Weekly Closed-End Fund Roundup: PDT Cuts, FSCO Boosts, Some CEFs Getting Bubbly (July 9, 2023)

Summary

- 6 out of 22 CEF sectors positive on price and 3 out of 22 sectors positive on NAV last week.

- PDT reduces distribution by 15%, FSCO boosts distribution by 15%.

- Some CEFs getting bubbly.

- Looking for a helping hand in the market? Members of CEF/ETF Income Laboratory get exclusive ideas and guidance to navigate any climate. Learn More »

cemagraphics

Author’s note: This article was released to CEF/ETF Income Laboratory members on July 11, 2023. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Data is taken from the close of July 7th, 2023.

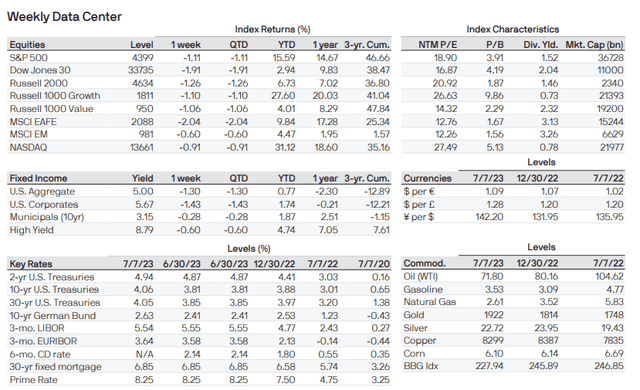

JPMorgan releases a nice Weekly Market Recap every week. These are the key index levels this week for equities:

Weekly performance roundup

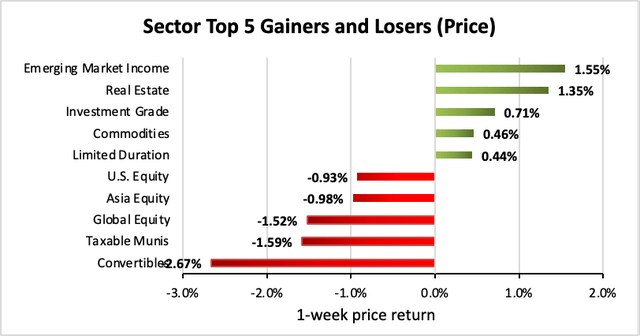

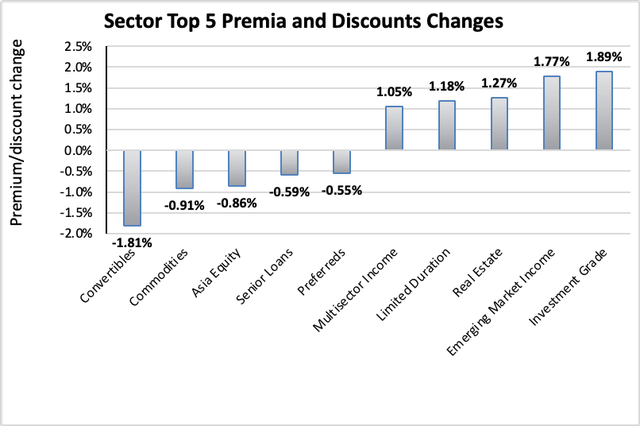

For CEFs, 6 out of 22 sectors were positive on price (down from 18 last week) and the average price return was -0.37% (down from +0.36% last week). The lead gainer was Emerging Market Income (+1.55%) while Convertibles lagged (-2.67%).

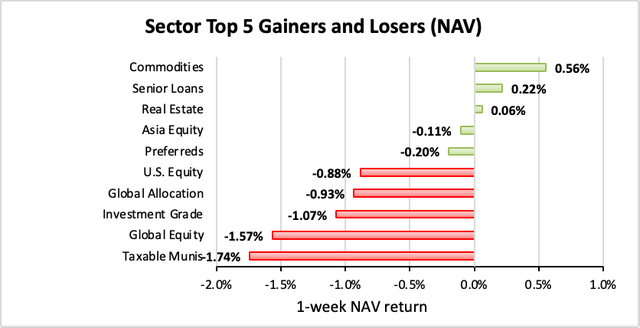

3 out of 22 sectors were positive on NAV (down from 11 last week), while the average NAV return was -0.55% (down from -0.48% last week). The top sector by NAV was Commodities (+0.56%) while the weakest sector by NAV was Taxable Munis (-1.74%).

