Organon & Co.: A Tough Spot To Be In Right Now

Summary

- Organon & Co's share price has fallen significantly, with a p/e below the sector average and a 5.4% dividend yield, but its cash flows are barely above its nearly $300 million dividend, potentially limiting dividend growth.

- The company recently made HADLIMA, a product developed with Samsung Bioepis, available in the US, expanding its product range and maintaining its position as a major supplier of necessary products and medicines.

- Despite strong net margins, the company's free cash flow (FCF) margin has decreased, which is disrupting the future potential valuation of the company.

shapecharge

Investment Outline

Investing into companies when the valuation looks undervalued and there is more potential upside than downside is the very essence of value investing. With Organon & Co. (NYSE:OGN) one would think that might be as the share price has fallen drastically. The p/e is far below the rest of the sector, under 5 on a forward basis, whilst yielding a dividend of 5.4%.

The revenue streams for OGN are robust and unlikely to see major disruption in my opinion. With safety like that, I think the company deserves a bigger premium. The dividend right now accounts for nearly $300 million, and the cash flows are just above $320 million in the last 12 months. I think this difference is too low and opens up the possibility of lacking dividend growth for the medium term, or until OGN can raise its cash flows. Because of this, OGN is fit as a hold rating in my opinion.

Recent Developments

In recent news, OGN announced on July 1 2023 that together with Samsung Bioepis have made HADLIMA available to patients in the United States. The product is available in both citrate-free high concentration and citrate-containing low concentration.

The CEO Kevin Ali was very positive about the progress and said the following, “As the largest loss-of-exclusivity event in pharmaceutical history, this is a singular moment for the US health care system to embrace biosimilars. Every stakeholder should be invested in the success of this market to realize the value biosimilars can create for patients, providers, and the US healthcare economy”.

This announcement broadens the portfolio of products for OGN and sets the scene for them to continue benign a major supplier of necessary products and medicines.

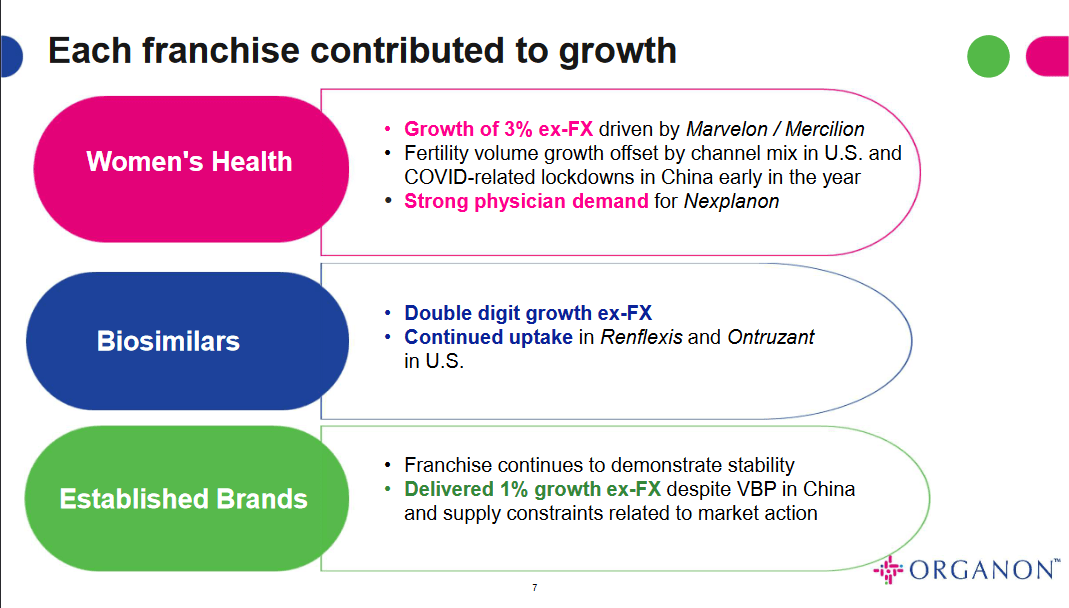

Franchises (Investor Presentation)

The three franchises that make up OGN all face demand and contribute to the business's growth and maintain a dominant position. As for the franchise making up the largest portion of the revenues it remains to be “Established Brands”, netting over $1 billion for Q1 FY2023.

Margins

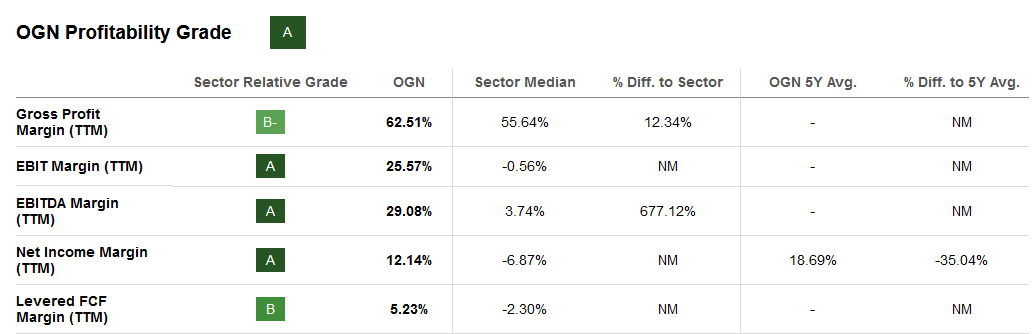

Margin Profile (Seeking Alpha)

The margin profile of OGN is very good when compared to the rest of the sector. This is in my opinion a highlight when evaluating OGN. The margins are solid and have over time grown sustainably. But the FCF margins have taken a hit recently and back in 2019 FCF per share was $10.55. The TTM number now is $1.69 per share. This decrease has been the result of a lower FCF margin. Going forward, a key challenge to make OGN a buy rating in my opinion will be raising this margin. The net margins remain very strong but the lower FCF margin translates into OGN receiving such a lower valuation right now I think.

