VB: Changing My Mind On Vanguard's Small-Cap ETF

Summary

- I decided to sell the VB ETF fund due to its underperformance compared to the S&P 500 and Invesco Nasdaq-100 Trust.

- Despite its low expense ratio and solid 10-year average annual return, the VB ETF's increased diversification has not resulted in increased short-, medium-, or long-term returns.

- The VB ETF's over-weighting in the industrial and consumer discretionary sectors may not prove advantageous in the long run due to its under-weighting in the technology sector.

syahrir maulana

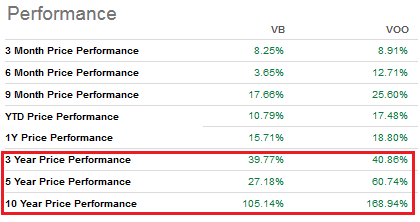

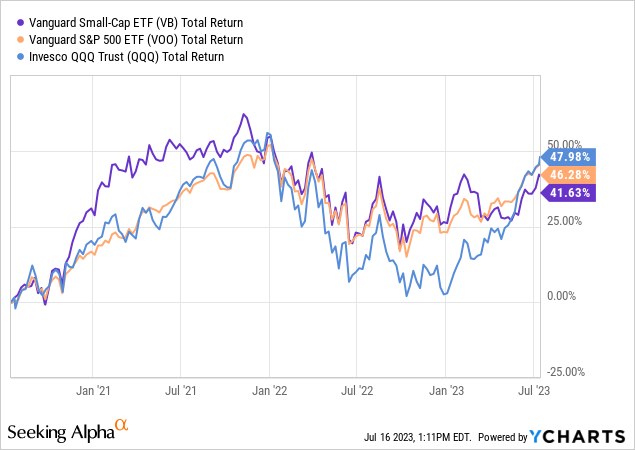

Back in September of 2021, Seeking Alpha published my article The Vanguard Small-Cap ETF: A Great Way To Diversify Your Mega-Cap Portfolio. Since that time, large-cap technology stocks have helped the S&P 500 outperform the small-cap focused (NYSEARCA:VB) ETF by ~9%. Further, and as the chart below clearly shows, on a longer-term basis the returns of the Vanguard S&P 500 ETF (VOO) have been superior to VB.

Seeking Alpha Compare Tool

As a result, and in my quest to simplify my portfolio by reducing equities that don't offer significant return and/or diversification advantages, I have decided to sell the fund and - over time - move the proceeds into existing positions in VOO and the Invesco Nasdaq-100 Trust (QQQ).

Other Considerations

That said, many investors might still consider the VB ETF to be an attractive holding for its relatively low expense ratio (0.05%, only 2 basis points higher than VOO's fee) and its solid 10-year average annual return (9.46%).

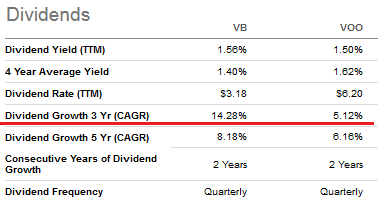

In addition, and somewhat surprising to me, is that both the VB and VOO ETFs have roughly the same yield (~1.5%), but the VB ETF's three-year dividend CAGR is actually significantly higher than that of the S&P 500:

Seeking Alpha Compare Tool

Meantime, the VB ETF is much (much) more diversified as compared to the S&P 500 VOO ETF, holding almost 3x the number of total companies (1,459) and with the top-10 holdings having only a 3.5% allocation as compared to 30.4% for the S&P 500's top-10 components. However, as mentioned earlier, if that increased diversification doesn't come with increased short, medium, or long-term returns, what is the point?

Indeed, while the chart above clearly shows that VB had a strong showing vs. the S&P 500 from the fall of 2020 to the fall of 2021, it suffered greatly during last-year's severe bear market and VOO has begun, once again, to outperform.

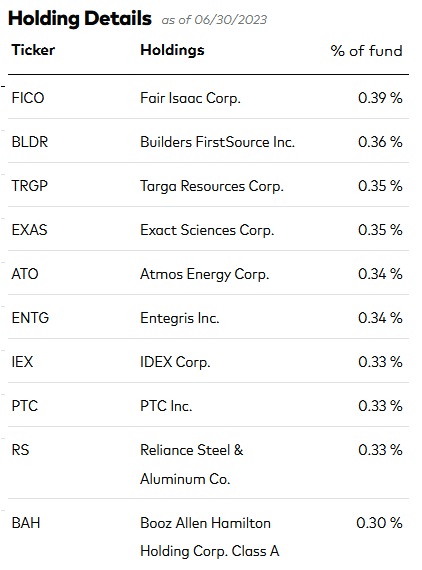

Portfolio

The top-10 holdings in the VB ETF are shown below and were taken directly from the Vanguard VB ETF homepage, where investors can find more detailed information on the fund:

Vanguard

My followers know that, at this point in my ETF articles, I will typically run though descriptions of a few of the top-10 holdings. However, given that the VB ETF holds 1,459 companies, no one company - no matter how good (or how bad ...) - can significantly move the fund's NAV given that all of the top-10 holdings have less than a 0.4% allocation, and that level declines rather rapidly as one goes down the list of the 1,459 holdings.

