Earnings Should Power This Bull Market Forward

Summary

- The stock market has soared over the past nine months on improving rates of change in economic datapoints.

- Now, we need corporate fundamentals to validate the market's advance.

- Earnings for the second quarter should be the catalyst to power the market higher moving forward.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect. Learn More »

Lemon_tm

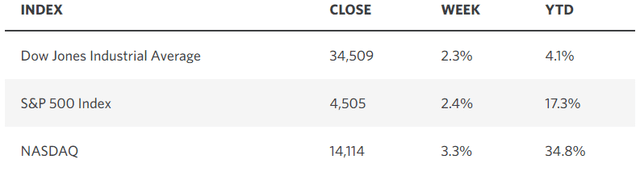

It was another outstanding week for the major market averages, as stocks are now reflecting the dramatic improvement we have seen in the rate of inflation over the past year. The market started to look forward last summer when the various rates of inflation peaked, but now we are at a transition point when corporate profits need to validate current price levels if we are to see a continuation of the gains. The earning season started out strong on Friday, with our largest banks posting profits much better than expected. JPMorgan CEO Jamie Dimon said "the US economy continues to be resilient," and that "almost all of our lines of business saw continued growth in the quarter." I think this is a harbinger of things to come for second-quarter reports, and I remain optimistic.

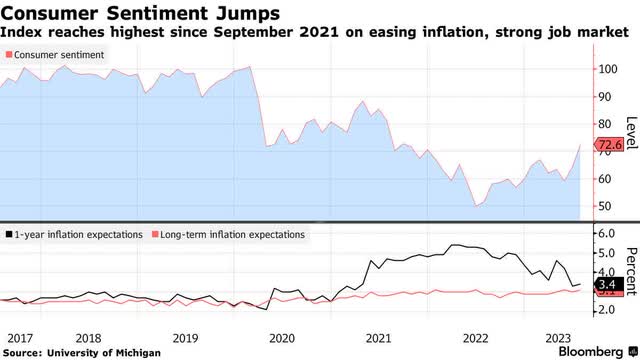

Of course, any form of resiliency is a double-edged sword, as it rejuvenates the call for a more restrictive monetary policy. Friday's consumer confidence report was a perfect example, halting the four-day rally over concerns that the economic landscape might be too resilient. The University of Michigan reported that its index rose by the most in one month since 2006 to what is almost a two-year high. The improvement was based on consumers' view that the job market remains strong, while inflation continues to abate. That's another way of describing a soft landing, but sentiment still has plenty of room for improvement and remains well below pre-pandemic levels. Sentiment improved for all groups except low-income households, but that should change soon.

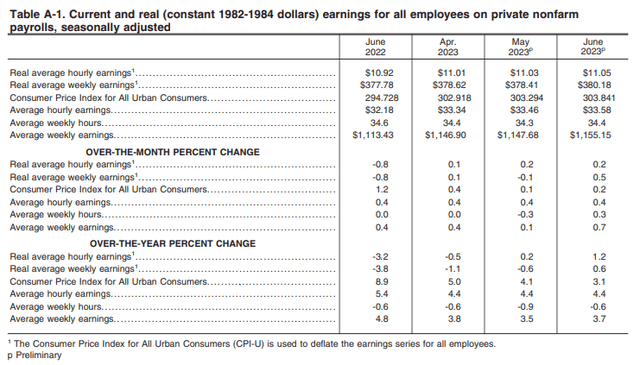

One of the tenants of my bullish outlook for the market and economy at the beginning of this year was that as consumers worked down excess savings, we would see a return to real wage growth. Restoring inflation-adjusted wage growth would help offset the loss of spending power resulting from depleted savings. We finally saw that last week on a convincing basis in the Real Earnings report from the Bureau of Labor Statistics that accompanies the Consumer Price Index report. Note that real (inflation-adjusted) average weekly earnings growth, which considers changes in the length of the workweek, has improved from -3.8% in June of last year to +0.6% this June. That is an extremely positive rate of change that should help sustain real consumer spending growth.