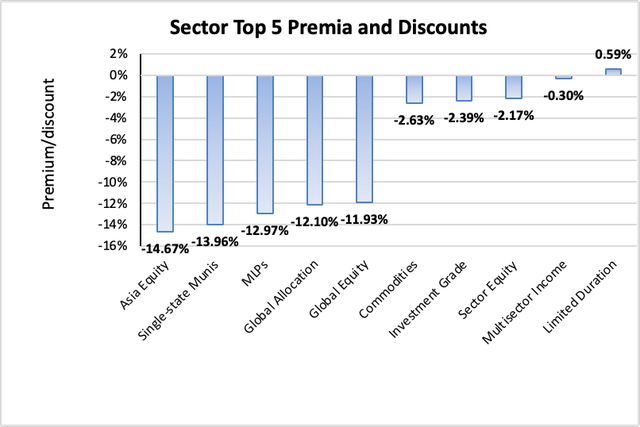

The sector with the highest premium was Limited Duration (+0.59%), while the sector with the widest discount is Asia Equity (-14.67%). The average sector discount is -7.81% (up from -8.02% last week).

The sector with the highest premium/discount increase was Investment Grade (+1.89%), while Convertibles (-1.81%) showed the lowest premium/discount decline. The average change in premium/discount was +0.25% (down from +0.43% last week).

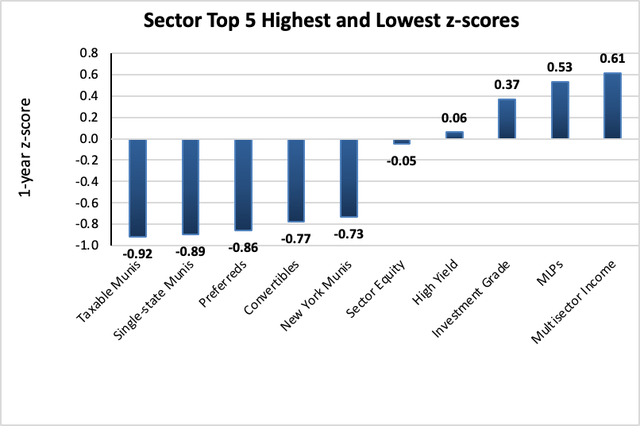

The sector with the highest average 1-year z-score is Multisector Income (+0.61), while the sector with the lowest average 1-year z-score is Taxable Munis (-0.92). The average z-score is -0.37 (up from -0.43 last week).

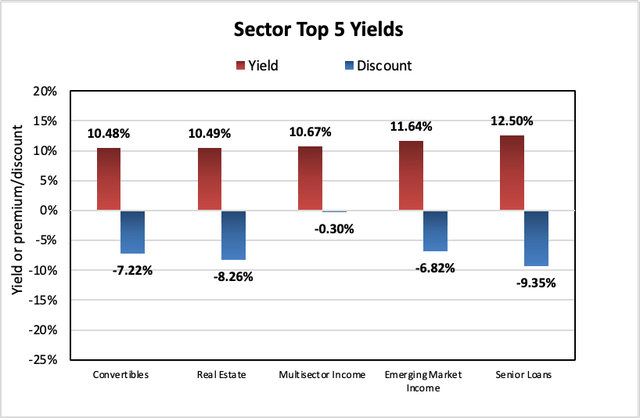

The sectors with the highest yields are Senior Loans (+12.50%), Emerging Market Income (+11.64%), and Multisector Income (+10.67%). Discounts are included for comparison. The average sector yield is +8.16% (up from +8.14% last week).

