IPO Update: Turnstone Biologics Readies $75 Million IPO Plan

Summary

- Turnstone Biologics Corp. has filed proposed terms for a $75.4 million IPO.

- The firm is developing drug treatment candidates for solid tumors and other cancer conditions.

- Turnstone Biologics' major partners have terminated their collaboration agreements, so I'm cautious about the firm's prospects.

- My outlook on the IPO is Neutral [Hold].

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

DNY59

What Is Turnstone Biologics Corp.?

I previously wrote about Turnstone Biologics Corp.’s (TSBX) initial IPO filing here.

Since that time, the company has filed a follow-up SEC registration statement detailing its capitalization and proposed IPO terms and pricing information.

The firm was founded to develop differentiated treatment approaches using tumor-infiltrating lymphocytes [TILs] for treating various cancers.

Management is headed by president and CEO Sammy Farah, M.B.A., Ph.D., who has been with the firm since October 2015 and was previously president of Synthetic Genomics Vaccines and was Chief Business Officer at Immune Design Corp.

The firm's lead candidate, TIDAL-01, is in Phase 1 trials for the treatment of breast cancer, colorectal cancer, uveal melanoma and other cancer types.

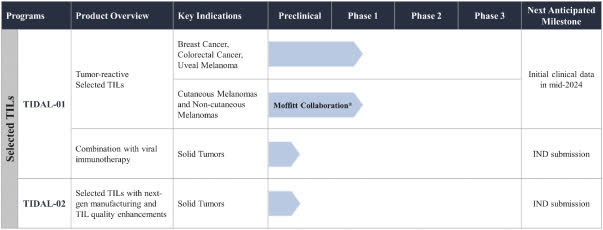

Turnstone's development pipeline is as follows:

Drug Development Pipeline (SEC)

As of March 31, 2023, Turnstone has booked fair market value investment of $193 million from investors, including Versant Ventures, OrbiMed, F-Prime Capital and FACIT Inc.

Turnstone’s Market & Competition

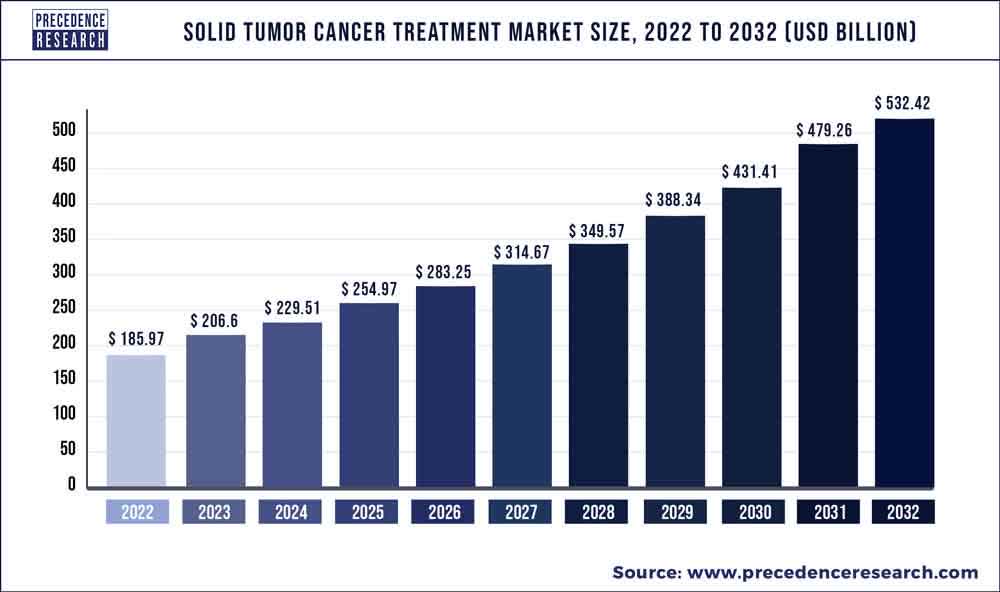

According to a 2023 market research report by Precedence Research, the global market for solid tumor cancer treatments was an estimated $186 billion in 2022 and is forecast to reach $532 billion by 2032.

