AMD: More Downside Risk Than Upside Potential

Summary

- The semiconductor industry demand recovery will likely not happen in 2023 as anticipated.

- Many data points from the manufacturing sector and multiple semiconductor market peers support this claim.

- In anticipation of the long term, Advanced Micro Devices' valuation may have risen too drastically without considering the near-term industry conditions.

JHVEPhoto

Introduction

I recently trimmed my position in the semiconductor sector. During the process, I sold some Advanced Micro Devices (NASDAQ:AMD) shares. In my previous article in April, I had a bullish view of the company due to the optimistic environment surrounding the potential semiconductor demand recovery. At the time, the trough for the industry was quickly becoming history, setting up a new growth environment.

However, today, although I continue to agree that the industry trough may be history, the recovery may not be as quick as I initially thought. Instead of a quick V-shaped recovery, the industry may see an elongated demand recovery due to potential economic weakness. Consumer demand for electronics is continuing to see no clear sign of recovery, let alone growth, despite economic strength in services. This has led to the demand recovery forecast being largely pushed back to 2024 from the second half of 2023. Therefore, I am downgrading my rating on AMD shares to a sell.

Demand Environment

The service and travel industry is seeing growth along with a strong U.S. economy; however, the story may be slightly different for the semiconductor industry. Numerous data points are pointing to a less-than-ideal demand environment for the semiconductor industry that AMD is part of.

First, the ISM manufacturing index shows the weak manufacturing market activity in the U.S. The PMI stood at 46% in June, down from 46.9% in the previous month. As a data reading under 50% represents a contractionary environment, I believe it is reasonable to argue that the manufacturing industry is in a recession, which means that the durable goods demand is seeing no signs of recovery. In the report, it says that the "companies [are] continuing to manage outputs down as softness continues and optimism about the second half of 2023 weakens" as the "demand eased again." This continued to trend of new orders, production, employment, and backlogs contracting supplier deliveries faster.

In a market environment where manufacturing activity is contracting due to weakness in demand and the future expectation of a demand seen in new orders, I believe it is hard to expect a short-term demand recovery for AMD.

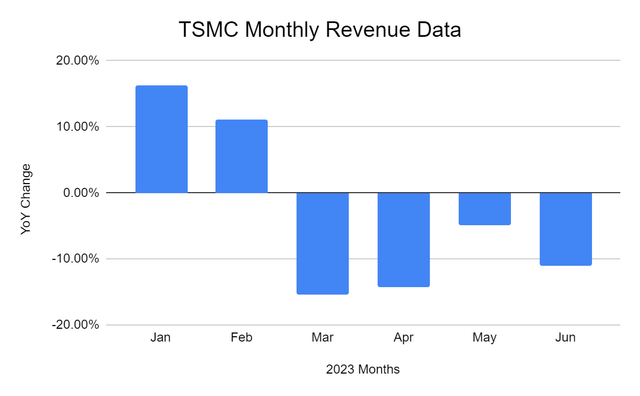

Further, Taiwan Semiconductor Manufacturing Company Limited (TSM, "TSMC") reported monthly sales data, providing more detailed insights into the semiconductor industry demand environment. As the chart below shows, TSMC is showing no clear sign of growth in both year-over-year and month-over-month sales data. In fact, after a slight rebound in May, June continued to see an accelerating revenue slowdown from the pandemic times.

I interpret the following data as a negative sign for the semiconductor market. TSMC is the biggest semiconductor fabrication company, if the demand for consumer electronics and data centers were truly recovering, TSMC's monthly sales should have reflected positive monthly sales data. Thus, combining both the manufacturing data and TSMC's sales data, I believe arguing for a slower-than-expected recovery in the semiconductor industry is reasonable.

[Chart created by author using TSMC Data.]

Finally, Micron Technology, Inc. (MU), a memory chip maker, has also given more data points for the semiconductor industry. During the earnings call, the company's management team acknowledged two positive developments. One, customer inventories are declining to normal levels, which will likely happen toward the end of 2023 or early 2024. Two, the second half of 2023 will be better for the company than the first half due to a recovery in demand.

However, the management team also said that the company's "expectations for calendar 2023 industry bit demand growth have been further reduced to low- to mid-single digits in DRAM and to high-single digits in NAND." This comes even after the "AI-driven demand [being] stronger than [the company's] expectations" as "the PC, smartphone, and traditional server demand forecasts are now lower." As such, similar to the data points from TSMC and the ISM Manufacturing Data, Micron is also not seeing a strong demand recovery in the semiconductor industry in the near future.

Overall, looking at all three data points from the memory-chip industry, the manufacturing industry, and the semiconductor fabrication industry, I believe the conclusion is fairly simple: semiconductor demand is not likely to see material growth in 2023.

Why?

Economic activity for the first half of 2023 has been strong. Then, why has this strength not been reflected in the semiconductor industry? I believe the change in consumer spending sentiment has played a key role. Consumers realized the value or the importance of services and experiences, which has led to a boom in the travel and services industry. On the other hand, during the pandemic, all consumers could spend money on were material goods, likely creating a situation where consumers' desire for services and experiences was far higher than for material goods. With no signs of travel demand cooling, the current trend could continue negatively affecting the semiconductor demand and ultimately AMD.

Valuation

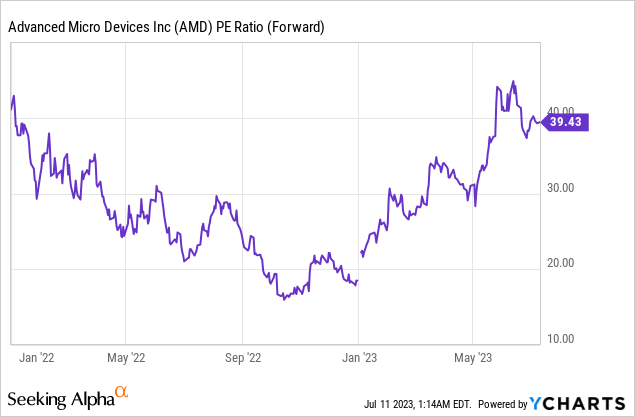

Considering the market demand environment, I believe AMD is too expensive today. Recent excitement of the semiconductor industry seeing a trough in demand along with the hopes of an AI boom has massively inflated AMD's valuation. As the chart below shows, the company has a forward price-to-earnings ratio of about 39 today, which is on par with the valuation multiples seen in early 2022 when the company's stock price fell from historic highs reached during the pandemic. With no clear signs of semiconductor demand recovery, I believe it is hard to expect a further valuation multiple expansion for AMD.

While I agree that the AI boom will be a monumental opportunity for AMD, I believe it is highly unlikely to make a material impact on AMD's bottom and top line in 2023, which is paramount for the movement of the company's stock price in the near term. Therefore, it is likely unreasonable that the company is trading near an all-time high valuation multiple when there are more near-term risks than reward potentials.

Summary

AMD saw a massive appreciation in its valuation in recent months. However, I believe this run has occurred despite the state of the semiconductor market. The manufacturing industry continues to be in a contractionary territory while the services industry, such as travel shows strength. This suggests that consumers, after the pandemic, are valuing experiences more than physical goods such as consumer electronics products.

Further, TSMC's monthly sales data supports this argument. The firm is not seeing a year-over-year recovery going into the second half of the year, as I had previously expected in my bullish article for AMD. Finally, Micron, a key memory chip player, also highlighted the diminished demand for consumer electronics products.

Therefore, considering the demand concerns surrounding AMD, I believe the current valuation is too expensive. Investors may have ignored the near-term risks in anticipation of the future long-term potential. Advanced Micro Devices stock is a sell.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.