Philip Morris Q2 Earnings Preview: Worst Among Anti-ESG Investments

Summary

- Philip Morris International Inc. will release its second quarter earnings report on July 20 before the stock market opens.

- In this update, I share my thoughts on the upcoming earnings release, focusing on PMI's earnings quality, the recent Swedish Match acquisition, and dividend expectations.

- I answer the question of whether PM, despite being the most "socially acceptable" tobacco company, is nevertheless burdened by comparatively higher interest rates - an "ESG penalty", so to speak.

- I also share whether I'm a buyer of PM stock ahead of earnings, taking into account the solid rebound after the recent plunge to $90.

latest IQOS tobacco heating device Ирина Мещерякова/iStock Editorial via Getty Images

Introduction

There is no doubt that Philip Morris International Inc. (NYSE:PM) is currently the best positioned tobacco company in terms of modified risk products such as heated tobacco (e.g., IQOS, IQOS Iluma, and BONDS by IQOS), oral nicotine products (ZYN and General Snus, both through Swedish Match) and e-vapor (Veev). In my previous articles from February and April 2023, I explained why I am a big proponent of the Swedish Match acquisition. However, PMI has a renewed presence in the U.S. not only through Swedish Match, but soon also through IQOS, which it will market exclusively starting in May 2024.

Philip Morris International's earnings report will be released on Thursday, July 20, 2023, at 7 a.m. eastern time. In this update, I share my expectations for the upcoming earnings report and conference call (scheduled at 9 a.m.) and highlight what investors should look for in the results. I will also discuss an aspect that I believe is becoming increasingly important for companies operating in less socially acceptable industries and potentially affected by poor ESG (environmental, social, governance) ratings - namely, higher interest rates compared to companies with the same credit rating but operating in more "acceptable" industries. In the conclusion, I share whether I am a buyer of PM stock ahead of earnings, taking into account the run-up after the recent slump to a stock $90.

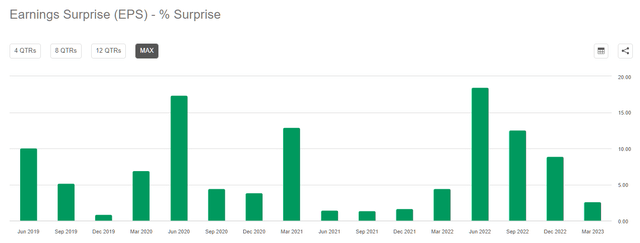

The Likelihood Of An Earnings Beat, And A Word On Earnings Quality And Growth

In the recent past, Philip Morris International's management has always reliably exceeded analysts' quarterly estimates. For example, the company has not missed analysts' earnings per share (EPS) estimates once in at least the last 16 quarters (Figure 1). Similarly, I find it remarkable that the worst miss on revenue, which is much harder to manage, was only 1.5%, in the second quarter of 2021. I strongly expect the company to at least meet analysts' earnings estimates on Thursday, in part because estimates haven't really changed in the last six months. However, I would not necessarily infer a post-earnings jump in share price, because of the market's likely anticipation. Also, it should be kept in mind that PMI stock's share price has already recovered well from the slump at the end of May/beginning of June.

Figure 1: Philip Morris International Inc. (PM): Earnings per share surprise over the last 16 quarters (Seeking Alpha)

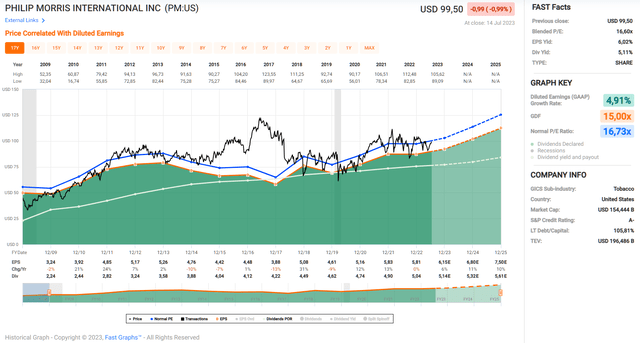

For a company with a solid track record of beating analysts' estimates, skeptical investors naturally might suspect earnings management. However, comparing adjusted operating income (Figure 2) and diluted earnings on a GAAP basis (Figure 3), we see that PM has been and is expected to continue to be a consistent, yet rather modest, earnings growth performer (5.0% and 4.9%, respectively, since 2008). Free cash flow conversion is similarly solid, suggesting no earnings management. The M-score, a scoring model used to assess potential earnings management, also does not indicate a high probability of manipulation, as the values (-2.23 based on 2022 earnings, -2.61 on a five-year average) are well below the critical threshold of -1.78.

