SCHG: Cheaply Priced Expenses, Richly Priced Holdings

Summary

- Schwab's US Large Cap Growth ETF seems to have gained popularity due to its low expense ratio and strong performance, despite trailing behind Invesco's QQQ Trust.

- SCHG is heavily concentrated in technology, healthcare, and consumer discretionary sectors, exposing investors to company-specific risks. Top holdings show revenue growth but some concerns regarding operating margins.

- Despite the growth stocks appearing richly priced, SCHG offers a cost-effective option for growth exposure, but investors should carefully analyze individual holdings and assess risks.

PeopleImages/iStock via Getty Images

Introduction

Ohhh growth stocks, how I love you, and oh how I hate you. In 2020, you provided me with the growth I needed to buck the COVID slowdown, but in 2022, you crushed me. Why must you treat me so, oh growth stocks?

- The Author.

On that note, within today's article, I'll examine one of the most popular growth funds within the ETF community, that of Schwab's US Large Cap Growth ETF (NYSEARCA:SCHG), which was recently suggested to me in the comments of a previous article I wrote on this site.

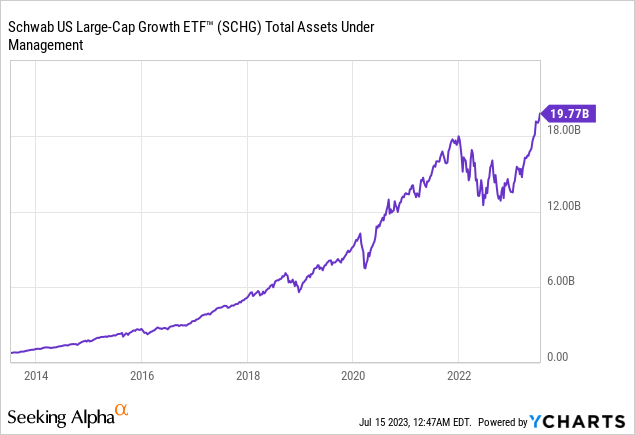

This passively managed growth fund has clearly resonated with the investor community as its AUM has grown from ~$2B around a decade ago to nearly $20B as of July 2023.

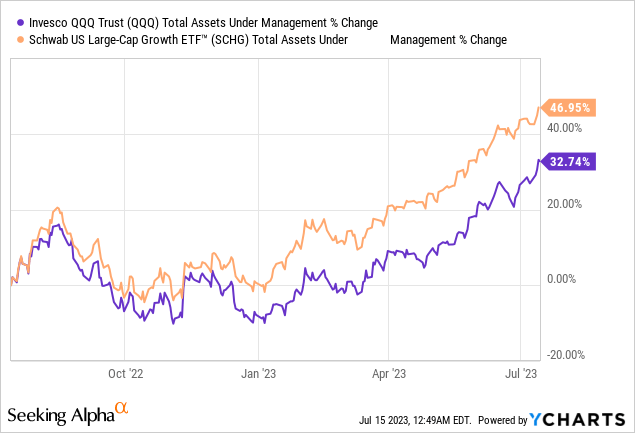

And sure, compared to growth funds like Invesco's QQQ Trust (QQQ), SCHG is still quite small, but things may change, as of 2023, SCHG is now outgrowing its larger peer by a wide margin.

But can the trend continue? And what is it about this fund that has made it so popular in the ETF investing community?

Overview

To try to answer that question I will examine the fund's holdings, performance, and fee structure. Let's start with the easiest part, and arguably one of the most important features of the fund, the fees.

Expense Ratio

We'll keep this part of the analysis brief, SCHG is cheap.

Its annual expense ratio is just 4bps, that's 0.04%. That means for each $10,000 you invest in the fund, only $4 is lost to fees per year.

Two other popular growth funds, QQQ, and Cathie Wood's ARK Innovation ETF (ARKK) charge 0.2% and 0.75% respectively. This means that SCHG costs somewhere between one quarter and one-fifteenth of what other growth funds charge.