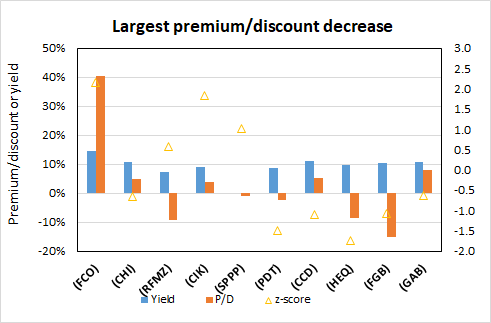

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | z-score | Price change | NAV change |

| abrdn Global Income Fund, Inc. | (FCO) | -4.41% | 14.61% | 40.59% | 2.2 | -3.52% | -2.46% |

| Calamos Convertible Opp & Inc | (CHI) | -4.25% | 10.65% | 4.80% | -0.7 | -4.46% | 2.44% |

| RiverNorth Flexible Municipal Income Fund II | (RFMZ) | -3.61% | 7.42% | -9.22% | 0.6 | -2.78% | 0.87% |

| Credit Suisse Asset Mgmt Income | (CIK) | -3.52% | 9.15% | 3.90% | 1.8 | 0.34% | -0.45% |

| Sprott Physical Platinum & Palladium Tr | (SPPP) | -3.13% | % | -0.92% | 1.0 | -0.09% | -0.94% |

| JHancock Premium Dividend Fund | (PDT) | -3.07% | 8.68% | -2.48% | -1.5 | -3.23% | 0.00% |

| Calamos Dynamic Convertible and Income | (CCD) | -2.79% | 11.11% | 5.19% | -1.1 | -3.08% | -1.88% |

| John Hancock Hedged Equity & Income Fund | (HEQ) | -2.69% | 9.64% | -8.63% | -1.8 | -3.80% | -1.28% |

| First Trust Spec Finance & Fincl Opp | (FGB) | -2.41% | 10.25% | -15.24% | -1.1 | -1.23% | -0.36% |

| Gabelli Equity | (GAB) | -2.29% | 10.62% | 8.03% | -0.6 | -2.59% | 1.49% |

Income Lab

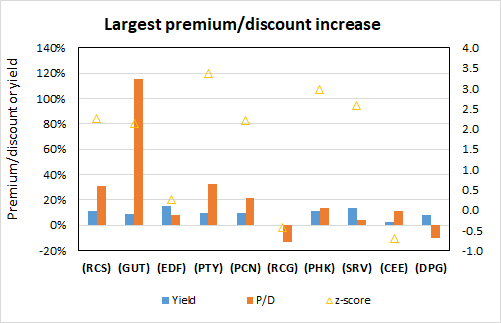

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| PIMCO Strategic Income Fund | (RCS) | 11.63% | 10.94% | 31.34% | 2.3 | 7.60% | -1.69% |

| Gabelli Utility Trust | (GUT) | 6.15% | 8.58% | 115.74% | 2.1 | 3.10% | -3.84% |

| Virtus Stone Harbor Emerging Markets Inc | (EDF) | 5.86% | 15.29% | 7.96% | 0.3 | 4.43% | -1.77% |

| PIMCO Corporate & Income Opportunity Fd | (PTY) | 5.40% | 9.98% | 32.81% | 3.4 | 2.07% | -1.04% |

| PIMCO Corporate & Income Strgy | (PCN) | 4.94% | 10.05% | 21.87% | 2.2 | 2.44% | -3.81% |

| RENN Global Entrepreneurs Fund ord | (RCG) | 4.70% | % | -13.16% | -0.4 | 1.65% | -1.26% |

| PIMCO High Income | (PHK) | 4.36% | 11.36% | 13.42% | 3.0 | 1.40% | 0.00% |

| NXG Cushing Midstream Energy Fund | (SRV) | 4.13% | 13.90% | 4.44% | 2.6 | 3.88% | -0.27% |

| The Central and Eastern Europe Fund | (CEE) | 3.60% | 2.58% | 11.45% | -0.7 | 2.10% | -0.92% |

| Duff & Phelps Utility and Infra Fund Inc | (DPG) | 3.47% | 8.43% | -9.69% | -2.9 | 2.47% | -1.02% |

Income Lab

New!

