Paramount: It's Finally Time To Buy The Massive Drop (Rating Upgrade)

Summary

- Paramount Global's parent company, National Amusements, is negotiating with creditors over its loans due to lower cash flows and financial risks.

- Despite a dividend cut and a weak Q2 expected in August, Paramount is expected to improve its earnings and free cash flow by 2024.

- I assessed that significant pessimism seems to have been priced in, as dip buyers returned confidently in late May, defending against the free fall.

- While income investors could remain sidelined for now, value investors could see a fantastic opportunity to buy more, while the market remains in a panic over PARA in the near term.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Lia Toby/Getty Images Entertainment

I have been waiting for an opportunity to become more constructive with Paramount Global (NASDAQ:PARA) stock, and I think the time has arrived. The Wall Street Journal, or WSJ, reported over the weekend that "Paramount's parent company is in talks with creditors after disclosing financial risks."

Accordingly, National Amusements was reported to be negotiating with creditors over the company's loans. Its lenders likely seized on the opportunity on its disclosure of its "ability to continue as a going concern" due to "lower cash flows" on its annual report. However, that caution has been present since the start of the COVID pandemic and, therefore, isn't a pivotal new development.

However, the timing of the negotiation likely stems from the lenders seeing an opportunity to renegotiate for better terms and charging higher interest rates to the company. Furthermore, National Amusements highlighted that it "has made all interest payments on the debt in question on time.: It also remains in talks and "is working to resolve the matter with its lenders expeditiously."

As the 80% holder of Paramount Global's voting stock, holders could feel discouraged to return to PARA in the near term. However, it's also crucial to note that the stock formed a timely bear trap or false downside breakdown in May.

That's right. I gleaned that dip buyers returned strongly in late May and helped defend PARA against a further selloff. In addition, PARA remains attractively valued (Seeking Alpha Quant rating of a "B+" valuation grade).

I previously urged investors to remain on the sidelines in early May after management slashed its dividend, likely leading to a mass exodus in Paramount income investors. However, I also highlighted that it seemed like a capitulation move. Still, I reminded holders to "remain patient until they observe constructive price action suggesting that investors are buying the current levels aggressively."

The good news is I think the opportunity is appropriate for investors to consider adding more exposure now. Let's assess a few crucial factors. Analysts' estimates on Paramount Global's forward dividend payouts have not worsened, expecting the company to report a downgraded quarterly dividend of $0.05 per share. In addition, the company is also likely to climb out of its free cash flow or FCF malaise in FY24, with its worst expected to bottom out in the first half of FY23.

Therefore, investors could expect Paramount to report another weak Q2 earnings release in August. However, I believe the market has already reflected it accordingly with the steep selloff in May, considering the analysts' estimates.

CFO Naveen Chopra remains confident in a recent June conference that the company expects its direct-to-consumer losses to peak this year, "leading to significant earnings and free cash flow improvement in 2024." Despite that, we must be circumspect about management's optimism, given the company's reliance on TV advertising in the near term, which is expected to remain tepid.

Paramount Global also faces near-term headwinds over the "double acting/writing strike, which is the first of its kind in 63 years." However, these challenges aren't expected to be "structural," even though "fixes take time." As such, Paramount Global's challenges on the strike and TV advertising are likely transitory, and I assessed buyers who returned in May had expected significant challenges as priced in accordingly.

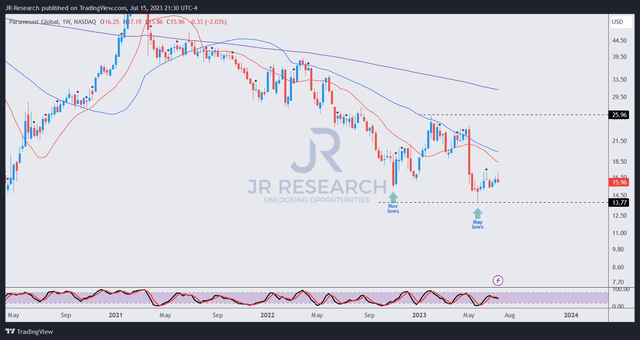

PARA price chart (weekly) (TradingView)

PARA formed an astute bear trap in late May as dip buyers returned in force to underpin those lows.

Also, since then, PARA dip buyers have refused to give up those levels, allowing the constructive consolidation I asked for before turning more optimistic over a mean-reversion opportunity.

However, holders who decide to add more shares must note that PARA remains in a downward bias. Therefore, I assessed that taking meaningful exposure off if PARA mean-revert to the low $20s zone seems appropriate.

For now, I see an attractive risk/reward profile for PARA investors who waited on the sidelines for buying support before considering returning. As such, I'm ready to upgrade my thesis on PARA.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Ultimate Growth Investing, led by founder JR Wang of JR Research, helps investors better understand a range of investment sectors with a focus on technology. JR specializes in growth investments, utilizing a price action-based approach backed by actionable fundamental analysis. With a powerful toolkit, JR also provides insights into market sentiments, generating actionable market-leading indicators. In addition to tech and growth, JR also offers general stock analysis across a wide range of sectors and industries, with short- to medium-term stock analysis that includes a combination of long and short setups. Join the community today to improve your investment strategy and start experiencing the quality of our service.

Seeking Alpha features JR Research as one of its Top Analysts to Follow for the Technology, Software, and the Internet category, as well as for the Growth and GARP categories.

JR Research was featured as one of Seeking Alpha's leading contributors in 2022.

About JR: He was previously an Executive Director with a global financial services corporation and led company-wide, award-winning wealth management teams consistently ranked among the best in the company. He graduated with an Economics Degree from Asia's top-ranked National University of Singapore (NUS). NUS is also ranked among the top ten universities globally. I currently hold the rank of Major as a Commissioned Officer (Reservist) with the Singapore Armed Forces.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (15)

You have any insights on WBD vs. PARA? I just did a quick stock comparison using a tool available on SA, and WBD seems better to me although I have not taken a deep dive into either stock yet.I did a similar comparison using a tool available on Schwab, and WBD got the nod there as well. You know I respect CFRA research, and it also likes WBD more than PARA.I don't particularly like either stock that much, but a prolonged strike (expected to possibly last through year end) and continued downward pressure on profits and stock prices could make WBD a decent play. Remember that price and valuation are the yin and yang of investing, so lower prices can often present (pun intended) you with a decent trade.