Co-Diagnostics: No Guidance, No Thank You

Summary

- The company's stock, which was trading at $6.13 in April 2022, is now trading at $1.35, a ~77% discount.

- It has multiple products but none have reported meaningful revenues to make up for its dwindling COVID test revenues.

- Management has withheld guidance and offers no credible path for a turnaround.

Olivier Le Moal

Co-Diagnostics (NASDAQ:CODX) has performed miserably since my most recent coverage of the stock in 04/2022's "Co-Diagnostics: Where's Eikon?" ("Where's Eikon").

In this article, I will report on what happened and assess its prospects going forward.

Co-Diagnostics' performance since Where's Eikon appears to be based on several factors.

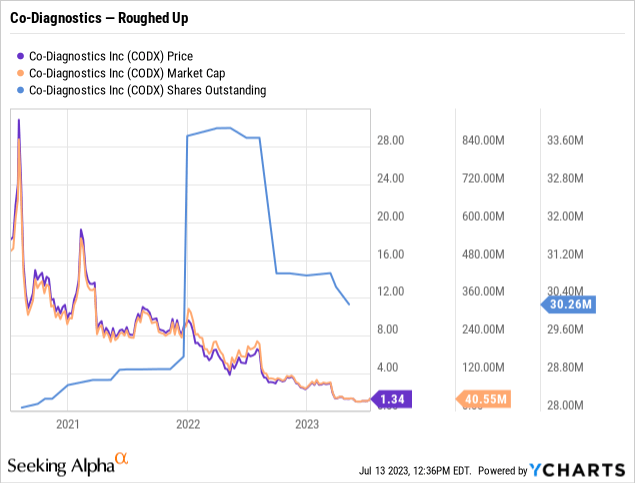

At the time of Where's Eikon's publication, Co-Diagnostics was trading at $6.13. As I write this article on 07/16/2023, it trades at $1.35, a ~77% discount. Its price chart below shows its trajectory over the last three years:

Its downdraft since 04/2022 is just a continuation of a longer malaise that has bedeviled it for the entire three-year period.

Its horrible collapse, which saw it drop from a closing high of >$30 on 08/03/2020 down to close below $10 less than a month later, was grim. Turning the clock back, 2020 was all about COVID. Little Co-Diagnostics was right in the thick of it. Seeking Alpha's Co-Diagnostics news feed for 08/2020 was rife with reports on its COVID diagnostic tests. Visions of sugarplums had driven Co-Diagnostics to unsustainable heights.

Soon enough, its trading degenerated. It closed at single digits on 09/01/2022. Thereafter, $10 was its ceiling with few exceptions. By 04/21/2022, it closed <$5.00. It has trended down to its closing price nadir of $1.04, where it twice closed in 05/2023. Thankfully, as I write on 07/16/2023, it has yet to close <#1.00 during the last three years.

Beyond moves directly traceable to COVID, Co-Diagnostics' other initiatives were haphazard. For example, it announced a string of joint venture test product approvals in India:

- 10/2021 for a dengue/chikungunya multiplex test;

- 01/2022 for a high risk HPV multiplex test;

- 02/2022 for SARAQ HBV viral load kit as an in vitro diagnostic ["IVD"];

- 04/2022 for SARAQ HCV viral load kit as an in IVD;

In addition, it completed principal design for a monkeypox test and shipped it to a distributor in 07/2022.

Beyond COVID testing, Co-Diagnostics' other initiatives have yet to take hold.

The products section of Co-Diagnostics' website reads as follows:

Co-Diagnostics offers a range of products and services ...[for] diagnostics laboratories, research institutions, and enterprises that rely on PCR technology across the globe.

It then goes on to list a diverse group of products. It has offerings nested under the following categories:

- Diagnostic Solutions - 7 diagnostic test kits that have passed its extensive internal validation assessments but, are only available as IVDs) where approved by the appropriate regulatory bodies as necessary;

- Research Solutions - 7 infectious disease detection products currently in development, many of which are available for Research Use Only [RUO] applications;

- Vector Control Solutions - 3 Vector Smart PCR tests and laboratory equipment for vector control applications to test mosquito populations where the insect is known to act as a vector;

- Agricultural Solutions - multiplexing products to assess agricultural products for molecular markers of disease-resistant crops and livestock and molecular diagnosis of crop and livestock diseases plus other common crop dangers such as weeds diseases and insects;

In sum, Co-Diagnostics' product cupboard boasts a rich and varied portfolio of diagnostic entries. Products are well and good. How about the more important mother's milk of product revenues generated from these products? For that, I first turn to its latest 10-K. It includes the following rather dour report (p, 12):