Value For Investors

For investors interested in OGN the primary value you can receive is collecting the dividend. Right now sitting at a 5.4% yield. The payout ratio sits at 25% and I am worried we won't see an increase in the short term as the FCF is significantly lower than previous years. Once the FCF increases I don’t think investors should be expecting a raise in the divided. Such an announcement could be worrying. As mentioned earlier, OGN had around $320 million in FCF for 2022, and the dividend distributed amounted to just shy of $300 million. That doesn't leave a lot of room for disappointment. Besides the dividend, there isn't necessarily any value that investors can collect. The company doesn't buy back shares it dilutes shares instead and has done so between 2019 and 2022.

Valuation

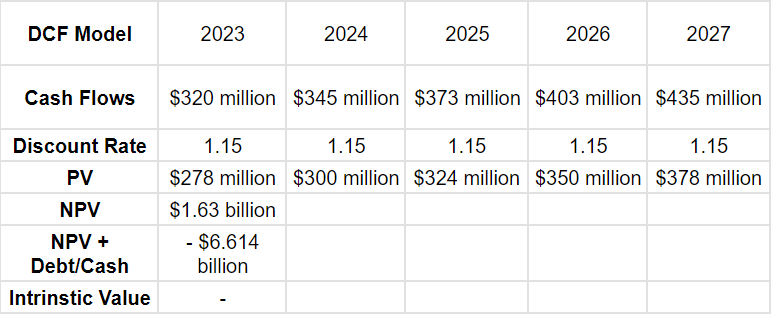

Some of the important markets that affect OGN are “Female Contraceptives” and “Biosimilars”. Both of these key markets are expected to post strong growth going forward, 8.5% and 23.5% respectively. I still view the FCF as a struggling point for OGN and will be modeling the company with a DCF model. As a result of the growing markets in which they operate, I am not as negative about the FCF outlook as one might think.

DCF Model (Author)

The model here showcases that the amount of debt that the company has makes it a risky investment right now. The Net Present Value of the cash flows is $1.63 billion but when accounting for the $8.7 billion of debt the results speak for themselves as OGN might struggle to pay down future debts with such lacking FCF. But when not accounting for the debt and including the cash they have we have a NPV of $2.089 billion. Dividing that with 255 million shares outstanding, the intrinsic value lands at $8.1 per share. The current share price is trading at a 153% premium to that and highlights why right now OGN offers lacking growth prospects to make an investment case as the valuation seems too rich to get in at, despite a p/e of under 5.

Risks

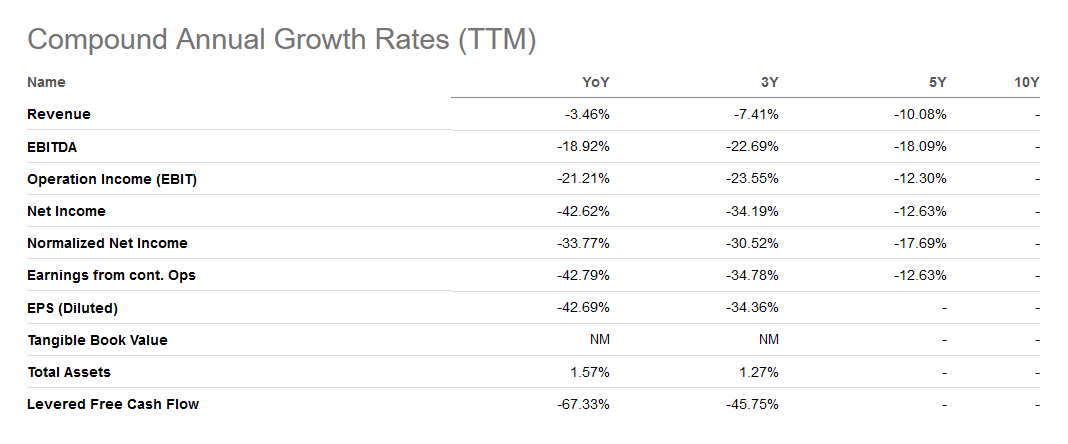

The historical growth right now with OGN has been rather disappointing. What I am mostly looking at is the FCF which is the sole source of providing value to investors here. The lack of a turnaround seems to result in low multiples that OGN receives.

Historical Growth (Seeking Alpha)

The FCF is down 67% YoY and makes future dividends come into question about the likelihood of raising, or even maintaining it without diluting shares to raise capital. Besides that, the interest rates are rising and that has meant for OGN the interest expenses they are paying right now is $422 million in 2022. Going forward this might be a weighing liability on the net margins and the FWD p/e might be rising rather than decreasing.

Investor Takeaway

Sometimes the very best deals in the market might be just an illusion. I often find myself very skeptical about companies that look too good to be true at first glance. When diving deeper into the revenues and historical growth of OGN we can see why it receives a low p/e multiple of 4.8. The FCF has taken a massive hit and is unlikely to recover to its former self. That leaves the current share price at a difficult price point to invest. But for those already in the company I think holding onto shares and collecting the over 5% dividend yield still seems worth it for the time being. Rating OGN a hold.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.