GEE Group: Beware Of This Potential Value Trap

Summary

- GEE Group's stock has rebounded from its year-to-date low in March following the announcement of a $20 million share repurchase program, Q2 earnings results, and improved employment statistics.

- Despite these positive signs, the company's history of poor capital allocation has made it a value trap. If this does not improve, it will continue to be a value trap.

- I make a comparison to Heidrick and Struggles, an industry peer, to further show why GEE Group has been a value trap.

- I estimate that GEE Group will trade at $0.575 per share by the end of the year and recommend a hold rating due to better opportunities elsewhere.

Ceri Breeze

GEE Group Inc. (NYSE:JOB) operates in the temporary and permanent personnel placement industry, an industry that investors remain cautious on. Recent economic statistics regarding employment have somewhat eased this fear and GEE Group’s stock has bounced back nicely from its year to date low in March. Along with this, there has been some shareholder activism that has pushed management to begin a share repurchase program. In April, they announced a $20 million repurchase program and as of June 20 they had repurchased 647 thousand shares.

The management team is also presenting at an investor conference in an attempt to draw interest from investors. This is another good sign that management is committed to improving returns for shareholders.

These efforts are promising, especially when considering GEE Group’s management has made some baffling capital allocation decisions in the past, but it’s not a fix for business underperformance. The bottom line is that unless returns on acquisitions improve, the stock will likely continue underperforming going forward and will continue to be a value trap.

With that in mind, I see the stock as fairly valued despite looking cheap. In this article I'll provide an overview of GEE Group and the industry it operates in, I'll discuss GEE Group’s past financial performance, I'll compare GEE Group to industry peers, and I’ll cover the assumptions that lead to my valuation estimate.

Business and Industry Overview

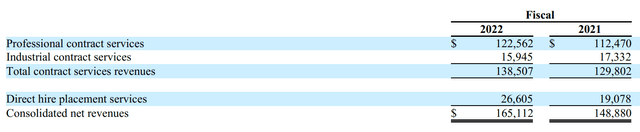

GEE Group primarily provides temporary and permanent staffing solutions for clients in the professional services sector, but also for clients in the industrial services sector. In 2022, approximately 83% of revenue came from temporary contract services, and 88% of that revenue came from professional services clients with the rest coming from industrial services clients. The final 17% of total revenue came from permanent hire placement services.

GEE Group Revenue by Segment (2022 Annual Report)

Gross margin for the professional contract, industrial contract, and direct hire segments were 26.6%, 15.4% and 100% respectively. Costs for contract placements include employee benefits and payroll taxes, while all costs associated with direct hires are included in SG&A expenses.

SG&A expenses increased from 28% of revenue in 2021 to 31% of revenue in 2022. This increase was due to a higher volume of business, and wage inflation.

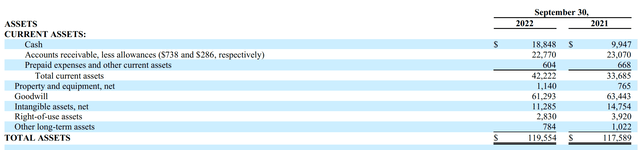

Along with SG&A expenses, GEE Group records relatively large amortization expenses related to intangible assets from acquisitions and has recorded goodwill impairment expenses also related to those acquisitions.

The business is capital light, but they have spent a significant amount of cash on acquisitions in the past and management has said in recent earnings calls that they will continue to spend cash on acquisitions.

The staffing industry is highly fragmented and highly competitive. There are a handful of publicly traded staffing companies, most of which rely on acquisitions to grow. This makes capital allocation, acquisition decision making, and skill at integrating acquisitions highly important for businesses in this industry. I have covered HireQuest, Inc. (HQI), and I believe it is a superior operation when compared to GEE Group. The market seems to believe this too as HireQuest's stock is currently trading at a premium multiple.

HireQuest's superior performance is driven by a franchise business model which incentivizes franchisees to grow organically and run efficient operations, and it's also driven by smart capital allocation. The market trusts Rick Hermanns, HireQuest’s CEO, to make smart acquisitions and as such believes HireQuest has a long runway for growth that will be accretive to earnings.

