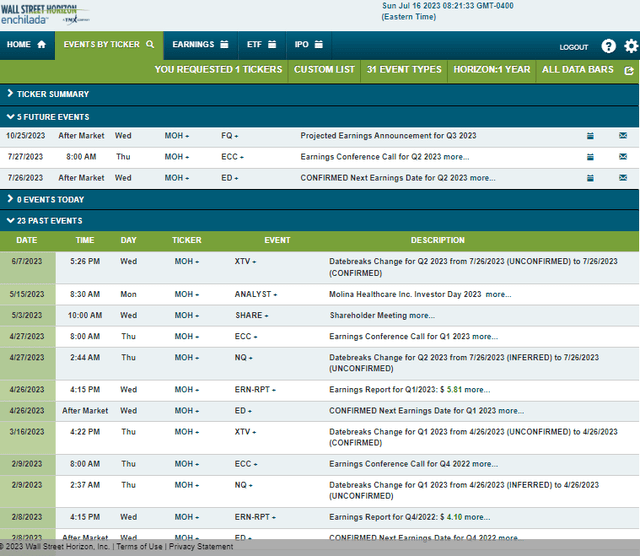

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings date of Wednesday, July 26 AMC with a conference call immediately after the numbers hit the tape. You can listen live here. No other volatility catalysts are seen on the corporate event calendar.

Corporate Event Risk Calendar

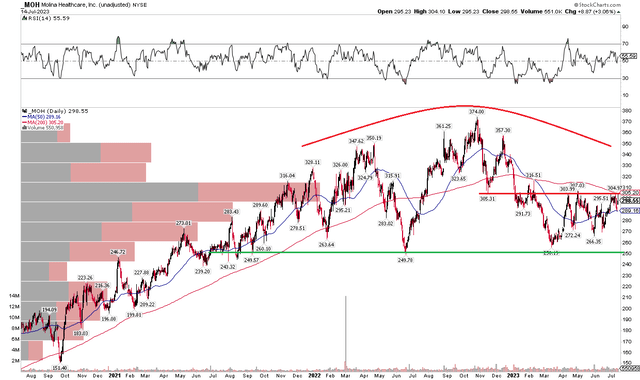

The Technical Take

MOH has been an underperformer this year. The stock is down about 10% while the broader market is higher by nearly 20%. Notice in the chart below that MOH has been putting in a bearish rounded top formation. This is a bullish to bearish reversal signature with key support in the $250 to $260 zone. So long as that support holds, a long position is in decent shape. Today, shares trade near important resistance levels near the $300 mark.

That is where the falling 200-day moving average comes into play and where the stock stalled earlier this year as well as just recently. I would like to see MOH rally through $305 to $317 - that would help promote the chance of a breakout from this multi-month consolidation, potentially leading to a test of the $350 to $374 range highs. With high volume by price up to $315, I would not be surprised if MOH continues to struggle ahead of and through earnings results.

Overall, it is a mixed bag, but the technical situation is certainly less sanguine compared to where I see fair value on the fundamentals.

MOH: A $250 to $300 Trading Range In Play

The Bottom Line

I have a buy rating on Molina Healthcare. Shares appear discounted too greatly today though the technical chart and momentum have work to do to buttress the bullish argument.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.