In fact, SCHG is so reasonably priced, that compared to Vanguard's (VTI), a standard, vanilla, US market index fund, SCHG is only one basis point more costly. That is despite the Vanguard fund holding more than $300B in assets versus Schwab's $20B, that's quite the feat.

In fact, I think you would be hard-pressed to find another growth fund that trades so cheaply. Seriously, do you know of a single growth fund that charges less? I am curious!

SCHG gets an A++ when it comes to fees.

Performance

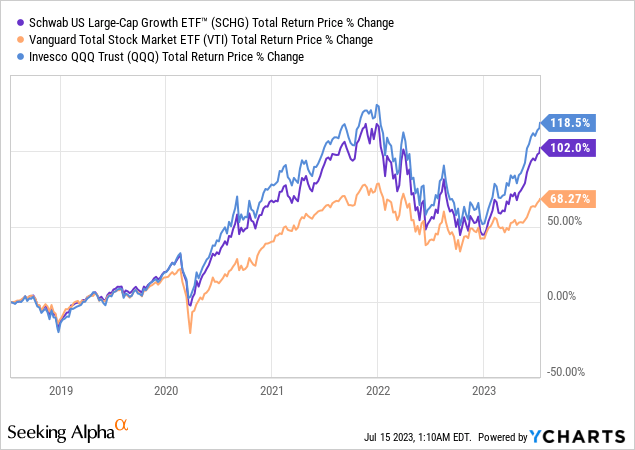

One weak spot for SCHG is its total returns, sure it's crushed the performance of the market as a whole, but it has trailed behind the aforementioned "Triple Q". That similar performance can largely be explained by the chart below.

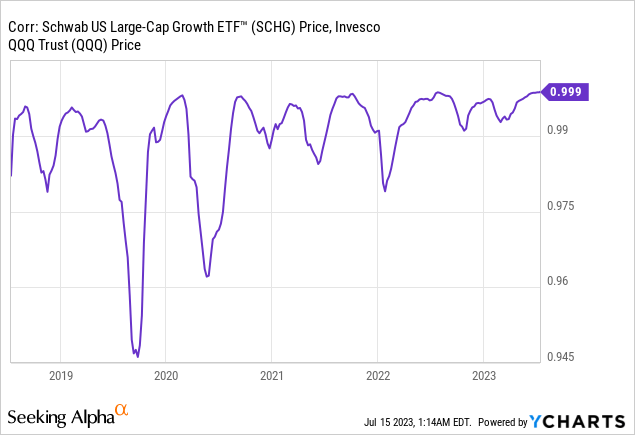

You see, SCHG is extremely correlated with QQQ, in fact, as of today, its correlation is nearly 1:1. While the correlation has remained tight between 0.95 and 1, it has had periodic moments of divergence such as during the pandemic in 2020 and during the crash of early 2022 as the fed enacted it's tightening regime.

Interest Rates and Growth Stocks

Speaking of the Fed, and the impact it has had on growth stocks, it's highly uncertain where rates will end up. It's also equally challenging to predict how long the Fed will keep the economy in this restrictive state, especially as new economic indicators, such as the most recent CPI report, suggest that inflation is slowing.

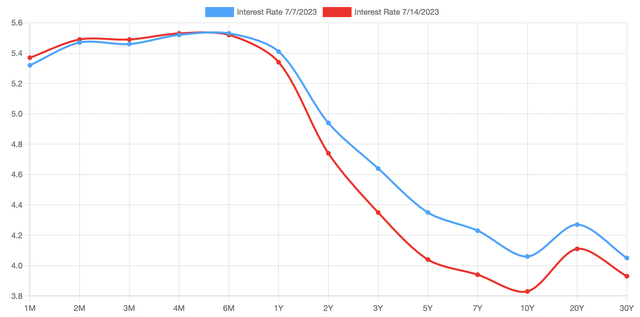

After all, less inflation should lead to lower rates, we saw this evidenced in recent treasury yield curve data.