This represents a forecast CAGR (Compound Annual Growth Rate) of 11.09% from 2023 to 2032.

The main drivers for this expected growth are improvements in treatment options coupled with government emphasis on creating greater availability amid higher demand from patients worldwide.

Also, the chart below shows the historical and projected future growth rate of the solid tumor treatment market from 2023 to 2032:

Solid Tumor Treatment Market Size (Precedence Research)

Major competitive or other industry participants include the following:

Iovance Biotherapeutics

Achilles Therapeutics

Instil Bio

KSQ Therapeutics

Lyell Immunopharma

Obsidian Therapeutics

Intima Bioscience

Adaptimmune Therapeutics

Adicet Bio

Alaunos Therapeutics

Atara Biotherapeutics

Immatics N.V.

Turnstone Biologics' IPO Date & Details

The initial public offering date, or IPO, for TSBX is expected to be July 20, 2023 and scheduled to be available for investors to trade on the open market starting July 21, 2023.

(Warning: Compared to stocks with more history, IPOs typically have less information for investors to review and analyze. For this reason, investors should use caution when thinking about investing in an IPO, or immediately post-IPO. Also, investors should keep in mind that many IPOs are heavily marketed, past company performance is not a guarantee of future results and potential risks may be understated.)

TSBX intends to sell 5.8 million shares of common stock at a proposed midpoint price of $13.00 per share for gross proceeds of approximately $75.4 million, not including the sale of customary underwriter options.

Existing collaboration partner Takeda Pharmaceutical Company (TAK) has indicated a non-binding interest in purchasing shares of up to $8 million in the IPO and at the IPO price.

If Takeda chooses not to purchase shares of the IPO, it may purchase shares in a private concurrent offering no later than July 31, 2023.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $147 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 27.2%. A figure under 10% is generally considered a "low float" stock which can be subject to significant price volatility.

Management says the firm qualifies as an "emerging growth company" as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements; prospective shareholders would receive less information for the IPO and, in the future, as a publicly-held company within the requirements of the Act.

The company also claims to be a "smaller reporting company," meaning it may be exempt from the more stringent financial reporting requirements before and after an IPO. For a non-exhaustive comparison of emerging growth company and smaller reporting company reporting and related requirements, view a summary here.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

approximately $70 million to $75 million to fund the continued development of TIDAL-01 in our two Phase 1 clinical trials for the treatment of breast cancer, colorectal cancer, uveal melanoma and other non-cutaneous and cutaneous melanomas, through initial clinical data update in mid-2024 and continued development into the second quarter of 2025;

approximately $15 million to $20 million to advance our TIDAL-02 program through candidate declaration and TIDAL-01 and viral immunotherapy combination program through an investigational new drug application, or IND; and

remaining proceeds, if any, for working capital and general corporate purposes.

We believe that the net proceeds of this offering, together with our existing cash, cash equivalents and short-term investments will enable us to fund our operations into the second quarter of 2025.

(Source - SEC.)

How To Invest In The Company’s Stock: 7 Steps

Investors can buy shares of the stock in the same way they may buy stocks of other publicly traded companies or as part of the pre-IPO allocation.

Note: This report is not a recommendation to purchase stock or any other security. For investors who are interested in pursuing a potential investment after the IPO is complete, the following steps for buying stocks will be helpful.

Step 1: Understand The Company's Financial History

Although there is not much public financial information available about the company, investors can look at the company's detailed financial history on their form S-1 or F-1 SEC filing (Source).

Step 2: Assess The Company's Financial Reports

The primary financial statements available for publicly-traded companies include the income statement, balance sheet, and statement of cash flows. These financial statements can help investors learn about a company's cash capitalization structure, cash flow trends and financial position.

