Crispr Therapeutics: An Interesting Company In A Still Developing Field

Summary

- CRISPR Therapeutics, a biotech company specializing in gene-based medicines, has submitted applications to the FDA for its lead product, Exa-cel, a gene-edited cell therapy for severe sickle cell disease and transfusion-dependent beta thalassemia.

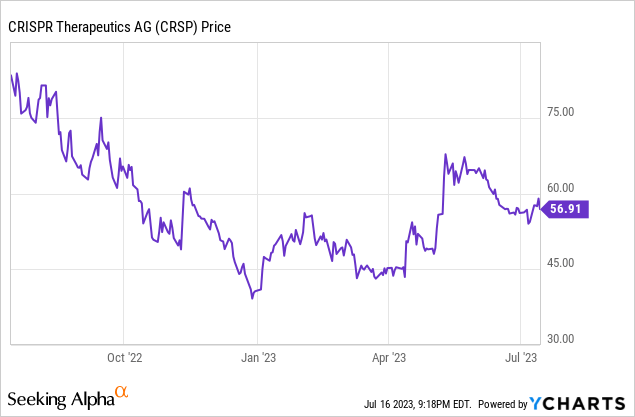

- Despite promising results from two pivotal trials of Exa-cel, the company's stock has been under pressure, falling from its 52-week high of $86.95 in February to $56.91 as of July 14, 2023.

- The company faces several risks and challenges.

byakkaya

I give CRISPR Therapeutics (NASDAQ:CRSP) a hold. It is an exciting company but in a new field's very early stages of development. I might miss out on any potential gains by sitting on the sideline and seeing what happens, but I will take missing out on gains to decrease the high risk of investing in such a new field.

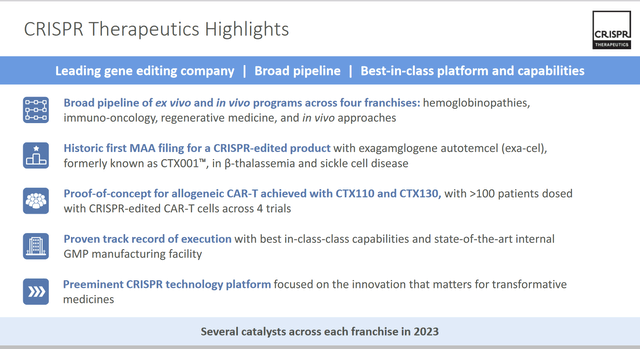

CRISPR is a biotechnology company that focuses on developing gene-based medicines using its proprietary CRISPR/Cas9 platform. The company has a portfolio of therapeutic programs across various disease areas, including hemoglobinopathies, oncology, regenerative medicine, and rare diseases. The company's lead product candidate is exagamglogene autotemcel (Exa-cel), a gene-edited cell therapy for treating severe sickle cell disease and transfusion-dependent beta thalassemia.

The company recently announced positive results from two pivotal trials of Exa-cel, showing durable and consistent clinical benefits in patients with these blood disorders. The company also announced that the FDA has accepted its biologics license applications for Exa-cel for both indications, with a target action date of February 2024. If approved, Exa-cel could become the first gene therapy for sickle cell disease and transfusion-dependent beta thalassemia in the US and potentially command a high price tag of more than $2 million per patient.

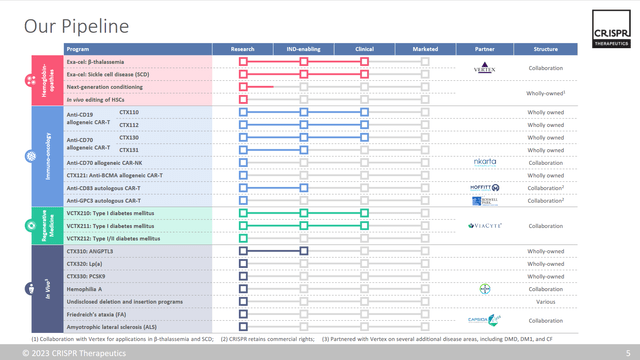

The company also has several other programs in its pipeline, such as CTX001, a gene-edited cell therapy for the treatment of severe combined immunodeficiency due to mutations in the IL2RG gene; CTX110, a CAR-T cell therapy for the treatment of CD19-positive B-cell malignancies; and CTX120, a CAR-T cell therapy for the treatment of multiple myeloma. The company collaborates with Vertex Pharmaceuticals (VRTX) to develop gene-editing therapies for cystic fibrosis and other diseases.