Compared to just one week ago, the 2-year, 3-year, 5-year, 7-year, and 10-year treasury yields all decreased significantly. This impacts the growth sector in two main ways, issuing debt is now less costly, and higher stock prices make equity cheaper to issue as well.

Growth companies are more reliant on external capital to grow, so interest rates can be particularly impactful to their future growth rates.

A Highly Concentrated Fund

Back to the fund, SCHG has a total of 245 holdings, but it is heavily concentrated within its top 10 positions which make up 55% of the overall portfolio.

Because of the scale of that concentration, it becomes especially important for investors to analyze exactly where they are invested as they will be exposed to company-specific risks (and rewards).

| % of Fund | Name | Ticker |

| 14 | APPLE INC | (AAPL) |

| 12 | MICROSOFT CORP | (MSFT) |

| 6 | AMAZON COM INC | (AMZN) |

| 6 | NVIDIA CORP | (NVDA) |

| 4 | TESLA INC | (TSLA) |

| 4 | ALPHABET INC | (GOOGL) |

| 3 | META PLATFORMS INC | (META) |

| 3 | ALPHABET INC | (GOOG) |

| 2 | UNITEDHEALTH GROUP INC | (UNH) |

| 2 | VISA INC CLASS A | (V) |

As you can see in the chart above SCHG provides exposure to the largest mega-cap growth stocks that I'm sure you are all familiar with: Apple, Microsoft, Amazon, Nvidia, Google, and Tesla.

A whopping 44% of the fund is invested in technology companies and a further 15% and 12% are invested in healthcare and consumer discretionary companies respectively.

Top heaviness is not a feature unique to SCHG, it's common among most large-cap growth funds, and even the S&P 500 which I would argue has become a large-cap growth fund on its own (another story). The concentration problem has gotten so bad that special rebalancing action is being taken for the Nasdaq 100 index due to the huge weight of its top stocks.

Financial Performance of The Holdings

As a growth fund, there's an expectation that holdings are vastly growing revenues (and ideally earnings) in exchange for the premium valuation those stocks carry. Let's see if that is the case.

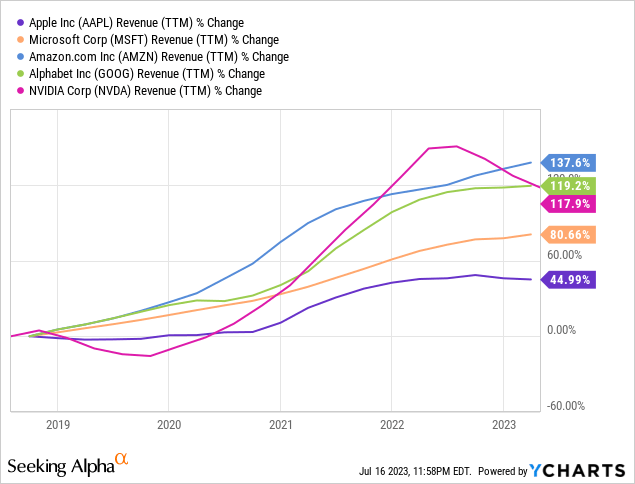

First, looking at revenue growth, we can see that the top 5 holdings in this fund have all increased their revenues over the past 5 years and 3 of them more than doubled in that time frame (Amazon, Google, and Nvidia).

Still, I would like to note, regardless of its positive growth, Apple's story is a bit more concerning as 45% revenue growth over 5 years is clearly on the softer side of "growth". That's why despite being a tech name, I find it hard to classify Apple as a true "growth stock", it's simply not growing fast enough (from my point of view).