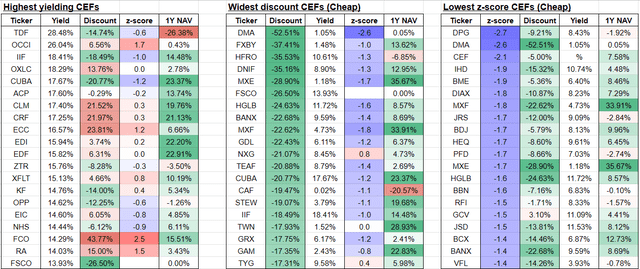

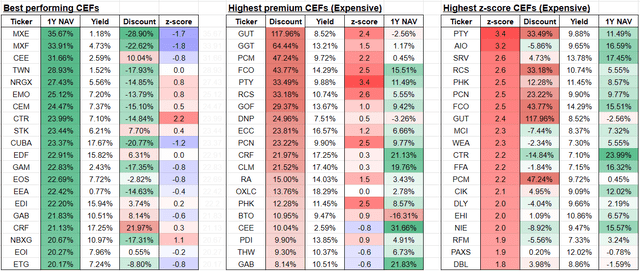

From our screener, here are the CEFs with the highest yields, widest discounts, and lowest 1-year z-scores:

From our screener, here are the CEFs with the best 1-year performance, highest premiums, and highest 1-year z-scores:

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

June 22, 2023 | Neuberger Berman High Yield Strategies Fund Announces Preliminary Results of Rights Offering.

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

June 23, 2023 | Nuveen Senior Loan Closed-End Funds Announce Shareholder Approval of Proposed Mergers.

June 7, 2023 | Goldman Sachs Asset Management Announces Liquidation of Goldman Sachs MLP and Energy Renaissance Fund.

April 24, 2023 | Kayne Anderson Energy Infrastructure Fund and Kayne Anderson NextGen Energy & Infrastructure Announce Updated Terms for Proposed Merger.

April 13, 2023 | Nuveen Preferred Closed-End Funds Announce Proposed Mergers.

March 30, 2023 | Center Coast Brookfield MLP & Energy Infrastructure Fund Announces Planned Reorganization.

March 27, 2023 | Kayne Anderson Energy Infrastructure Fund and Kayne Anderson NextGen Energy & Infrastructure Announce Proposed Merger.

March 22, 2023 | Board of First Trust Dynamic Europe Equity Income Fund Approves Conversion into an ETF.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

June 29, 2023 | Saba Capital Files Lawsuit Against 16 Closed-End Funds Over Control Share Provisions.

------------------------------------

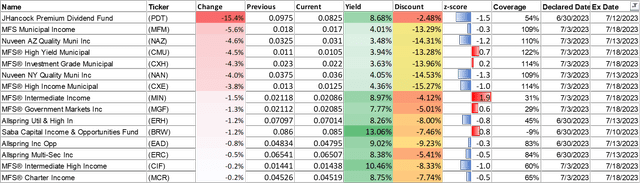

Distribution changes announced this month

These are sorted in ascending order of distribution change percentage. Funds with distribution changes announced this month are included. Any distribution declarations made this week are in bold. I've also added monthly/quarterly information as well as yield, coverage (after the boost/cut), discount and 1-year z-score information. I've separated the funds into two sub-categories, cutters and boosters.

Cutters

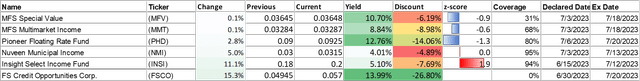

Boosters

Not much in the way of CEF news this week. John Hancock Premium Dividend Fund (PDT) cut its distribution by -15.4%, while FS Credit Opportunities Corp (FSCO) boosted by +15.3%.