Figure 2: Philip Morris International Inc. (PM): FAST Graphs chart for the 2008 to 2025 period, based on adjusted operating earnings per share (FAST Graphs tool) Figure 3: Philip Morris International Inc. (PM): FAST Graphs chart for the 2008 to 2025 period, based diluted GAAP earnings per share (FAST Graphs tool)

However, a look at the two FAST Graphs charts above shows that PMI has been treading water for quite a long period of time, but this is due in significant part to the substantial investments, which are the main driving force behind Philip Morris' now undisputed top position in the segment of modified risk products.

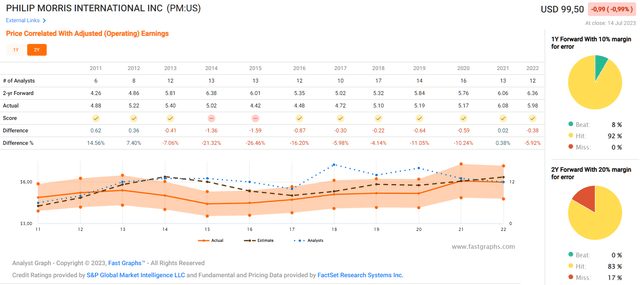

As a result of these investments and the rapidly growing adoption of IQOS, as well as the fact that one-time costs should decline, Philip Morris' profits are expected to rise sharply over the next few years. Looking at the company's two-year forward analyst scorecard (Figure 4), one might question the realization of this magnitude of growth (10% and 11% in 2024 and 2025, respectively). However, I would not attribute the rather poor analyst scorecard to PMI's undeniably strong position, which is confirmed, for example, by the fact that the company is sticking to its ambitious self-imposed goal of becoming a majority smoke-free company by 2025 - and this despite the fact that it no longer includes Russia and Ukraine, two former top growth markets for IQOS, in its adjusted results. Swedish Match also plays a very important role in this context, and its recent acquisition is probably also the reason why analysts have raised their growth expectations for 2024 and 2025 quite aggressively by around 6% and 10%, respectively.

Figure 4: Philip Morris International Inc. (PM): FAST Graphs two-year forward analyst score card (FAST Graphs tool)

What To Watch For In Philip Morris' Upcoming Earnings Report

Meanwhile, PMI has likely paid the final $1.7 billion plus accrued interest to Altria Group Inc. (MO) in exchange for exclusive rights to market IQOS in the U.S. beginning in May 2024. It will be interesting to hear an update on management's plans to commercialize the conventional IQOS product line (besides domestic manufacturing), including in light of the known patent issues with British American Tobacco (BTI) related to an earlier version of its Vuse heated tobacco system.

To date, only the conventional IQOS system holder and three heated stick brands have received written marketing approval from the FDA. The announcement of a Premarket Tobacco Product Application (PMTA) submission for IQOS ILUMA (and possibly other devices, see link to the portfolio in the Introduction) as a first step toward being able to market the clearly superior device(s) in the U.S. would be great news. Although a filing at this time would validate Philip Morris' ambition to make a strong U.S. launch in 2024/25, I wouldn't bet on an announcement in the upcoming earnings call, as the company previously expected to file the application at an unspecified time in the second half of 2023.

Swedish Match's flagship product (ZYN nicotine pouches) saw very strong volume growth of almost 47% year-over-year in Q1 2023. I eagerly await the volume growth numbers for the second quarter of 2023 and hopefully some data on sales and profitability as the integration progresses. In addition to ZYN, it will be interesting to compare the performance of Swedish Match's snus (and snuff) product sales and volumes with those of competitors Altria Group Inc. (see my somewhat sobering analysis) and British American Tobacco p.l.c. (see my bullish note). Altria's oral nicotine products segment, for example, performed rather poorly in Q1 2023, despite strong growth in its flagship nicotine pouch brand on!. The company's snus and snuff brands (e.g., Copenhagen, Skoal) saw year-over-year volume declines ranging from 3.6% to 8.2%.