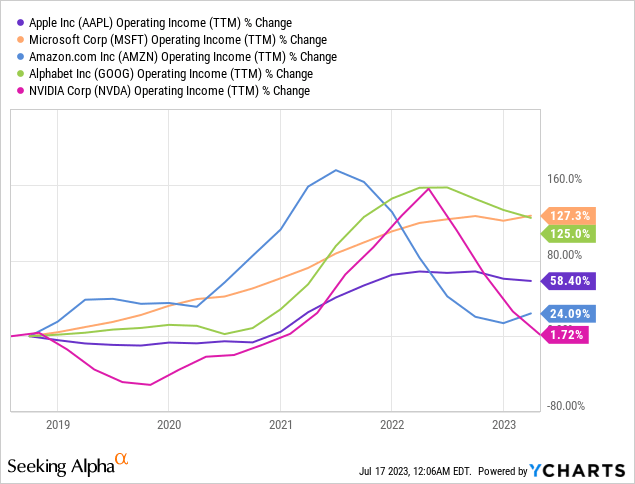

For the other companies, as revenues grew rapidly operating income grew at a much slower pace on average. This indicated that margins may be suffering as they continue to grow. Amazon and Nvidia jump out as prime examples as both are rapidly growing the top line but operating income is only up between 0 and 25% over 5 whole years.

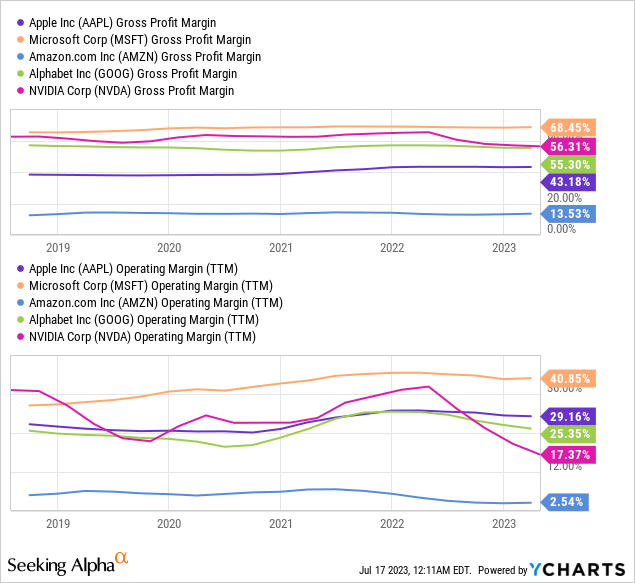

Looking at the chart above my thesis appears to be correct: Amazon and Nvidia have much weaker operating margins compared to 5 years ago. On the other side of that coin, Microsoft has steadily grown theirs.

Though, in defense of Nvidia and Amazon their gross margins are more or less flat suggesting that the decline in operating margins may have to do with them investing in their future versus a deteriorating business model. Which may be exactly what growth investors are looking for depending on your investment philosophy.

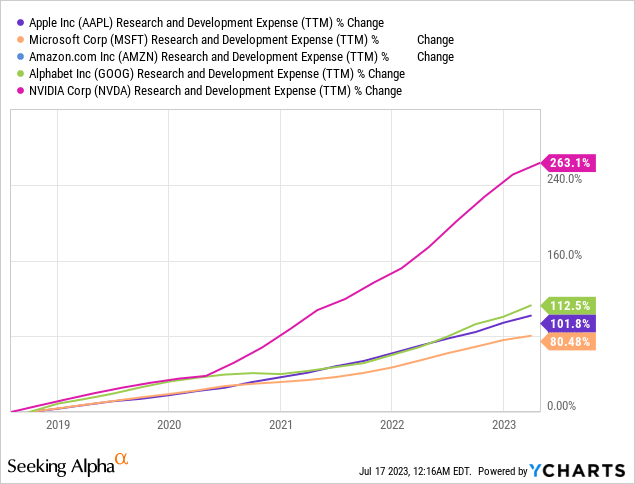

For the companies that YCharts has data for, Nvidia is increasing its investment in R&D at a more rapid pace compared to the other large holdings in this fund having expanded R&D spend by 263% over 5 years.