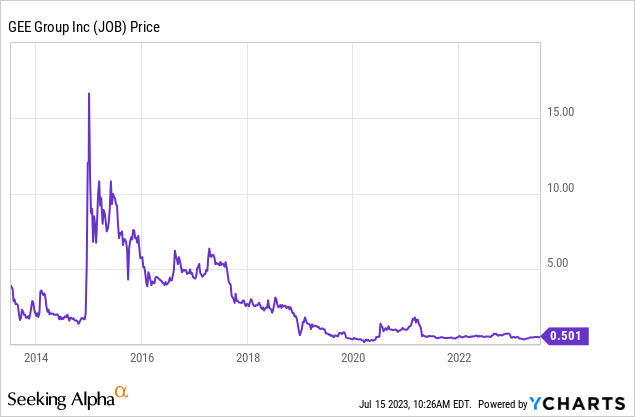

The market is making no such bet on GEE Group as past capital allocation decisions have led to significant destruction of shareholder value.

Past Financial Performance

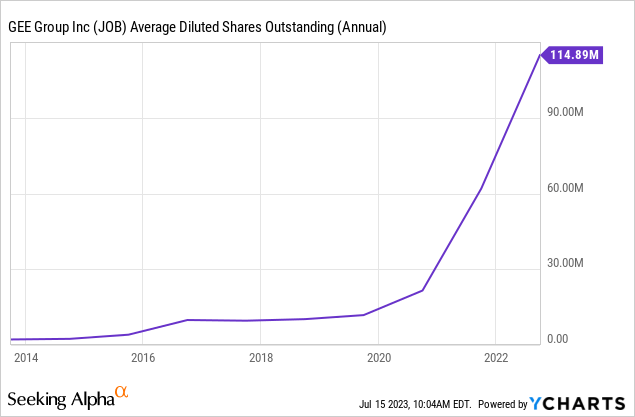

An investment in GEE Group anytime over a year ago would have done quite poorly. Just in the past 10 years, despite growth in operating income, cash earnings per share have not increased due to issuing equity in 2021 that was used to pay off debt incurred for past acquisitions.

Since 2013, revenue has increased from $43 million to $163 million and operating income has increased from ($1.3) million to $9 million. These seem like great results but in the context of the $37.5 million spent on acquisitions and the dilution that occurred as a result of it, they are not as impressive.

The business looks capital light which would imply a high ROIC, but due to the past acquisitions and the necessity of acquisitions to grow, invested capital needs to include goodwill and intangible assets. With this included, ROIC has been quite low. In 2022, which included elevated one-off earnings due to pandemic related cyclicality, I calculate that ROIC was 9%, which is also the highest ROIC generated by GEE Group over the past 10 years.

GEE Group Assets (Q2 2023 10-Q)

In my HireQuest report, I also covered Robert Half International, Inc. (RHI), and Heidrick & Struggles International, Inc. (HSII). Both HireQuest and Robert Half generated an ROIC over 40% in 2022 and they consistently had an ROIC above 20% prior to that year. Hedrick and Struggles on the other hand generated an ROIC of about 20% in 2022 with prior years being closer to 10%. Both HireQuest and Robert Half command premium valuations, while the market assigns Heidrick and Struggles a trailing EV/EBITDA multiple of 3.8.

The difference between these companies is capital allocation and is the reason Heidrick and Struggles, and GEE Group have been value traps. The market believes HireQuest and Robert Half will continue to make smart and accretive acquisitions while it has no faith that Heidrick and Struggles will do the same.

I put GEE Group into the same category as Heidrick and Struggles as it has a similarly low ROIC and a similarly poor history of capital allocation. The market is also putting GEE Group into the low quality category as the stock is trading at a trailing EV/EBITDA multiple of 5. This will factor into my valuation estimate below.

