Enbridge: A Reliable Yield, But Richly Valued Vs. The Sector

Summary

- Enbridge, an energy infrastructure company, has a hold rating due to its high free cash flow yield and solid dividend, but shares trade at a premium to the sector.

- The company's earnings growth is modest, and it faces the risk of rising financing costs due to elevated market interest rates on its unhedged floating-rate debt.

- Despite a soft growth outlook, Enbridge's profitability is sound, with a robust FCF yield of 6.9%.

- Ahead of earnings in early August, I highlight one key price point the bulls must defend.

pandemin

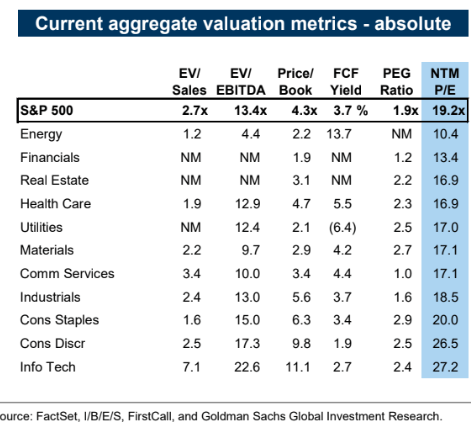

It's not hard to find decent value in the Energy sector these days. After steep relative losses compared to the S&P 500 this year, and as oil and gas prices have eased, it's a mixed technical and fundamental picture. Still, the typical free cash flow yield in the Energy space is by far the highest among the 11 sectors at 13.7%. So, even if you spot a seemingly high absolute FCF yield, it is always helpful to keep things in perspective.

Hence, I have a hold rating on Enbridge Inc. (NYSE:ENB). The firm sports $2.53 in FCF per share, or nearly 7% in FCF yield. Moreover, earnings growth is seen as modest while the P/E is at a premium to its peers.

Energy: High Free Cash Flow Yielding Sector

Goldman Sachs

According to Seeking Alpha, "ENB together with its subsidiaries, operates as an energy infrastructure company. The company operates through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services."

The Alberta-based $74.4 billion market cap Oil and Gas Storage and Transportation industry company within the Energy sector trades at a somewhat high 42.1 trailing 12-month GAAP price-to-earnings ratio and pays a high 7.2% trailing 12-month dividend yield. Ahead of earnings on August 4, the stock carries a low 18% implied volatility percentage.

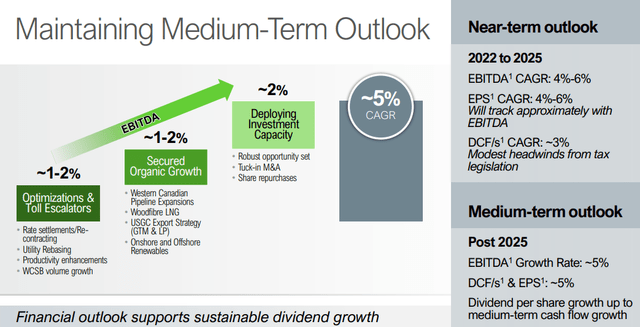

Back in May, Enbridge reported a bottom-line beat, though EPS came in not far from the consensus estimate. The management team reaffirmed its FY 2023 outlook, which calls for EBITDA growth of between 4% and 6% annually through 2025 with comparable EPS growth. What I found encouraging was that cash flow from operating activities soared from $2.9 billion in Q1 2022 to $3.9 billion this past quarter. That should be plenty to support the high yield, in my opinion.

What the company and shareholders must watch out for is the possible risk of rising financing costs due to elevated market interest rates on its unhedged floating-rate debt. I dug deeper and found that short-term borrowings sum to more than $1 billion, lower from year-ago levels, but the current portion of long-term debt is above $5.5 billion for the first time in at least 10 years. Still, if oil and gas prices rise that should help ENB, and there are signs that are starting to take place.

Enbridge Near- and Medium-Term Outlooks

On valuation, the Wall Street consensus estimate calls for 2023 EPS growth of just 4% while out-year per-share profit growth is expected to stay weak at just 2.5%. Go out to 2025, though, and earnings are seen accelerating by more than 8%, summing to $2.43. Dividends, meanwhile, have been growing at a solid 5.5% clip over the past five years, though the payout has been virtually unchanged over the last two years. With a robust free cash flow yield of 6.9% as of July 14, 2023, profitability is sound despite the soft growth outlook. Cash flow from operations is particularly attractive at an even $9 billion over the last four quarters.