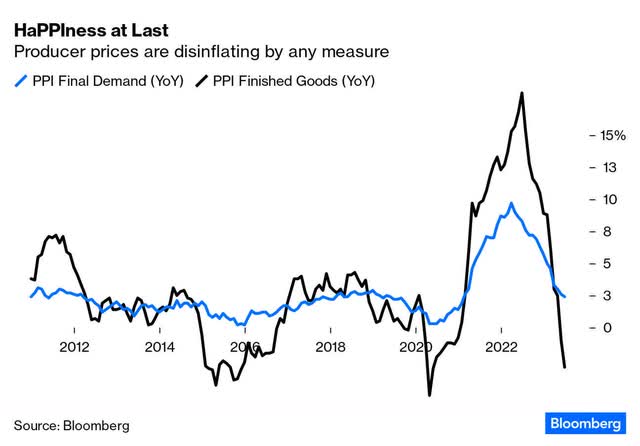

The latest warning from the bear camp on the inflation front is that the headline number of 3% will uptick in July, due to the extremely favorable comparison we had with June of last year. That is true, but the core rate, which is higher and more important to the Fed, should continue to decline due to lower used-vehicle prices and shelter costs. Last week's Producer Price Index report revealed that we are on the cusp of deflating with just a 0.1% increase over the past year, and this tells us the disinflationary trend is intact. As this data relates to markets, Bespoke Investment Group points out that when the spread between the PPI and CPI has been at a record high, as it is today, we typically see a period of above-average stock returns follow. That makes sense to me, given the positive rates of change that are mounting.

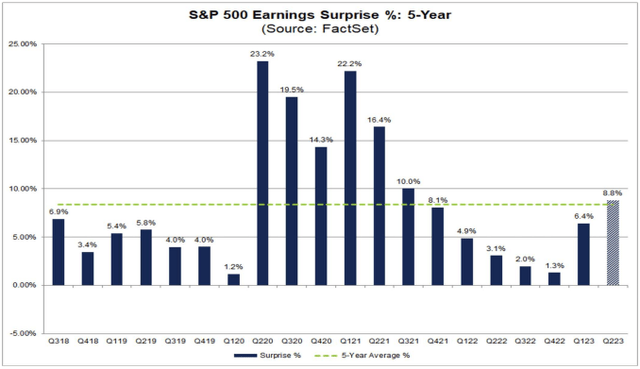

The most important of these rates of change is in corporate earnings expectations. While only 6% of S&P 500 companies have reported to date, earnings so far are 8.8% above estimates, which is above the 5-year and 10-year averages. Note that this is a dramatic improvement from last quarter's 6.4% and the fourth quarter of 2022's 1.3%, which was the cycle low. That was also the quarter during which the bear market ended. Rates of change are far more important than absolute numbers.

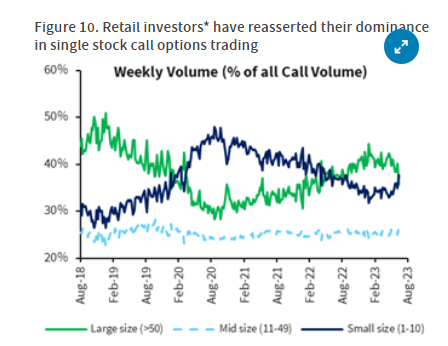

Another important change comes with respect to the meaningful improvement in investor sentiment, which is another double-edged sword. When sentiment is abysmal, as it was this spring, there were countless buying opportunities. We need it to improve so that more investors buy stocks, and we realize higher prices, but that also greatly diminishes new investment opportunities. As of late, there is clearly a more speculative fervor in the air, as retail investors are once again piling into stock call options at an increasing rate.

Yahoo Finance

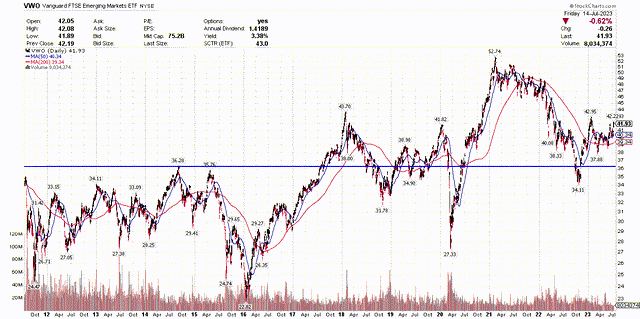

Lastly, as it becomes more difficult to find good values in a market that continues in a steady uptrend, it may be optimal to look outside the U.S. for value. The plunge in the dollar on the tailcoats of the extremely favorable inflation news and decline in bond yields is a boon for the emerging world, as most of their debt is priced in dollars.

The Vanguard Emerging Markets ETF (VWO) has been hugging the flatline for more than a decade, with a return of about 7% as of Friday's close. The yield is approximately 3.3%. This looks like an attractive investment option to gain stock exposure without assuming the valuation risks that come with the major market averages in the U.S.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

This article was written by

Lawrence is the publisher of The Portfolio Architect. He has been managing portfolios for individual investors for 30 years, starting his career as a Financial Consultant in 1993 with Merrill Lynch and working in the same capacity for several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. In addition to writing for Seeking Alpha, he is also a Leader on the new fintech platform at Follow.co.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VWO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice. Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)