Valuation

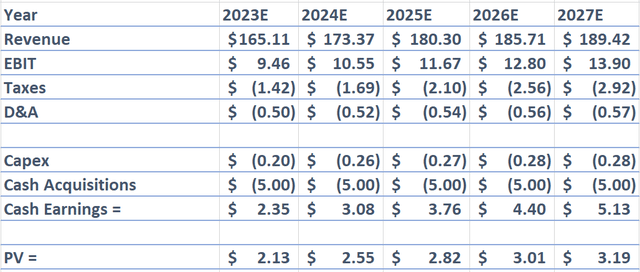

GEE Group DCF Valuation (Created by Author)

GEE Group DCF Valuation Continued (Created by Author)

Using a DCF model, I calculate GEE Group’s intrinsic value to be $0.64 per share. For organic growth, I assume 0% revenue growth in 2023, followed by 5%, 4%, 3% and 2% in the years following through 2027. I assume a constant 35% gross margin and $5 million cash spent on acquisitions per year through 2027. I assume every dollar spent on acquisition flows through to gross profit so I am adding $5 million per year to gross profit. I’m assuming increasing SG&A leverage with SG&A as a percentage of revenue declining to 28% in 2027, amortization of goodwill and intangibles of 2% of revenue through 2027, the tax rate to increase to 21% in 2027, 0.15% of revenue to be spent on capital expenditures per year, and a weighted average cost of capital of 10%.

All of this brings me to a fair value estimate of $0.64 per share.

Valuation Using Earnings Multiple

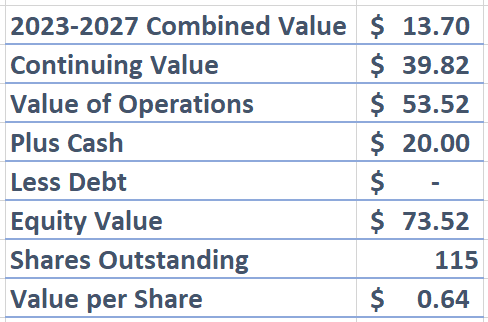

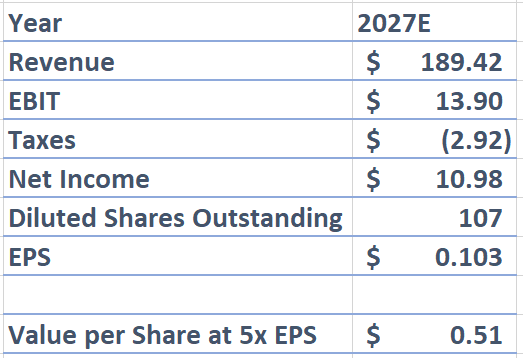

GEE Group Earnings Multiple Valuation (Created by Author)

For my estimate using an EPS multiple, I am taking my 2027 estimate of EBIT less taxes from above, assuming diluted shares outstanding decline by 2 million shares per year, and I’m applying an EPS multiple of 5 to 2027 EPS.

I am using a multiple of 5 because of GEE Group’s similarity to Heidrick and Struggles. Heidrick and Struggles is currently trading at a trailing EPS multiple of 7 and it has been as low as 6 within the past 10 years. A 5 times EPS multiple based on 5 year forward earnings seems reasonable using this comp. With this multiple and earnings estimate, I can see GEE Group's stock trading at $0.51 per share.

For a final price target I will take the midpoint of my two estimates, which is $0.575 per share. This would provide 15% upside by the end of the year. My DCF valuation already takes optimistic assumptions into account (organic growth, margin expansion etc.) so I don’t see much upside beyond this.

Final Thoughts

GEE Group is not the best business within the industry it operates in and the market knows this. Unlike HireQuest and Robert Half, GEE Group is more similar to Heidrick and Struggles which has history of poor capital allocation and low ROIC.

Even though GEE Group's management has instituted a share repurchase program which provides more of a shareholder friendly approach to capital allocation, GEE Group will make more acquisitions in the future. The market does not believe these acquisitions will create much shareholder value and is assigning the stock a low earnings multiple. This has made the stock, along with Heidrick and Struggles' stock, a value trap.

Using both a DCF approach and an earnings multiple approach that takes industry peer comps into account, I estimate that GEE Group will trade at $0.575 by the end of the year and I don’t see much upside beyond this. As such, there are better opportunities available and I am rating JOB stock a hold.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)