Suncor Energy: Canadian Oil Has Strength

Summary

- Suncor Energy Inc. has a dividend yield of more than 5% and an incredibly manageable sustaining capital.

- The company has substantial additional cash flow, which it can use to drive a variety of shareholder returns.

- The company has a multi-decade reserve life that is the backstop to valuable long-term shareholder returns.

- The Retirement Forum members get exclusive access to our real-world portfolio. See all our investments here »

mysticenergy

Suncor Energy Inc. (NYSE:SU) is a Canadian integrated oil sands company, with a market capitalization of almost $40 billion. The higher cost of oil sands meant that the company's share price suffered heavily during COVID-19, but it's since managed to recover. The company's strong position and increased efficiency will enable additional shareholder returns.

Suncor Energy's Overview

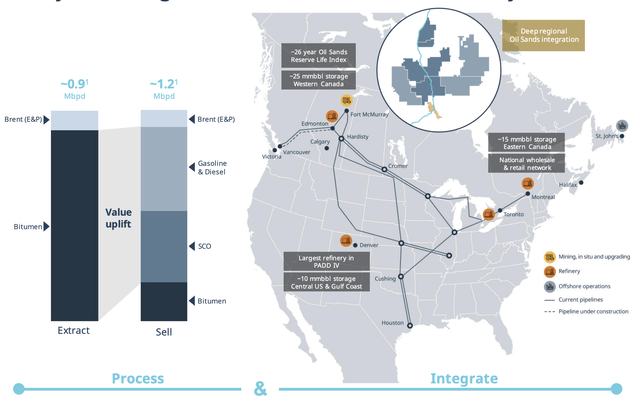

Suncor Energy has an impressive and integrated asset portfolio to take advantage of Canadian oil sands.

Suncor Energy Investor Presentation

Overall, the company extracts 0.9 million barrels/day, primarily Bitumen (heavy crude) from the Canadian oil sands. The company uplifts the value of these assets primarily, through its midstream, refining, and downstream operations. The company's oil sands have a 26-year reserve life index, enabling many years of production.

The company's integrated assets come with strong midstream and downstream assets. These assets, with substantial storage, enable strong margins and future shareholder returns.

Suncor Energy's Assets

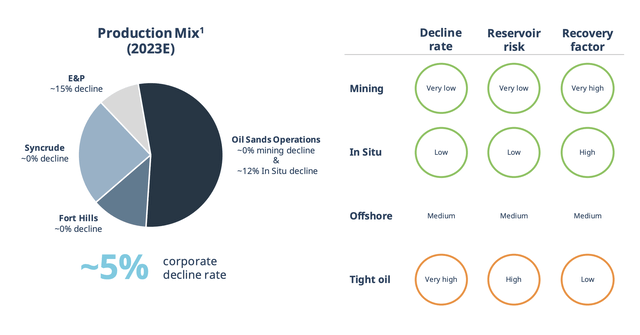

The company has a strong portfolio of assets. The company has 6.6 billion barrels of 2P reserves.

Suncor Energy Investor Presentation

That means the company has a multi-decade portfolio. Across its portfolio, the company saw a 5% decline rate. The company has a very high recovery factor across its assets, and some such as Syncrude and Fort Hills have had a 0% decline. The company's long reserve life here means that its capital obligations remain minimal.

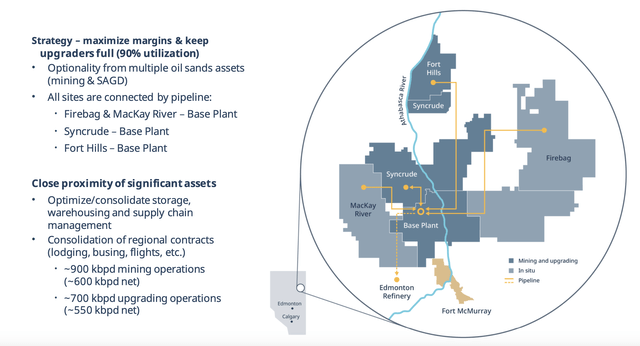

Suncor Energy Investor Presentation

As seen above, the company has a strong portfolio of assets, with upstream, midstream, and downstream strength. The company is working to keep utilization high, with 90% utilization enabling the company's margins to be much stronger. The company's assets being near each other also enables substantial synergies.

The company's impressive asset portfolio will enable continued production and returns.

Suncor Energy's Financials

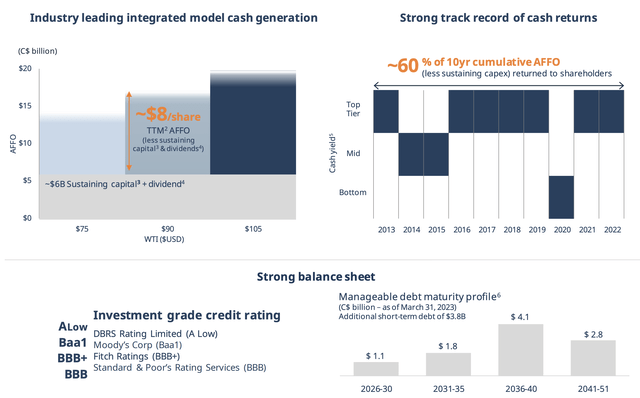

Putting together the company's impressive asset portfolio and strong margins, the company has an impressive financial position.

Suncor Energy Investor Presentation

The company's debt is 0.8x AFF0 at $80 Brent for the year (slightly above current prices). The company's debt load is very manageable for the company at this level and at current prices. The company's debt load from 2026-2030 is $1.1 C$ billion or $800 million USD. From 2031-2035, that's $1.8 billion or $1.4 billion USD.

The company's incredibly minimal debt levels versus its market capitalization are something that it can comfortably pay without posing a risk to the company. The company's base level of cash flow can easily cover its dividend of more than 5% + its sustaining capital for the company to continue its production at the same level.

At current prices of $75 WTI, the company's AFFI is $13 billion CAD or $7 billion CAD after sustaining capital + dividend. That's $5 billion USD or a double-digit yield on top of the company's dividend of more than 5%. That, combined with a minimal dividend yield, will enable substantial shareholder returns.

Thesis Risk

The largest risk to the thesis is crude oil prices. At current WTI prices, the company is incredibly profitable, with a double-digit return for shareholders. However, at prices below that, the company gets less profitable. The company has a low breakeven, but it also has less diversification as the market moves away long-term from oil. That hurts its potential for returns.

Conclusion

Suncor has tamed the oil sands and managed to decrease its breakeven level. The company has ramped up its dividend in recent years and now offers a dividend of more than 5% in conjunction with manageable sustaining capital. On top of that, the company continues to generate massive free cash flow at a variety of prices.

That's enough for the company to drive substantial additional shareholder returns. The company's debt load is low and manageable, with minimal exposure to rising interest rates. With a multi-decade reserve life powering all of this, Suncor Energy Inc. stock is a valuable long-term investment and a worthy investment to any portfolio.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

This can eventually have a huge positive impact for SU share prices in the near future.