...We were able to achieve net income during the calendar year ending December 31, 2021 due to the high demand for our Logix Smart COVID-19 and other COVID-19 tests during the COVID pandemic. During the calendar year ending December 31, 2022 we experienced a decline in demand for our Logix Smart COVID-19 and other COVID-19 tests and operated at a net loss during the period. We do not have any way of predicting when or if we will achieve profitability again

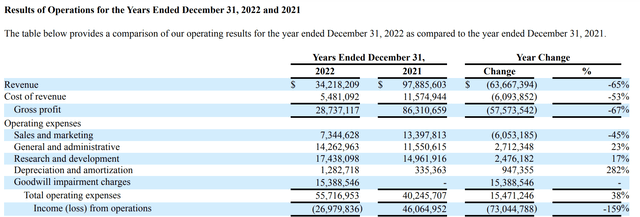

Its 10-K also includes the following:

What about a breakdown of the sources for this revenue? Unfortunately, it contains no disaggregated revenue report. Sometimes I can ferret out more information by searching for "product revenue". No luck here. Its lengthy ITEM 1: BUSINESS section (pp 4-11) of its 10-K describes numerous operational details about Co-Diagnostics.

It lists its various products, the countries where it operates, and its regulatory status. It also includes:

- competitive advantages;

- intellectual property status;

- major customers; and

- competition.

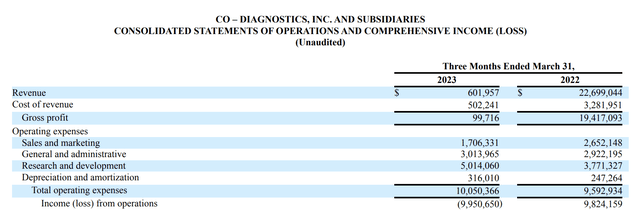

Yada yada. It is quite informative. Frustratingly, I found nothing on its revenues from its diverse group of products, except only the strong implication that COVID revenues are controlling its performance. Turning to its Q1, 2023 10-Q confirms this implication. Check out its latest statement of operations below:

For Q1, 2023, Co-Diagnostics' revenues have fallen through the floor. Now that COVID has dropped from top to bottom of the mind, none of Co-Diagnostics' sundry other products aggregate enough revenues to cover even a small percentage of its expenses.

Co-Diagnostics' future is uncharted territory.

Co-Diagnostics' market cap has dropped to ~$40 million. In his opening remarks to its Q1, 2023 earnings call, CFO Brown attributed its revenue falloff to declining global COVID testing. Unhappily, as revenues declined, overall expenses rose from $9.6 million to $10.1 million.

Overall expenses grew despite a decrease in variable compensation and third-party commissions. Brown attributed the increase to R&D spending as Co-Diagnostics' worked to implement its various initiatives. In this respect, he called out its at-home and point-of-care Co-Dx PCR Home platform. He advised that it had cash, cash equivalents and marketable securities at quarter's end of $75.3 million, down from at $81.3 million on 12/31/2022.

The good news for investors is that Co-Diagnostics is free of any gnarly debt that can rise up to savage a company's liquidity. The other good news is that its business puts it in line for occasional cash grants.

During the earnings call, CEO Egan advised of the potential for two grants expected in support of multiplex respiratory and tuberculosis test panels for its new Co-Dx PCR Home platform. He was unable to give details during the call. However, on 07/13/2023, Co-Diagnostics issued a release advising of the award of $1.2 million in funding from the National Institutes of Health [NIH].

It will use these NIH funds to complete the development of its flu A/B, COVID-19, and RSV multiplex test panel. It is set to begin clinical trials on the Co-Dx PCR Home in time for the upcoming flu season. CEO Egan has an optimistic timeline for this test panel; he indicated a goal of having it for the upcoming flu season.

This is a goal, is it one likely to be met? I am doubtful. When addressing its 2023 guidance, CFO Brown was a little too cute. He reported:

Turning now to our guidance, our near-term focus will be concentrated on maximizing the use of cash and cash preservation in order to allow us the greatest opportunity to achieve our 2023 and future company development and our operational goals. Internally, company’s success will not be based on income statement captions, rather it will be measured on achievement of the development and operational goals discussed in our call. As a result, we will not be providing financial guidance at this time.

Conclusion

Co-Diagnostics reported ~$0.6 million in Q1, 2023 revenues. That spreads out to ~$2.4 million annually. Add in its $1.2 million grant and you have $3.6 million. Suppose it gets a second grant of equal size, then you have $4.8 million income.

This pales into insignificance compared to its annual expenses of ~$40 million. It takes a true optimist to put new money in Co-Diagnostics at this stage. Too risky for me, I am holding back.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.