The company's stock has been under pressure lately, falling from its 52-week high of $86.95 in February to its current price of $56.91 as of July 14, 2023.

Upcoming Catalysts

CRISPR Therapeutics has several upcoming catalysts that could boost its stock performance and advance its gene-editing pipeline. Some of these are:

- FDA decisions on Exa-cel: The company's most advanced product candidate, Exa-cel, is a gene-edited cell therapy for the treatment of severe sickle cell disease and transfusion-dependent beta thalassemia, two rare blood disorders that affect millions of people worldwide. The company has submitted biologics license applications for Exa-cel for both indications to the FDA and to the regulatory authorities in the UK and the EU. The FDA has granted priority review to both applications, with a target action date of February 8, 2024, for sickle cell disease and March 30, 2024, for beta thalassemia. If approved, Exa-cel could become the first gene therapy for these diseases in the US and generate significant revenues and profits for the company.

- Clinical data updates: The company is also expected to present new clinical data from its ongoing trials of Exa-cel and other gene-editing programs at various medical conferences and publications in the fourth quarter of 2023 and beyond. The company has already reported positive results from two pivotal trials of Exa-cel, showing durable and consistent clinical benefits in patients with sickle cell disease and beta thalassemia. The company is also conducting phase 1/2 trials of CTX110, CTX120, and CTX130, its allogeneic CAR-T cell therapies for various cancers, as well as phase 1 trials of CTX001, its gene-edited cell therapy for severe combined immunodeficiency. The company may also initiate new trials of its regenerative medicine and in vivo gene-editing programs, such as VCTX210 for type 1 diabetes mellitus and CTX310 for ANGPTL3 deficiency.

- Strategic partnerships: The company has established several strategic partnerships with other biotechnology companies and academic institutions to leverage its gene-editing platform and expand its pipeline. The company's most notable partner is Vertex Pharmaceuticals (VRTX), with whom it has collaborated to develop Exa-cel and other gene-editing therapies for cystic fibrosis and other diseases. The company also has partnerships with ViaCyte, Bayer, Capsida Biotherapeutics, Nkarta Therapeutics, and KSQ Therapeutics. The company may announce new partnerships or collaborations to enhance its capabilities or provide additional funding or resources.

Others could come from its pipeline below:

Competition

CRISPR Therapeutics operates in the highly competitive and rapidly evolving field of gene editing, where it faces competition from other biotechnology companies that use CRISPR/Cas9 or alternative gene-editing tools to develop therapies for various diseases. Some of the company's main competitors and their similarities and differences are:

- Intellia Therapeutics (NTLA): Intellia is another leading gene-editing company that uses CRISPR/Cas9 to develop in vivo and ex vivo therapies for diseases such as transthyretin amyloidosis, acute myeloid leukemia, hemophilia A, and primary hyperoxaluria type 1. Intellia has a strategic partnership with Regeneron Pharmaceuticals (REGN) to co-develop and co-commercialize gene-editing products for various diseases. Intellia also collaborates with Novartis (NVS) to develop cell therapies for cancer. Intellia is ahead of CRISPR Therapeutics in its in vivo gene-editing program, as it has recently reported positive interim data from a phase 1 trial of NTLA-2001, its candidate for transthyretin amyloidosis. However, Intellia is behind CRISPR Therapeutics in terms of its ex vivo gene-editing program, as it has not yet initiated clinical trials of its cell therapies for blood disorders or cancer.

