Tesla: Clearly Too Expensive Again (Rating Downgrade)

Summary

- I am moving my Tesla rating back to "Sell" based on the reappearance of extreme overvaluations and excessive investor enthusiasm. A material price decline into 2024 is likely.

- Tesla's valuation is quite stretched compared to other tech giants, EV manufacturers, and leading auto names. At some point, investors must properly rerate slowing growth rates and increasing competition.

- Hundreds of new EV model entrants into 2026, the probability of recessionary demand over the next 12-18 months, and an unexpected reversal higher in inflation/interest rates are risks to consider.

KanawatTH

My two articles on Tesla, Inc. (NASDAQ:TSLA) in early 2023 discussed some upside potential back to $200+ a share. Both articles rated the stock as a Hold, following my bearish call at $300 a year ago here - correctly explaining why a major drop down to $100 was possible. Well, it looks like the resumption of bubble-thinking by growth investors on Wall Street has been able to carry not only artificial intelligence (AI) names in a straight-up manner but dragged past Big Tech winners higher at the same time.

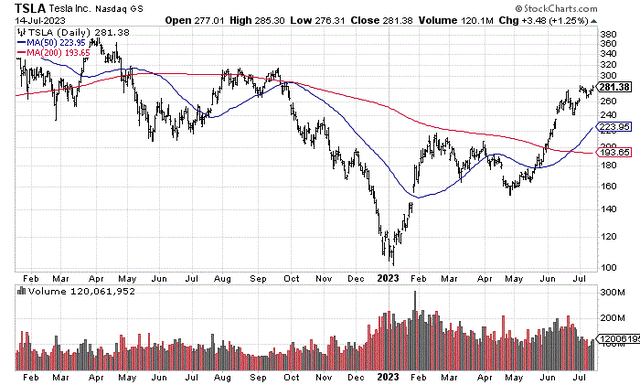

StockCharts.com - Tesla, 18 Months of Daily Price & Volume Changes

My last article in April here explained how the strong odds of a recession in the second half of the year should put a cap on Tesla's results and its stock quote. Since then, U.S. economic activity numbers have impressed and beaten forecasts of a slowdown. It's honestly not rocket science to understand why Tesla has captured a renewed bid of optimism. The concept of a soft landing with auto and home purchase demand remaining elevated is squarely to blame.

(Note: If you want a direct readout that the Fed's effort to cool speculation on Wall Street, in general, has failed miserably, the NASDAQ 100-Index (NDX) spike in price during 2023 is undeniable evidence more work has to be done in policy tightening, or we risk another major spike in inflation. Realistically, with home price gains still happening, on top of the sharp rebound in U.S. stock market wealth of late, I have little hope inflation rates will fall below 3% over the next 12 months.)

So, here we go again. I am moving my rating of Tesla back into the Sell category, based purely on overvaluations and excessive enthusiasm by investors. Sizable price drop risk, with further upside possible only if the speculative Wall Street boom continues to expand, is now my forecast for the rest of 2023. And, if today's stretched valuation rises in the coming months, price "crash" risk will increase significantly.

Valuation Stats

Not only has Tesla's company valuation returned to a position that dwarfs the rest of the entire automotive industry combined today, but simple statistics derived from price or enterpriser value to underlying operating results are screaming for investor caution. Even if you believe Tesla's other business adventures put it in the industry category of a Big Tech leader as opposed to a car company (which I do not), the valuation picture appears quite extended again.

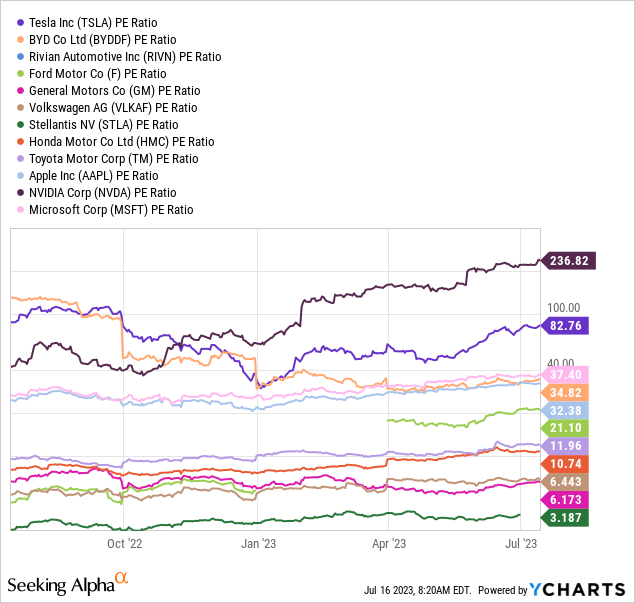

By far, Tesla easily holds the title of the most expensive carmaker to own for investors. In addition, out of the U.S. Big Tech sector, only the AI-mania king of Nvidia Corporation (NVDA) is sitting at a richer valuation, based on economic boom hopes and dreams.