The company’s recent financial results can be summarized as follows:

Highly variable collaboration revenue

Uneven operating results

Increasing cash used in operations

As of March 31, 2023, Turnstone had $33.5 million in cash and $20.5 million in total liabilities.

Additional financial information is available from the company's registration statement here.

Step 3: Evaluate The Company's Potential Compared To Your Investment Horizon

When investors evaluate potential stocks to buy, it's important to consider their time horizon and risk tolerance before buying shares. For example, a swing trader may be interested in short-term growth potential, whereas a long-term investor may prioritize strong financials ahead of short-term price movements.

Step 4: Select A Brokerage

Investors who do not already have a trading account will begin with the selection of a brokerage firm. The account types commonly used for trading stocks include a standard brokerage account or a retirement account like an IRA.

Investors who prefer advice for a fee can open a trading account with a full-service broker or an independent investment advisor, and those who want to manage their portfolio for a reduced cost may choose a discount brokerage company.

Step 5: Choose An Investment Size And Strategy

Investors who have decided to buy shares of company stock should consider how many shares to purchase and what investment strategy to adopt for their new position. The investment strategy will guide an investor’s holding period and exit strategy.

Many investors choose to buy and hold stocks for lengthy periods. Examples of basic investing strategies include swing trading, short-term trading or investing over a long-term holding period.

For investors wishing to gain a pre-IPO allocation of shares at the IPO price, they would ‘indicate interest’ with their broker in advance of the IPO. Indicating an interest is not a guarantee that the investor will receive an allocation of pre-IPO shares.

Step 6: Choose An Order Type

Investors have many choices for placing orders to purchase stocks, including market orders, limit orders and stop orders.

Market order: This is the most common type of order made by retail traders. A market order executes a trade immediately at the best available transaction price.

Limit order: When an investor places a buy limit order, they specify a maximum price to be paid for the shares.

Stop order: A buy-stop order is an order to buy at a specified price, known as the stop price, which will be higher than the current market price. In the case of buy-stop, the stop price will be lower than the current market price.

Step 7: Submit The Trade

After investors have funded their account with cash, they may decide on an investment size and order type, then submit the trade to place an order. If the trade is a market order, it will be filled immediately at the best available market price.

However, if investors submit a limit or stop order, they may have to wait until the stock reaches its target price or stop-loss price for the trade to be completed.

Thoughts On The IPO

Turnstone Biologics Corp. is seeking public capital market investment to fund the development of TIDAL-01 and TIDAL-02 treatment candidates.

The company’s financials have shown fluctuating collaboration revenue, variable operating results and growing cash used in operations.

The firm's lead candidate, TIDAL-01, is in Phase 1 trials for breast cancer, colorectal cancer and uveal melanoma and other cancer types.

TIDAL-02 is still in preclinical development.

Management says it expected to provide mid-trial updates on its two trials for its TIDAL-01 candidate in mid-2024.

The company’s investor syndicate includes a number of well-known life science venture capital firms.

Turnstone has had two major pharmaceutical company collaboration agreements, one with AbbVie and one with Takeda Pharmaceuticals, although both agreements have been terminated and will no longer provide collaboration revenue to Turnstone.

The market opportunity for treating solid tumors and other major cancers is extremely large and will continue to grow over the coming years as the global population ages.

BofA Securities is the lead underwriter and the two IPOs led by the firm over the last 12-month period have generated an average return of 36.3% since their IPO. This is a top-tier performance for all significant underwriters during the period.

Risks to the company’s outlook as a public company include normal and customary risks associated with its trial efforts in difficult-to-treat cancers.

As for valuation expectations, management is asking IPO investors to pay an Enterprise Value of $147 million, which is below the typical range for biopharma firms at IPO.

Although Takeda may continue to increase its stake in Turnstone Biologics Corp., with both collaboration agreements terminated and the company largely on its own for future development efforts, I’m cautious on Turnstone’s future prospects.

I’m therefore Neutral [Hold] on the TSBX IPO.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.