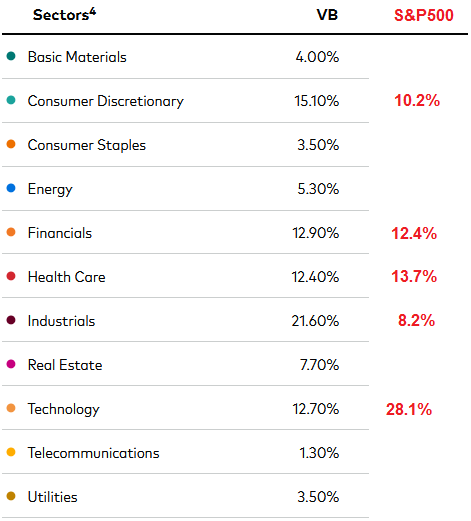

As a result, arguably more important than the individual holdings in the VB ETF, is the fund's allocation across sectors and its differentiation as compared to the S&P500 (added in red by the author):

Vanguard

As can be seen in the graphic, VB's largest allocation is to the industrial sector (21.6%) - which is more than 2.5x that of the S&P 500. That may be attractive given the Biden administration's ability to pass a comprehensive and long-term infrastructure investment bill. The Consumer Discretionary sector also has significantly higher allocation in the VB ETF as compared to the S&P 500 (50% more), which may bode well for the fund on a pickup in the overall consumer-led economy. That said, I'm not convinced that either one of these sector over-weights will prove advantageous - over the long run - given the relatively significant under-weighting of the Technology Sector, arguably the most vibrant of all sectors, as compared to the S&P500.

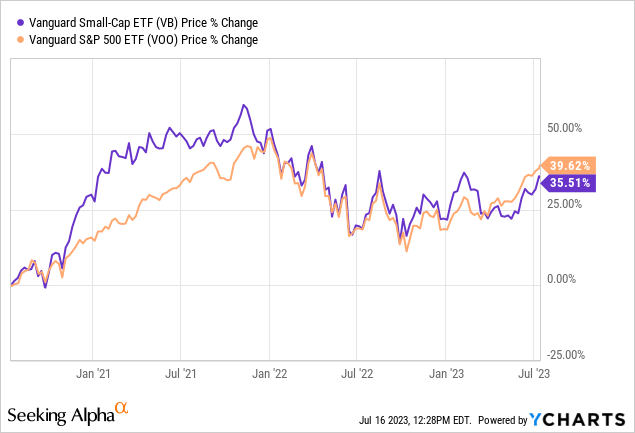

Performance

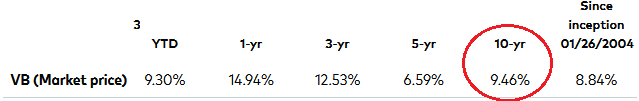

However, as stated previously, the VB ETF does have a relatively solid long-term performance track-record:

Vanguard

That said, the VOO ETF's 10-year average annual return is 12.8%. So, once again, what's the point of the supposed diversification benefit of the VB small-cap ETF if the long-term returns are significantly lower than the plain-old S&P 500?

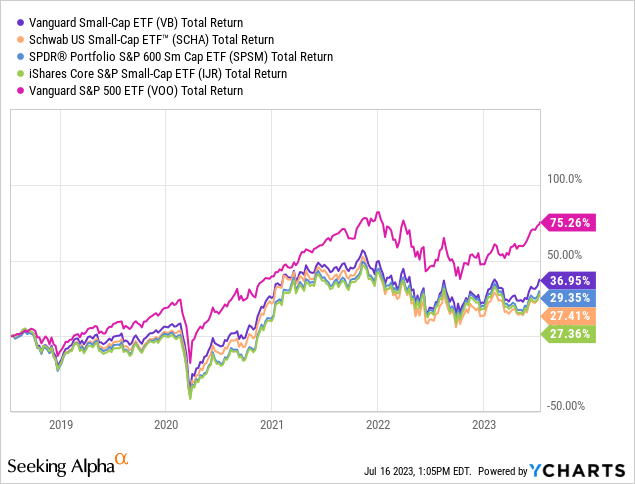

The following graphic compares the five-year total returns of the VB ETF with some of its small-cap competitors - the Schwab US Small-Cap ETF (SCHA), the SPDR Portfolio S&P 600 Small Cap ETF (SPSM), and the iShares Core S&P Small-Cap ETF (IJR) - along with that of the S&P 500 as represented by the VOO ETF:

While the VB ETF compares quite favorably against its direct competitors, again, the fund's returns (and that of its small-cap oriented peers) significantly lag that of the S&P500.

Summary and Conclusion

As my followers are likely aware, several years ago I began an effort to simplify my portfolio by reducing the number of its overall holdings. It has been a successful endeavor that has led to a portfolio that is easier to track and analyze, and my returns have increased as well (versus the S&P500, which is the benchmark I use to measure my portfolio's performance).

Prior to this portfolio simplification effort, I had added the VB ETF to help diversify my portfolio - a portfolio that was significantly over-weight both large-cap technology and energy stocks. The problem is the fund has under-performed and has detracted from my overall returns. As a result, I plan to sell the VB ETF this week and move the proceeds (over time) into existing positions the VOO and QQQ ETFs.

I'll end with a three-year comparison of the VB ETF to VOO and QQQ:

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VOO, VB, QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am an electronics engineer, not a CFA. The information and data presented in this article were obtained from company documents and/or sources believed to be reliable, but have not been independently verified. Therefore, the author cannot guarantee their accuracy. Please do your own research and contact a qualified investment advisor. I am not responsible for the investment decisions you make.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (9)

I already own VB and this article makes me like it even more for the long term.Tech is going to have its day of reckoning, and with its massive outperformance over the last 14 years it is due for long stretch of underperformance much like 2000-2010