Despite the fact that PM declared and paid its fourth quarterly dividend of $1.27 on its common stock in June, I would not expect a dividend increase to be announced during the upcoming earnings release. Philip Morris typically announces its annual dividend increase in September. The last 1.6% increase was already quite small, and given the debt taken on to acquire Swedish Match, I would not expect more than a $0.01 or $0.02 increase in the quarterly dividend. However, PMI should not be dismissed as a dividend growth stock that can't keep up with inflation just because it is currently growing slowly. I fully expect the company to return to more meaningful growth once the acquisition is digested and Swedish Match is properly integrated. The synergy potential in the U.S. shouldn't be underestimated. ZYN is growing rapidly, and its cash flow contribution will quickly become more significant (currently estimated at $500 million annually, or about 5% of PMI's free cash flow before the acquisition).

In the context of cash flow (and thus dividend) growth, investors should keep in mind the likely lower capital expenditures going forward, as well as the extremely favorable economics for both pouch products and heated tobacco sticks. I think PMI is pursuing a very smart strategy by offering heated tobacco products somewhat cheaper than traditional cigarettes, or at least not raising prices as aggressively. This gives consumers an incentive to switch, while also benefiting from the comparatively lower excise tax in many countries.

In my view, the long-term outlook for Philip Morris stock is very solid, but it's important to remember that the stock is also valued accordingly. At nearly $100, Philip Morris stock is fairly valued, but still expensive compared to its main competitor, British American Tobacco. To give you some perspective: PM stock currently trades for more than twice BTI's adjusted earnings multiple and nearly half its free cash flow yield. Likewise, British American's dividend yield of 9.2% compared to PMI's 5.1% is simply enormous.

However, there is a further aspect that should be considered by long-term investors in tobacco stocks - potentially higher borrowing costs due to an "ESG penalty".

PMI Likely Faces Higher Borrowing Costs Due To An "ESG Penalty"

Mainly due to the recent acquisition of Swedish Match as well as higher interest rates, PMI's debt servicing ability will be comparatively weak for the foreseeable future. I have discussed this aspect in detail in my earlier articles linked above.

However, in addition to these well-known effects, I think it is important to consider a third aspect, namely that of an "ESG penalty". As I have shown in another article, the bonds of companies with rather poor ESG ratings trade at a discount to better rated companies in the same credit rating category. This is not necessarily surprising, given the increasingly obvious push by regulators to invest in "sustainable" activities and potentially penalize "unsustainable" investments. In particular, institutional investors are increasingly unwilling (or increasingly discouraged/disincentivized, see this EBA opinion) to invest in the equity or debt of "socially unacceptable" or "unsustainable" companies. The EU is clearly leading the way in this regard, aiming to become the first climate-neutral continent ("European Green Deal").

While this "anti-ESG premium", which should be readily reflected in the credit rating of the respective company, is of course nice for retail bond investors, who are not subject to the same regulatory standards as institutional investors, the perspective of shareholders is quite different. Tighter regulation is likely to lead to higher interest rates and thus lower net profits attributable to shareholders of companies that are not in line with the agenda of, for example, the EU. A solid balance sheet is more important than ever.

As a result, there is also likely to be an impact on PMI's debt servicing ability, despite the fact that it is the most "socially acceptable" tobacco company due to its leading smoke-free products portfolio.

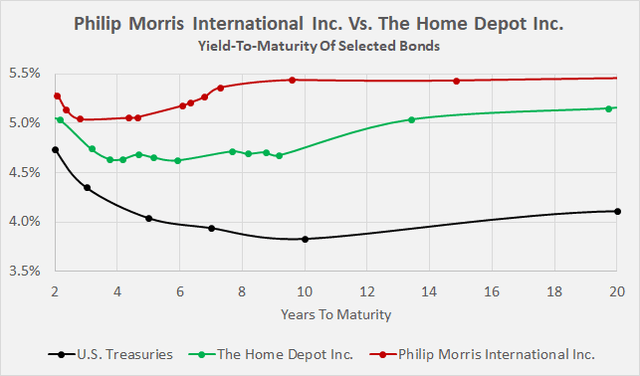

Applying the same methodology as in my article linked above, a comparatively small but still significant ESG penalty becomes apparent (Figure 5). Bond investors are currently demanding an interest rate about 30 to 70 basis points higher relative to The Home Depot Inc.'s (HD) bonds, even though PM's and HD's long-term debt is rated A2 by Moody's (stable outlook last affirmed in November 2022 and December 2021, respectively)

Figure 5: Philip Morris International Inc. (PM) versus The Home Depot Inc. (HD): Identification of a potential anti-ESG interest rate premium (own work, based on July 14 (U.S. Treasuries) and July 17 market data (PM and HD bonds))

However, compared to peers such as Altria and British American Tobacco, which I included in my in-depth analysis of the "anti-ESG premium" hypothesis linked above, the premium currently demanded on PMI's debt is rather small. Therefore, and because PMI is indisputably the most "socially acceptable" tobacco company, also due to its self-imposed goal of becoming a majority smoke-free company by 2025, I would not over-interpret the long-term impact on the company's debt servicing ability.