When we review the investment world's primary valuation tool of the price to trailing earnings ratio, Tesla and Nvidia stand out from the rest of my peer pack. This list also includes EV manufacturers BYD Company (OTCPK:BYDDF) and Rivian Automotive (RIVN), large automakers Ford (F), General Motors (GM), Volkswagen (OTCPK:VLKAF), Stellantis (STLA), Honda (HMC), and Toyota (TM), plus diversified Big Tech giants Apple (AAPL) and Microsoft (MSFT). Tesla's 83x multiple represents an earnings yield of 1.2%, just a fraction of cost-of-living inflation rates above 3%, without even considering a rebound for inflation is now likely.

YCharts - Tesla vs. Auto & Big Tech Peers, Price to Trailing Earnings, 1 Year

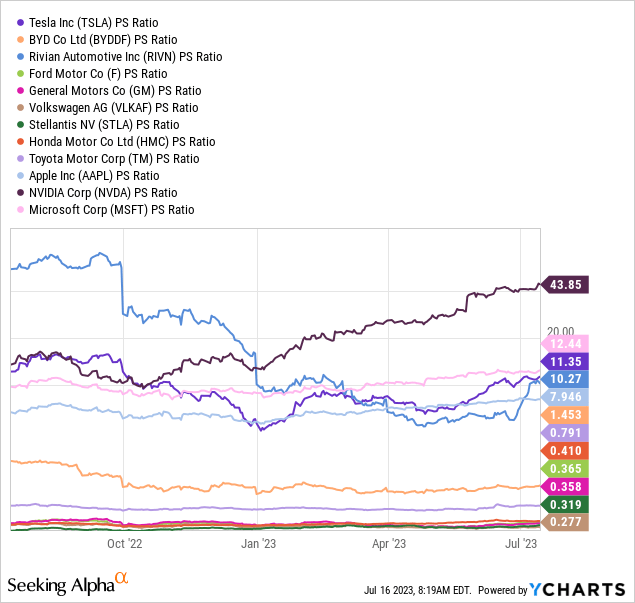

The price to sales multiple has improved over the last year at Tesla but remains near the top of the peer list at 11x. I would note that high-growth stocks with limited debts over the decades typically trade at a sales ratio beyond 10x. The nagging question for Tesla shareholders... is this valuation still deserved on slowing growth and increasing competition?

YCharts - Tesla vs. Auto & Big Tech Peers, Price to Trailing Sales, 1 Year

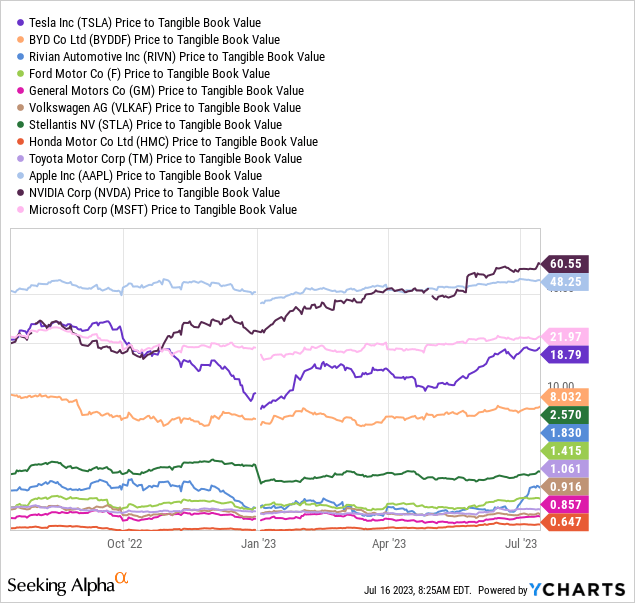

Another nosebleed valuation stat is price to tangible book value. When you take all owned hard assets like cash, receivables, inventory, and cost-accounting plant and equipment, then subtract all debts and liabilities, net tangible assets are a long way from today's $281 share price. The near 19x ratio on underlying net hard assets is far above the median average of the rest of the auto industry of a little under 1.5x.