Some CEFs are getting a bit bubbly here, as seen in our list of top CEF premium/discount gainers for last week. These include several PIMCO funds, namely RCS which gained +11.63% in premium and trades at a +31.34% premium and +2.3 z-score, PTY which gained +5.40% in premium and trades at a +32.81% premium and +3.4 z-score, PCN which gained +4.94% in premium last week and trades at a +21.87% premium and +2.2 z-score, and PHK which gained +4.36% in premium last week and trades at a +11.36% premium and +3.0 z-score. PCM is also expensive here at a +47.24% premium and +2.2 z-score. I would be considering rotating out of some of the more expensive PIMCO funds to cheaper ones (such as PFN, PDI and PDO owned in our Income Generator portfolio) to take advantage of the valuation discrepancy.

Strategy Statement

Our goal aims to provide consistent income with enhanced total returns. Our CEF rotation strategy includes trading between CEFs to exploit fluctuations in valuations. This is because CEF prices are inefficient, with investors often overreacting to both the upside or downside, or being unaware of upcoming corporate actions. This could help capture alpha from CEFs for the nimble investor.

We compare our performance against two benchmarks: the fund-of-CEFs ETF (YYY), and the global asset allocation portfolio ETF (GAA).

Income Lab

Remember, it's really easy to put together a high-yielding CEF portfolio, but to do so profitably is another matter! Our experience has been that it is very possible to earn profitable returns in CEFs. While there are numerous opportunities in the closed-end fund sector, it is essential to remain vigilant of the associated risks. Blindly chasing yield is not a prudent strategy.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

At the CEF/ETF Income Laboratory, we manage closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

CEF/ETF Income Laboratory is a premium newsletter on Seeking Alpha that is focused on researching profitable income and arbitrage ideas with closed-end funds (CEFs) and exchange-traded funds (ETFs). We manage model safe and reliable 8%-yielding fund portfolios that have beaten the market in order to make income investing easy for you. Check us out to see why one subscriber calls us a "one-stop shop for CEF research.”

Click here to learn more about how we can help your income investing!

The CEF/ETF Income Laboratory is a top-ranked newsletter service that boasts a community of over 1000 serious income investors dedicated to sharing the best CEF and ETF ideas and strategies.

Our team includes:

1) Stanford Chemist: I am a scientific researcher by training who has taken up a passionate interest in investing. I provide fresh, agenda-free insight and analysis that you won't find on Wall Street! My ultimate goal is to provide analysis, research and evidence-based ways of generating profitable investing outcomes with CEFs and ETFs. My guiding philosophy is to help teach members not "what to think", but "how to think".

2) Nick Ackerman: Nick is a former Financial Advisor and has previously qualified for holding Series 7 and Series 66 licenses. These licenses also specifically qualified him for the role of Registered Investment Adviser (RIA), i.e., he was registered as a fiduciary and could manage assets for a fee and give advice. Since then he has continued with his passion for investing through writing for Seeking Alpha, providing his knowledge, opinions, and insights of the investing world. His specific focus is on closed-end funds as an attractive way to achieve income as well as general financial planning strategies towards achieving one’s long term financial goals.

3) Juan de la Hoz: Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He is the "ETF Expert" of the CEF/ETF Income Laboratory, and enjoys researching strategies for income investors to increase their returns while lowering risk.

4) Dividend Seeker: Dividend Seeker began investing, as well as his career in Financial Services, in 2008, at the height of the market crash. This experience gave him a lot of perspective in a short period of time, and has helped shape his investment strategy today. He follows the markets passionately, investing mostly in sector ETFs, fixed-income CEFs, gold, and municipal bonds. He has worked in the Insurance industry in Funds Management, helping to direct conservative investments for claims reserves. After a few years, he moved in to the Banking industry, where he worked as a junior equity and currency analyst. Most recently, he took on an Audit role, supervising BSA/AML Compliance teams for one of the largest banks in the world. He has both a Bachelors and MBA in Finance. He is the "Macro Expert" of the CEF/ETF Income Laboratory.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PDO, PDI, PFN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.