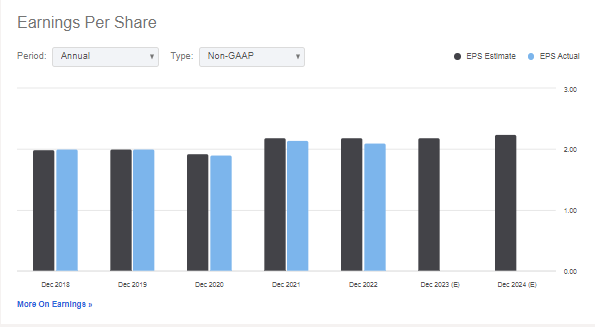

Enbridge: Earnings Per Share Estimates: Meager Growth Through 2025

Seeking Alpha

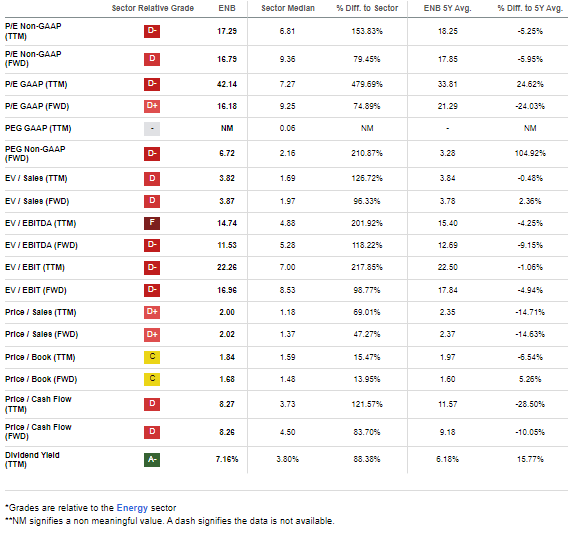

When considering the growth trajectory and sound profitability condition, I assert that the forward operating P/E of nearly 17 is on the high side. You can buy better cash flow, and more highly profitable Energy sector companies for considerably less. Thus, while a 9 P/E (on par with the sector median) could be used, I will still give Enbridge the benefit of the doubt and apply a 15 multiple on a generous $2.25 of forward EPS. That yields a stock value of $33.75. So it is not a buy on valuation, but I do not see the stock as grossly overvalued either.

ENB: Not Cheap Compared to the Lowly-Priced Energy Sector

Seeking Alpha

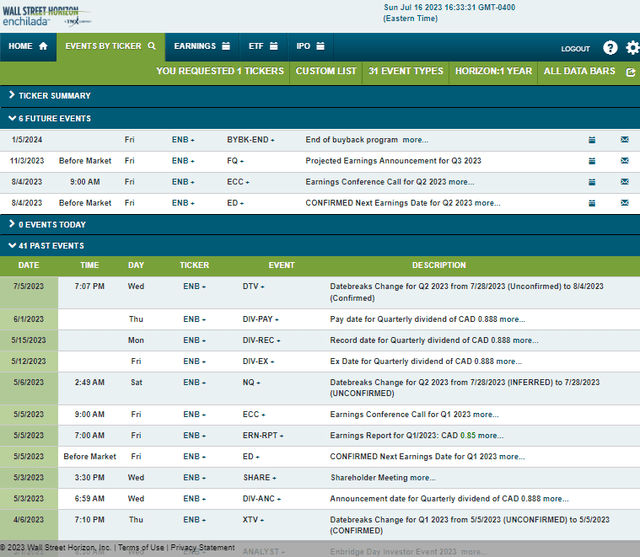

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2023 earnings release before the open on Friday, August 4 with a conference call later in the morning. You can listen live here. Beyond the reporting date, Enbridge has a stock buyback plan that is slated to end at the start of 2024. Be on guard for possible news about a refreshed share repurchase program during the upcoming earnings release.

Corporate Event Risk Calendar

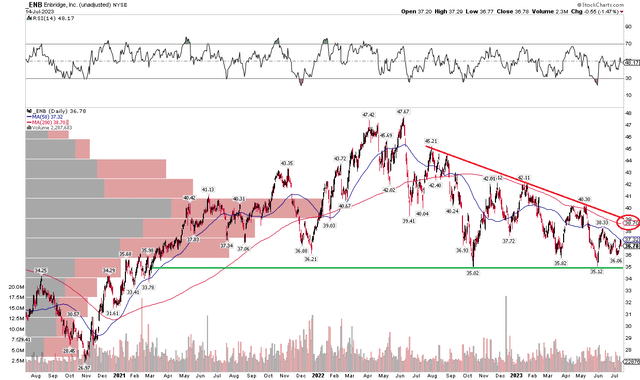

The Technical Take

Like the lukewarm valuation, ENB's chart leaves something to be desired if you are a bull. Notice in the graph below that shares are once again drifting back toward key support near the $35 level. The $34 to $37 range has been key for the better part of the last three years. A breakdown under that zone would likely risk an accelerated bearish move. With a downward-sloping long-term 200-day moving average, the bears appear to be in control.

What's more, I see a downtrend resistance that comes into play not far above where the 200-day is today, so there is a confluence of possible selling in the $38 to $40 zone. Finally, a high amount of volume by price is seen up to $41, further capping an upside move should it materialize.

Overall, the chart is mixed, but I assert that ENB must hold above the $34 to $35 area.

ENB: Descending Triangle, Key Support Near $35, 200dma Moving Lower

The Bottom Line

I have a hold rating on Enbridge. Unlike so many other oil & gas companies, the valuation is up in the mid-teens on a forward non-GAAP P/E basis while its free cash flow yield, while decent, is below those of comparable firms. The chart is also ho-hum in my view.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.