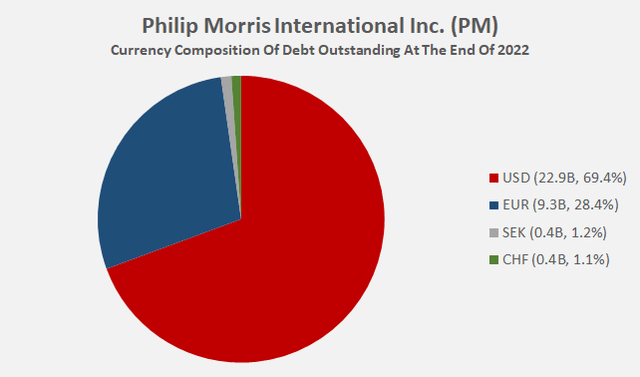

Instead, I think it is more important to focus on the aspect that PMI has significant exposure to U.S. dollar-denominated debt (Figure 6) while generating the majority of its revenues and earnings outside the United States. However, with the consolidation of Swedish Match and the expected revenue contribution from IQOS, the impact of U.S. dollar appreciation on debt servicing ability will mitigate somewhat.

Figure 6: Philip Morris International Inc. (PM): Currency composition of debt outstanding at the end of 2022 (own work, based on PM's 2022 10-K)

Conclusion

Tobacco giant Philip Morris International Inc. will release its second-quarter results on Thursday, July 20, 2023, before the stock market opens. Given the company's solid track record, it's reasonable to expect an earnings beat, but I see no reason to speculate on a share price pop and rush to buy PM stock ahead of the results. While there is no doubt about the company's high quality and solid growth prospects, as a long-term investor, I prefer to analyze the upcoming earnings report carefully before deciding to add to my already sizable position. As I previously disclosed, I shifted some of the proceeds from the sale of my 3M position (MMM) into PM stock, fortunately at a time when the stock was trading at just over $90 - which I consider a modest discount to fair value.

Nevertheless, I maintain that British American Tobacco is currently the best tobacco stock from a risk/reward perspective due to its very compelling valuation, its still acceptable smoke-free portfolio, and its manageable (mostly balance sheet-related) risks. Speaking of which, I recently noticed a fairly significant "anti-ESG premium" in British American's bonds. With even more regulatory pressure expected on institutional investors in the future, I think this is a headwind that needs to be considered when investing in "socially unacceptable" companies. In theory, Philip Morris falls into the same category, but given its significant investments and leadership position in the smoke-free products segment, this risk is far less pronounced. This can be shown by comparing its bond yields with those of companies that have the same A2 credit rating with a stable outlook, such as The Home Depot.

This permits the conclusion that PM stock is among the worst of the "anti-ESG investments" - probably one reason, besides the comparatively high valuation, why vulture investor Kenneth Dart favored British American Tobacco (and Imperial Brands p.l.c., (OTCQX:IMBBY, OTCQX:IMBBF). However, the fact that no withholding tax is levied on dividends in the U.K. likely also played an important role.

On Thursday, I expect the announcement of the final $1.7 billion payment to Altria. News of an already filed PMTA for IQOS ILUMA (and probably also other devices) would certainly confirm PMI's strong conviction to become a major player in the U.S., but I wouldn't bet on their announcement given previous statements. Investors should keep a close eye on ZYN's growth, which has been very good so far. I would be very happy to see sales and profitability data in the upcoming earnings release, considering the integration of Swedish Match progresses smoothly. In any case, this shrewd (and certainly not overly expensive) acquisition has allowed PMI to overtake Altria and British American - de facto overnight - as the market leader for oral nicotine products in the United States.

Investors will have to wait until September for a dividend increase announcement, but I would argue that now is definitely not the time to expect an inflation-beating raise. PMI is focused - rightly, in my opinion - on shoring up its balance sheet, which has suffered significantly as a result of the Swedish Match acquisition. I am confident that PMI can return to solid earnings, cash flow, and consequently dividend growth that outpaces inflation, as the company is the undisputed number one smoke-free products company in the world (and continues to operate a highly profitable cigarette business with brands like Marlboro).

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there's anything I should improve or expand on in future articles, drop me a line as well.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PM, MO, BTAFF, IMBBF, HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws - neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)