Microsoft has invested less heavily compared to its peers but even it has increased R&D spending by over 80% which is no small amount considering Microsoft's massive scale. Investors in these companies must therefore be comfortable with the capital allocation abilities of the management at these businesses.

Valuation

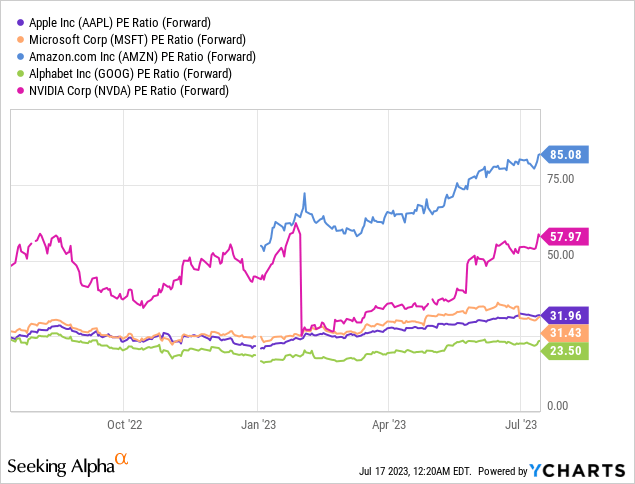

Given the importance of future earnings for these "growth" stocks I think it's better to value the companies based on those future expectations as opposed to lagging data.

Still, even using future earnings, these companies are richly priced, the cheapest of them is Google with price-to-forward earnings of 23.5x, and Amazon is the most richly valued with a Price to Forward earnings of 85x.

Even Apple, with its stalling top-line growth, is priced at 32x… which converts to a meager 3% earnings yield.

Ouch.

Conclusion

In conclusion, Schwab's US Large Cap Growth ETF seems to have gained popularity for its low expense ratio and strong performance compared to the broader market. Despite trailing behind Invesco's QQQ Trust, SCHG has outperformed the market.

The fund's high concentration in top holdings, particularly in technology, healthcare, and consumer discretionary sectors, exposes investors to company-specific risks. The financial performance of the top holdings shows revenue growth but concerns regarding operating margins for certain companies. Valuation-wise, these growth stocks appear richly priced.

Overall, SCHG offers a cost-effective option for growth exposure, but careful analysis of individual holdings and risk assessment is essential for investors.

All of that said, if an investor is looking for a growth fund with extremely low fees, this fund would be my recommendation.

P.S.

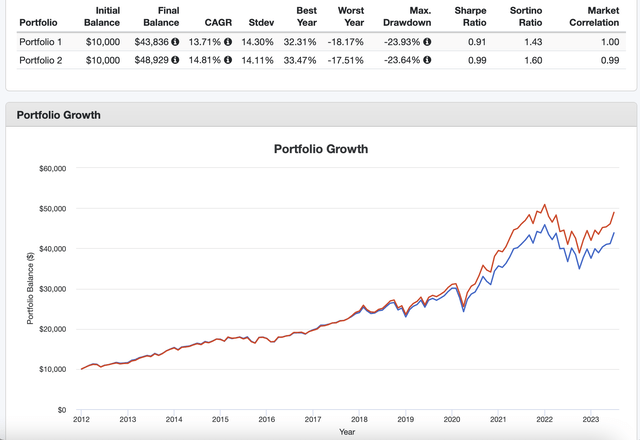

In my second to last article, I wrote about a popular dividend fund, (SCHD), another popular low-cost Schwab fund. After running a few tests I found that a 50/50 portfolio of SCHD and SCHG outperformed the S&P with less volatility.

Thought this might be an interesting data point for some of you… (S&P is Blue, SCHG and SCHD is Red)

Thank you for reading, Cheers!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)