YCharts - Tesla vs. Auto & Big Tech Peers, Price to Tangible Book Value, 1 Year

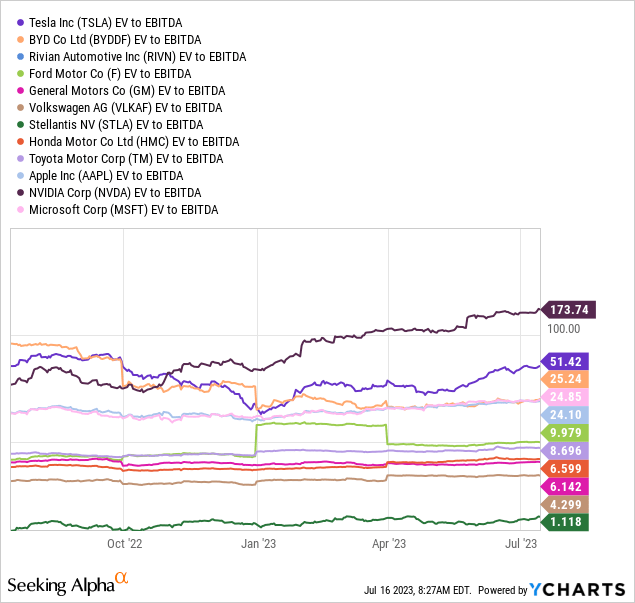

Then, when we include debts and account for cash on the balance sheet, the enterprise valuation picture, if anything, looks more overvalued for investors. EV to EBITDA of 51x is almost the same level as a year ago and remains a material premium vs. the whole peer group median average of 9x.

YCharts - Tesla vs. Auto & Big Tech Peers, Enterprise Value to Trailing EBITDA, 1 Year

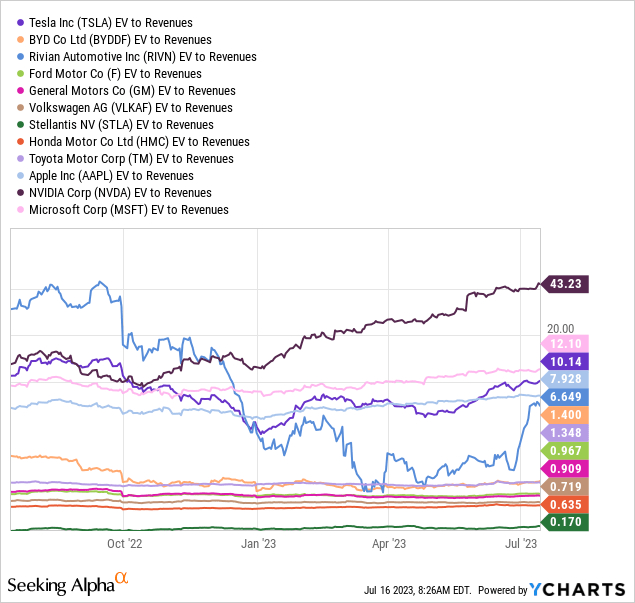

EV to revenues of 10x is well above the automaker median average of less than 1x. You have to ask yourself if Tesla is really worth this kind of multiple vs. several individual company peers that could theoretically be matching EV unit production in as little as five years.

YCharts - Tesla vs. Auto & Big Tech Peers, Enterprise Value to Trailing Revenue, 1 Year

Slowing Pace of Growth

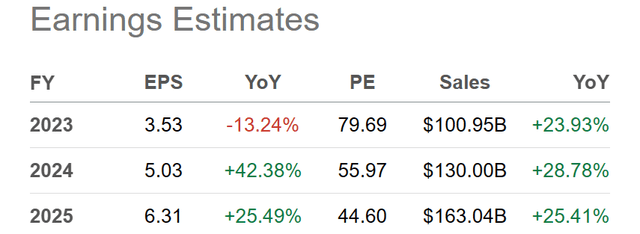

After witnessing a sales rise of +50% annually between 2019-22, alongside an even faster jump in net income, Wall Street is now projecting a strong but no longer exceptional company growth rate of +25%. Why? It's a result of mushrooming competition in electric vehicle offerings and production industry-wide, plus a mathematical function of its much larger size today vs. 2018.

Seeking Alpha Table - Tesla, Analyst Estimates for 2023-25, Made July 15th, 2023

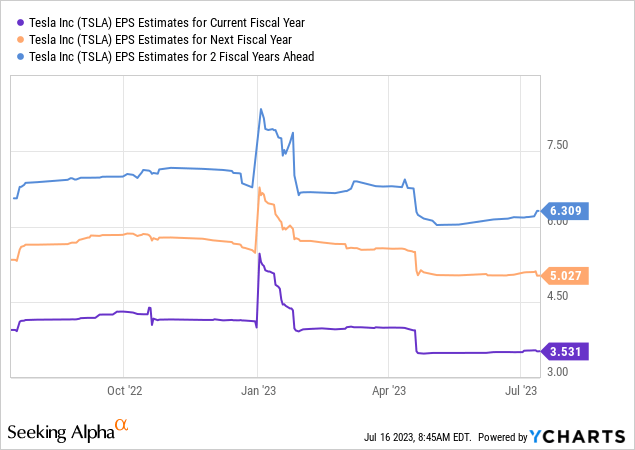

And, the idea of price competition holding back income growth is now the baseline assumption from analysts. As a consequence, EPS estimates for future years have been in a steady "downtrend" since early 2023, with downgraded revisions to projections now the norm. Today, expectations for operating income between 2023-25 are lower than a year ago.