- Editas Medicine (EDIT): Editas is another gene editing pioneer that uses CRISPR/Cas9 to develop therapies for diseases such as Leber congenital amaurosis 10, sickle cell disease, beta thalassemia, and ocular diseases. Editas collaborates with Allergan (AGN) to develop and commercialize gene-editing products for ocular diseases. Editas also has a research agreement with Juno Therapeutics (JUNO) to explore the use of gene editing for engineered T-cell therapies for cancer. Editas is the first company to initiate a clinical trial of an in vivo CRISPR/Cas9 therapy, as it has dosed the first patient with EDIT-101, its candidate for Leber congenital amaurosis 10, a rare inherited eye disease. However, Editas is behind CRISPR Therapeutics regarding its ex vivo gene-editing program, as it has not yet filed an investigational new drug application for its cell therapy for sickle cell disease and beta thalassemia.

- Sangamo Therapeutics (SGMO): Sangamo is a biotechnology company that uses zinc finger nucleases (ZFNs), a different type of gene-editing tool, to develop therapies for diseases such as hemophilia A and B, beta thalassemia, sickle cell disease, Huntington's disease, and Fabry disease. Sangamo has partnerships with Pfizer (PFE), Sanofi (SNY), Biogen (BIIB), and Kite Pharma (KITE) to co-develop and co-commercialize gene-editing products for various indications. Sangamo is one of the most experienced gene-editing companies, as it has been developing ZFNs since 1995 and has initiated several clinical trials of its gene-editing products. However, Sangamo faces competition from CRISPR Therapeutics and other companies that use CRISPR/Cas9, which is considered more precise, efficient, and versatile than ZFNs.

Risks and Challenges

Despite its promising pipeline and potential to cure genetic diseases, CRISPR Therapeutics also faces several risks and challenges that could limit its success or cause harm to patients, the environment, or society. Some of these are:

- Off-target effects: CRISPR/Cas9 may cause unintended changes in other parts of the genome, which could have harmful consequences such as cancer, immune reactions, or loss of function. Although the company claims to have optimized its gene-editing process to minimize off-target effects, recent studies have suggested that CRISPR allegedly may cause more damage to genes than previously understood, raising concerns about the safety and accuracy of the technology.

- Regulatory hurdles: CRISPR/Cas9 is a novel, complex technology that poses significant regulatory challenges for the FDA and other agencies. The company has to demonstrate its gene-editing products' safety, efficacy, and quality in rigorous clinical trials and manufacturing processes, which could take longer and cost more than expected. The company must also comply with ethical and legal standards that may vary across different countries and regions, limiting its market access or exposing it to litigation risks.

- Competition: CRISPR/Cas9 is not the only gene-editing technology available, and CRISPR Therapeutics is not the only company developing gene-editing therapies. The company faces competition from other biotechnology companies that use CRISPR/Cas9 or alternative gene-editing tools such as zinc finger nucleases (ZFNs) or transcription activator-like effector nucleases (TALENs). Some of these competitors may have more experience, resources, or partnerships than CRISPR Therapeutics or may develop products that are more effective, safer, or cheaper than the company's products.

- Ethical concerns: CRISPR/Cas9 may raise ethical issues such as the potential for human germline editing, gene drive, or biosafety. Human germline editing refers to modifying genes in reproductive cells or embryos, which could have permanent and inheritable effects on future generations. Gene drive refers to manipulating genes in wild populations of animals or plants, which could alter their traits or behavior in ways that could affect the ecosystem. Biosafety refers to preventing accidental or intentional release of genetically modified organisms into the environment. These applications of CRISPR/Cas9 may have unforeseen consequences or pose moral dilemmas that could spark public controversy or backlash.

Financials

Per the company's last quarterly filing, the company has $1882 million in cash and marketable securities and $146 million in current liabilities. The company burned $53 million in operational costs last quarter during this time. Early-stage biotech companies have high burn rates, which will only increase as the drugs get into later and more costly stages of development. I would expect the company to continue to make partnerships or dilute in the future to continue to operate.

Conclusion

In conclusion, CRISPR Therapeutics is a promising biotechnology company with a strong pipeline of gene-editing therapies that could potentially transform the treatment of various diseases. However, the stock also faces significant uncertainties and risks that could limit its upside potential or cause further downside pressure. Therefore, investors should know these factors before buying or selling the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)