YCharts - Tesla, Falling Analyst Estimates for Future EPS Results, 2023-25, Made July 15th, 2023

Final Thoughts

The main reason I continue to be leery of owning Tesla is exploding competition poses a serious risk to operating profitability. Price competition from literally hundreds of new EV model entries sourced from all the major automakers is hitting the market into 2026. Even if Tesla remains the top seller and leading brand name in the industry, slackening profit growth will push investors away from today's steep overvaluation setup.

The secondary risk is that all car sales, including for Tesla models, will suffer in the event of a recession, especially during a prolonged period of weak economic growth around the world. China's economy, #2 in importance as a driver for company sales and production behind the U.S., has not reopened from COVID-19 shutdowns with the robust expansion trends many experts predicted. In fact, China's managed economy is already witnessing a government effort to ease monetary policy and prop up total demand.

I know Tesla bulls believe the enterprise can overcome all challenges, no matter the share valuation or competition or economic outlook. However, I firmly believe Tesla is like every other company and will have to deal with reality, including the related math as an investment. Past success was based on truly exceptional growth in sales, given a leading near-monopoly position in EV production globally. Honestly, Tesla has never faced recessionary conditions (it's debatable if the 2020 pandemic period represented a typical economic contraction event), where consumer car buying turns lower for all industry players.

It's entirely possible, current sales and EPS estimates will prove on the high side of future results in a recessionary, growing competition backdrop. In that case, the overvaluation setup of July 2023 may be reaching for an even greater extreme than any of us understand.

Buying at $281 in July could be a very high-risk proposition. In terms of downside targets, I am thinking Tesla will again trade below $200 later this year, perhaps all the way back to $150 during 2024. With CPI of 3% on top of EPS and sales projected growth rates of 25% from today, a trailing P/E closer to 50x and a 2-year forecast of around 30x seem like a defendable math-based area to buy shares.

Regrettably, my updated forecast is for inflation rates to reverse in the wrong direction, with calendar year CPI reaching 4% to 5% on spiking commodities by early 2024. Late in the cycle is when the commodity supply/demand balance is tightest. So, if we get a soft landing with better-than-expected demand trends, a jump in crude oil, grains and metals cannot be ruled out into the winter.

To the point, a secondary bump higher in inflation and interest rates would hurt growth-stock valuations just like 2022's version of reality. In addition, the odds of a recession next year would jump dramatically, which would be horrible news for Tesla investors. Be careful what you wish for... as a soft-landing episode for the global economy is my outside-of-the-box logic to sell Tesla.

The contrarian in me says selling into strength in this stock is the only reasonable play, because the future may not be as rosy as hoped. Those following the stock quote price trend may be getting duped into believing all is well with the world and Tesla's future, at exactly the wrong moment in time.

The upside Tesla buy argument is now essentially the greater fool theory of 2021, all over again. You have to count on new buyers pushing the price and valuation ever higher, disregarding all rational analysis of this security. Sure, such an outcome could continue for a few extra months, but all good things do come to an end, even for CEO Elon Musk and the overly concentrated tech boom on Wall Street during 2023.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (13)

Average SA analyst rates it a hold. This guy says it's a definite sell due to the greater fool theory. Methinks somebody doesn't understand the company, it's trajectory and it's overall plan.

Here's another word for you: Baloney.

Have you checked the RSI?

Have you checked the PEG ratio.

'Clearly' not.

If you know what the PEG ratio is then you know it's in a very favorable position compared to other technical stocks, such as Google and Facebook. It indicates that Tesla is much undervalued compared to those stocks. Clearly IS a bargain.

And yes, Tesla is a disruptive technical stock."Tesla is only worth $150 to $200 to me in a best-case economic scenario from today."

Oh, I'm sure.

But you're wrong. Such Tesla analysis has always been wrong. The Tesla-bashers don't have a clue."Do what you must with your own investment capital."

Don't mind if I do. Thanks.

In the meantime, I'll refrain from discouraging others from the investment opportunity of a lifetime.